'Pre-halving top' due soon? 5 things to know in Bitcoin this week

Bitcoin has slowed down into the end of February, and BTC price predictions have broadly lost their bullish slant.

Bitcoin (BTC) is gearing up for the February monthly close with BTC price action at a crossroads — can the highs hold?

Still above $50,000, the largest cryptocurrency has lost bullish momentum over the past two weeks.

Hopes of an attack on higher levels remain for some, but reality appears to be catching up with sentiment as buyer pressure fails to overcome some parties’ appetite to sell.

The coming days are all but guaranteed to upend the status quo — key United States macroeconomic data will combine with a classic volatility source in the form of the monthly candle close.

The macro landscape is in itself precarious — inflation recently beating forecasts has left a question mark over future Federal Reserve actions and whether risk assets will enjoy a benchmark interest rate cut any time soon.

For Bitcoin, the timing of this is especially pertinent given its own internal dynamics, with the next halving creeping ever closer.

Cointelegraph takes a look at these topics and more in the weekly roundup of key BTC price factors to consider when charting the market over the coming days.

All eyes on BTC price monthly close

Bitcoin continues to trade in a narrow range after the weekly close — on in place throughout the second half of February.

At $51,700, the latest close offered little inspiration to bulls, coming in around $450 lower than previously, data from Cointelegraph Markets Pro and TradingView confirms.

For trading resource Material Indicators, the writing is already on the wall.

“That’s a red W close for BTC with a new Trend Precognition (down) signal,” it wrote in a post on X (formerly Twitter) about one of its proprietary trading tools.

“Signal is tentative until this new candle closes. I do expect it to validate, however we do have some wild cards with Thursday’s U.S. Economic Data coinciding with the Monthly Close. Expecting more volatility as we approach the M Close.”

Some popular market observers are more upbeat despite the sideways action. Among them is social media pundit Bitcoin Munger.

“Market makers look like they now have their eye on $53k shorts,” part of his latest X post reads.

$50k support continues to hold like a rock.

Market makers look like they now have their eye on $53k shorts.

Bitcoin bears are going to get wiped out this week. The road to $60k+ is on the horizon. Tick tock. #bitcoin https://t.co/6WuiME1HL9 pic.twitter.com/Lz4cNLg0p2

— Bitcoin Munger (@bitcoinmunger) February 25, 2024

Data from statistics resource CoinGlass showed BTC/USD still up by more than 20% in February.

PCE data precedes monthly close

The week in macro markets is headlined by U.S. jobs and spending data, the latter known to be the Fed’s preferred inflation gauge.

Both come on Feb. 29, offering a potentially volatile end to the month for risk assets.

Employment trends stirred market sentiment in January, while the Personal Consumption Expenditures (PCE) Index is crucial to Fed policy when it comes to interest rate decisions.

The numbers come at a difficult time. Inflation data has recently overshot expectations, and markets have substantially repriced the odds of the Fed cutting rates at its March meeting.

Per data from CME Group’s FedWatch Tool, March currently has just a 4% chance of seeing rates decreasing, with May on 25%.

At the same time, optimism in U.S. stocks is such that the S&P 500 is near all-time highs.

“Last week was all about Nvidia, this week it is back to the Fed,” trading resource The Kobeissi Letter wrote in part of an X post about the coming week.

“Can the run into record highs continue?”

Key Events This Week:

1. New Home Sales data – Monday

2. CB Consumer Confidence data – Tuesday

3. US Q4 2023 GDP data – Wednesday

4. January PCE Inflation data – Thursday

5. ~10% of S&P 500 companies report earnings

6. Total of 12 Fed speaker events this week

Another busy…

— The Kobeissi Letter (@KobeissiLetter) February 25, 2024

Kobeissi referenced the particularly strong earnings report by tech giant Nvidia last week.

Difficulty due to come off latest record highs

With BTC price action cooling off, network fundamentals are checking their own growth this week.

The latest estimates from statistics resource BTC.com suggests that Bitcoin mining difficulty will decrease at its upcoming automated readjustment on Feb. 29.

Difficulty, like hash rate, has seen near vertical upside over much of the past year, with retracements never lasting long before new all-time highs replace them.

Currently, this new decrease is due to be around 2%, while the two previous adjustments were increases of 8.2% and 7.3%, respectively.

As Cointelegraph reported, a popular theory currently argues that Bitcoin miners will be eager to make the most of current supply rules in advance of April’s block subsidy halving, which will cut the amount gained in rewards per newly-mined block by 50% to 3.125 BTC.

That said, 2024 has conversely seen a distribution trend among miners, even contrasting with some larger-volume investor classes, or “whales.”

According to data from on-chain analytics firm Glassnode, from a peak of 1,833,321 BTC on Oct. 23, the BTC balance of known miner wallets has decreased by 1.16%.

Nonetheless, research notes that overall, accumulation is more than compensating current new supply.

“Currently, the monthly issuance of Bitcoin stands at 27,000, yet an anticipated halving event in April is to cut this issuance to 13,500 BTC per month. Interestingly, across all cohorts, Bitcoin accumulation is outpacing issuance by over four-fold,” James Van Straten, research and data analyst at crypto analytics firm CryptoSlate, wrote last week.

“Drilling deeper into specific cohort behavior, ‘Whales,’ those entities holding between 1k-10k Bitcoins, are accumulating approximately 236,000 BTC over a 30-day period, thereby leading the accumulation race. Meanwhile, ‘Super Whales,’ those holding 10k Bitcoin or more, have been observed distributing about 50k Bitcoin in the past month.”

Analyst considers Bitcoin’s “pre-halving top”

Bitcoin halvings tend to give investors a “final bargain-buying opportunity” at the beginning of macro uptrends, says popular trader and analyst Rekt Capital.

In one of his latest YouTube Shorts, Rekt Capital studied BTC price retracements seen around both the 2016 and 2020 halving events.

The first of these reached 40% of the local top just before the halving, while 2020 managed a 19% correction.

“But let’s say the pre-halving top is coming quite soon,” he explained.

“A 19% retrace — so essentially mimicking a 2020 retrace around the halving event — would get us into $42,000, and that’s approximately the top of that reaccumulation range that we just broke out from.”

The video also entertained the idea of a deeper dip, with $37,000 and $31,000 on the table as significant floor levels based on historical halving behavior.

Also entertaining the possibility of a substantial BTC price comedown is Venturefounder, a contributor to on-chain analytics platform CryptoQuant.

For him, the 50-day moving average forms a point of historical reference.

“Since Bitcoin’s cycle bottom in 2023, each time BTC is over 12% above its 50-day moving average, there had been a correction,” he noted on X.

“Each correction ended between 8-11% below its 50DMA.”

The 50-day trendline currently sits at $45,700, a level Venturefounder added is the dollar cost average (DCA) price for investors in the spot Bitcoin exchange-traded funds (ETFs), which launched last month.

He nonetheless acknowledged that the trendline is moving higher and getting increasingly close to spot price, thus potentially being apt to lose significance if the market continues to track sideways.

Speculator profit-taking gives $48,000 BTC price target

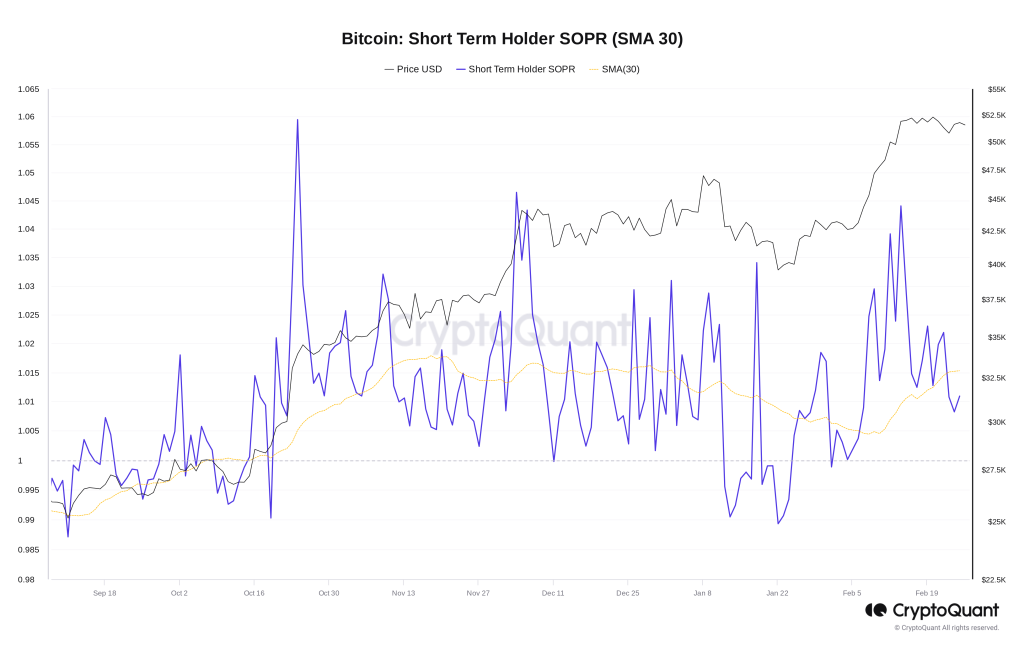

Short-term holders (STHs) form another reason to believe that BTC price downside may be on the horizon.

Related: Bitcoin’s funding rate turns negative, but have traders turned bearish?

In one of its Quicktake market updates on Feb. 25, CryptoQuant contributor CryptoOnChain warned over potential profit-taking to come.

Analyzing the Short-Term Holders’ Spent Output Profit Ratio (SOPR) metric, CryptoOnChain concluded that conditions might soon be right for speculators to distribute to the market.

STH-SOPR measures the extent to which STHs — investors hodling BTC for 155 days or less — are in profit versus their purchase price. The metric’s 30-day moving average value hitting local highs has coincided with BTC price retracements.

Now, CryptoOnChain argues, Bitcoin “is approaching the selling area of short-term investors.”

“Examining the technical chart also confirms this issue,” the Quicktake confirmed.

“Bitcoin is in the area below the resistance in the technical chart. It looks like Bitcoin may drop to the $48,000 area.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses