Why is Ethereum (ETH) price down today?

Ether price is down today as rising Bitcoin dominance snatches the spotlight away from ETH and altcoins.

Ether (ETH) price is down by 3.18% on Jan. 9 and the recent price correction comes amid reduced activity on the Ethereum network and investors choosing to focus on Bitcoin (BTC) with the looming spot ETF decision.

Let’s investigate the reasons why Ether price is down today.

Bitcoin price action and spot ETF news dominate headlines

The Ether sell-off comes as Bitcoin continues to dominate the crypto markets with an expected spot BTC ETF approval likely on Jan. 10. While some analysts believe the spot Bitcoin ETF approval could benefit Ether price in the long run, the second largest digital asset is down 0.5% to begin 2024.

Bitcoin dominance reached 50% on Oct. 15, 2023, and has not dipped below that key level since. While dominance waned on Dec. 30, 2023, it quickly shot up to start 2024. Bitcoin dominance versus the crypto market is at 53% on Jan. 9.

Typically, decreasing Bitcoin dominance is positive for crypto markets, signaling a potential altseason, but the results have yet to arrive.

Related: MicroStrategy is already up nearly $1B from Bitcoin in 2024

Ethereum revenue and fees waiver

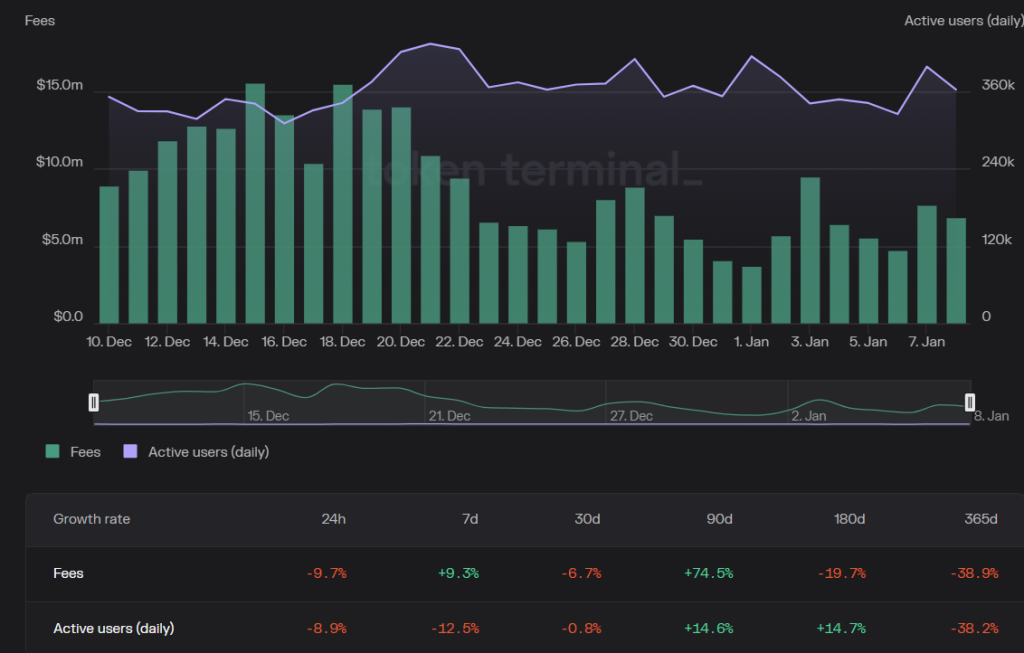

Ether price fell coinciding with Ethereum network fees plummeting. Ethereum network fees have fallen 10% in 24 hours on Jan. 9 and 6.7% in 30-days. Current daily fees are at $6.9 million compared to a monthly high of $15.5 million recorded on Dec. 15, 2023.

Correlating with the fee drop off, Ethereum network registered lower daily active users (DAUs) of 325,255 on Jan. 9, a 12.5% decrease in 7 days.

Related: Which gaming guild positioned itself best for the bull market?

The major decrease in volume comes as other protocols, including the Bitcoin BRC-20 standard and Solana (SOL) gain momentum.

ETH traders have mixed expectations for 2024

Market analysts are showing contrasting perspectives in regard to Ether’s shorter and medium-term price performance. While looking at technical price aspects of Ether’s movement, veteran trader Peter Brandt suggested that Ether is a short trade if the price falls below $2,100.

I know in advance that this Tweet will land like an egg dropped onto a pile of scrap metal. My bias remains to be short $ETH. I'm a swing trader in ETH, not a hodler. The chart lacks underlying strength IMO. If I go short below 2100 and am wrong, that's not a big deal to me. pic.twitter.com/bWEflcoNn0

— Peter Brandt (@PeterLBrandt) January 9, 2024

On the other hand, independent market analyst Scott Melker highlighted potentially oversold conditions by pointing to a bullish divergence in the ETH/BTC pair on the weekly timeframe.

$ETH / $BTC

Just hit the last key support on the chart at .0492, which I have been watching for weeks.

Oversold on weekly RSI, potential bullish divergence.

Give me, please. pic.twitter.com/ci0FiPg1LQ

— The Wolf Of All Streets (@scottmelker) January 9, 2024

Investors’ appetite for high-risk assets and their interest in DeFi could continue to diminish if macro events, the emergence of new blockchains and a reduction in volume. The eventual increase in Ethereum network-based protocols and the potential of a spot Ether ETF may prove to be a long-term catalyst for price growth.

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] There you can find 69621 additional Information on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Here you will find 25331 more Information on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Here you will find 61983 additional Information on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Here you will find 68788 additional Information on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/ethereum/1770/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/1770/ […]