Ethereum ETFs to be Web3 growth ‘call option’ — Crypto analyst

Ether has a “much larger addressable market” than Bitcoin as it could be considered a bet on the entire Web3 industry, claims a crypto analyst.

Ether (ETH) may have an easy-to-explain selling point after all — an option for investors to bet on the future growth of Web3 — after recent doubts about defining Ether neatly to sell the idea of spot Ether exchange-traded funds (ETFs), according to a crypto analyst.

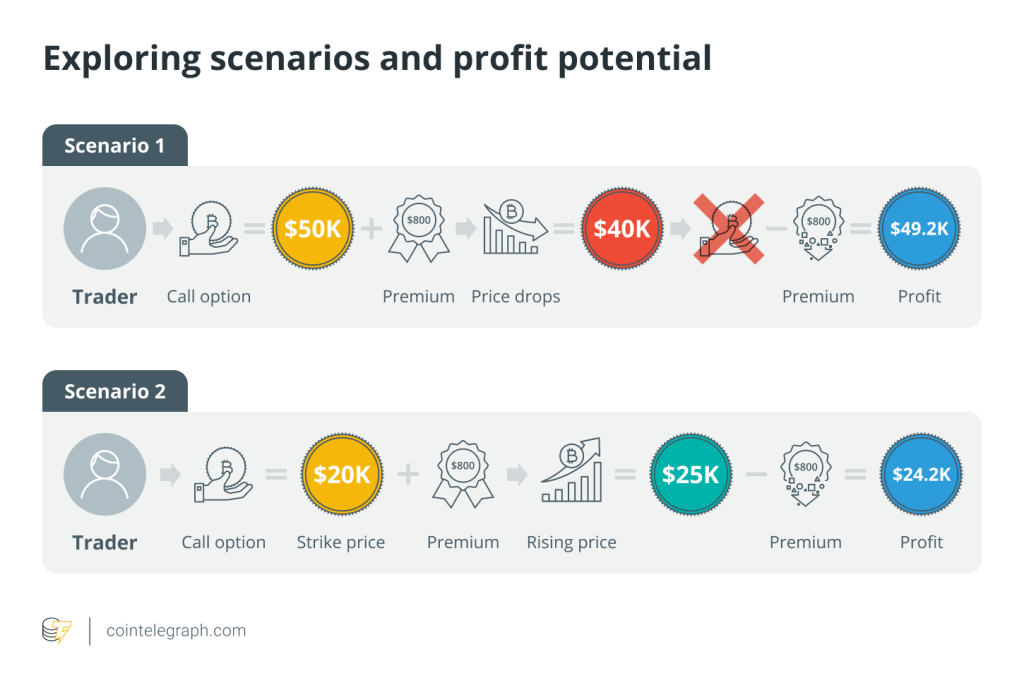

“ETH is a tech play on the growth of Web3. A ‘call option’ or ‘high-growth index for Web3 adoption.’ Whereas Bitcoin is ‘digital gold,’” The DeFi report crypto analyst Michael Nadeau said in a May 28 report.

The Web3 industry is set to bring in annual revenue of $33.5 billion by 2030, according to Grand View Research data.

Ethereum potentially has “a much larger addressable market” when you break the two largest cryptocurrencies down with simple investment terminology, Nadeau argued.

Nadeau believes Ether could break its November 2021 all-time high of $4,870 once spot Ether ETFs launch as they will increase demand pressure as seen with Bitcoin after the launch of spot Bitcoin ETFs in January.

However, Ethereum validators are different because they don’t have high operating expenses like Bitcoin miners. This means Ethereum validators aren’t forced to sell to cover costs, only putting more pressure on the demand side.

“ETH does not have the same level of ‘structural sell pressure’ that BTC has since ETH validators do not incur operating expenses as Bitcoin Miners do.”

He also noted that Ether is much more “reflexive” to positive feedback loops compared to Bitcoin (BTC).

“This reflexivity could be expressed with price action leading on-chain activity, which leads to more ETH burned, which can further drive narratives, more price action, more on-chain activity, and more ETH burned,” he claimed.

Nadeau claimed Ethereum has “superior network effects” compared to Bitcoin, and provides the opportunity for investors to stake Ether and earn a yield, which Bitcoin lacks.

Related: Ethereum ETFs launch next month ‘certainly possible’ — Analyst

The comments were made on the same day as what could potentially be the largest amount of Ether staked in a single transaction.

On May 28, $500 million worth of Ether was staked on Lido, per Etherscan data.

“Likely the record for the most amount of ETH staked in one single transaction,” founder of DeFiance Capital Arthur Cheong argued in a May 28 X post.

It follows criticism from several crypto analysts who said Ethereum lacks a straightforward selling point, unlike Bitcoin’s long-touted “digital gold” narrative.

“Ethereum still has no elevator pitch, despite years of attempts,” Glassnode lead analyst James Check said.

Bloomberg ETF analyst Eric Balchunas noted Bitcoin’s “digital gold” selling point, asking if “a simple one-liner like that [exists] for Ether? If so, what is it?”

Responses