US national debt passes $35T — 5 Things to know in Bitcoin this week

Bitcoin bulls demand a rematch with final resistance below all-time highs to start the week as BTC price upside puts $70,000 back in play.

Bitcoin sets up a crunch climax to July at $70,000 comes into view in time for the monthly close.

In what promises to be a frantic few days for BTC price action, bulls are attempting to claw back lost support at key psychological levels.

Can they succeed? This is the question on everyone’s lips going forward as Bitcoin returns to price points absent for nearly two months.

The weekly close did not disappoint, saving the market from a “red” candle, but continued momentum is now essential.

On paper, the situation looks promising — miners are recovering, macroeconomic signals increasingly favor risk assets, and traders are betting on the end of Bitcoin’s post-halving retracement.

That said, the scope for flash volatility is there — the United States Federal Reserve will decide on interest rate changes this week, while Chair Jerome Powell can move markets in an instant with his press commentary.

US unemployment data will hit at the end of the week, providing a final window for erratic crypto price moves.

Cointelegraph takes a closer look at these topics as BTC/USD lines up an important retest of final resistance before all-time highs.

Bitcoin bounces back to grill final BTC price resistance

Bitcoin bulls got a last-minute reprieve at the latest weekly close as the one-week candle edged from red to green.

At around $68,265 on Bitstamp, per data from Cointelegraph Markets Pro and TradingView, Bitcoin rounded out a hectic weekend at what became a launch level for further gains into the July 29 Asia trading session.

New multiweek highs came as a result, with BTC/USD reaching $69,848 for the first time since June 10.

Unsurprisingly, traders are in a positive mood as Bitcoin approaches key resistance below March’s all-time highs.

“Every halving event, Bitcoin goes through a couple months of choppy price action,” popular trader Jelle wrote in one of his latest posts on X.

“Once that phase comes to an end, the true bull market starts. This time probably won’t be different.”

