Price analysis 5/31: BTC, ETH, BNB, SOL, XRP, DOGE, TON, SHIB, ADA, AVAX

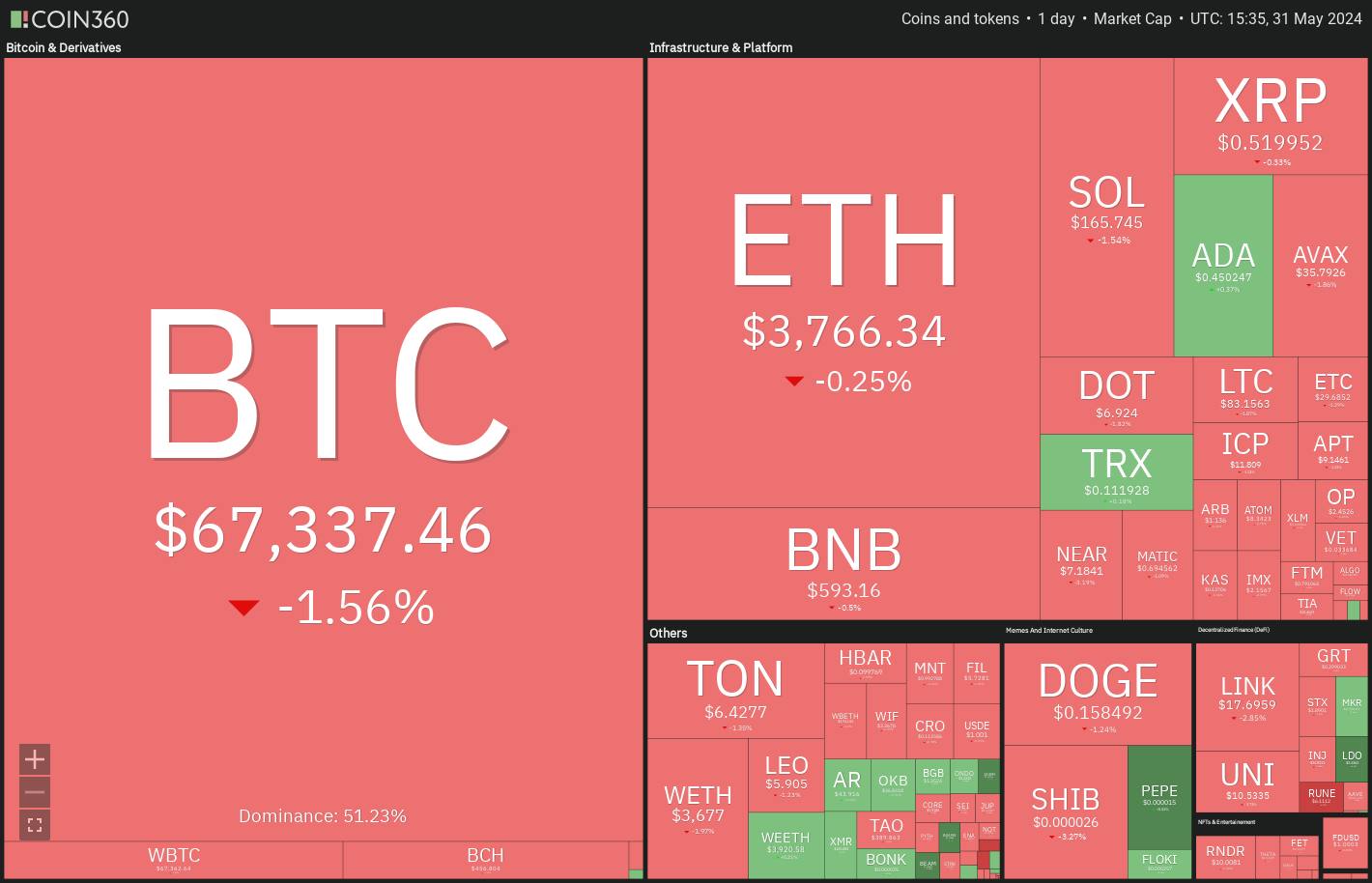

Bitcoin and Ether may spend more time inside a range before starting a trending move.

Bitcoin (BTC) has been range-bound for several days, indicating a tussle between the bulls and the bears for supremacy. Trading firm Mosaic Asset believes that “loosening financial conditions” could boost a risk-on trade, and Bitcoin could be on the verge of a breakout to the upside.

