Bitcoin spot volumes confirm crypto markets’ ‘euphoric’ phase — Glassnode

Data suggests that a fresh influx of investor capital marks the crypto market entering a euphoric phase.

As market participants await the Bitcoin halving event, which is expected to send BTC’s price higher, investors’ speculative interest in the crypto market has risen to levels seen in the 2021 bull run, according to a Glassnode report. This increases the chances of a substantial directional price move.

The market is in a state of euphoria

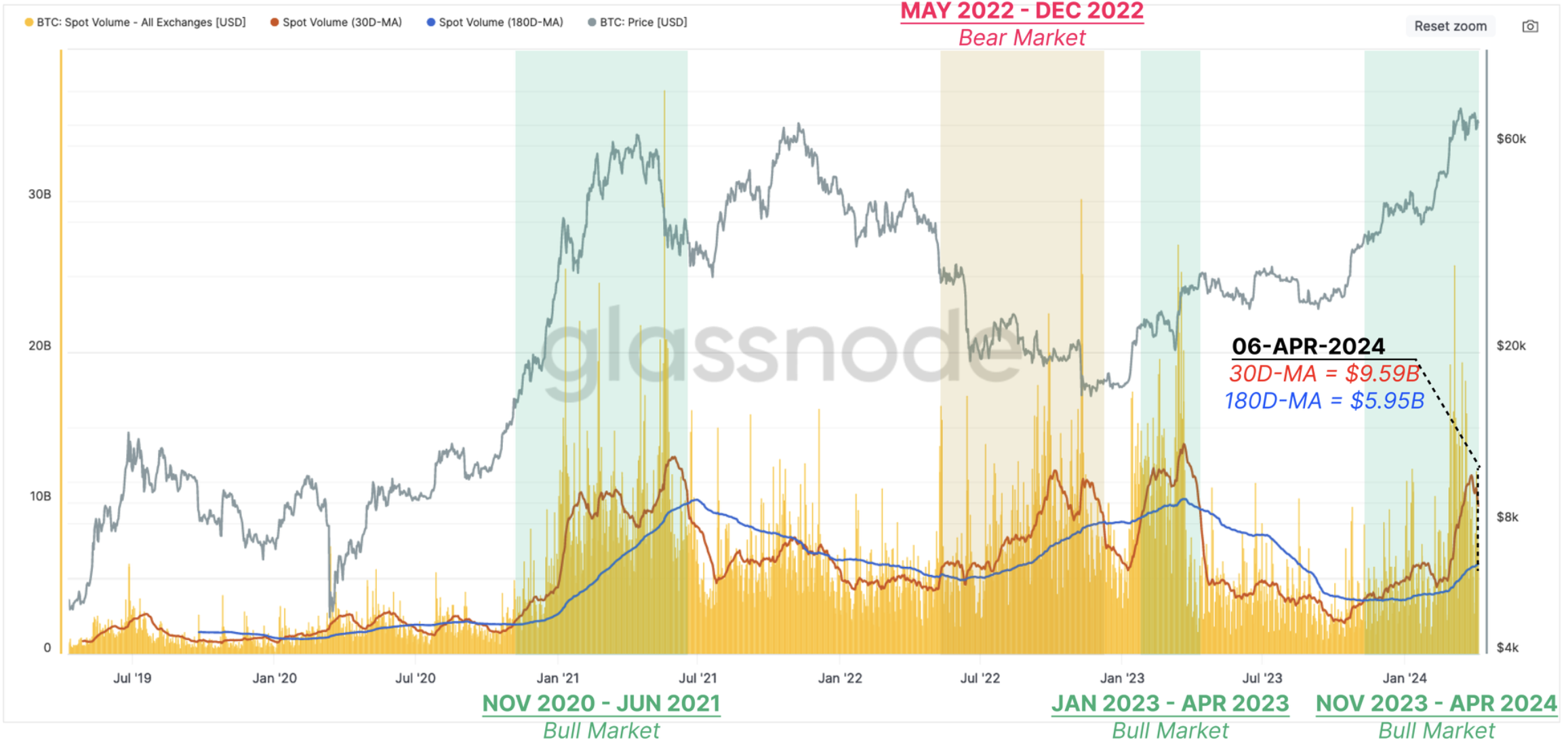

Bitcoin’s (BTC) price continues its impressive performance in 2024, with the flagship cryptocurrency hitting new all-time highs in March. BTC spot trading volume has soared since the spot Bitcoin ETFs began trading in the U.S. on Jan. 11, with daily volumes peaking in March. Glassnode noted that the market has “transitioned into a euphoric phase,” with profit-taking climbing considerably.

Data suggests Bitcoin’s bullish momentum has been building up since October 2023 as the market was pushed into a high liquidity and volatility regime.

The crypto analytics firm reported that BTC’s year-to-date performance is supported by “strong demand” in spot markets, mirroring a similar structure seen during the 2021 bull run.

