Blockchain-based tech merges monetary theory to enhance crypto utility as payments

Combining technology, on-chain data and monetary theory can stabilize digital currencies and democratize access to advanced trading strategies.

Stability-focused cryptocurrency initiative Kelp introduces a unique blend of technology, on-chain data, AI, and monetary theory to offer a stabilized currency.

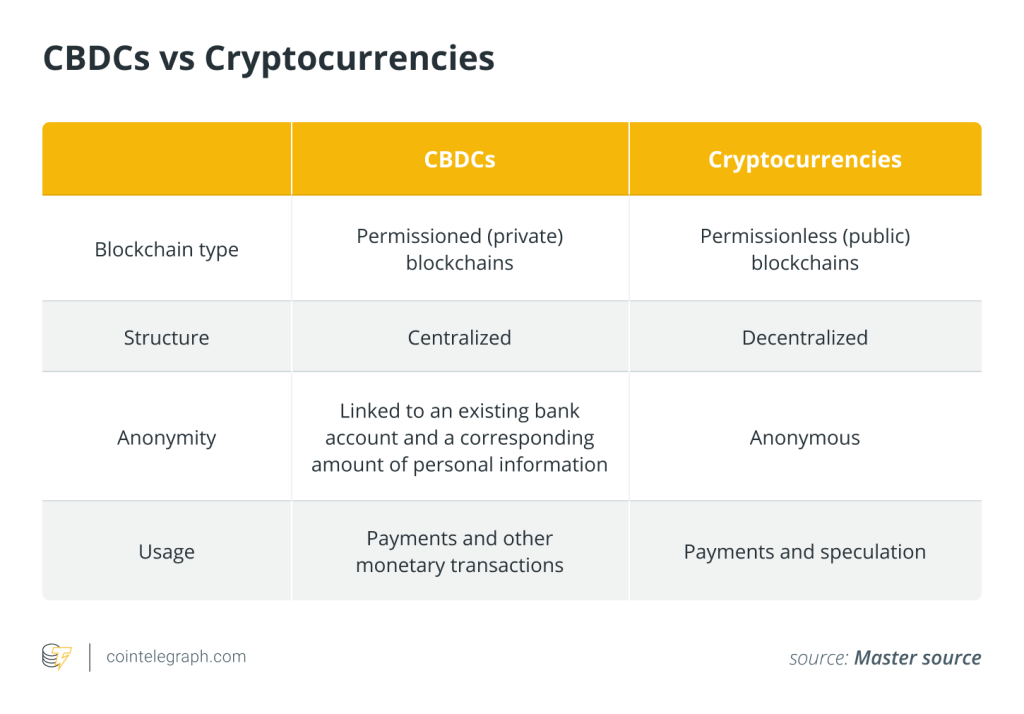

Cryptocurrencies have carved a niche that marries the decentralization ethos with the reality of market dynamics. The crypto market beckons the broader populace with the promise of an alternative financial system that is both inclusive and transparent.

Despite its potential, the crypto industry grapples with challenges that hinder its mass adoption and utility, such as volatility and trust. The volatility is not just a symptom of speculative trading. It also reflects the nascent state of the underlying technology and the market’s ongoing struggle to find equilibrium amid varying supply and demand pressures.

Additionally, the industry faces significant regulatory hurdles. The global patchwork of crypto regulation – ranging from outright bans to enthusiastic embracement – displays traditional financial systems’ struggle to reconcile crypto’s decentralized nature with existing frameworks.

Compliance with these regulations, particularly those related to Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, presents a formidable challenge for crypto projects, necessitating innovative solutions to balance privacy with transparency.

A fresh take on making crypto useable as a currency

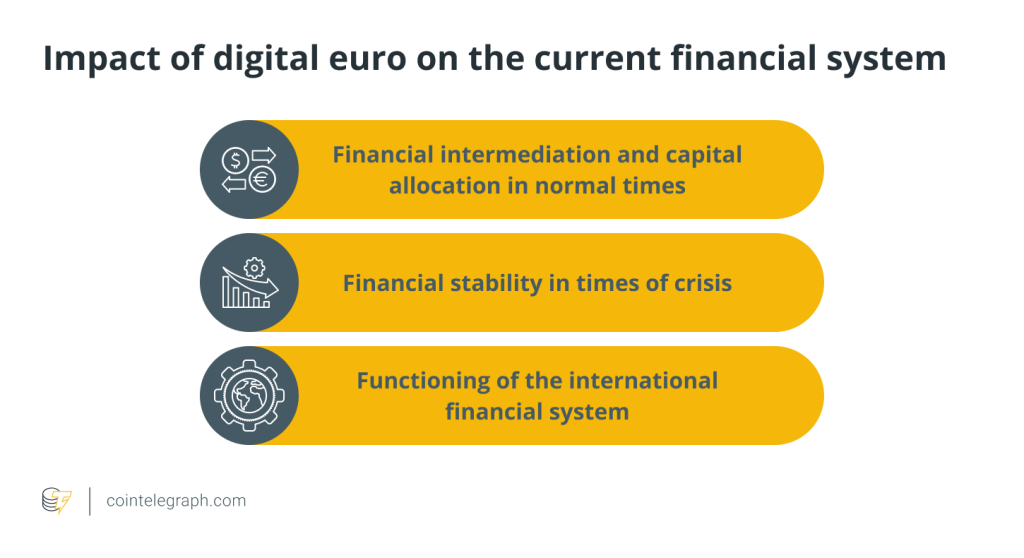

Enter Kelp, a cryptocurrency initiative that seeks to establish the next global reserve currency by addressing the challenges plaguing the industry through a unique blend of technology, on-chain data and monetary theory. Kelp distinguishes itself by employing a governance model governed by a monetary policy reminiscent of traditional fiat currencies.