CryptoQuant founder and CEO Ki Young Ju said in a post on X that Bitcoin remained near $10,000 for six months in 2020 with high on-chain activity before skyrocketing to $64,000 in 2021. A similar trend was being seen in 2024, with “$1B added daily to new whale wallets, likely custody.”

Although a breakout has eluded Bitcoin, the bulls have achieved nearly an 11% rally in May. That is the first positive close after three years of negative monthly performance in May. That gives positive momentum to the buyers to extend the bullish performance in June.

Could buyers defend the support levels in Bitcoin and altcoins? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin rebounded off the support line of the symmetrical triangle pattern on May 30, but the bulls could not sustain the higher levels.

The bulls will have to shove the price above the triangle to gain the upper hand. That could start a rally to the overhead resistance of $73,777. The bears are expected to mount a strong defense at this level.

Conversely, if the price continues lower and breaks below the support line, it will suggest that the bears have seized control. The BTC/USDT pair could then tumble to $64,600 and eventually to the crucial support at $59,600. The bulls are likely to buy in the zone between $56,550 and $59,600.

Ether price analysis

Ether (ETH) is once again attempting to bounce off the breakout level of $3,730, signaling that the bulls are defending the level.

The rising 20-day EMA ($3,559) and the RSI in the positive territory indicate that the bulls have the upper hand. Buyers will try to propel the price to the stiff overhead resistance of $4,100. This is an important level for the bears to defend because a break above it will clear the path for a rally to $4,868.

Instead, if the ETH/USDT pair turns down and breaks below $3,730, it will suggest that the positive momentum has weakened. The advantage will tilt in favor of the bears if they yank the price below the 20-day EMA.

BNB price analysis

BNB (BNB) has been gradually slipping toward the uptrend line, which is likely to act as a strong support.

If the price rebounds off the uptrend line with force, the bulls will again try to push the BNB/USDT pair to the overhead resistance at $635. If this level is scaled, the pair will complete an ascending triangle pattern. This bullish setup has a pattern target of $775.

On the contrary, if the price dives below the uptrend line, it will invalidate the bullish pattern. That could accelerate selling and sink the pair to $536 and subsequently to the vital support at $495.

Solana price analysis

The failure of the bulls to start a strong bounce in Solana (SOL) from the 20-day EMA ($165) shows a lack of demand at the current levels.

The bears will try to strengthen their position by pulling the price below $162. If they do that, the SOL/USDT pair could drop toward $140. There is a minor support at the 50-day SMA ($152) but it is unlikely to hold.

Contrary to this assumption, if the price turns up from the current level and rises above $174, it will suggest that the bulls are trying to retain the advantage. The pair could then climb to $189 and eventually to $205.

