Binance trading volumes hit yearly high at $1.12T in March

Binance spot trading volumes hit a yearly high in March as Bitcoin and Ethereum rose to new highs.

The spot trading volume of Binance exchange hit the highest level since May 2021, following seven consecutive months of ascent, according to a new report from CCData.

According to an April 5 report by cryptocurrency analytics platform CCData, Binance’s spot trading volume increased by 121% to $1.12 trillion in March

The report said the combined market share of the exchange also increased by 1.04% to 44.1% in March.

CCData highlights Binance’s recovery after settling its case with the United States Department of Justice and paying a $4.3 billion settlement fine. This is evidenced in its derivatives trading volumes, which have risen by 89.7% to $2.91 trillion, also achieving their highest levels since May 2021.

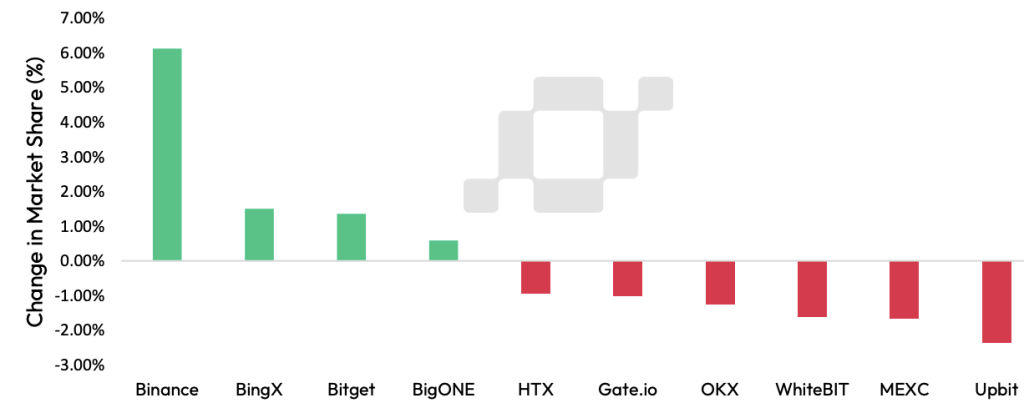

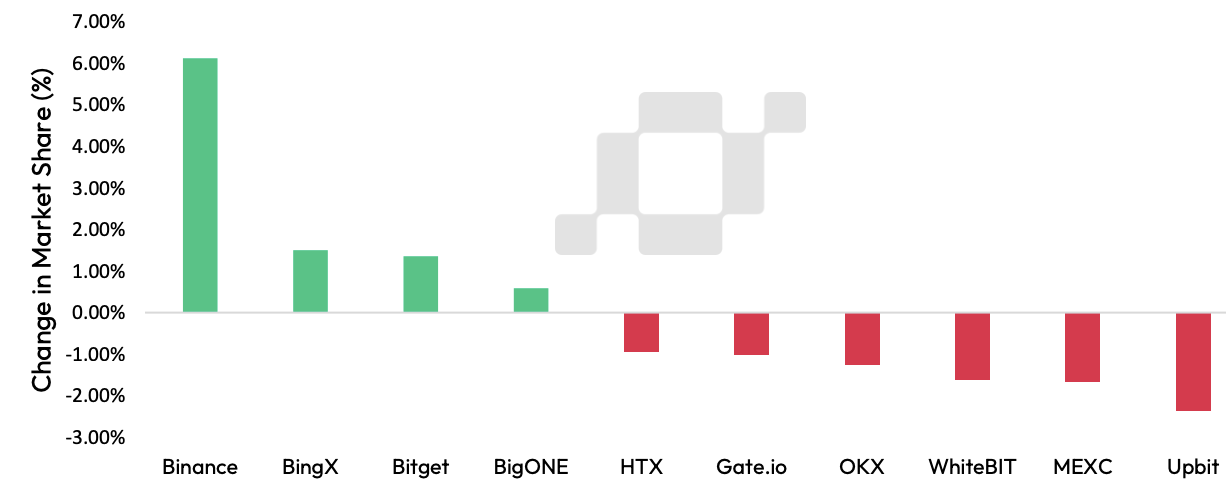

CCData analysts also noted that Binance made the largest gain in spot markets, increasing its market dominance by 2.3% compared with February. The exchange also saw the biggest gains year-to-date, now accounting for 38.0% of the spot trading volumes on CEXs.

