ETH price may repeat $2.7K January spike as Bitcoin cools — analysis

Ethereum is stealing Bitcoin traders’ attention as BTC price action rests within a consolidation range.

Bitcoin (BTC) returned to attack liquidity at $43,500 after the Feb. 6 Wall Street open as attention focused on Ether (ETH).

Anticipation rises over ETH price move

Data from Cointelegraph Markets Pro and TradingView tracked repeat BTC price action within a narrow intraday range.

The largest cryptocurrency saw new February highs of $43,515 on Bitstamp the day prior before giving back all its gains, only to attempt a reclaim after the daily close.

Overall, however, BTC/USD lacked direction, and traders turned to more interesting activity for largest altcoin Ether.

“Bitcoin remains in between levels,” Michaël van de Poppe, founder and CEO of MN Trading, wrote in a post on X (formerly Twitter).

“This means that there’s still a period of consolidation, from which I think that Ethereum is going to start outperforming, especially if the upgrades are going to be a success. Pre-halving perhaps $48K.”

Popular trader and analyst Rekt Capital suggested that ETH/USD might even copy the move that saw it spike to 18-month highs last month.

$ETH already showing signs of price stability at this ~$2274 Range Low support

Still technically positioning itself for a repeat of last month’s move#ETH #Crypto #Ethereum https://t.co/3ljv7fTkm4 pic.twitter.com/zerO7PfOlJ

— Rekt Capital (@rektcapital) February 6, 2024

Discussing altcoins in general over the weekend, Rekt Capital concluded that broad consolidation within a narrowing wedge construction was still in progress, but that bulls could take charge.

“A breakout from here would likely kickstart the Q1 Altcoin Hype Cycle,” part of X comments stated about the aggregate altcoin market cap.

Bitcoin ETFs record 7th day of net inflows

The latest developments among the United States spot Bitcoin exchange-traded funds (ETFs) meanwhile continued to offer encouraging signals.

Related: 3 Bitcoin price forecasts calling new all-time highs and more in 2024

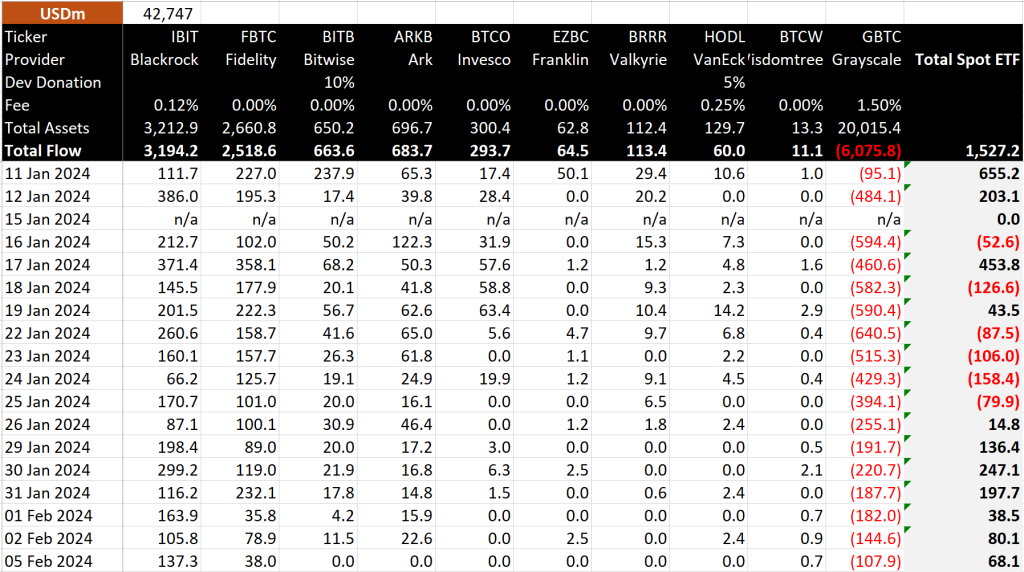

Outflows from the Grayscale Bitcoin Trust (GBTC) were once again lower than the previous week at around 2,600 BTC ($114 million), per data from crypto intelligence firm Arkham.

“Yesterday’s ETF net flows saw another +$68M increase. That makes 7 consecutive positive days of net inflows,” popular trader Daan Crypto Trades noted while uploading the figures to X.

Today’s #Bitcoin Sent to out by $GBTC/Grayscale comes out to be ~2.6K $BTC or ~$114M worth.

Same as yesterday!

Yesterday’s ETF net flows saw another +$68M increase.

That makes 7 consecutive positive days of net inflows. https://t.co/aT85g7jQzC pic.twitter.com/EtOMvn4UDn

— Daan Crypto Trades (@DaanCrypto) February 6, 2024

BitMEX Research, the analysis arm of crypto exchange BitMEX, called the latest inflows tally a good result for leader BlackRock but a “slow day” for other ETF providers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Here you can find 76605 more Information to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Here you will find 63215 additional Information to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] There you can find 14688 additional Info on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4152/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4152/ […]