On-chain indicators suggest Bitcoin market is now ‘high risk’ — Glassnode

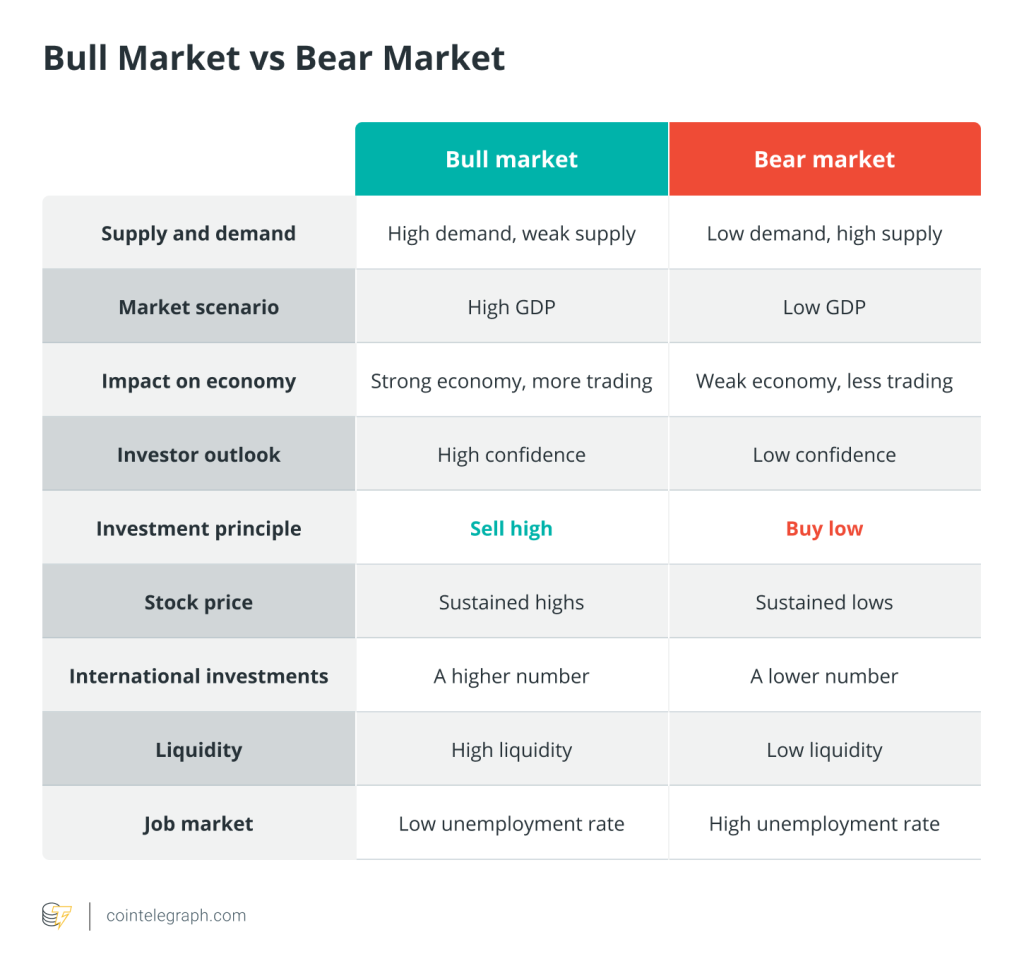

A market indicator is flashing that Bitcoin is now firmly in a “high risk” zone — a sign it could be in the early stages of a bull market, says Glassnode.

On-chain indicators assessing Bitcoin’s (BTC) value have entered a “high-risk” zone and could mean the cryptocurrency is in the initial stages of a bull market, says the crypto analysis platform Glassnode.

In a Feb. 10 X post, Glassnode shared that an indicator to identify Bitcoin’s long-term valuation compared relative to its market value had pushed above the “mid-risk” zone and is firmly in the “high-risk” band.

The high-risk level is typically witnessed during the early stages of a Bitcoin bull market as it shows long-term investors have returned to a “meaningful level” of profitability, Glassnode noted in an earlier Feb. 8 report.

After the challenging recovery since the FTX collapse, this indicator has advanced to 2.06, entering the High Riskregime.