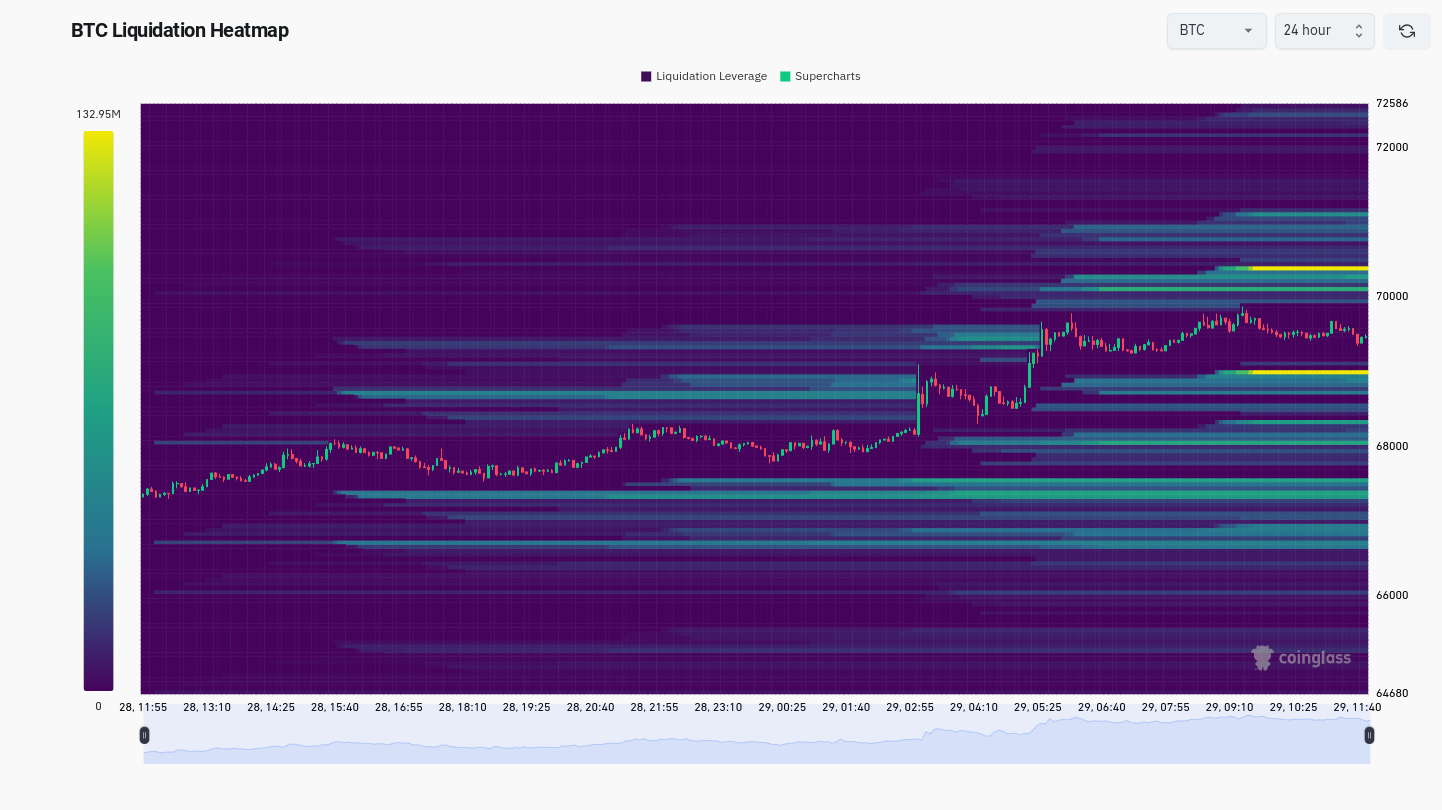

That resistance, meanwhile, remains formidable, with data from monitoring resource CoinGlass showing the nearest block of asks focusing on $70,400 at the time of writing. As Cointelegraph reported, billions of dollars in shorts stand to be liquidated should the price rapidly head higher.

The key feature of recent days was US Presidential candidate Donald Trump’s speech at the Bitcoin 2024 conference in Nashville, Tennessee.

Trump, along with fellow contender Robert F. Kennedy Jr., pledged to turn the 200,000 BTC confiscated by the US government into a strategic reserve if elected.

While already rumored to be the case, Trump’s confirmation did little to shift BTC price action itself, which conversely headed lower in the hours following.

For trader Daan Crypto Trades, however, it is a question of time. In his latest X content, he suggested that the “real move” on BTC/USD may only now be starting.

“The rumour that Trump would announce a strategic Bitcoin reserve started last week. During that time, $BTC mostly traded up, while stocks took a massive beating,” he summarized.

“Usually, BTC would have traded down considerably during such weakness in the general markets. But it didn’t, which I think is mostly contributed to this narrative that was going on. We likely traded 5-10% higher than we ‘should have’ because of this.”

