3 Ethereum price metrics point to further downside in ETH

ETH price continues to underperform Bitcoin price, and the downside is set to continue.

After rallying to 26% to $3,563 leading into the launch of spot Ethereum ETFs, Ether (ETH) price has underperformed over the last month compared to Bitcoin and the broader crypto market. This underperformance has led traders to question whether the altcoin will have a sustained recovery. ETH price is down 4.3% over the last seven days and 2.11% over the last month.

To put this into context, Bitcoin (BTC) price climbed by 7.7% over the last 30 days, while the total cryptocurrency market capitalization rose by 6.2% over the same period.

and other top layer 1 tokens. BTC’s price has rallied 7% over the last 30 days, while other top-cap layer 1 tokens, Solana’s SOL and Cardano’s (ADA), have rallied 27A number of market and technical indicators show that Ether is weakening and may record further losses before embarking on a sustained recovery.

Ether price has trailed Bitcoin since May

Ether has underperformed Bitcoin as well as other top layer 1 tokens. BTC price has rallied 7% over the last 30 days, while other top-cap layer 1 tokens, Solana’s SOL and Cardano’s (ADA) have rallied 27% and 6%, respectively, over the same timeframe.

Although the ETH/BTC ratio is up 5% over the last three days, it has underperformed on longer timeframes, dropping 14% between May 23 and July 30.

Currently, there are a number of reasons for ETH’s underperformance, including Ethereum-specific factors in 2024 such as outflows from US-based Ether exchange-traded funds (ETFs).