These levels are typically seen during the early stages of bull markets, as long-term investors return to a relatively meaningful level of profitability. pic.twitter.com/XMSjJjUc1z

— glassnode (@glassnode) February 9, 2024

The long-term holder market value to realized value (MVRV) indicator aims to identify when Bitcoin is over or undervalued compared relative to its “fair value.”

It contrasts the “market value” of Bitcoin with its “realized value” — the price when Bitcoin was transferred between long-term holder wallets — it “strips out” short-term market sentiment and provides a metric that shows if the market is overheated.

The price of Bitcoin has steadily increased over the past week, climbing from $42,317 on Feb. 4 to $48,582 at the time of publication, per CoinGecko.

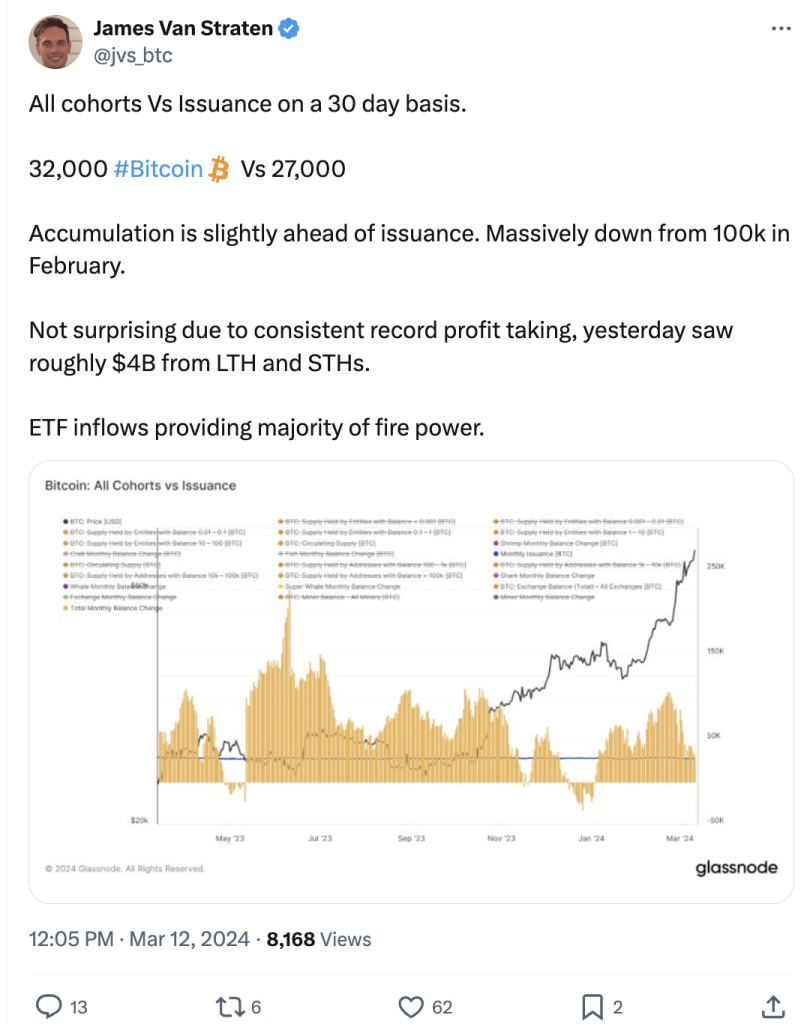

Bitcoin’s strength over the last week has been attributed to dwindling outflows from the Grayscale Bitcoin Trust (GBTC) — the asset manager’s newly converted exchange-traded fund — combined with $9.1 billion worth of inflows into nine of the spot Bitcoin ETFs since they went live on Jan. 11.

Related: Bitcoin’s market structure beneficial to price post-halving — Grayscale

The new United States Spot Bitcoin ETFs generated a net inflow of $541 million on Feb. 9, marking the largest day of inflows for the products, excluding the first day of trading, according to data from crypto analytics platform SoSoValue.

Meanwhile, Grayscale’s GBTC notched its lowest day of outflows, with just $51.8 million exiting the fund on Feb. 9, marking a 91% decrease from its record daily outflow of $620 million on Jan. 23.

Lowest outflow day yet for $GBTC — $51.8 million https://t.co/YK5Wplyil8

— James Seyffart (@JSeyff) February 9, 2024

Responses