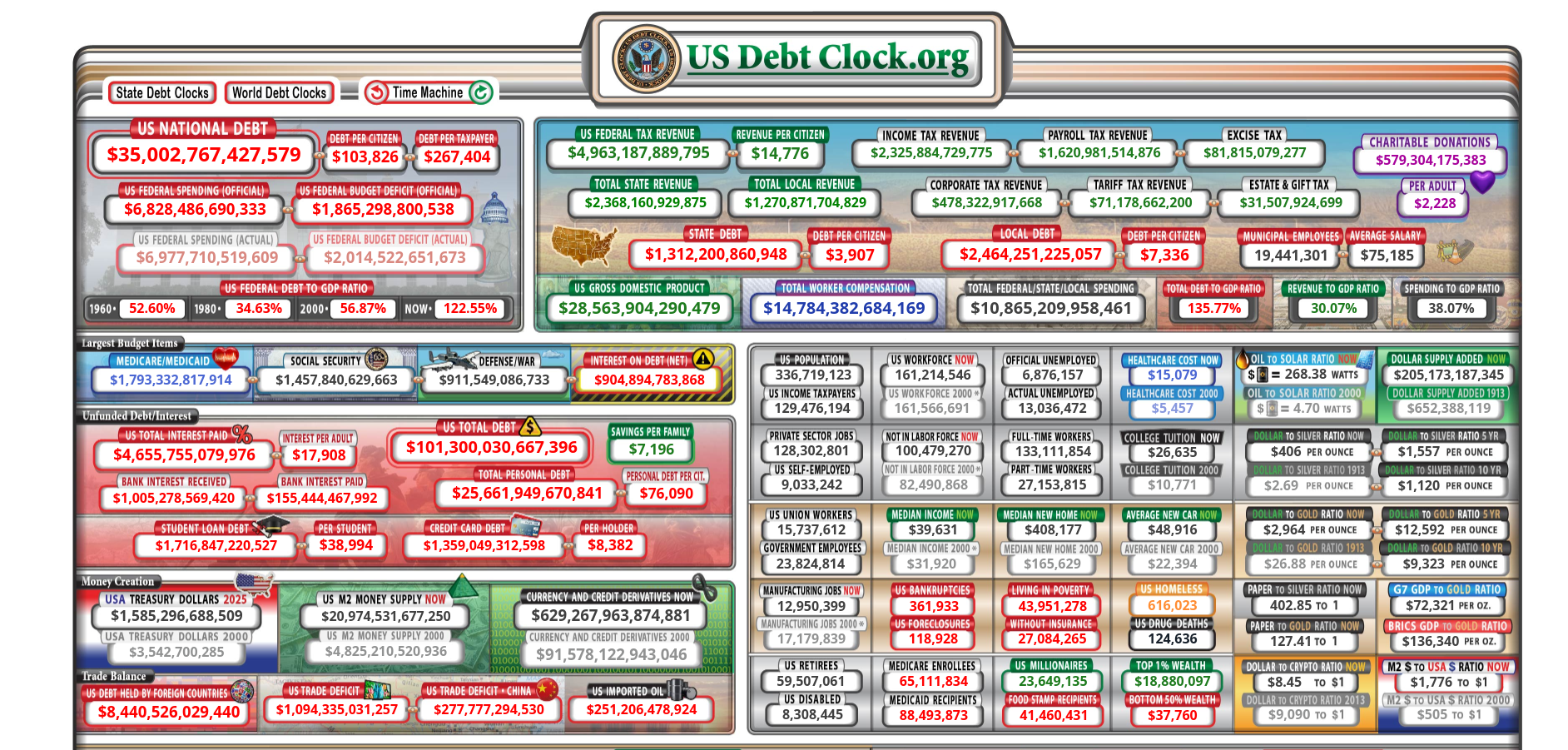

FOMC week begins with US debt milestone

As US national debt hits $35 trillion for the first time in history, the power to move crypto markets lies to a large extent with Fed Chair Jerome Powell this week.

His press conference, which will follow the latest Federal Open Market Committee (FOMC) decision on interest rates, can dictate longer-term expectations for economic policy simply by the tone of language used.