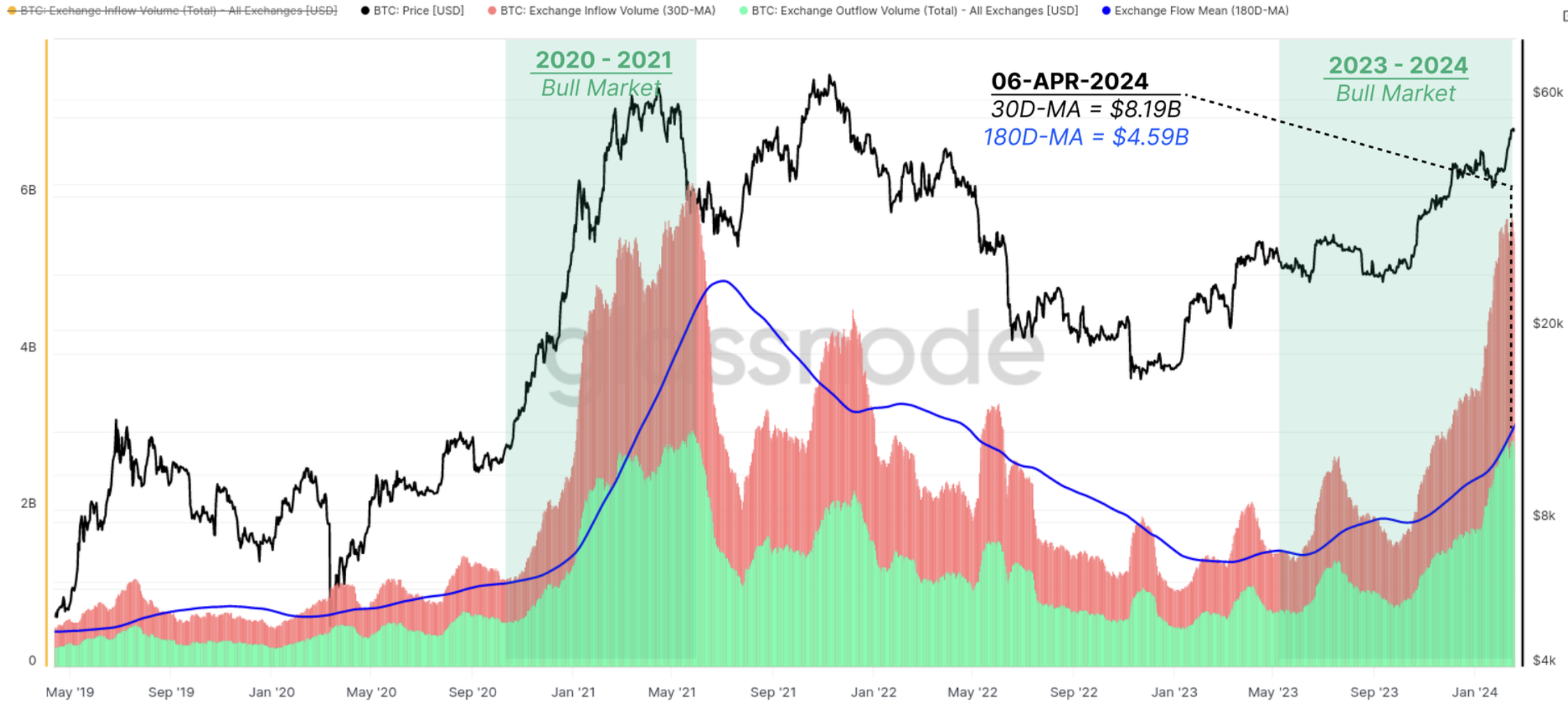

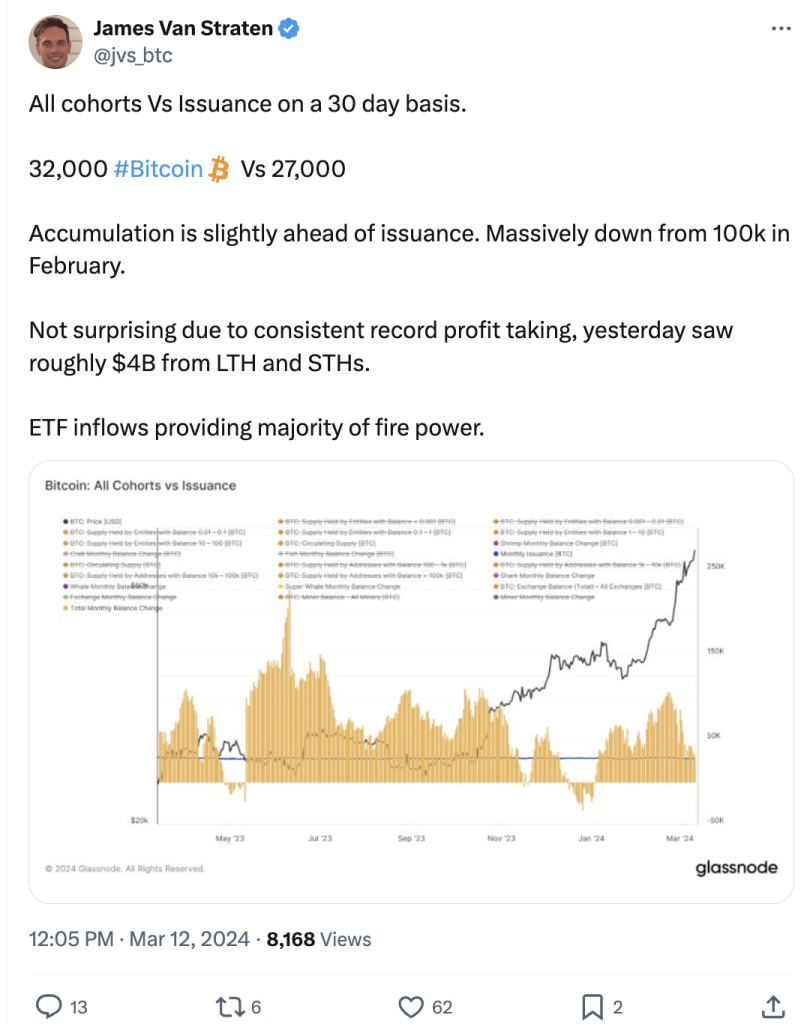

Bitcoin’s flow in and out of exchanges has also increased significantly since July 2023. Glassnode data shows that the monthly average of total inflows and outflows from exchanges is currently at $8.19 billion per day, substantially higher than the 2021 bull market peak.

“Overall, Bitcoin’s YTD price action is supported by a significant uptick in spot trade volume and exchange flows on-chain.”

Due to high liquidity and the upcoming Bitcoin supply halving, a cloud of euphoria is covering the market, a clear indication that the bull market is on. Bitcoin’s realized profit also increased to 1.8% in March, reclaiming the 2021 peak. This suggests that “1.8% of the market cap was locked in as profit over a 7-day period.”

