Solana beats Ethereum in weekly total fees for the first time — Research

On July 28, Solana topped $5.5 million in daily total fees, the highest for the network in three months.

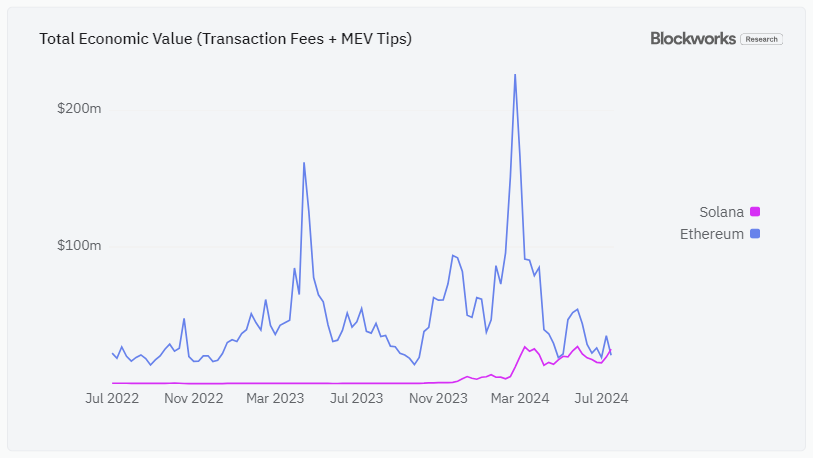

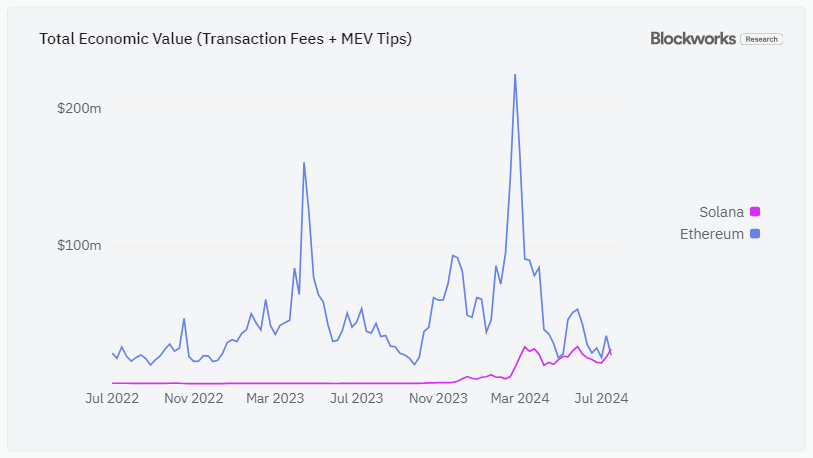

Layer-1 blockchain Solana surpassed rival Ethereum in weekly total fees for the first time in the week of July 22, clocking approximately $25 million in revenue versus Ethereum’s $21 million , according to Blockworks Research.

The purported “Ethereum killer” has been on a tear in 2024, aided by an ongoing frenzy of celebrity coin trading hosted largely on Solana-based memecoin platforms such as pump.fun and Moonshot. Memecoins now exceed $50 billion in total market capitalization.

Related: Pump.fun flips Ethereum in 24-hour revenue generation — DefiLlama

Total value locked (TVL) on Solana has soared to around $5.5 billion, a more than three times increase since the start of 2024, according to data from DeFiLlama. On July 28, Solana topped $5.5 million in daily total fees, the highest for the network in three months, according to Blockworks Research.

The total fee data encompasses all forms of revenue for Solana validators, including tips and maximum extractable value (MEV), Blockworks data analytics manager Dan Smith said in a post on the X platform. He added that 58% of fee revenue came from MEV tips and 37% from priority transaction fees.

“Solana validators and stakers are absolutely eating this cycle,” Smith said.

According to 21.co’s Dune analytics page, Solana stakers have earned cumulative rewards of more than $32 million and are currently clocking yields of approximately 7%. By comparison, Ether (ETH) is yielding 3.3% APR, according to StakingRewards.com.

Ethereum remains the undisputed leader by TVL, which currently stands at almost $60 billion, according to DefiLlama. It also hosts the largest number of protocols, at 1,135, according to DefiLlama.

The recent launch of celebrity coins on the Solana blockchain resulted in massive losses for holders, with most token values falling by over 99%, according X post by cryptocurrency analyst Slorg.

Even the “best performing” celeb coins “are down more than 70%, according to Slorg, who added:

“Exactly half are down over 99%, with 7 others being down more than 90%. Let me remind you this is only about a month into their lifespan.”

Responses