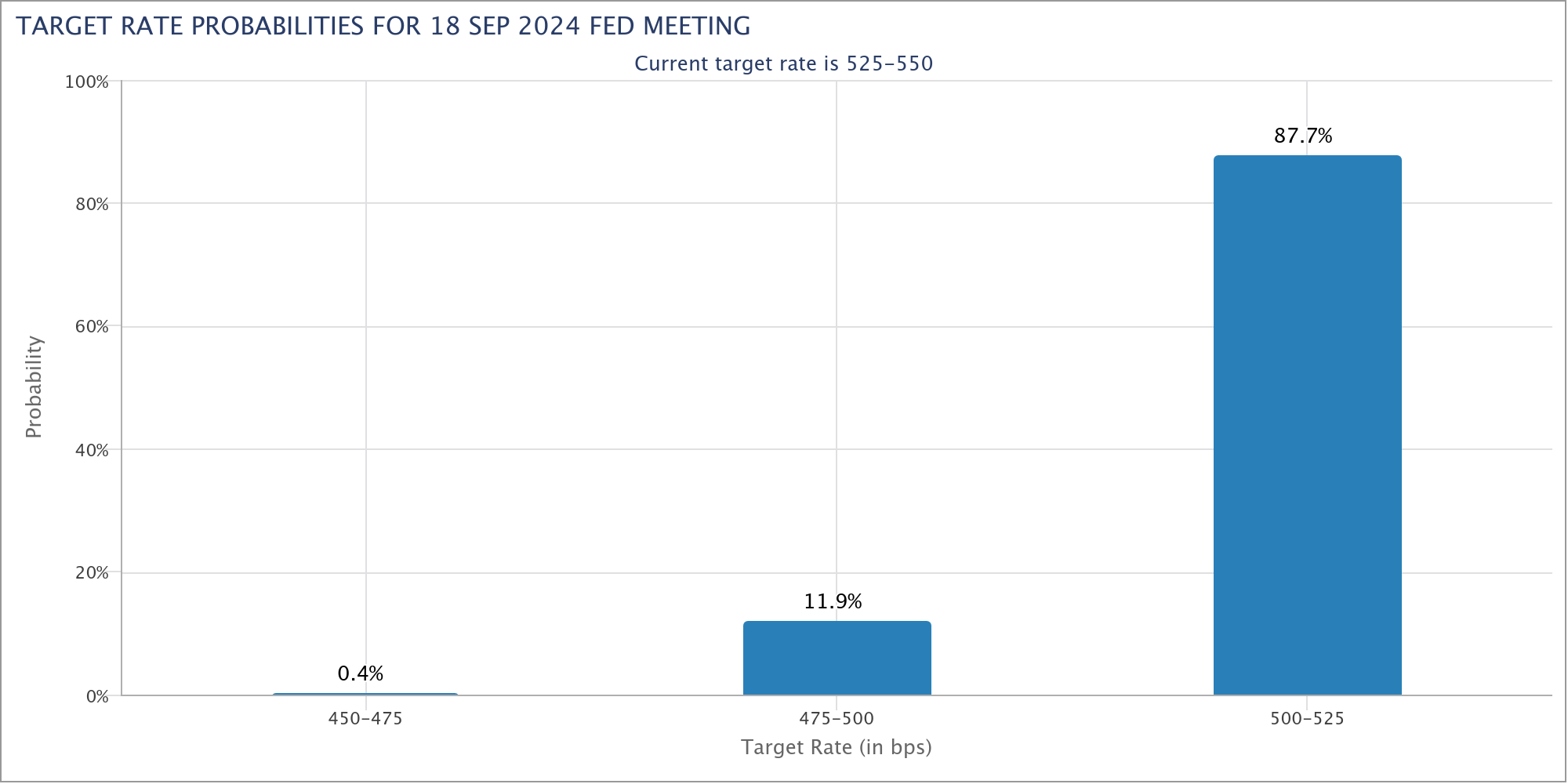

That said, markets see few surprises from the decision itself — no rate cuts are expected until the next FOMC meeting in September.

The latest estimates from CME Group’s FedWatch Tool put the odds of rates staying the same this month at nearly 96%. Conversely, they have fully priced in a cut in some form for September.

Those cuts are the key focus for crypto and risk-asset traders, as their presence should boost overall investment liquidity.

This week, however, the Fed is not alone — US jobless claims will follow FOMC, providing even more scope for surprise crypto market moves.

“Volatility is back with a huge week ahead,” trading resource The Kobeissi Letter summarized in an X thread.

“We have economic data, earnings, and the July Fed meeting all at the same time this week.”

Commenting on the macro week ahead, popular trader CrypNuevo warned that Powell may play it safe and avoid any firm commitment to cuts.

“I imagine something such as: ‘We’ll cut rates when we make sure inflation is moving back down to 2% and for that, we must stay data-dependent. We need to see the coming data from the next 2 months,’” he told X followers at the weekend.

“If so, markets could experience volatility due to investors’ disappointment.”

As such, BTC/USD may retrace post-FOMC, while high-timeframe analysis still calls for a retest of liquidity around all-time highs.

“Those highs haven’t been hit for a while, creating an OI gap and also gathering a lot of liquidations in HTF,” CrypNuevo added, referring to open interest and liquidity areas.

