Ethereum network strength, macroeconomic factors back ETH’s rally to $2.5K

A variety of bullish factors back Ethereum’s recent rally to $2,500.

Ether price witnessed a 10% price increase in the first nine days of February, breaking above $2,450 for the first time in three weeks. This movement was aligned with the broader cryptocurrency market’s bullish momentum and significantly influenced by the macroeconomic environment.

Despite the reasons behind Ether’s (ETH) rally, investors are growing more bullish as deposits on the Ethereum network increase. However, is this momentum sufficient for a sustainable rise above $2,800?

Weak economic data in China and U.S. fiscal debt trends create opportunity for risk-on assets

On Feb. 4, United States Federal Reserve Chair Jerome Powell emphasized the need for a more sustainable public debt path in an interview. In 2023, U.S. debt service costs represented 2.4% of the economy’s gross domestic product, and projections indicate a potential increase to 3.9% in 2034, as reported by the Congressional Budget Office. These projections will prompt the Fed’s policy interest rate to decrease, according to Neil Irwin, author of Axios Macro.

Traditional finance investors faced additional concerns from China when the January Purchasing Managers’ Index revealed manufacturing activity contraction for the fourth consecutive month. Following the Chinese central bank’s largest cut in mandatory cash reserves for banks in three years, the government introduced measures to support the real estate development market, currently under pressure due to high debt leverage, according to AP News.

Investors also sold some fixed-income positions, causing the two-year U.S. Treasury yield to reach its highest level in two months at 4.48%, up from 4.21% on Feb. 1. Simultaneously, on Feb. 9, the S&P 500 index reached a record high above $5,000, indicating that investors are not overly concerned about a potential economic crisis, at least in the short term. Nevertheless, the U.S. fiscal debt trends, highlighted by the Fed chair, create an ideal scenario for scarce alternative assets such as Ether.

This movement poses challenges for cryptocurrencies as the stock market continues to attract the majority of the flow for risk-on assets. However, it simultaneously opens the door for alternative investments, as some stocks, like chipmaker Nvidia and e-commerce giant Amazon, are currently trading at 33x earnings for 2024, significantly higher than the S&P 500 average of 22x.

Ether’s price rally is backed by the Ethereum network activity

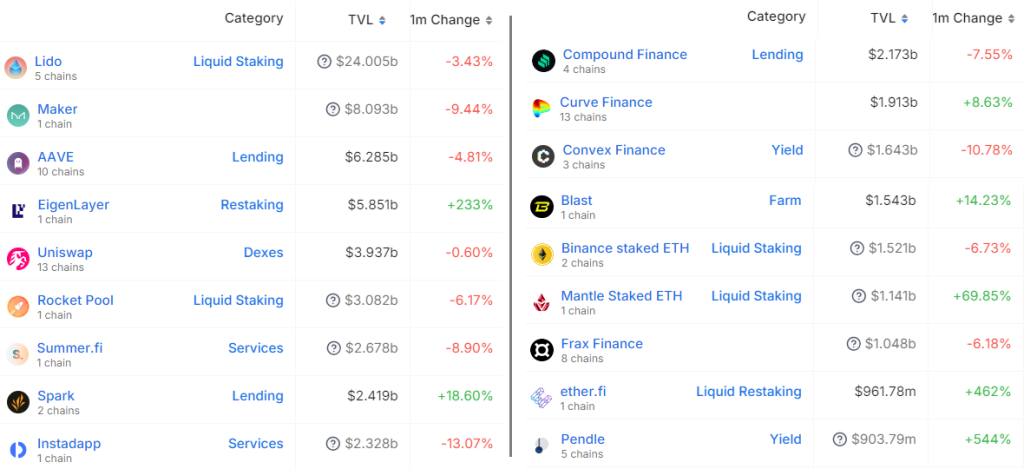

To assess whether Ether’s price gains in February are backed by sustainable demand for ETH, one should monitor the Ethereum network’s on-chain activity. The network’s smart contract deposits, measured by the total value locked (TVL), reached an 11-month high on Feb. 9 at 16 million ETH, marking a 19% increase from the previous month. However, most of the surge occurred on the EigenLayer liquid staking solution, which jumped to a $5.85 billion TVL on Feb. 9, up from $1.15 billion the previous month.

Other noteworthy mentions encompass the liquid staking applications Mantle LSP and Ether.fi, along with the yield farming service Pendle. Importantly, the Ethereum network has maintained its status as the absolute leader in fees, serving as a proxy for effective demand. To illustrate, Ethereum’s $10.4 million in fees over 24 hours is eight times larger than Tron’s and more than 12 times higher than BNB Chain’s, as reported by DefiLlama.

Related: Bitcoin ETFs spark optimism around Ether ETF, but is it realistic?

Beyond Ethereum’s existing use cases, another source of optimism for Ether investors lies in a potential new nonfungible token format dubbed ERC-404. This method would allow fractionalized capabilities within the current ERC-721 standard. Although in its initial stages, this promising proposal could enhance sector activity and further stimulate demand for ETH. Additionally, the eagerly awaited Dencun network upgrade is scheduled for March 13, bringing benefits such as reduced transaction costs for layer-2 rollups.

Considering the potential interest from fixed-income investors seeking alternatives to stocks and the ongoing growth and development of the Ethereum network, Ether investors are clearly not feeling apprehensive about the recent 10% price gains or the $2,650 resistance, and compared with Ether’s last test of it on Jan. 11, the price action appears stronger.

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] There you will find 89754 additional Info to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] There you will find 13457 additional Information on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] There you will find 98426 additional Info on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Here you will find 50301 additional Information to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4302/ […]

… [Trackback]

[…] Here you will find 39666 additional Information on that Topic: x.superex.com/news/ethereum/4302/ […]