In January this year, analytics firm Kaiko reported that Binance experienced an increase in trading volume, with its market share climbing 50% within just two months of its settlement with the U.S. DOJ.

In spite of the regulatory challenges, the exchange claimed to have seen a more than 40 million increase in the number of users in 2023. Binance highlighted that this was nearly a 30% increase compared to the previous year and attributed the growth to its “key services.”

Related: Binance exec’s legal case in Nigeria adjourned until April 19

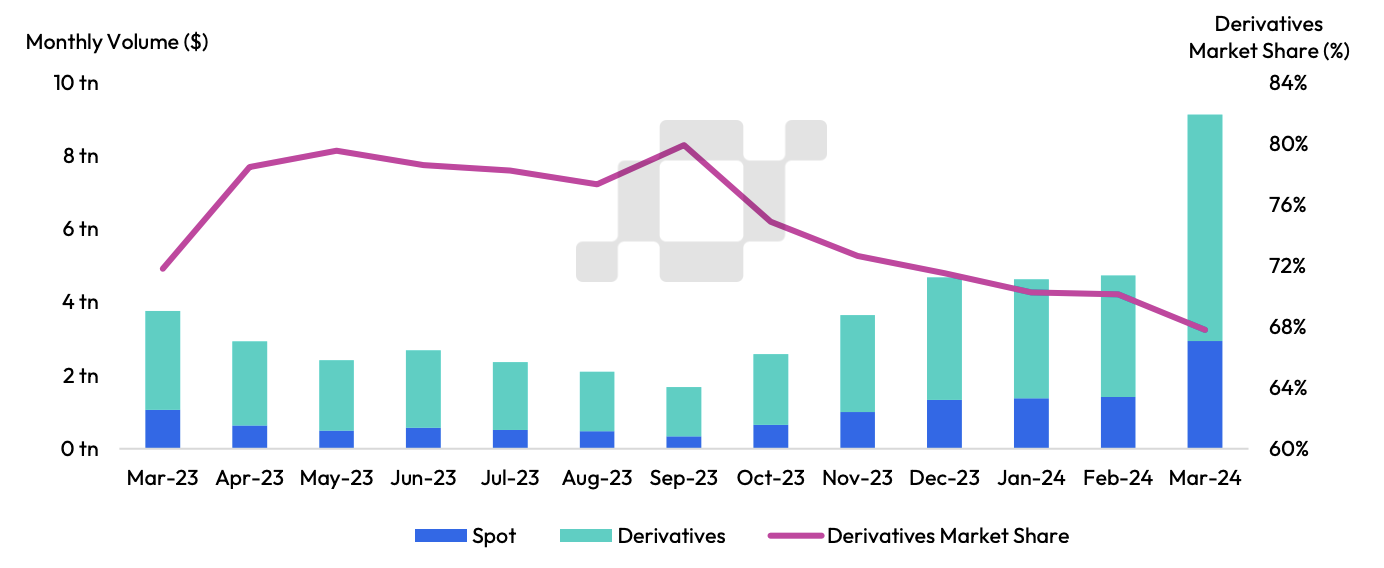

Meanwhile, the combined spot and derivatives trading volume on centralized exchanges (CEX) also rose 92.9% to a new all-time high of $9.12 trillion in March, as traders flocked to the markets while Bitcoin also reached new all-time highs, CCData reported.

Trading volume in crypto derivatives CEXs also rose 86.5% to a record high of $6.18 trillion, which is triple the total market capitalization of all cryptocurrencies.

“This surge occurred as investors and traders speculated on the price action following Bitcoin’s approach toward a new all-time high in March.”

The spike in spot trading and derivatives trading activity also coincides with the growing excitement around the success of spot Bitcoin ETFs and the BTC supply halving, which is expected later in April.

This development highlights how much the public still trusts centralized exchanges despite recent failures such as FTX.

Responses