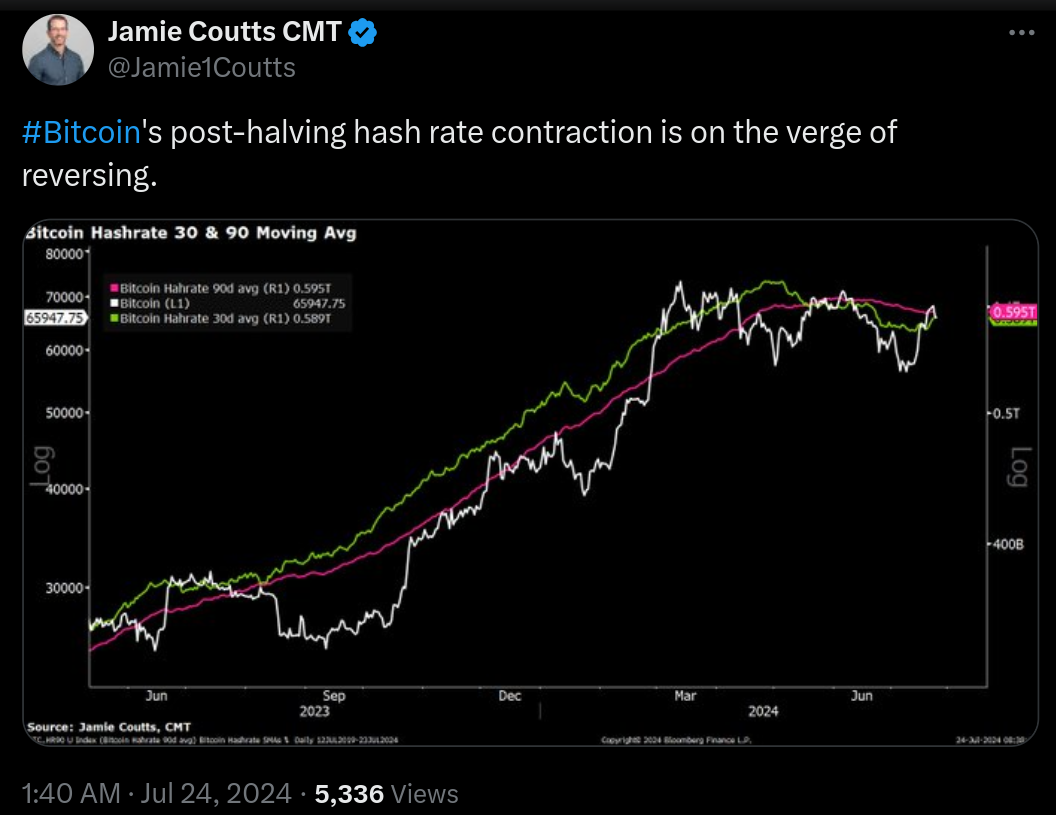

Bitcoin mining difficulty set for new highs

Bitcoin network fundamentals are wasting no time in showing which side of the bull/bear battle miners are on this week.

The latest estimates from monitoring resource BTC.com calculate that on July 31, Bitcoin mining difficulty will hit new all-time highs.

These will come if a giant 8% difficulty increase becomes a reality; this is nonetheless dependent on miners’ cost-effectiveness.

That surge would follow a 3.2% uptick from two weeks prior, and take difficulty to 88.61 trillion.

