Bitcoin price shows strength as investors anticipate return of money printing

Bitcoin rallies as central bank stimulus packages become more common, and the Fed’s signal of “higher for longer” interest rates aligns with investors’ market view.

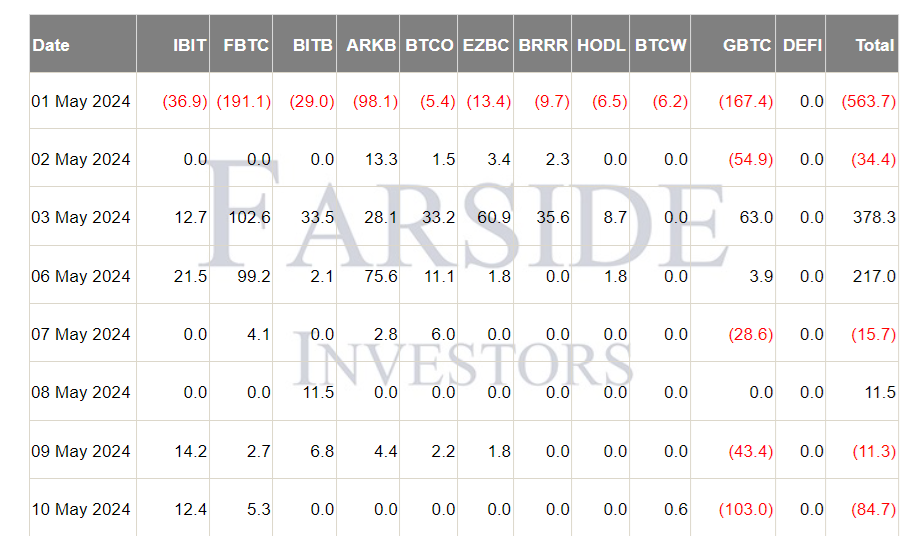

Bitcoin (BTC) rose by 2% in the last 24-hours, recovering after two days of difficulty in surpassing the $61,500 resistance. By sustaining price levels above $62,500, the current upside movement demonstrates that Bitcoin can still experience positive price fluctuations regardless of the U.S. spot Bitcoin exchange-traded fund (ETF) flows, which saw $100 million in net outflows over four days.

Several factors have improved sentiment toward cryptocurrencies, beginning with China’s announcement of issuing $138 million in long-term bonds to boost the economy. Although this was expected since the announcement in March, it reaffirmed that governments are acknowledging increased risks of recession. This was in response to data indicating that China’s aggregate credit decreased in April for the first time in seven years.