At the heart of Kelp’s proposition is the Kelp Protocol, an algorithm designed to predict what the circulating supply should be in order to stabilize the price of Kelp based on a modified version of the quantity theory of money. Kelp’s approach aims to mitigate the price volatility of cryptocurrencies, making Kelp a more reliable store of value and medium of exchange.

The principles of central banking underpin Kelp’s stabilization mechanism within a decentralized framework. The synthesis allows for a stabilized currency that leverages blockchain technology for transparency and security.

How daily tasks and referrals democratizes decentralized access

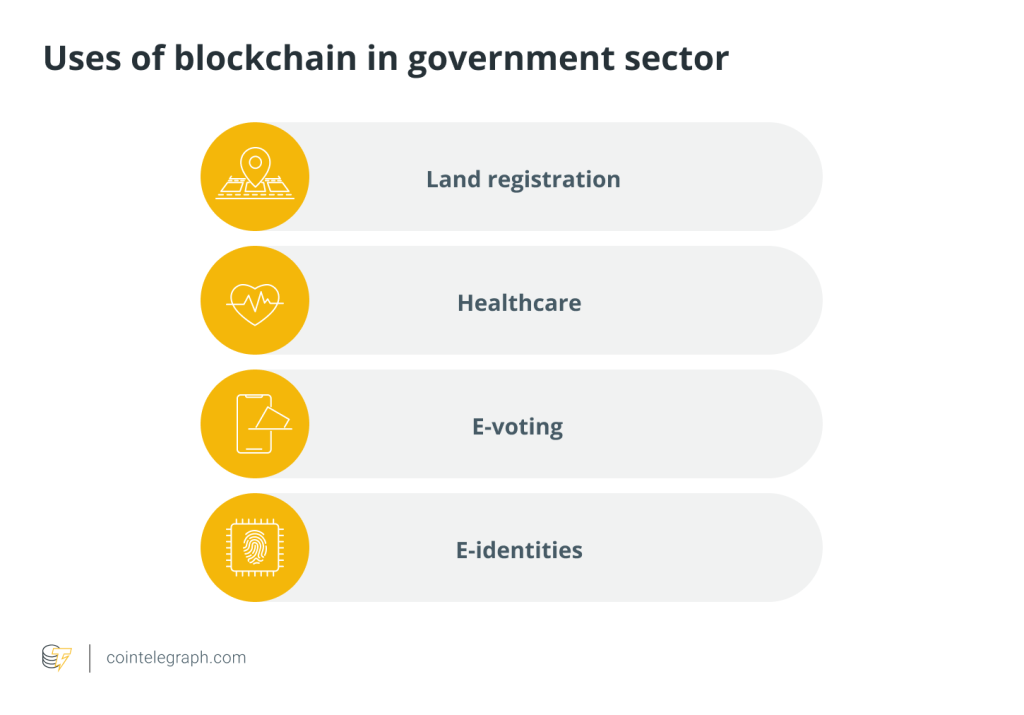

Allowing users globally to reserve Kelp before its launch, the platform’s Reservation Program democratizes participation in its new currency through simple daily tasks and referrals. Users can complete tasks to earn currency allocations without substantial upfront investments or deep technical knowledge.

Traditionally, hedge fund strategies have been the preserve of the wealthy, requiring significant capital and access to complex financial instruments. Kelp aims to break this perception and democratize hedge fund-style trading strategies with Kelp Autonomous Trading Engine, or KATE.

By navigating the complex landscape of global crypto regulation, Kelp aims to set a precedent for responsible and sustainable cryptocurrency development. Kelp has plans to maintain user privacy while adhering to KYC and AML guidelines, emphasizing continuous adaptation to regulatory changes.

The path forward for Kelp. Source: Kelp.org

This commitment extends to the project’s Token Release Strategy, which carefully regulates the introduction of new tokens into circulation, minimizing inflationary pressures and aligning with its objectives of achieving price stability and a minimum circulating supply.

Challenging Ripple in a race toward decentralized payments

Kelp is in the process of raising a $102 million presale to collateralize the token and support the ecosystem. The fundraising effort will help Kelp ensure liquidity and a stable foundation for the features it’s building. Kelp has currently raised over $270,000 toward this goal of “stable money for all.”

Kelp represents a nuanced approach to the challenges facing the cryptocurrency industry. By integrating monetary policy with blockchain technology, Kelp aspires to stabilize its currency and set a new standard for digital currencies. Its focus on regulatory compliance, community involvement and innovative stabilization mechanisms positions Kelp as a noteworthy participant in the ongoing evolution of the cryptocurrency space.

Responses