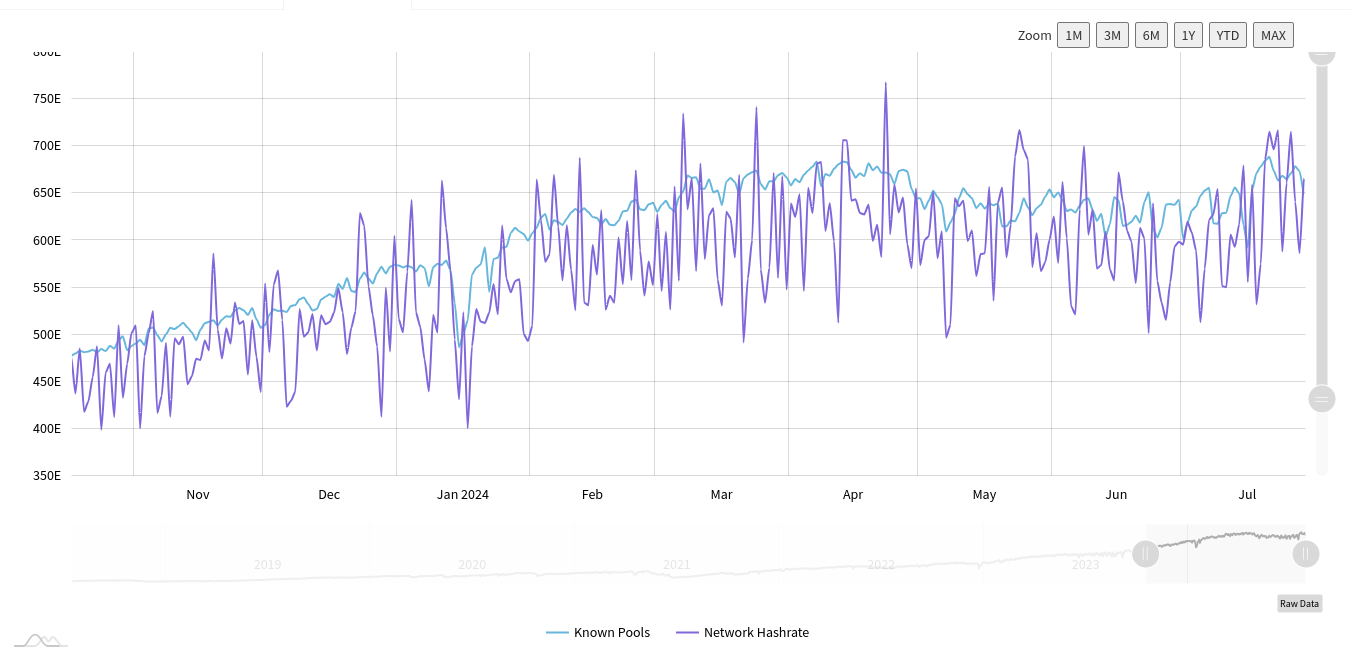

As Cointelegraph reported, a miner renaissance has been on the cards for some time, evidenced by both hashrate and the associated hash ribbons indicator calling the end of miners’ post-halving “capitulation” phase.

The latest raw data from MiningPoolStats continues to show hashrate coiling below all-time highs of its own — currently at 665 exahashes per second (EH/s) at the time of writing.