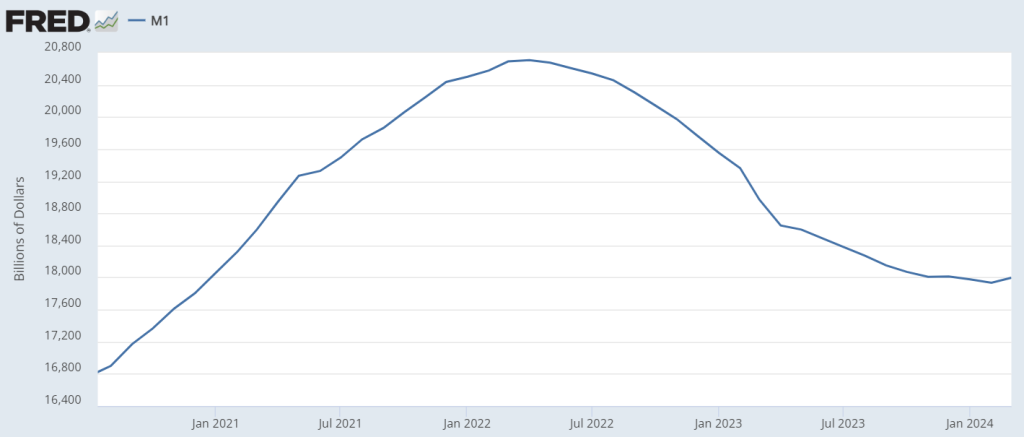

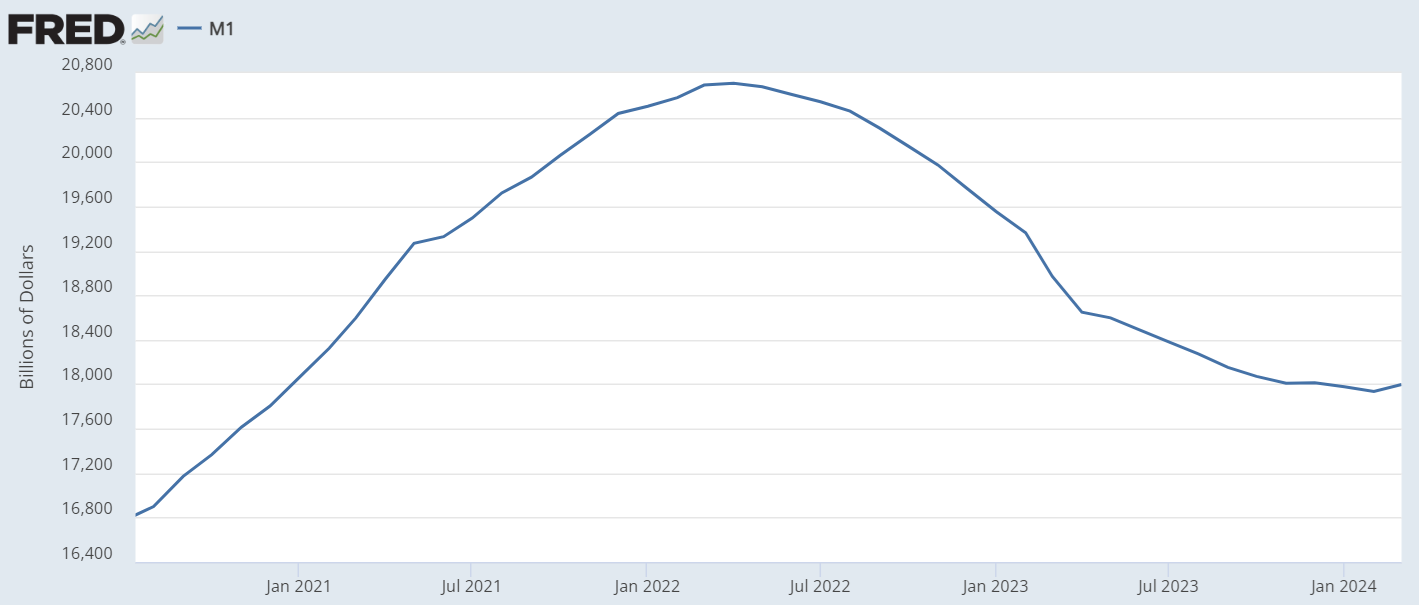

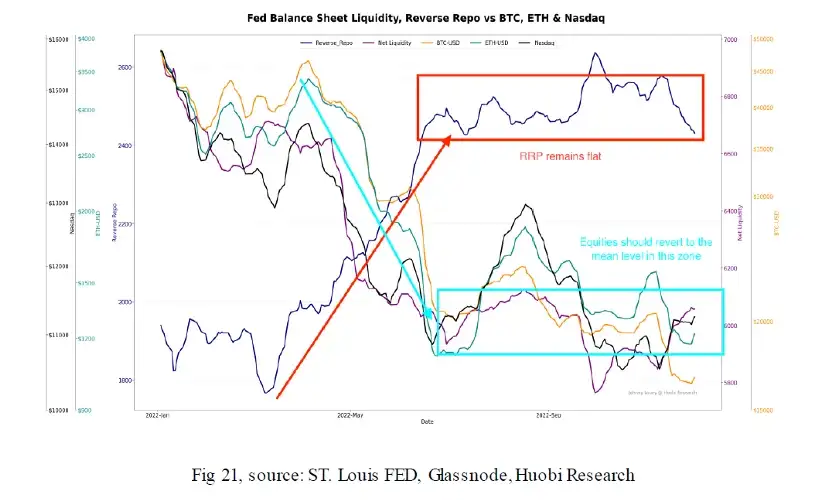

Zou Wang, an investment director at Shanghai Anfang Private Fund Management, told Reuters that the market now anticipates further liquidity injections from China’s central bank, possibly including cuts to interest rates. Such actions would exacerbate issues stemming from recent expansive measures by the U.S. Federal Reserve (Fed), which led to an increase in the U.S. monetary supply in March for the first time in two years.

