Judge finds Ripple Labs liable for $125M penalty in SEC case: Law Decoded

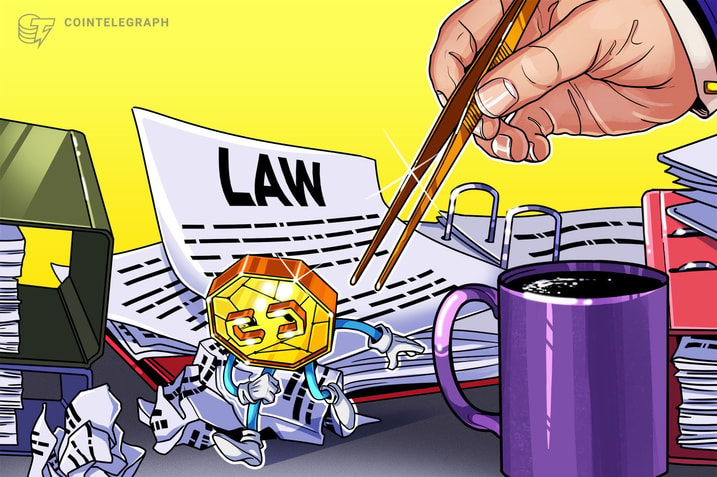

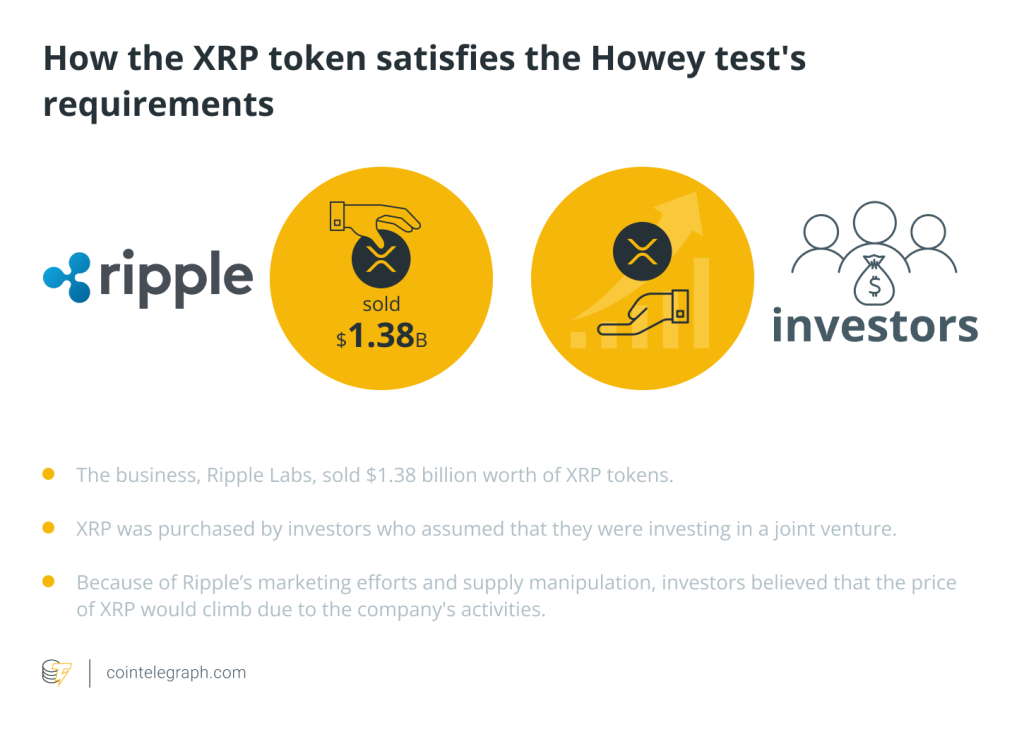

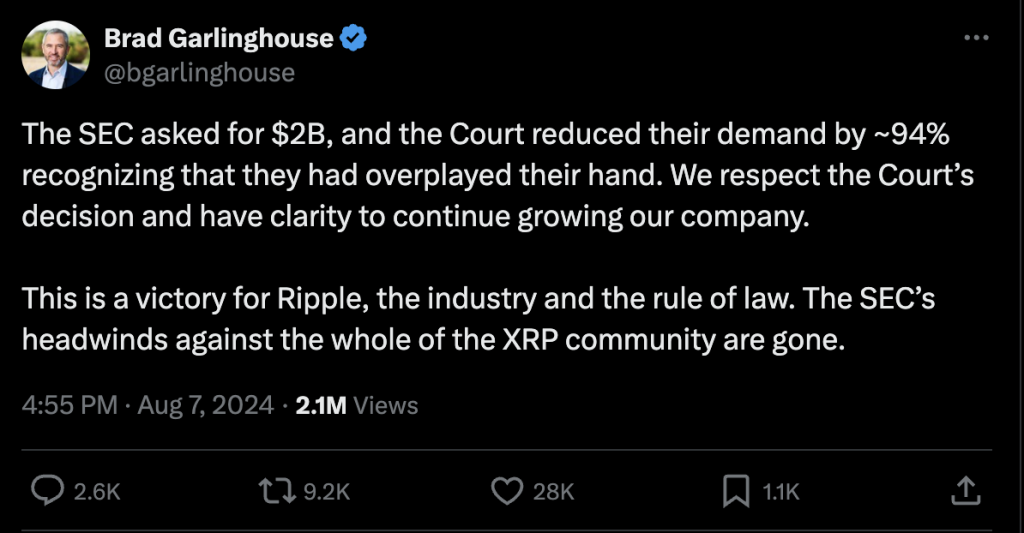

Ripple faces a $125 million civil penalty after a federal judge rules in favor of the SEC, rejecting the agency’s $2 billion claim.

On Aug. 7, a federal judge issued a $125 million civil penalty against Ripple Labs in the now-concluded United States Securities and Exchange Commission vs. Ripple case.

In the Aug. 7 filing in the US District Court for the Southern District of New York, Judge Analisa Torres found that Ripple Labs was “permanently restrained and enjoined” from violating US securities laws.

According to the filing, the civil penalty was expected to be paid to the SEC within 30 days. The judgment was given despite the US regulator arguing for a far bigger sum of $2 billion.

Based upon the court’s findings of Ripple’s expert report summarizing relevant contracts, the court found that “1,278 transactions violated Section 5,” resulting in the $125 million civil penalty.

Crypto coalition calls for “clear rules of the road” from Biden, Harris

A crypto coalition has called on the current US administration of President Joe Biden and Vice President Kamala Harris to provide a clearer digital asset regulatory framework to deliver “enormous economic and national security benefits” for the country.

On Aug. 7, the Crypto Market Integrity Coalition (CMIC) wrote to Biden and Harris asking for “clear rules of the road.”

