Hong Kong begins phase 2 of CBDC pilot

Hong Kong’s central bank will accept proposals on potential use cases of a digital Hong Kong dollar from industry participants until May 17.

The Hong Kong Monetary Authority (HKMA) has launched phase two of its e-Hong Kong dollar (e-HKD) pilot program and urged industry participants to apply and submit potential use cases for its central bank digital currency (CBDC).

On March 14, the HKMA announced that it started the second phase of the e-HKD pilot to explore the potential of a digital Hong Kong dollar. This includes diving deeper into key areas from the first phase, where an e-HKD could provide value. This includes programmability, tokenization and atomic settlement. Furthermore, the HKMA said it will also attempt to look into new use cases that were not covered in the previous phase.

The central bank urged market participants to apply, giving them until May 17 to submit their applications. The HKMA estimates that the second phase of the e-HKD pilot will last until mid-2025 to give the participants enough time to test and evaluate the use cases they are proposing.

The financial regulator also provided guidelines to those who want to participate in the pilot. According to the HKMA, applications will be assessed based on their innovative elements or uniqueness from existing market offerings, impact on consumer experience, readiness for market testing, compliance with existing regulations and how it maximizes e-HKD use in Hong Kong.

Related: Hong Kong’s crypto stance: Execs weigh in on Web3 in the region

The CBDC project was launched in 2021 as part of Hong Kong’s “Fintech 2025” strategy. On June 8, 2021, the central bank published its CBDC plans. It highlighted that it was part of the government’s broader efforts to promote digital finance adoption within the special administrative region by 2025.

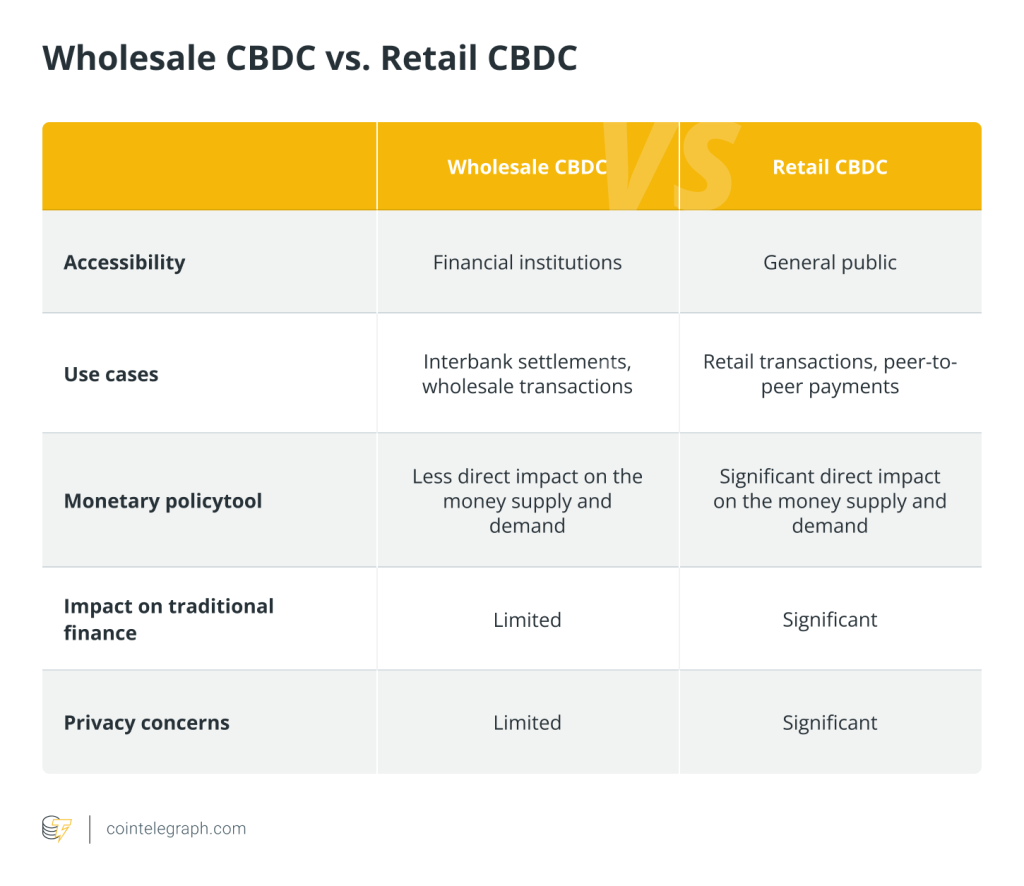

The central banking institution claims that it has been conducting research on CBDCs since 2017 to understand their potential applications. The HKMA said it is currently increasing its efforts to boost “Hong Kong’s readiness to issue CBDCs at both wholesale and retail levels.”

Prominent institutions, like payment processor Visa, participated in the e-HKD pilot. On Nov. 1, Visa completed its digital Hong Kong dollar pilot test with local banks HSBC and Hang Seng Bank. The pilot involved the tokenization of deposits where money was minted on a blockchain ledger with the backing of a balance sheet.

Responses