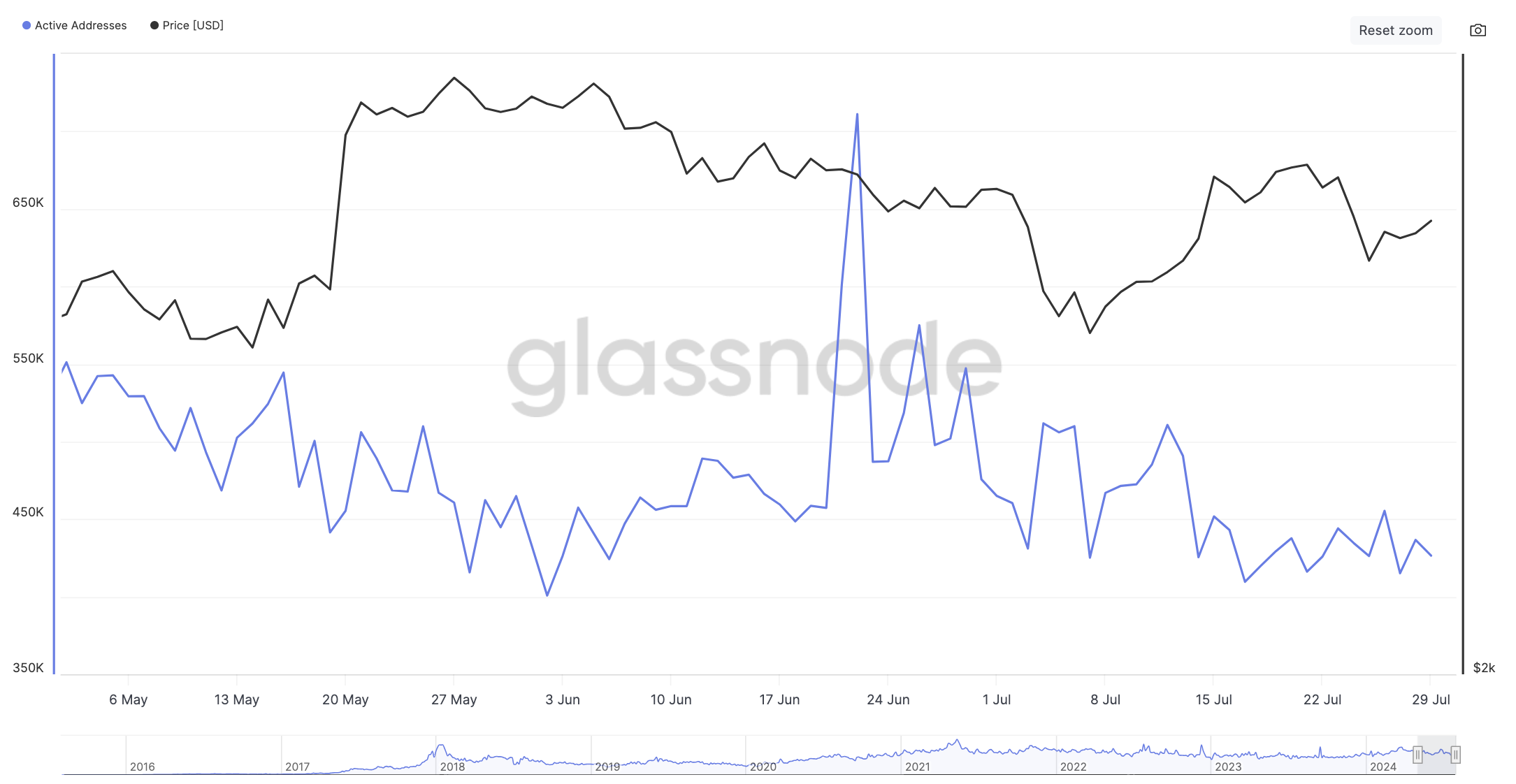

Moreover, Ethereum’s network activity (in specific metrics) has declined over the last month. Data from Glassnode shows that daily active addresses (DAA) on Ethereum dropped from 711,078 addresses on June 22 to 426,472 on July 10.

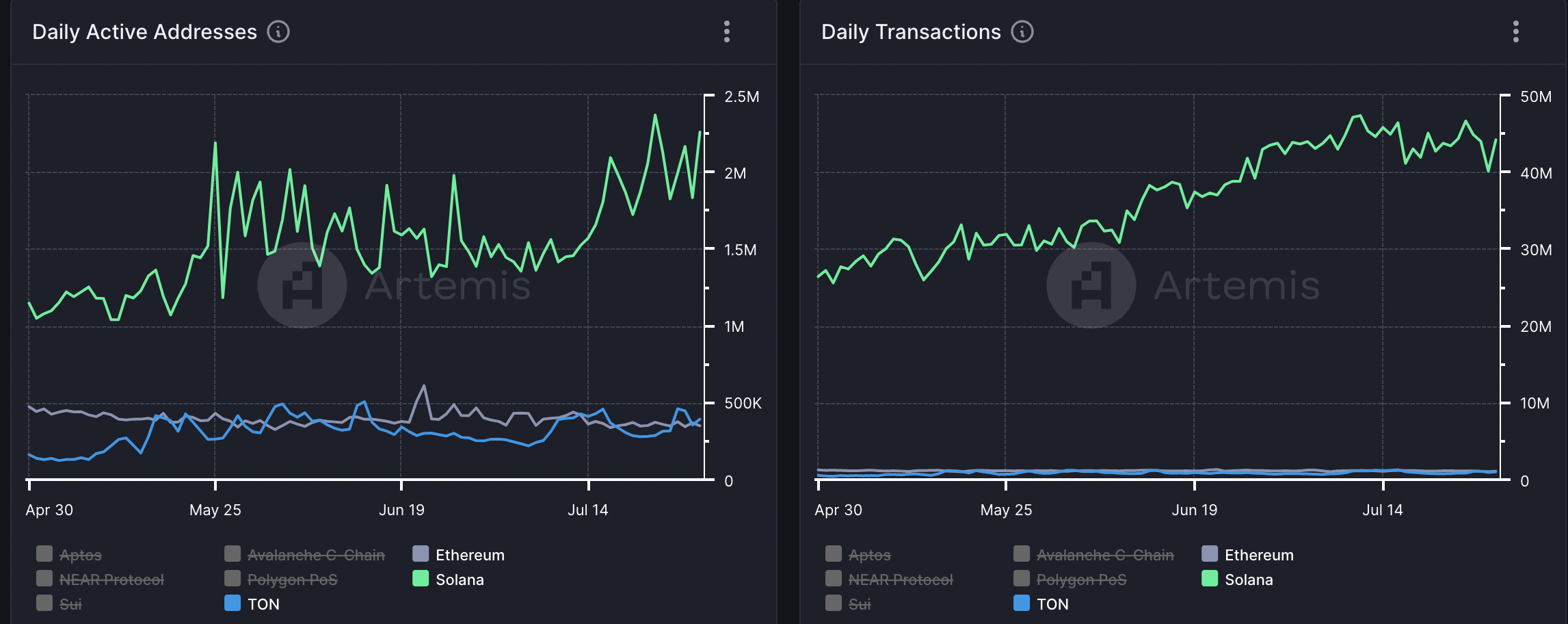

Although Ethereum remains the network to beat in the layer 1 sector, Solana has recently captured its market share in this segment in terms of onchain activity and total fees, among other onchain metrics.

Data from Artemis shows that Solana has dominated the layer-1 sector in terms of daily active addresses and daily transaction volume. TON and Ethereum have fought neck and neck since May 17 when Ton first surpassed Ethereum, gaining a foothold near the start of June, beating Ethereum DAAs.

Spot Ether ETF outflows weigh down ETH price

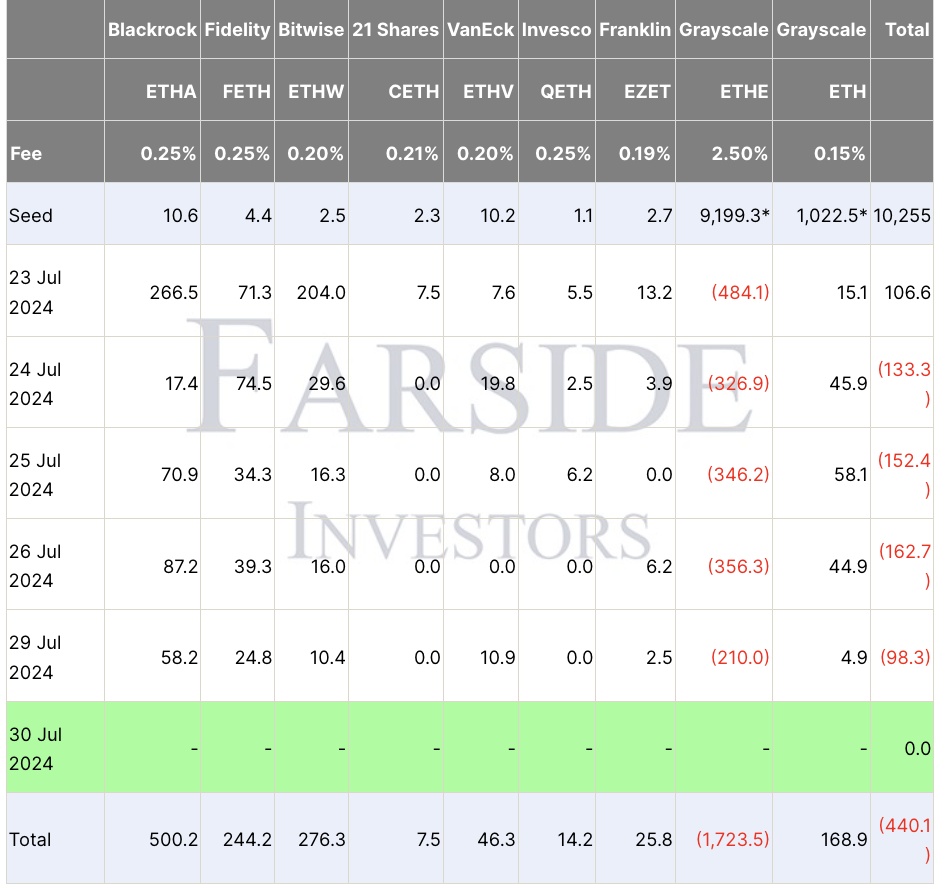

The newly launched spot ETH ETFs got off to a contrasting start, witnessing over $1.23 billion in inflows since they began trading on July 23. However, these inflows have been overwhelmed by more than $1.723 billion in net outflows from Grayscale’s converted ETHE product.

The combined net outflow for the spot Ethereum ETFs now stands at $440 million, according to data from Farside Investors.

