Celsius moves a massive $1B in Ethereum to CEXs: Repayments incoming?

The bankrupt crypto lender moved a whopping 443,961 ETH to Coinbase Prime, Paxos, and FalconX wallets over 13 transactions on Jan. 25.

Defunct crypto lending platform Celsius has been seen moving large amounts of Ether (ETH) to centralized exchanges amid creditor expectations the firm will start repaying creditors in liquid crypto in mid-February.

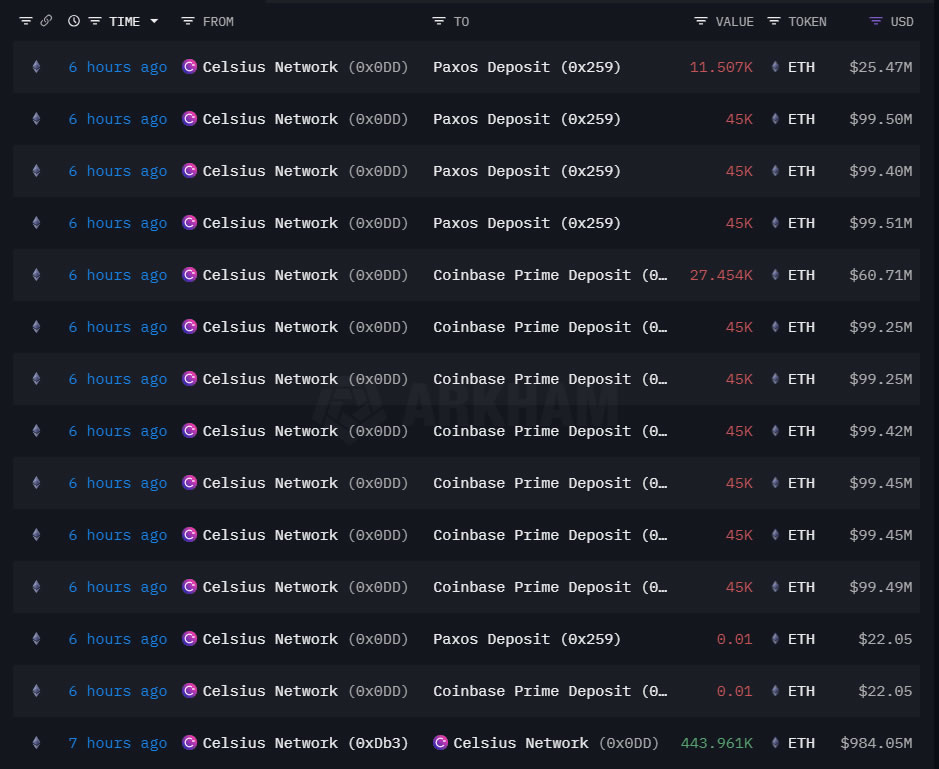

On Jan. 26, there were several large transactions of Ether from the Celsius Network wallet to deposit wallets for Paxos and Coinbase Prime.

The largest transaction was for 443,961 ETH worth $984 million at the time of the transfer from Celsius to another network-controlled wallet in preparation for moving.

443,961 #ETH (982,202,866 USD) transferred from #Celsius to unknown wallethttps://t.co/39EY8uFFqa

— Whale Alert (@whale_alert) January 25, 2024

A total of 13 transactions followed over the next hour, moving this huge tranche of ETH to Coinbase and Paxos wallets, according to blockchain intelligence firm Arkham.

Spotonchain reported that “most of the 297,454 ETH sent to Coinbase was distributed to 12 fresh wallets, probably as part of an OTC deal.”

Only two days earlier, Celsius moved 575,081 ETH on Jan. 24 using addresses labeled Celsius Network: Staked ETH and Celsius Network: Eth2 Depositor in an internal transaction.

Overall, Celsius Network has moved 757,626 ETH to FalconX, Coinbase, OKX, and Paxos since Nov. 13, 2023, it stated, adding that currently, Celsius still holds 62,469 ETH valued at $138.8 million at current prices.

