SuperEx丨Crypto Files: The Biden-Crypto Saga

#SuperEx #Crypto #Biden

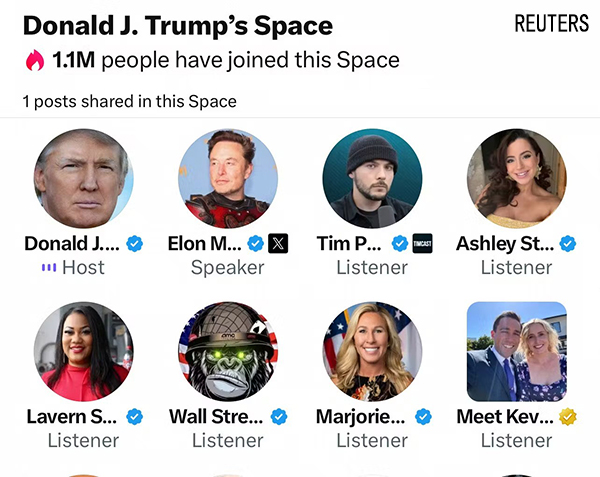

The U.S. election has concluded, and Biden is set to end his four-year term in office. Trump’s two non-consecutive terms ignited a wave of excitement in the crypto world, with BTC nearing $90,000 — madness! FOMO!

As Biden prepares to leave, we refrain from judging his actions, but we’ve discovered something intriguing: Biden’s complex history with crypto goes back further than expected, tracing back 33 years.

Thirty-three years ago, then-Senator Biden introduced the notable S.266 bill.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The S.266 Bill: Early Encryption Control

In 1991, as a senator, Biden introduced the Comprehensive Counter-Terrorism Act, also known as S.266. The bill called for government access to electronic communications, specifically encrypted data, in the interest of national security. At a time when encryption technology was in its infancy, Biden’s proposal met resistance from privacy advocates and technologists who argued that such an act could pave the way for state overreach and curb individual freedoms. Although it didn’t pass, S.266 set a precedent for government control over digital privacy — a stance that echoes in his policies toward cryptocurrency today.

Regulatory Approach Under Biden’s Presidency

Biden’s administration took a more conservative approach to cryptocurrency, focusing on rigorous regulatory oversight. Throughout his presidency, Biden prioritized financial transparency and compliance, enforcing stricter anti-money laundering (AML) and know-your-customer (KYC) measures within the crypto industry. In 2023, the Treasury and the SEC doubled down on regulation, treating digital assets like securities to ensure investor protection and market stability.

The 2021 Infrastructure Investment and Jobs Act, which Biden signed, caused a stir in the crypto community. The bill expanded the definition of “broker” to encompass entities involved in digital asset transactions, mandating that they report user transactions to the IRS. Critics argued that this move threatened to stifle innovation by imposing compliance burdens on individuals who might not even have the required reporting capabilities.

Biden’s appointments also reflected this cautious stance. SEC Chair Gary Gensler has pursued stringent regulatory measures, arguing that most cryptocurrencies qualify as securities and should be subject to SEC oversight. This approach significantly impacted the operations of crypto companies, some of which relocated operations overseas to avoid U.S. regulations.

Biden’s Stance on DeFi and Decentralization

Biden’s policy priorities often clashed with the principles underlying cryptocurrencies, especially those in decentralized finance (DeFi). With DeFi’s potential to disrupt traditional financial systems, Biden viewed the sector’s unregulated nature as a threat to financial stability. Thus, the administration implemented measures to control DeFi platforms offering liquidity and lending services, requiring them to adhere to regulatory frameworks or limit operations.

This approach has slowed DeFi’s development in the U.S., with many projects forced to adjust their compliance strategies or move their focus internationally. For example, certain DeFi protocols that allow users to exchange assets without intermediaries face tighter scrutiny under SEC regulations, which impose AML and KYC checks on decentralized applications.

The Future After Biden’s Term Ends

As Biden prepares to leave office, the U.S. crypto market may enter a new phase of opportunity. The next administration’s stance on digital assets will be crucial in shaping the market landscape. Should the succeeding administration adopt a more crypto-friendly policy, it could lead to another growth phase for the industry. Some industry leaders argue that global policy alignment on crypto regulation will drive market progress, with U.S. actions having a pronounced impact on worldwide sentiment.

Moreover, several U.S. states, including Florida and Wyoming, have taken steps to foster blockchain and cryptocurrency innovation, indicating a potential shift toward greater tolerance within certain regions of the country. Regardless of the regulatory approach of future presidents, the trend toward decentralization and digital currency innovation appears resilient, particularly as capital continues to flow into Web3 and metaverse applications.

Responses