US Bitcoin ETFs Continue to Attract Capital, Exacerbating Supply-Demand Imbalance

#US #BitcoinETF #Crypto

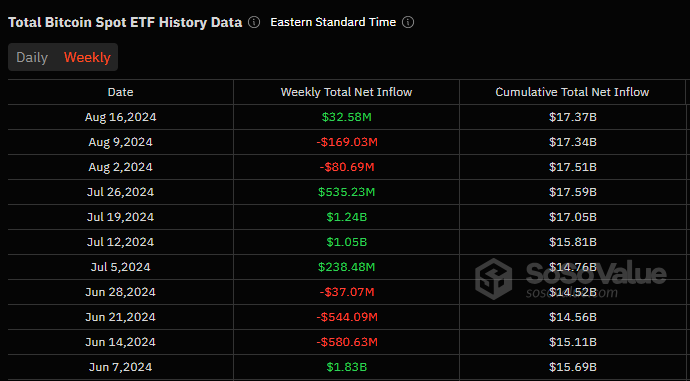

According to SoSoValue data, Bitcoin spot ETFs recorded a net inflow of $744 million last week.

- BlackRock’s IBIT led the inflows with $538 million for the week, bringing its cumulative net inflow to $39.77 billion.

- Fidelity’s FBTC followed with $136 million in net inflows.

The current total net asset value of Bitcoin spot ETFs stands at $94.35 billion, accounting for 5.65% of BTC’s market cap, with cumulative net inflows reaching $36.05 billion.

Many people may find it difficult to grasp the significance of these numbers, so let’s break it down further.

As of last week, BlackRock’s IBIT held 560,000 BTC. This figure implies that the $11 trillion asset management giant has absorbed 2.38% of the circulating supply using just a small fraction of its crypto allocation.

Moreover, the top 10 ETF issuers collectively hold 3.4 million BTC. This number not only exceeds the combined gold reserves of sovereign states like El Salvador and Ukraine but also directly removes over 16% of the circulating supply from the market.

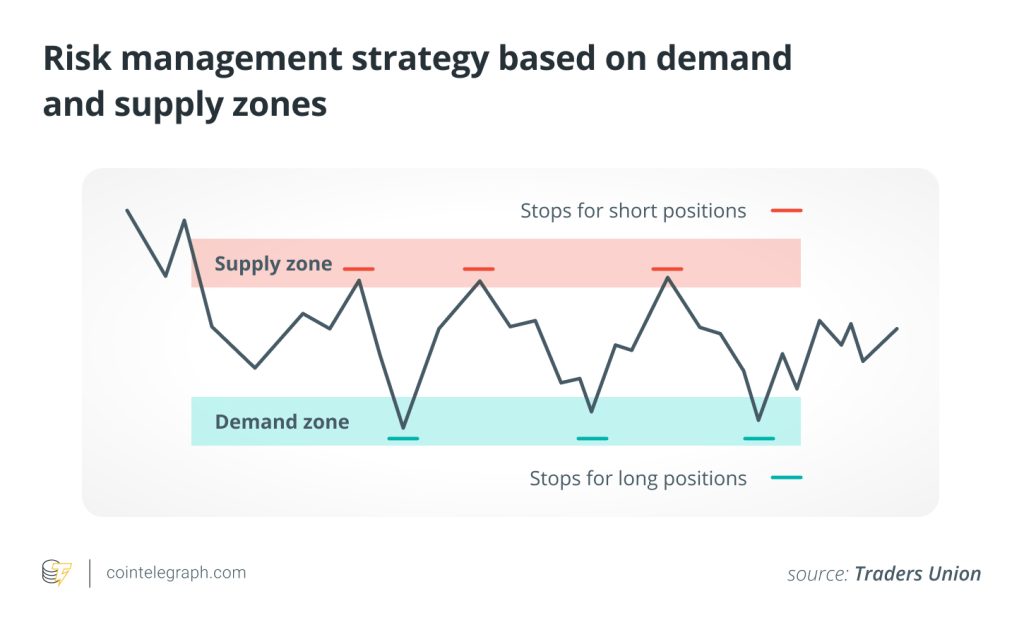

What about the supply side? According to incomplete statistics, the daily new production of Bitcoin has dropped to 450 BTC, translating to a daily supply value of only $280 million at current prices. In stark contrast, the average daily net inflow of spot ETFs reaches $106 million — and this doesn’t even include the institutional capital influx converted from Grayscale’s GBTC.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Interpretation of the Fundamental Causes of the Bitcoin ETF Supply-Demand Imbalance in the U.S.

The supply-demand imbalance of U.S. Bitcoin ETFs has become increasingly apparent, as institutional investors’ predatory acquisition of Bitcoin has formed a systemic trend. Imagine a scenario where traditional asset management products introduce pension funds and insurance capital into the crypto market through compliant channels —will the holding structure of Bitcoin change? And if so, what kind of change will occur?

