Ethereum NFTs rally, with EtherRock and BAYC leading sales

Weekly NFT sales volume on Ethereum rose over 99%, driven by a surge of interest in Pudgy Penguins and the Nobody collection.

Updated 4:30pm UTC: Added a comment from Ilan Rakhmanov, founder and CEO of ChainGPT.

Ethereum-native nonfungible tokens (NFTs) are starting to make a comeback, according to growing sales figures this week.

Wrapped Ether Rock #46 sold for $496,658 on Feb. 12, four days after Bored Ape Yacht Club (BAYC) #1726 was sold for $668,297, according to NFT data aggregator CryptoSlam. These represent the second- and third-largest sales of the month, following the $1.53 million sale of CryptoPunk #5363 on Jan. 31.

According to Anndy Lian, intergovernmental blockchain expert and author of the book NFT: From Zero to Hero, Wrapped Ether Rock and BAYC aren’t just NFTs but represent a status symbol that grants the holder prestige in the NFT community:

“The crypto market is anticipated to be more bullish. This brings the degen narrative back to the scene where this is a way to show their social and cultural capital of the NFTs.”

While the sale of BAYC #1726 seemed a strategic move, the Wrapped Ether Rock sale paints a different trend, Ilan Rakhmanov, founder and CEO of ChainGPT, told Cointelegraph:

“The Ether Rock sale seems like a price pump by someone who is trying to get more attention to the collection, as the actual sale price is much higher than any offer, which averages around $500.”

Ethereum’s NFT sales volume has risen 99.42% over seven days to $159.5 million, driven by a 25% sales increase by the Nobody collection, which generated $8.76 million worth of weekly sales. Bitcoin’s NFT sales fell 25% to $47.5 million during the same period.

According to Yehudah Petscher, NFT strategist at CryptoSlam, nonfungible token traders are shifting back to Ethereum following a surge of interest in Bitcoin Ordinals inscriptions and Solana-native NFTs:

“We used to just have cycles between assets, like crypto, memecoins, NFT art and NFT PFPs. Now, we have cycles between blockchains to factor in, too. Traders move to where there’s liquidity and opportunity, and they saw those opportunities elsewhere.”

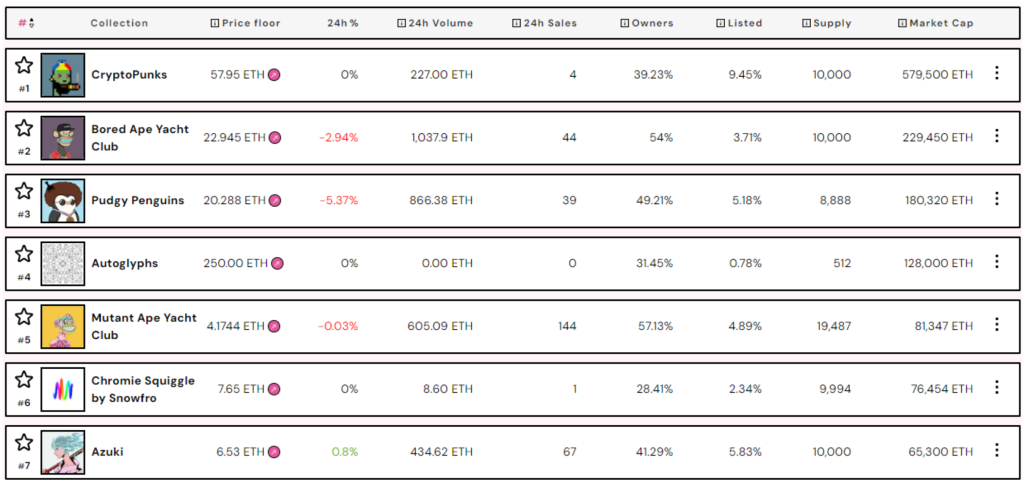

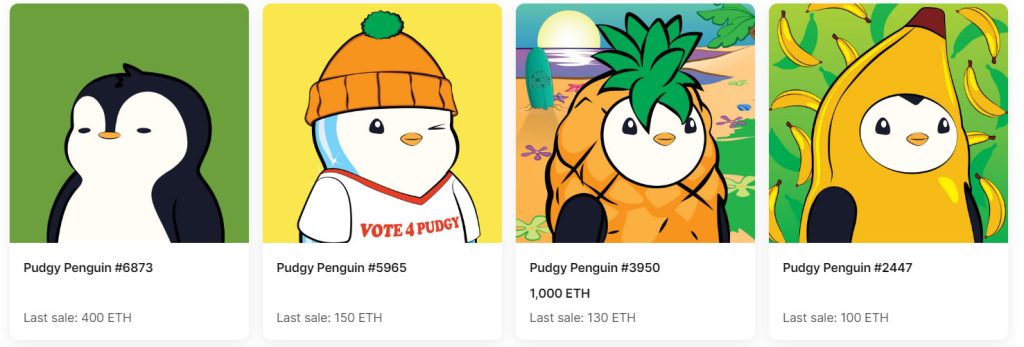

Contributing to Ethereum’s sales increase, the Pudgy Penguins collection’s floor price rose to a new all-time high of 21.5 Ether (ETH) ($53,427) on Feb. 10 before retracing to the current 20.28 ETH ($50.395). This is 13.1% away from the 22.94 ETH ($57,000) floor price of the Bored Ape Yacht Club, the second-largest Ethereum-native NFT collection, according to NFT Price Floor data.

The seven-day sales volume of Pudgy Penguins also rose 143% to $6.8 million, making it the fourth-largest NFT collection by weekly sales volume across all blockchains, according to CryptoSlam.

Interest in the collection started surging in December after the announcement of Pudgy World Alpha, a blockchain-based, open-world gaming experience set to release in Q1 2024.

The NFT market has been in a downtrend since May 2022. The floor prices of top blue-chip NFT collections CryptoPunks and BAYC are down 48% and 82% from their all-time highs, respectively.

Related: Ethereum gas fees hit 8-month high amid ERC-404 craze

… [Trackback]

[…] There you can find 81268 additional Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] There you will find 73087 more Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Here you will find 51561 more Info on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Here you will find 61405 additional Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Here you will find 91221 additional Information to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] There you can find 64749 more Info to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/nft/4369/ […]

… [Trackback]

[…] There you can find 34249 more Info to that Topic: x.superex.com/news/nft/4369/ […]