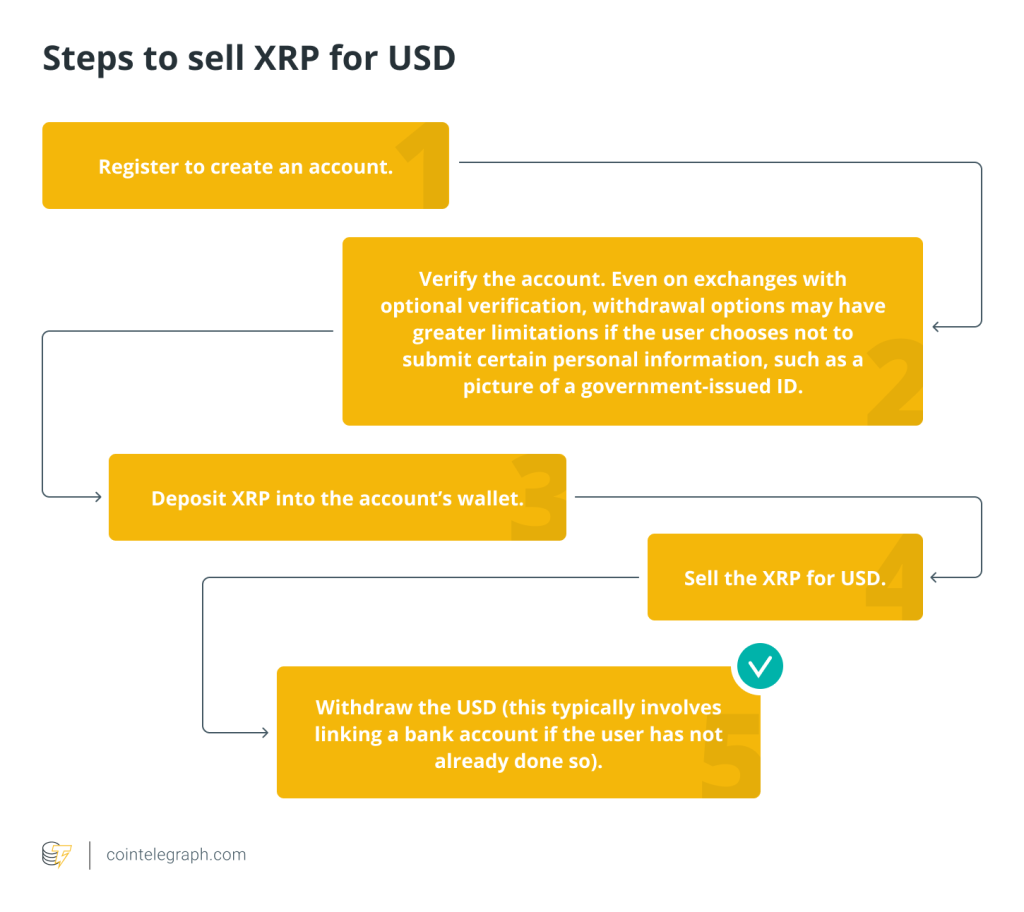

XRP price analysis

The bears are pulling XRP (XRP) below the moving averages. If they succeed, the next stop is likely to be the support line.

The bulls have defended the support line on three previous occasions, hence they will try to do that again. If the price rebounds off the support line with strength, the XRP/USDT pair could rise to $0.57. A break and close above $0.57 will complete the ascending triangle pattern, which has a pattern target of $0.68.

Conversely, if the price continues lower and breaks below the support line, it will suggest that the bulls have given up. The pair may then plunge to the critical support at $0.46.

Dogecoin price analysis

The bulls are struggling to maintain Dogecoin (DOGE) above the moving averages, indicating that the bears are selling on every minor recovery.

If the price skids below the 50-day SMA ($0.15), the DOGE/USDT pair could decline to $0.14. This level may act as a floor, but if broken, the slide could extend to the crucial support at $0.12.

Alternatively, if the price rebounds off $0.14, it will signal demand at lower levels. The pair may then consolidate between $0.14 and $0.18 for a while. A break and close above $0.18 will open the doors for a rally to $0.21.

Toncoin price analysis

Toncoin (TON) continues to trade near the moving averages, indicating a lack of aggressive buying or selling by the traders.

The flattish 20-day EMA ($6.39) and the RSI near the midpoint suggest that the range-bound action between $4.72 and $7.67 may extend for a few more days. If the price breaks below $6, the short-term advantage could tilt in favor of the bears. The TON/USDT pair could then drop to $4.72.

On the upside, a break above $6.73 will suggest that the bulls are back in the driver’s seat. The pair may then climb to $7.67.

Related: 3 solid Bitcoin indicators predicting BTC price rise to $75K in June

Shiba Inu price analysis

Tha failure of the bulls to push Shiba Inu (SHIB) above the overhead resistance of $0.000030 has resulted in a pullback to the 20-day EMA ($0.000025).

If the price rebounds off the moving averages, the bulls will again try to drive the SHIB/USDT pair above $0.000030. If they manage to do that, the pair could rally to $0.000033 and after that to $0.000039.

Conversely, if the price continues lower and breaks below the support line, it will signal that the bears are attempting a comeback. The pair may then slump to $0.000018, where the buyers are likely to step in.

Cardano price analysis

Cardano (ADA) continued lower and reached the support line of the symmetrical triangle pattern. The bulls are expected to defend the level aggressively.

If the price bounces off the support line and rises above the moving averages, it will suggest that the ADA/USDT pair may remain inside the triangle for some more time. A break and close above the triangle could start a strong up move toward $0.62.

Alternatively, if the price turns down and breaks below the support line, it will signal that the uncertainty has resolved in favor of the bears. That could start a downward move toward the next support at $0.35.

Avalanche price analysis

Avalanche (AVAX) has been range-bound between $29 and $40 for the past few days, signaling a balance between supply and demand.

If the price skids below the 50-day SMA ($36), the bears will attempt to pull the AVAX/USDT pair to the strong support at $29. This level is likely to attract strong buying by the bulls, keeping the pair inside the range for some more time.

The next directional move is likely to begin after the price breaks above $42 or below $29. If the $42 level is taken out, the pair may surge to $50. On the downside, a break below $29 could sink the pair to $20.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses