Rwandan central bank proceeds with ambitious retail CBDC project

The African country is eyeing a tokenized retail CBDC with offline transfer capabilities as it heads toward a cashless economy.

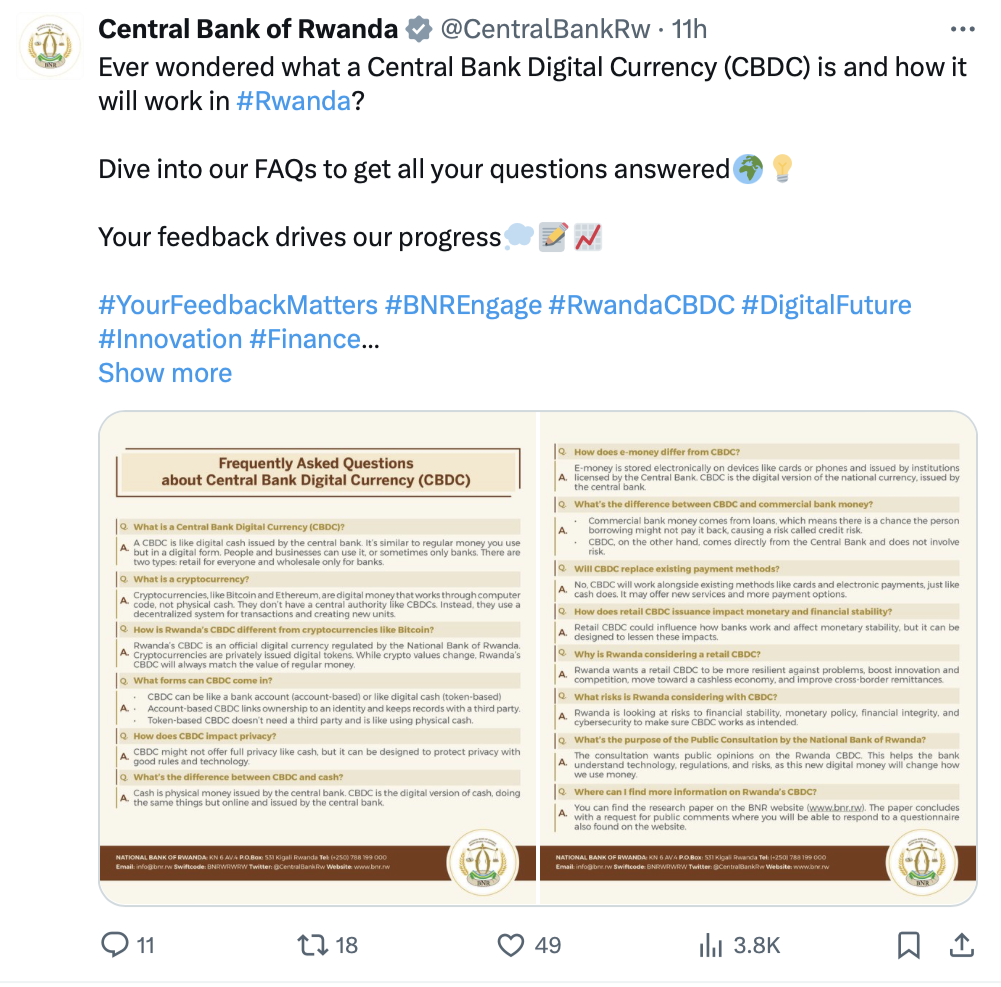

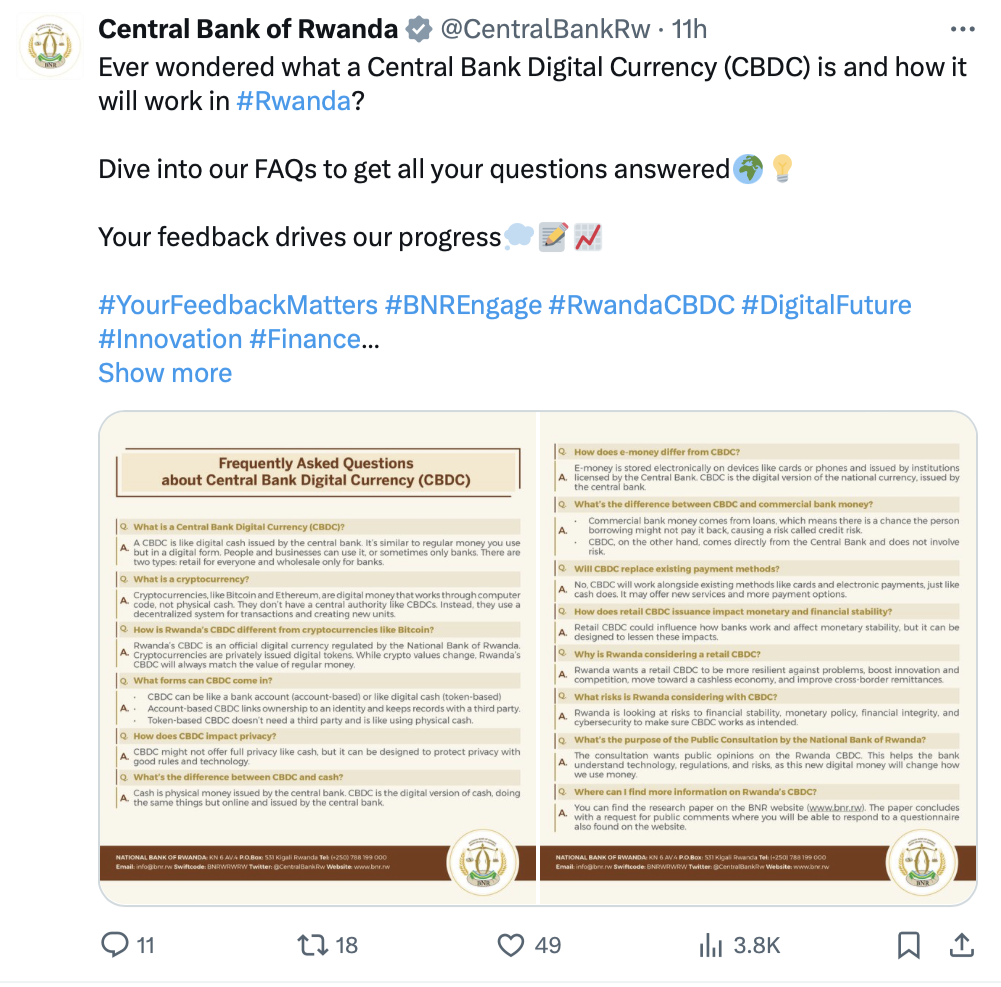

The National Bank of Rwanda (BNR) has opened up its just completed feasibility study on a retail central bank digital currency (CBDC) to public comment. The BNR is considering a national digital currency that incorporates the latest innovations in the technology and is highly tailored to local conditions.

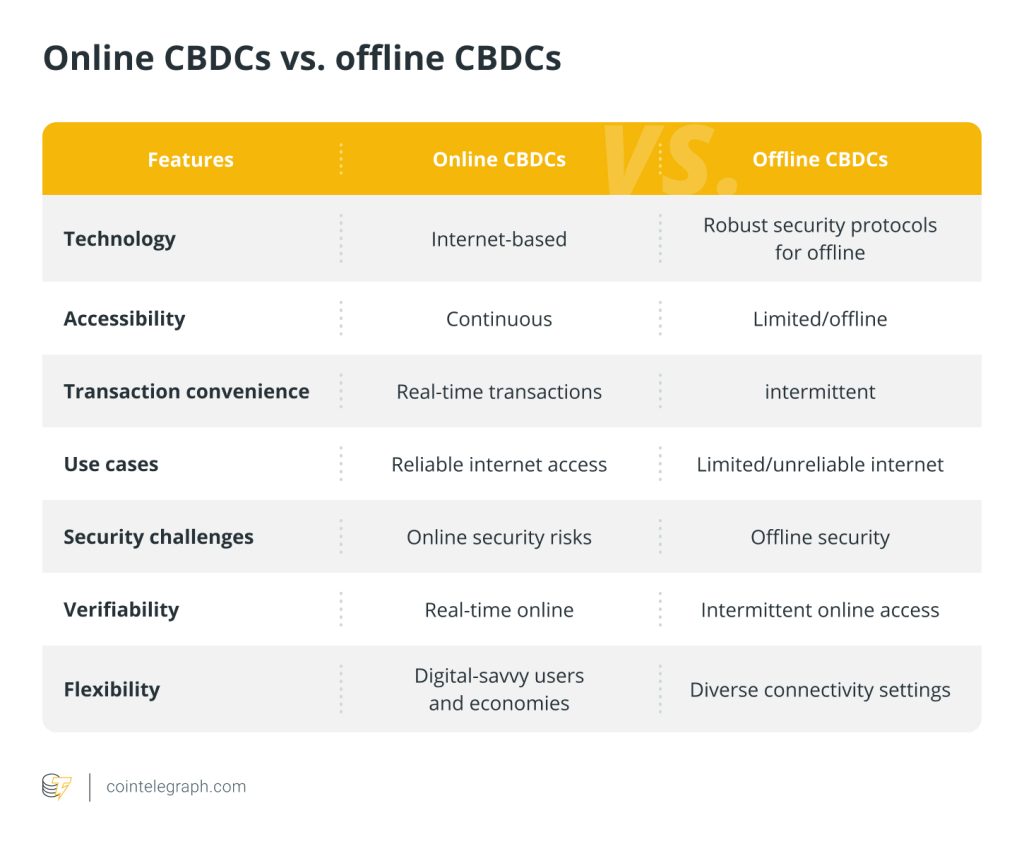

A retail CBDC would advance Rwanda’s cashless economy national initiative and increase the resilience of the financial system, which is still subject to frequent power outages, the BNR found. The central bank expects to spend $35 million on printing and maintaining its cash supply in the next five years, despite its cashless goal.

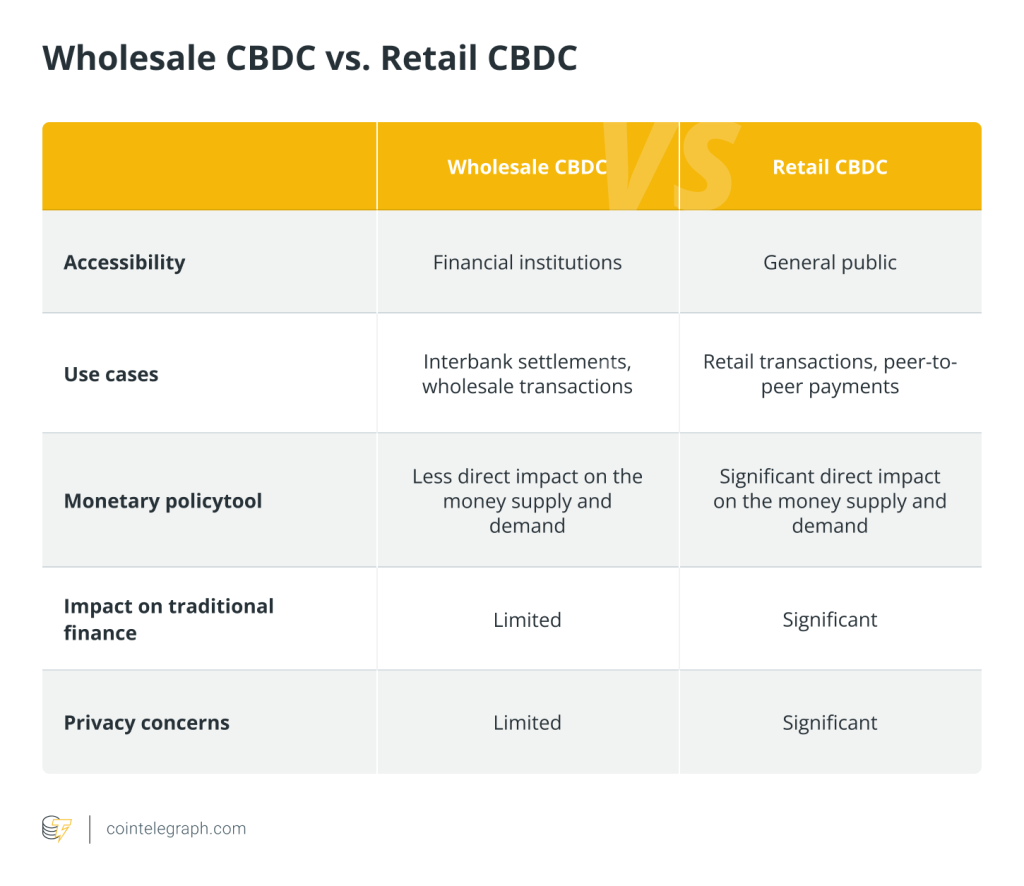

The BNR is proposing an interest-free, intermediated CBDC with interoperability with all the country’s existing payment systems and potentially other CBDCs. after the appropriate amendments to the country’s Central Bank Act are made. It recommended a token-based, rather than account-based, model with open programmability and smart contracts.