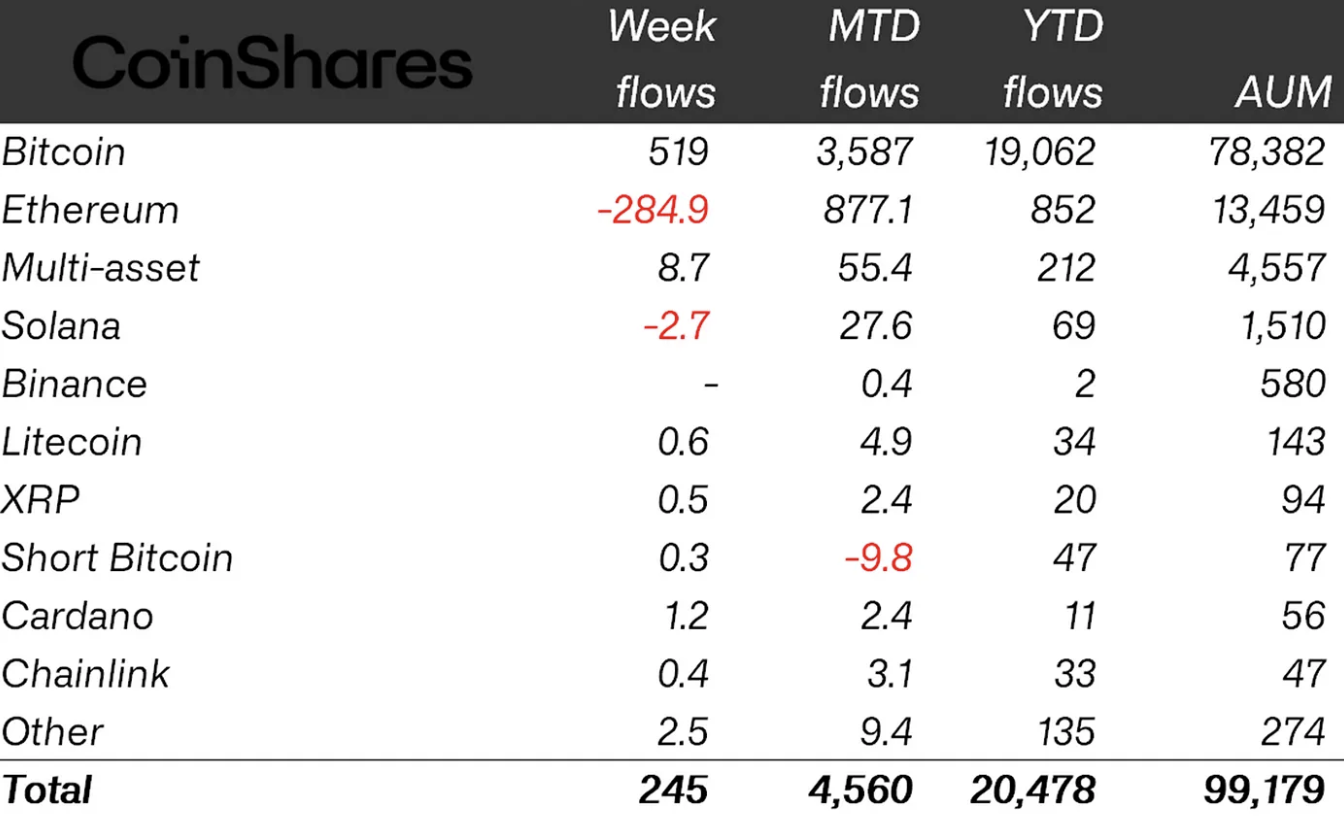

These gains coincide with $285 million worth of weekly inflows into Ethereum-based investment funds, including the US ETFs.

“This week saw continued outflows from Grayscale’s incumbent trust of US $1.5bn as some investors cash out, leading to a net outflow of US$285m last week,” says James Butterfill, researcher at asset management firm CoinShares.