The answer is that the retail investors and crypto-native funds, once dominant in the Bitcoin market, are ceding pricing power to Wall Street institutional players.

The Direct Consequences of the Supply-Demand Imbalance

The scissor gap caused by the supply-demand imbalance has already manifested in the market. Since 2024, the global reserves of BTC on exchanges have been steadily declining. As of February 2025, the available liquidity on exchanges has dropped to the lowest level since 2017. To put it in perspective, in October 2024, data showed that exchange liquidity had fallen to the lowest level since 2021 — clearly, the pace of the scissor gap is accelerating.

Impact of Spot ETFs on Miners

The rise of spot ETFs has also influenced the behavior of Bitcoin miners. As key suppliers in the Bitcoin market, miners’ selling pressure typically determines short-term market volatility. However, with the continuous inflow of ETF capital, miners’ selling pressure has significantly eased.

Faced with spot premiums offered by ETF institutions, leading mining pools have started to sell newly mined Bitcoin directly to market makers through OTC deals, further tightening the supply side of the Bitcoin market.

From a long-term perspective, miners’ revenue sources are gradually shifting to transaction fees. As miners reduce their Bitcoin selling, it may exacerbate liquidity shortages in the market.

The Role of Dormant Whale Wallets

Even more noteworthy is the movement of dormant wallets. Addresses holding more than 1,000 BTC (so-called “whale” addresses) have only released 3.2% of their holdings over the past six months, while the illiquid supply share of coins held for over a year has surged to a historic peak of 76%.

This collective hoarding behavior, combined with ETF accumulation frenzy, forms a resonance effect, pushing the market into a “liquidity vacuum” — a highly dangerous state where supply becomes increasingly scarce while institutional demand continues to surge.

Pros and Cons of the Supply-Demand Imbalance

The pros and cons of the supply-demand imbalance are quite evident.On the positive side, the price increase under supply-demand imbalance is unmistakable. Traditional institutional investors in the market typically adopt long-term holding strategies, and the Bitcoin purchased by ETFs generally does not immediately flow back into the market. This means that the circulating supply of Bitcoin is gradually decreasing, further driving price appreciation.

Of course, the price growth discussed here refers to the long-term trend, rather than short-term fluctuations and adjustments. This also explains why, despite the recent BTC price crash, many well-known analysts still believe that BTC prices will reach new highs — the fundamental reason being the supply-demand imbalance.

However, the continuous growth of Bitcoin ETFs also introduces some potential risks.

Firstly, the trend of centralization in the ETF market could compromise Bitcoin’s decentralized nature. Currently, a significant amount of Bitcoin is held by ETF custodians, granting these institutions a certain level of influence over the market.

Secondly, the expansion of the ETF market might increase market volatility. While ETFs provide a compliant investment channel, the speed and scale of capital inflows could trigger sharp price fluctuations if market sentiment changes.

Additionally, regulatory shifts could pose uncertainty to the development of the ETF market. Any regulatory adjustments affecting ETFs may lead to market instability, impacting both liquidity and price movements.

Bitcoin’s Monetary and Commodity Attributes Collide

In this unprecedented liquidity battle, Bitcoin’s monetary and commodity attributes are undergoing an intense collision. As institutional investors treat it as “digital gold” for strategic allocation, the market pricing mechanism starts to follow the inventory consumption model of commodities. Meanwhile, the HODLer community, adhering to the original vision of “peer-to-peer electronic cash”, inevitably sees the price discovery process dominated by the monetary network effect.

This fundamental cognitive dissonance leads to multiple anchoring points in Bitcoin’s valuation system — both constrained by the mechanical push of ETF capital flows, unable to escape the inevitability of the halving cycle, and forced to confront the macro shocks brought by the shift in global monetary policy.

Conclusion

In summary, the continuous accumulation of U.S. Bitcoin ETFs has profoundly impacted the market supply-demand structure, tightening Bitcoin’s liquidity and pushing the market into a new development phase. The long-term holding strategy of ETF institutions is gradually reshaping Bitcoin’s holding structure, shifting pricing power away from retail investors and traditional miners and toward Wall Street institutions.

At the same time, the scissor gap of supply-demand imbalance continues to widen — exchange liquidity dries up, miner selling decreases, and long-term holders keep accumulating, creating an unprecedented market landscape.

This trend provides strong support for the long-term upward trajectory of Bitcoin prices but also raises concerns about centralization risks and heightened market volatility. The rise of ETFs has diversified Bitcoin’s role in the financial market, enhancing its “digital gold” attribute while conflicting with the vision of a decentralized currency.

Looking ahead, the evolution of Bitcoin’s market structure and value anchoring will depend on regulatory policies, the pace of institutional capital flows, and global macroeconomic conditions. Bitcoin now stands at a historic crossroads, and the impact of the supply-demand imbalance may just be starting to unfold.

Responses