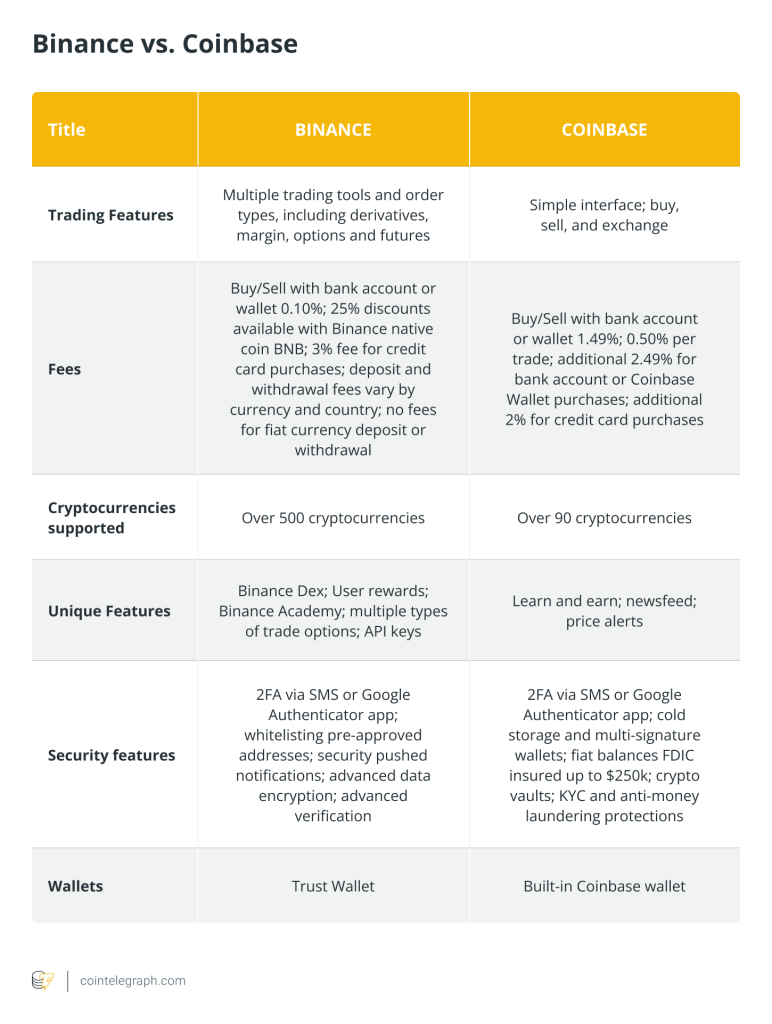

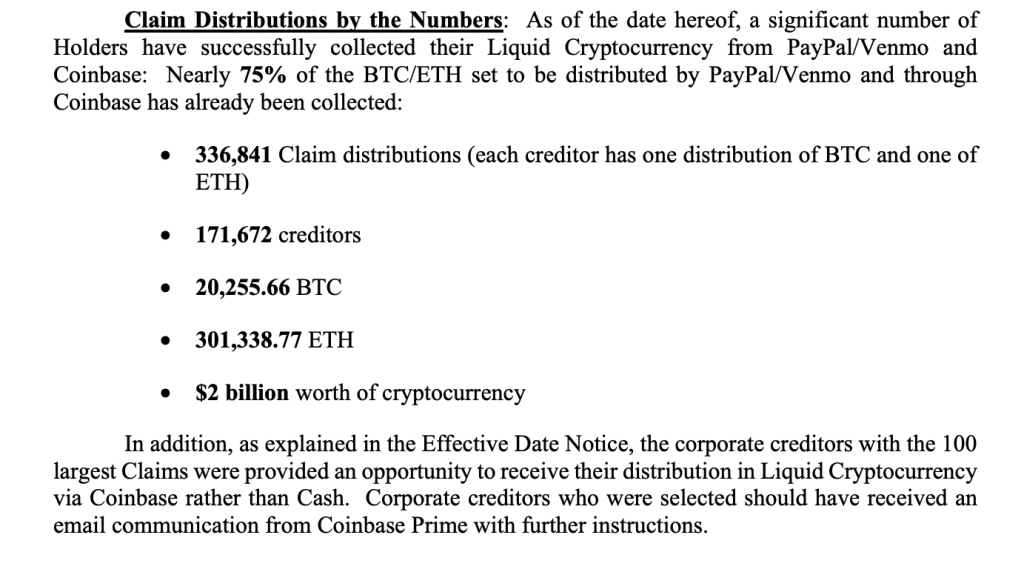

The exact reasons for the recent Ether transactions are not immediately clear. However, according to a Celsius asset distribution FAQ updated on Jan. 12, a limited number of corporate accounts will be able to receive cryptocurrency through Coinbase.

For non-corporate accounts, distributions to creditors residing in the United States will be made via PayPal, and distributions to creditors outside of the U.S. will be made by Coinbase, it stated.

A community of Celsius creditors on X, named “Celsius NewCo Community” said they expect the distribution of liquid crypto to Earn Creditors to start in mid-February, adding that the distribution window will be open for one year.

Celsius is aiming for an Effective Date of January 31st.

️ We expect the distribution of liquid crypto to Earn Creditors to start in mid-February.

⏳ The distribution window will be open for one year. pic.twitter.com/TznON0ddBV

— Celsius NewCo Community (@CelsiusNewCo) January 25, 2024

Meanwhile, Celsius user “TheHawk” reported that they had officially been able to remove all of their ETH from Celsius, adding that funds were in the custody account, not the Earn account.

Between Jan. 8 and 12, Celsius transferred another $95.5 million to Coinbase, while $29.7 million was transferred to FalconX, according to data from Arkham Intelligence.