Related: Trump’s Bitcoin push, spot Ether ETF debut, and more: Hodlers Digest, July 21-27

Ether bears establish resistance at $3,500

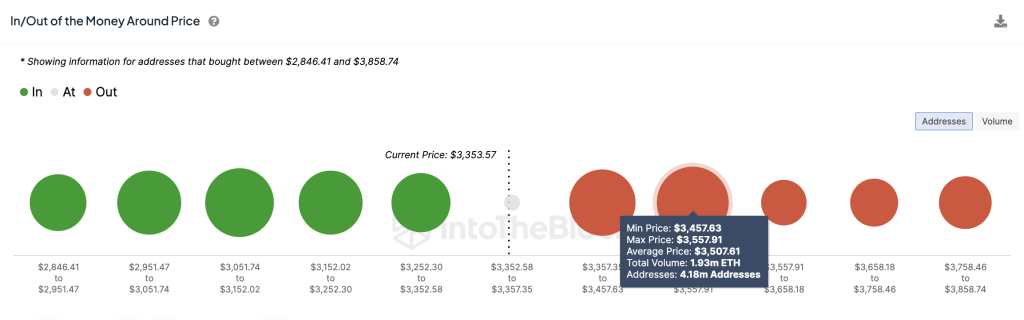

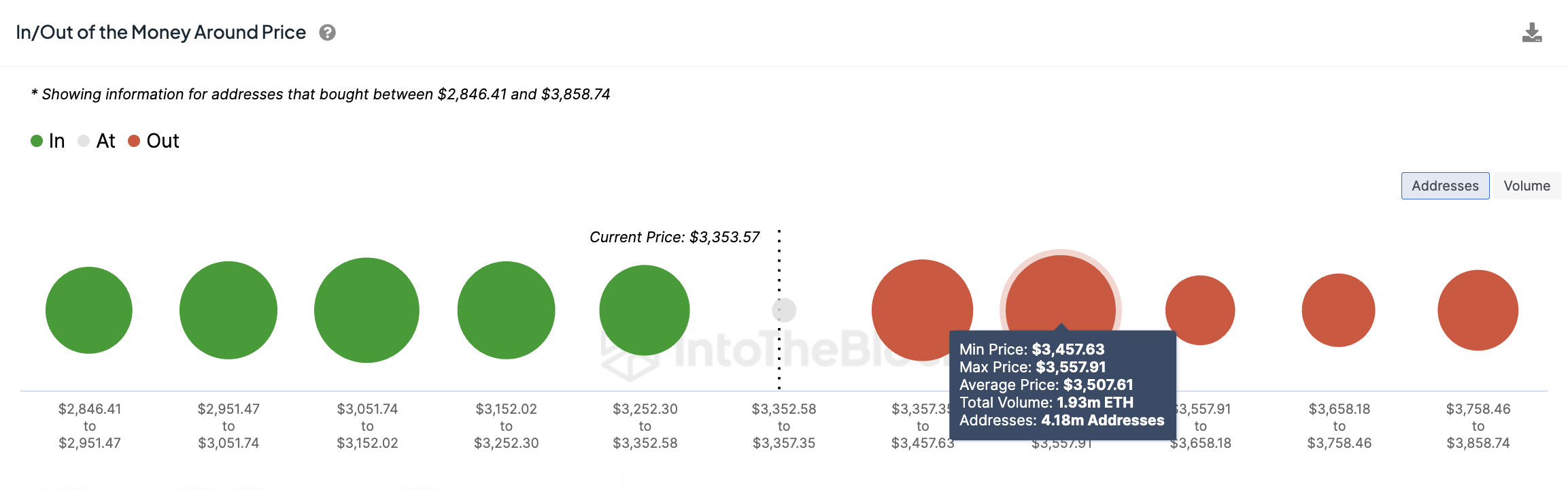

The continuous outflows from Ethereum-based funds are a reflection of a negative technical backdrop. Notably, Ether’s latest attempt at recovery was rejected by supply congestion from the $3,500 level. This is an indication that this area presents a stubborn barrier in ETH’s recovery path.

Data from IntoTheBlock reinforces the significance of this resistance zone. Its In/Out of the Money Around Price (IOMAP) model reveals that this area is within the $3,457 and $3,557 price range, where roughly 4.18 million addresses previously bought approximately 1.93 million ETH.

If this resistance level sees a high volume of activity from the sellers in the short term, Ether’s price is expected to sink deeper.

Responses