Glassnode expects new capital to flow into Bitcoin since “profit taken by one investor is matched by inflowing demand from the buying party on the other side.”

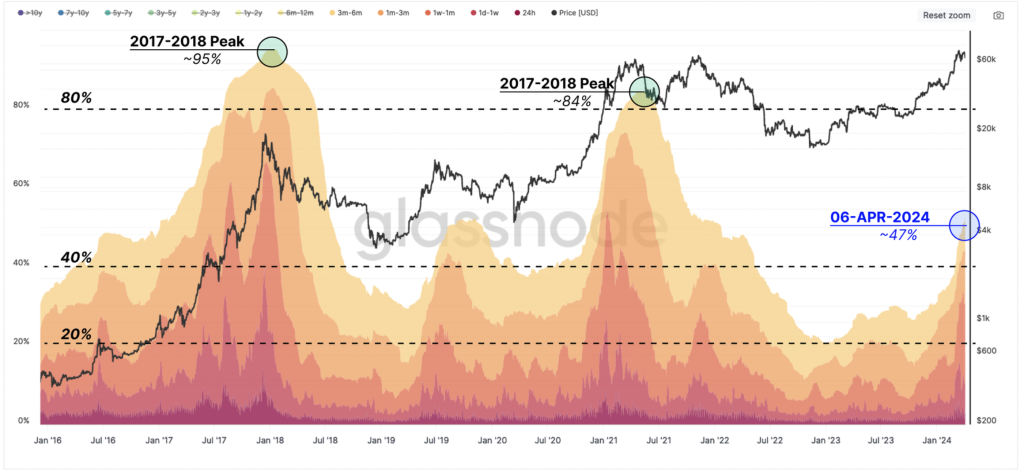

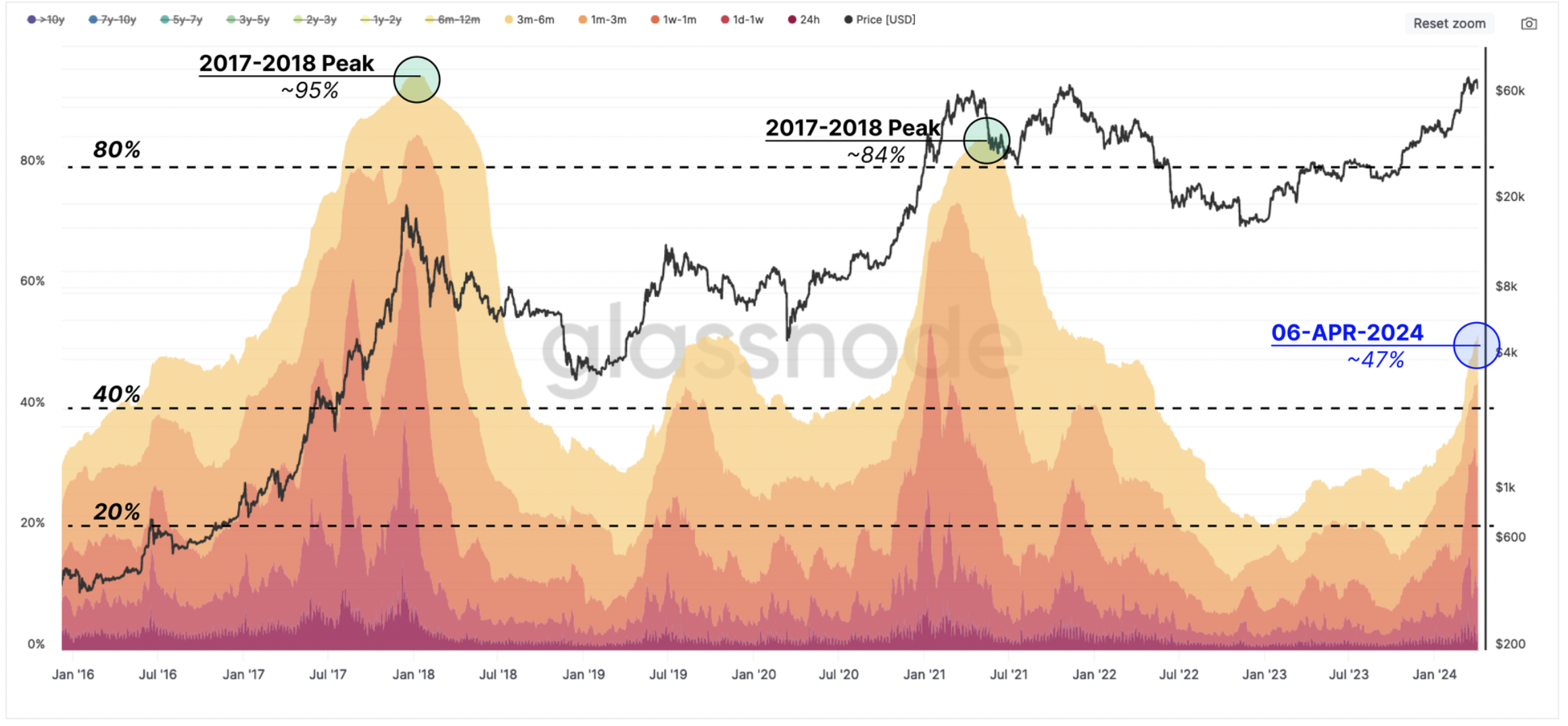

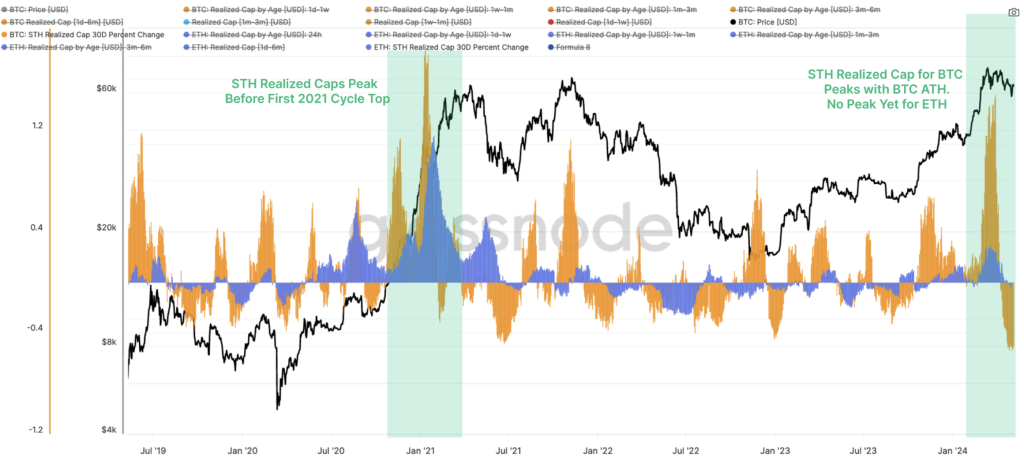

In terms of market dynamics, this means a new crop of investors is entering the market, as shown by the “rising share of wealth held by coins younger than 6 months in the Realized Cap HODL Waves, Glassnode wrote.

The aggregate share of coins younger than 6 months has increased sharply since early 2023, rising to 47% up from 20% on Jan. 1, 2023. This metric reached between 84% and 95% during the last bull markets.

“Analysts should start to pay more attention to the behavior of these new investors as their share of the capital increases.”

However, the chances of a sustained bullish rally over the next few weeks remain low due to profit-taking as Bitcoin trades above its 2021 all-time high.

“The balance of wealth is approximately balanced between long-term holders and new demand, suggesting the ‘Euphoria’ phase is still relatively early from a historical perspective.”

Responses