Why is Ether (ETH) price up today?

Ethereum price is up today as an uptick in network activity and investors’ expectation of a spot ETF approval in 2024 raise interest in ETH.

In the weeks leading up to the spot Bitcoin ETF approval, Ether (ETH) price secured a year-to-date high above $2,700 but sold off alongside the wider market after the ETF approval. This week, Ether price aims to kick-start a recovery that is fueled by increasing network activity

Let’s look at the factors driving Ether’s price.

Significant rise in network activity

Ethereum, the largest layer 1 blockchain by total value locked, is witnessing a significant rise in network activity.

Data from market intelligence firm Santiment shows 101,000 new ETH addresses daily and 484,000 unique addresses interacting with the blockchain and the network activity at approximately 30% more than it was 90 days ago. This suggests more users are transacting on the network, deploying smart contracts and building decentralized applications (DApps).

Santiment said,

“#Ethereum has returned to a $2,345 value for the first time since its fall began on January 22nd. The network is encouragingly rising in active addresses and network growth. The increased utility is a primary pillar to justify an increasing $ETH market cap”

Growing optimism for a spot Ethereum ETF approval

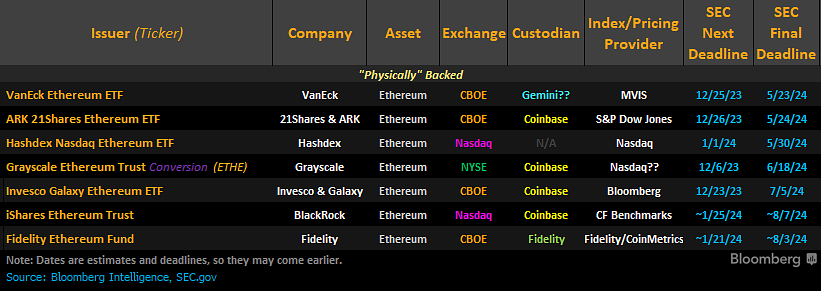

After 11 spot Bitcoin ETFs were approved by the U.S. Securities and Exchange Commission (SEC) on Jan. 10, the broader crypto market is now wondering whether a spot Ethereum ETF will come next.

Traders expect a spot ETH ETF approval also anticipater Ether’s price to rise significantly in the days leading up to and after the approval on May 23.

“Heading into the expected approval date on May 23, we expect ETH prices to track, or outperform, Bitcoin (BTC) during the comparable period,” Standard Chartered Bank said in a report on Jan. 30.

$BTC hit a peak of $48.6K on January but closed at $42K. Price is still down despite bullish sentiments post-ETF approval.

Meanwhile, eyes are on $ETH as StanChart analysts predict Ethereum to outperform Bitcoin when Spot ETH ETF gets approved on May 23.Are you bullish on ETH…

— QT (@QTDefi) February 1, 2024

X social network user Elja, shared similar sentiments, suggesting Ether could eventually hit $10,000.

#Ethereum $,?

➡️ Standard Chartered Bank predicts a spot ETH ETF by May 2024

➡️ Ethereum is following the last bull run fractal which can pump it past $15,000

➡️ Except Bitcoin, ETH is the only asset which as been deemed as a commodity by… pic.twitter.com/Oi1z4GGCUO

— Elja (@Eljaboom) February 1, 2024

Related: Ethereum closes in on Dencun mainnet following Sepolia activation

Ether trades above a strong support zone

From a technical perspective, ETH is sitting on a strong support zone compared to the resistance it faces in its recovery path. Data from IntoTheBlock shows that the immediate support around $2,250 is within the $2,230 and $2,297 price range, where roughly 3.38 million ETH were previously bought by about 2.95 million addresses

The ETH/USD daily chart below shows that the price has been oscillating around this level since Dec. 5, 2023, suggesting that the level is important for buyers and sellers.

If the bulls manage to hold above this level, they could push the price above the 50-day exponential moving average at $2,306, with a key level to watch on the upside being $2,500.

On the other hand, sellers could pull the price below this level with the 100-day EMA at $2,190, providing the first major support. More defense lines could emerge from the 200-day EMa at $2,039 and the $2,000 demand level.

… [Trackback]

[…] Here you can find 64971 more Info to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] There you will find 82037 more Info on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] There you will find 95378 more Information to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Here you will find 48487 additional Information on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] There you will find 10395 additional Information to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] There you will find 3865 additional Info on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Here you will find 68815 more Info on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Here you can find 14356 more Info to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] There you can find 31233 additional Info on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/ethereum/4006/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4006/ […]