The coalition group of crypto firms outlined that a clear road ahead would better protect US consumers from bad actors, secure America’s technological edge, and promote the US dollar.

The CMIC also stated that “public blockchains present an important opportunity” for the country to solidify its values and norms into “the global financial system.”

Continue reading

Russia legalizes Bitcoin and cryptocurrency mining

The President of Russia, Vladimir Putin, has approved legislation to reduce the country’s reliance on the US dollar in international trade.

The new law will take effect in November, enabling approved crypto-mining firms to register their companies through a state database.

Individual miners will also be allowed to mine digital currencies without official registration if their level of energy consumption remains below a specified threshold.

The Bank of Russia, the Ministry of Finance, and a select cabinet of Ministers within the Russian government will oversee the specific regulatory requirements over the coming months.

Continue reading

Customers Bank to strengthen AML compliance after Fed scrutiny

Directors of the crypto-friendly Customers Bancorp and subsidiary Customers Bank aim to polish their writing skills over the next two months in preparation for enforcement action against them.

According to the Aug. 5 filing, the US Federal Reserve Board executed the enforcement action due to deficiencies in management and Anti-Money Laundering practices.

The bank has 23 branches in 11 states and offers a distributed ledger-based Customer Bank Instant Transfer service, which allows customers to move money instantly 24/7.

Continue reading

Responses