Related: Celsius transfers $125M of ETH to exchanges as FTX and Alameda dump

Earlier in the month, the bankrupt lending firm stated that it had begun shifting assets to “ensure ample liquidity” in preparation for any asset distributions.

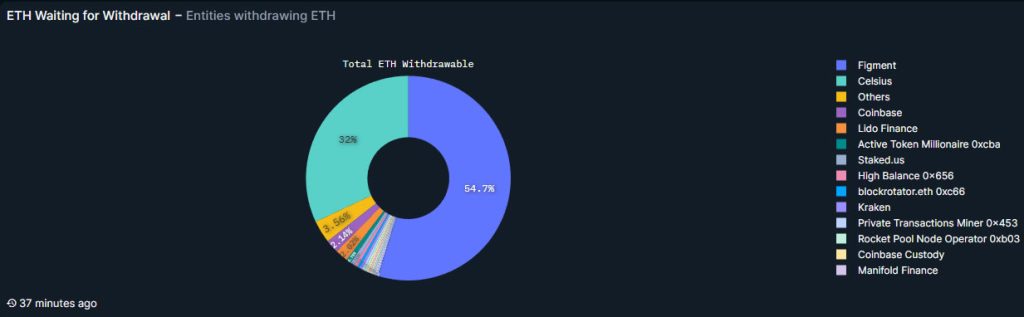

Celsius said it will unstake its existing Ether holdings to “offset certain costs incurred throughout the restructuring process” and “unlock ETH to ensure timely distributions to creditors.” It no longer has any ETH pending staking withdrawal, according to Nansen.

On Jan. 9, Celsius bankruptcy administrators filed an intent to notify its creditors that account holders who withdrew more than $100,000 in the 90 days before the date of the firm’s bankruptcy declaration on July 13, 2022, may be required to return them by Jan. 31, 2024.

ETH prices have yet to react, remaining flat on the day at $2,225 at the time of writing.

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] There you can find 4313 additional Info on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Here you will find 80719 additional Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Here you can find 41711 more Information to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3633/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/3633/ […]