At first glance, injecting more money into the economy seems beneficial, but it can lead to higher inflation over time, especially as companies and individuals might delay spending and investment. As fixed-income investors begin to recognize that their returns are barely keeping pace with rising inflation, scarce assets like Bitcoin could become more attractive.

Ultimately, investors are likely preparing for a continuous trend where governments will need to keep providing liquidity to forestall economic crises. While some might argue that the stock market would primarily benefit from this added liquidity, high interest rates adversely affect companies by raising their capital costs. Any debt issued in the past 16 years will encounter significantly higher rates upon refinancing.

Last week, Fed officials hinted that interest rates might stay elevated for an extended period, according to Yahoo Finance. Minneapolis Fed Chair Neel Kashkari notably stated, “I think it’s much more likely we would just sit here for longer than we expect,” and Chicago Fed Chair Austan Goolsbee remarked, “I think now we wait.” This strategy, while seemingly contradicting the push for increased liquidity, is carefully designed to delay inflationary pressures.

In essence, the U.S. central bank’s actions are intended to encourage more borrowing by companies and individuals to support employment and consumer markets. However, what the Fed cannot foresee is how much of this borrowed money will be spent on scarce assets to hedge against inflation, rather than stimulating the economy. It appears too early to fully evaluate such risks, but Bitcoin investors are skeptical about the Fed’s chances of achieving a soft landing.

Related: Japanese listed firm adds Bitcoin as reserve asset with 117 BTC

Additionally, Bitcoin’s value was influenced on May 13 by an unexpected factor: the return of social media influencer “Roaring Kitty,” a former marketer who played a pivotal role in the GameStop (GME) stock rally in 2021. Having been inactive on the X social network for nearly three years, the Bitcoin community appears hopeful for some form of remarkable influence from this personality.

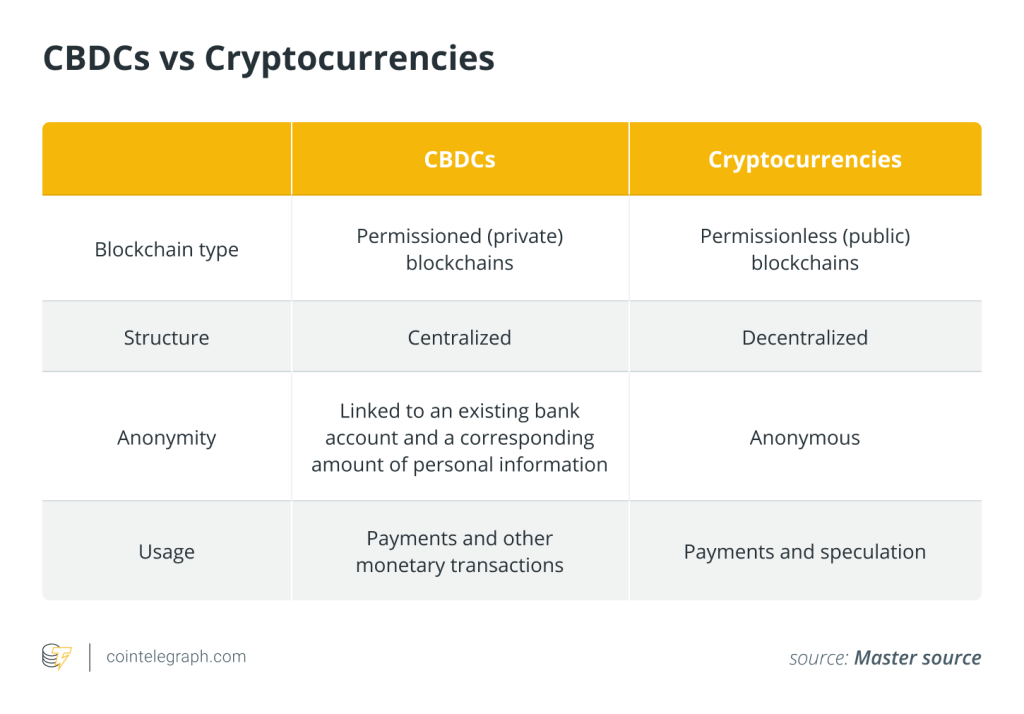

Cryptocurrency investors anticipate a positive shift in sentiment toward digital assets, fueled by a growing distrust in banks and traditional finance, especially in light of recent government bailouts, including the rescue of Philadelphia-based Republic First Bank. These investors believe that these developments may drive more participants toward cryptocurrencies.

Responses