Concern as BTC miner selling resurfaces

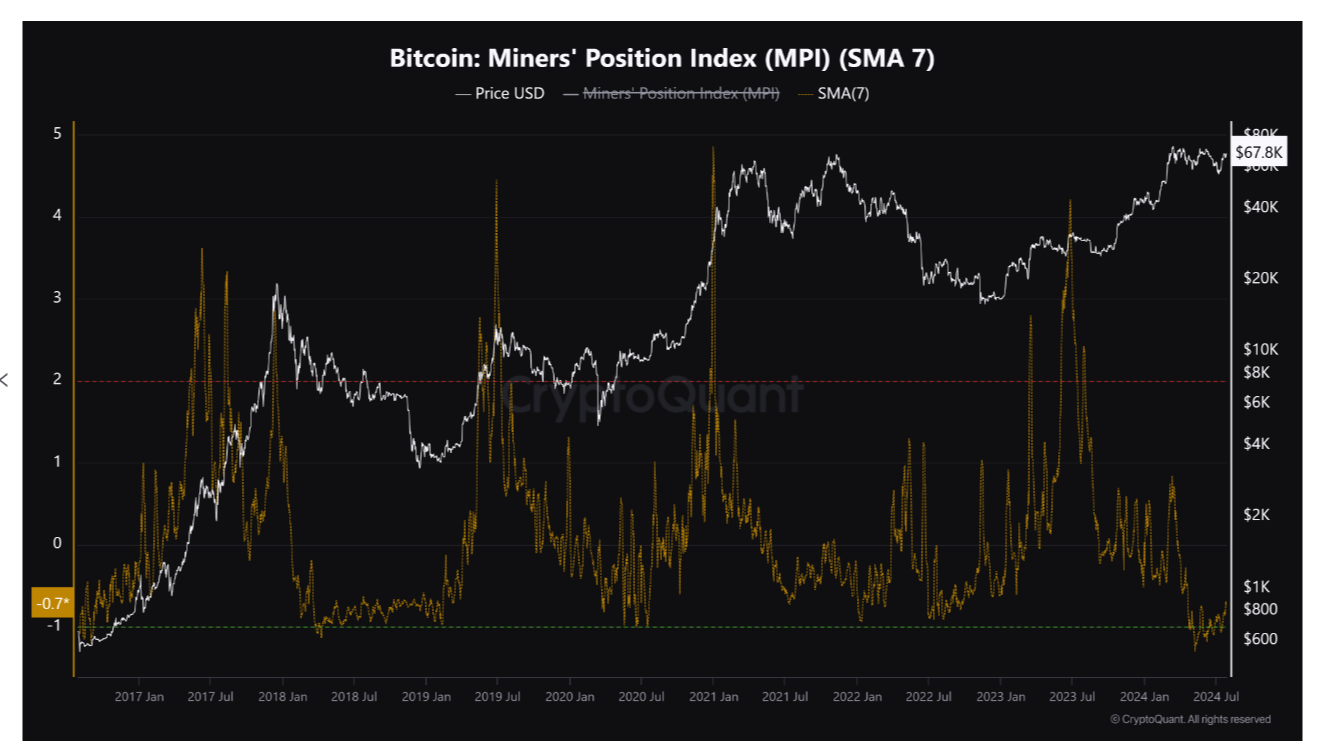

Analyzing the overall profitability of the mining sphere, however, on-chain analytics platform CryptoQuant warned that it is still early days for the comeback.

The miner position index (MPI), contributor XBTManager noted, remains at a “very low level.”

“This adds some selling pressure to the current structures but doesn’t create a significant overall selling pressure,” he wrote in one of CryptoQuant’s Quicktake blog posts.

