How Bitcoin ETFs could impact the average investment portfolio

Bitcoin ETFs could revolutionize the average investment portfolio, but BTC’s characteristics as an asset class could change.

On Jan. 11, the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin exchange-traded funds (ETFs), a significant milestone that could significantly impact the average household investor.

The ETFs saw eight-figure trading volumes in their first three days of trading. BlackRock and Fidelity quickly saw significant inflows from investors, with BlackRock’s iShares Bitcoin Trust now having over $1 billion in assets under management.

Some of the inflows come from investors who switched from other cryptocurrency investment products, with the Grayscale Bitcoin Trust (GBTC) seeing over $1 billion of outflows in just a few days. Bitcoin (BTC) ETF proponents believe the products may bring in additional investors to cryptocurrency, as it allows them to gain exposure to BTC without managing the private keys to a wallet.

Bitcoin as a tool against inflation

Lucas Kiely, chief investment officer of Yield App, told Cointelegraph that the ETFs provide investors with an opportunity to increase their portfolio diversification, as Bitcoin “can help spread the risk and diversify the return profile.”

Stefan Rust, CEO of independent economic data aggregator Truflation, told Cointelegraph he sees Bitcoin as one of the best asset classes to “purchase to combat inflation” and that “every household should own Bitcoin.”

Rust added that inflation is a “hidden tax on the average household” and has surpassed economic growth, which means household purchasing power has been eroding. He said that over the past three years, the U.S. has seen a 22% inflation rate, while its gross domestic product grew around 5–6% over the same period, meaning “the average household has seen its wealth diminishing by some 16% in real terms.” Rust added:

“In this environment, Bitcoin is a good safe-haven asset. It’s a finite resource, and this scarcity will ensure that its value grows along with demand, making it ultimately a good asset class for storing value or even increasing value.”

Rust said that Bitcoin ETFs will enable a new suite of financial products, as “there will be futures and collateralization associated with this ETF.” Investors, he added, will be able to “bet on the price of the ETF in six or 12 months and buy hedges against movements in that ETF over the same period.”

He said that eventually, it will be possible to “borrow or even take out a mortgage against the Bitcoin ETF” as the new asset class “replicates the existing financial system.”

Bitcoin ETFs can make it easier for everyone to invest in digital currencies, Rust said, even if they are unfamiliar with the nuances of the cryptocurrency world, as these funds will “lead to further democratization of investment opportunities, making the digital asset class accessible to a broader public.”

The rise of Bitcoin ETFs could significantly impact the existing financial system by legitimizing the cryptocurrency as an asset class. How that will impact the average household’s portfolio remains to be seen, but studies suggest a conservative allocation could do a lot.

Improving the 60/40 portfolio

Money managers have for decades argued that a so-called balance portfolio comprising 60% equities and 40% bonds or other fixed-income products could offer a good risk and return balance to investors willing to take on a moderate amount of risk.

The 60/40 portfolio has since become a classic investment strategy that is said to strike a proper balance between growth and stability, with equities helping push it higher while taking on higher risk, and bonds stabilizing it with their lower, more stable returns.

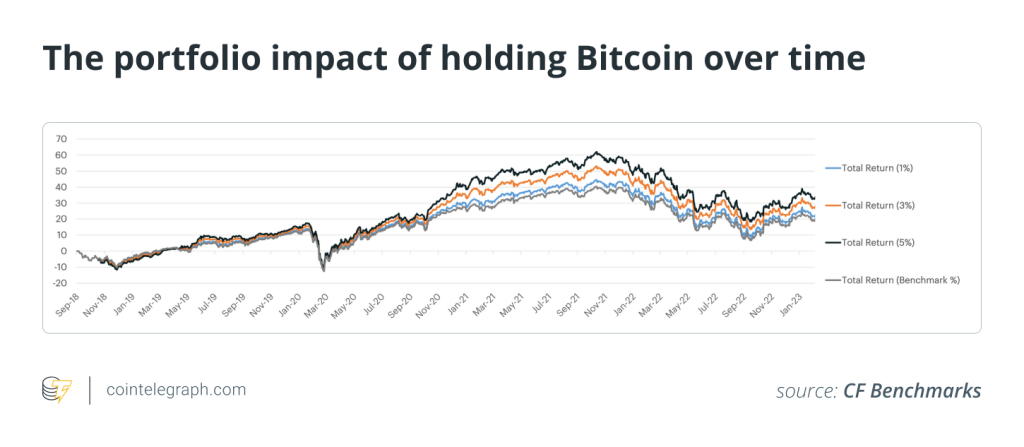

Rust noted that for the average household, Bitcoin ETFs could be an opportunity for diversification and to allocate between 1% and 5% into cryptocurrencies.

Speaking to Cointelegraph, Sui Chung, CEO of Kraken-owned firm CF Benchmarks, said that diversification “is often considered the only free lunch in investing” as it can “reduce risk while simultaneously improving potential returns.” Chung added:

“Now that the ETF has opened up BTC ownership to a broader swathe of the investing public, the key attraction many will see here is the diversification potential it can offer to a mixed-asset portfolio.”

CF Benchmarks has recently released a research report stating that the “main challenges of investing into Bitcoin are deciding exactly the right size for your initial investment” and how to maintain exposure after that.

Bitcoin is known for having cycles with significant drawdowns and mesmerizing rises, which means investors have to choose to allocate an amount large enough to contribute to their portfolios but small enough to allow their portfolios to weather the volatility.

The firm found that even a 1% allocation to Bitcoin has “increased returns without materially increasing the overall risk of the portfolio,” with the standard deviation of the portfolio only materially increasing once the exposure to BTC goes above 5% if the portfolio is rebalanced frequently. Such an allocation, the report found, could lead to between an 8% and 40% improvement in the risk-adjusted return, the Sharpe ratio.

Speaking to Cointelegraph, Zach Pandl, managing director of research at Grayscale Investments, said that Bitcoin is a “relatively high-risk investment and may not be suitable for all investors,” pointing out those that need capital in the near or intermediate term.

According to Pandl, investors betting on the 60/40 portfolio “cannot produce returns comparable to the last 40 years because the long decline in inflation is over.”

While he noted that ETFs will “likely be the most cost-effective, hassle-free way for average households to invest in Bitcoin” because many of the tax-related complexities are solved by the product, Pandl added that the product doesn’t undermine Bitcoin’s role as a store-of-value asset.

Despite all of these advantages, spot Bitcoin ETFs may not be the best solution for every investor, and for some, it would even be advisable to avoid them in some scenarios.

Risks of Bitcoin investment funds

While Pandl said that investing in Bitcoin can “substitute for other strategies offering return enhancement, diversification or both,” he said that the characteristics of cryptocurrencies may change over time, including their correlation with other assets. As a result, investors should regularly reevaluate their portfolios.

Truflation’s Rust also noted disadvantages associated with Bitcoin ETFs, including custody risk, as investing in Bitcoin via an ETF “puts the responsibility in the hands of a third party, and we have all seen that this can result in potential risk of losses.”

Although the companies managing these spot Bitcoin ETFs are experienced, “we’re still entering a new dimension,” he said. While self-custody is often the preferred investment method, not all users want to custody their own BTC.

Even futures ETFs have a hidden problem: rollover costs. According to Rust, these can “significantly erode returns over time,” and while spot Bitcoin ETFs don’t suffer from rollover costs, investors aren’t holding Bitcoin through them; they hold shares in a fund tracking BTC’s price.

Beyond the counterparty risk, this also means investors aren’t able to participate in the broader cryptocurrency ecosystem, including the burgeoning decentralized finance ecosystem. Holding Bitcoin directly, Rust adds, also offers a higher degree of privacy and less susceptibility to confiscation in case of legal or political changes.

To Yield App’s Kiely, spot Bitcoin ETFs, futures ETFs and direct Bitcoin investments are “essentially the same thing from a returns perspective,” with the only difference being the management fees associated with the ETFs, which he tells Cointelegraph “are small compared to the volatility of the asset itself.”

Looking ahead, Kiely believes that cryptocurrency ETFs will help Bitcoin’s influence in the wider financial system. Kiely said:

“In the next five to 10 years, crypto ETFs will form a healthy part of an allocation to alternatives across a broad range of investment portfolios. This would put them on a par with other alternative investment options, which does include gold ETFs.”

While the introduction of spot Bitcoin ETFs could increase investor confidence, and data suggests a conservative allocation into Bitcoin would have been beneficial in the past, it’s likely that as BTC matures as an asset class, the characteristics it is known for could change.

It’s worth noting that this change could be positive or negative, suggesting that Bitcoin also represents a paradigm shift for the traditional 60/40 portfolio and should at least be considered a part of the average household portfolio.

Responses