Tokenization would allow digital cash to be transferred offline using Bluetooth or Near Field Communication (NFC) technology and would not require a smartphone. This is in contrast to current electronic payment options.

Programmability would be a mixed blessing, the study noted:

“The advantages of open programmability, which facilitates value-added innovative products and services, are expected to outweigh the arguments of privacy and security.”

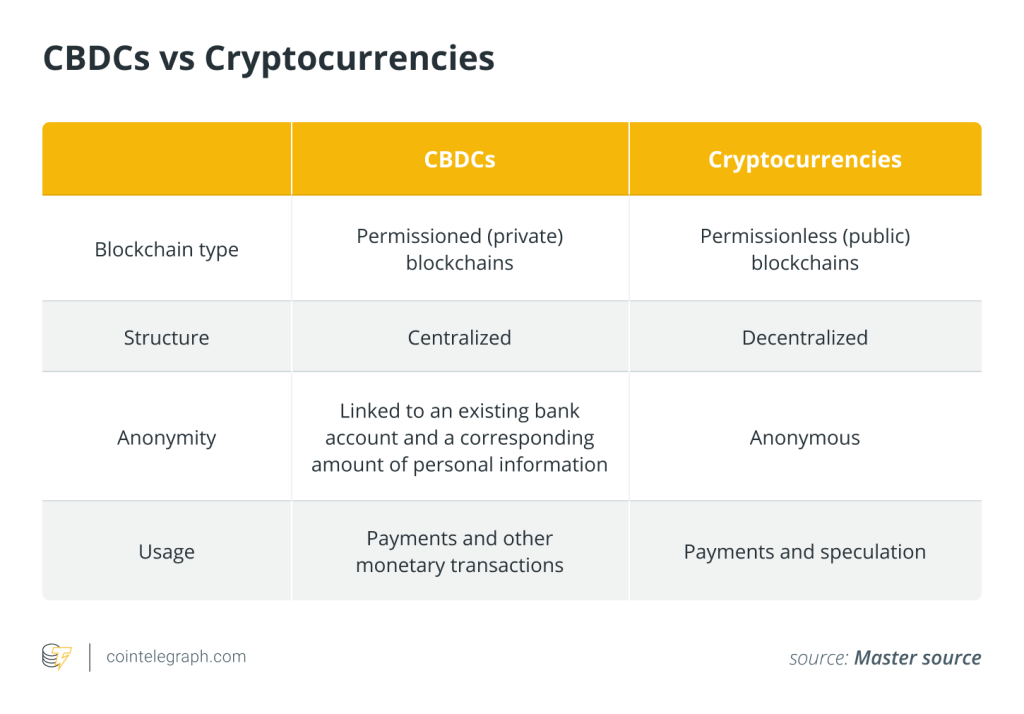

The BNR foresaw no more than “partial pseudo-anonymity” for the CBDC.

Related: BIS issues comprehensive paper on offline CBDC payments

Payment service providers currently make up less than 0.9% of the Rwandan financial sector. The sector is challenged by low financial literacy, high remittance costs and a large informal economy, among other things. The BNR noted that reducing the amount of cash in circulation could formalize more of the economy.

The study recommended the imposition of user fees and holding limits, without sorting out details. Public acceptance of a CBDC was also left an open question.

The BNR favored a distributed database model over a distributed ledger for increased reliability. Its analysis used the World Economic Forum’s CBDC Policy-Maker Toolkit.

Tokenized wholesale CBDC projects have been undertaken by Mastercard and Ripple, as well as the European Central Bank and the Bank for International Settlements’ new Project Agora. Tokenization in a retail CBDC may be an innovation. Offline CBDC transfers is also a subject of current research. China’s digital yuan features solutions similar to those proposed by the BNR.

Responses