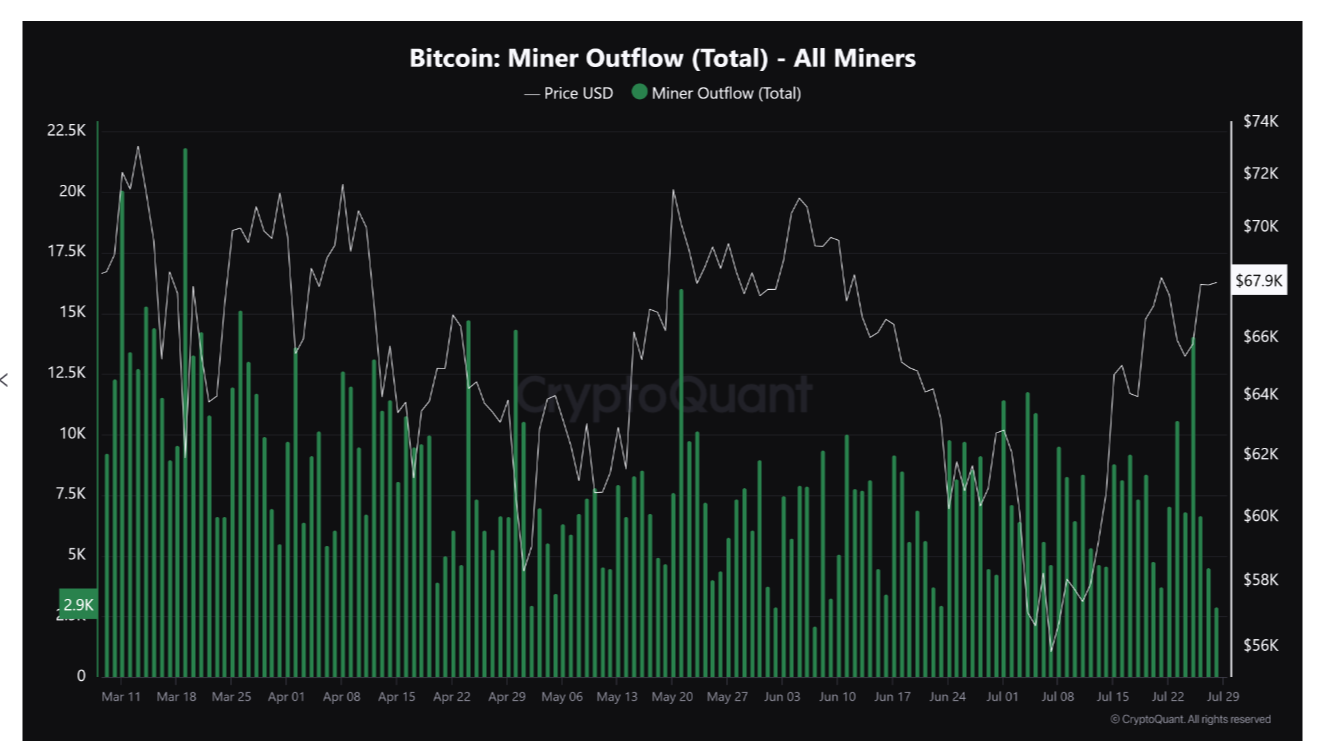

XBTManager appeared more concerned about BTC leaving known miner wallets, suggesting that selling is accelerating, not abating, at current price levels.

“After a support level of $53,000, miner outflow continues to rise,” he explained.

“Bitcoin has been observed leaving miner wallets at the current price level, which could create potential selling pressure. A similar example was seen on May 21.”

That date coincided with a trip above $71,000 for BTC/USD, this level forming a local high before the $53,000 lows hit at the start of July.

Sentiment calls for Q3 BTC price all-time highs

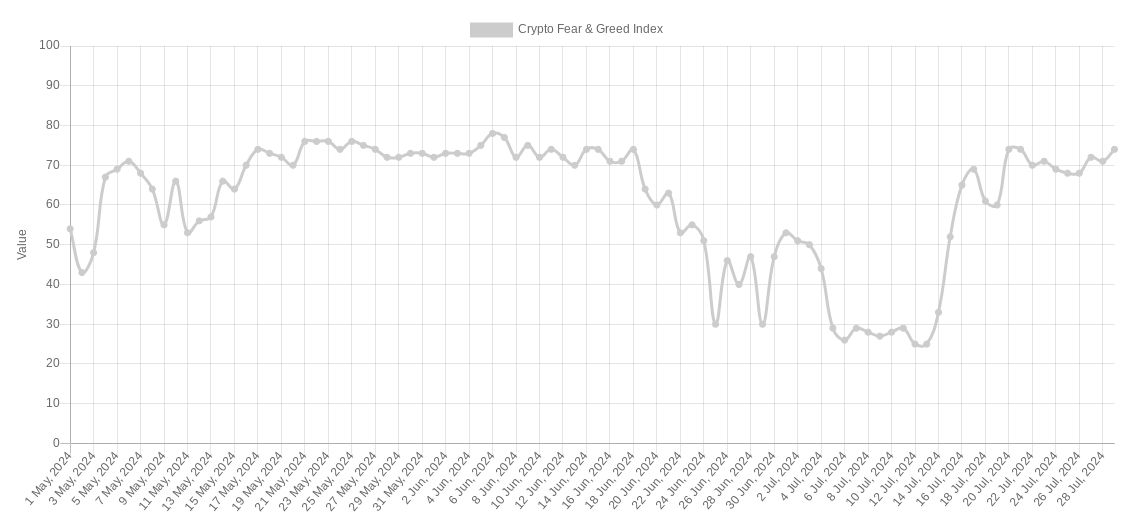

The Crypto Fear & Greed Index is back at levels not seen since early June.

Related: How high can BTC price go after Trump’s bullish Bitcoin speech?

The classic crypto market sentiment indicator is on the verge of returning to “extreme greed,” something arguably expected as Bitcoin tackles the final hurdles before price discovery.

Fear & Greed measured 74/100 on July 28, marking a giant 50-point increase in just two weeks.

As Cointelegraph reported over the weekend, bullish sentiment among crypto traders is at its highest in weeks and for the entire 16 months since the start of the bull market.

Research firm Santiment, which compiled the data, released an X survey last week asking when followers thought that Bitcoin would return to its record $73,800 level from March.

The majority of respondents guessed that this would occur by the end of October.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses