Telegram-linked Toncoin soars 50% in May for these 3 reasons

Toncoin is poised for a potential 20% increase in the upcoming weeks, mirroring a bullish fractal pattern previously observed in February 2024.

The price of Telegram-linked Toncoin (TON) cryptocurrency has rebounded by approximately 50% month-to-date—including a 15% jump in the last 24 hours—to reach $7.10 on May 10, its highest level in three weeks.

Toncoin has outperformed the broader crypto market, whose valuation has bounced by 15% in the same period.

This performance indicates that, although Toncoin’s movements are somewhat aligned with those of other leading cryptocurrencies, it possesses stronger catalysts that have enabled more substantial growth. Let’s take a closer look.

Notcoin airdrop boosts TON demand

Toncoin’s price rise occurs before the launch of Notcoin, a play-to-earn game, on May 16. Notcoin is a social clicking game that operates within the Telegram app. To play, participants engage with the Notcoin bot and are encouraged to invite friends to join.

The main activity in the game involves repeatedly tapping a golden coin displayed on the screen, which allows players to earn a virtual currency called Notcoin. So far, over 34.5 million players have participated in the “mining” of these Notcoin tokens.

The Notcoin team has confirmed an airdrop of a new native crypto, NOT, among the 34.5 million Notcoin token holders. Effective May 16, this crypto will start functioning atop the TON Blockchain — part of the Open Network’s layer 1 proof-of-stake (PoS) ecosystem.

In addition, NOT will go live for trading across leading crypto exchange platforms, including Binance and Bybit, on May 16.

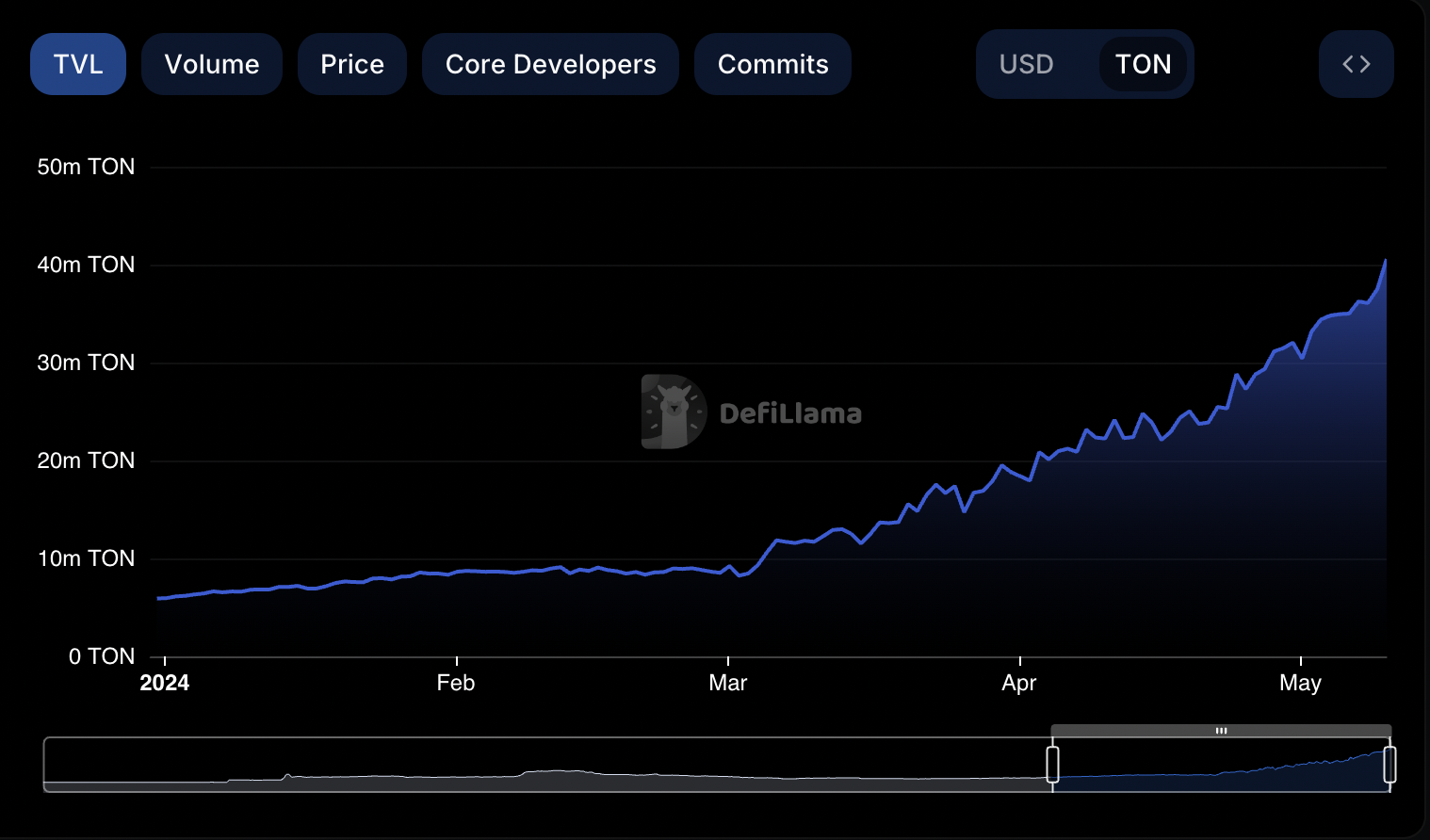

The days leading to the NOT launch on the TON blockchain have seen a significant rise in the total value locked (TVL) across its network. As of May 10, the TVL was 40.58 million TON, a 33% increase in May and a sevenfold increase so far in 2024, underscoring robust demand for Toncoin.

The rising TVL coincides further with the integration of Tether (USDT) stablecoins on the TON blockchain.

Pantera Capital’s undisclosed investment

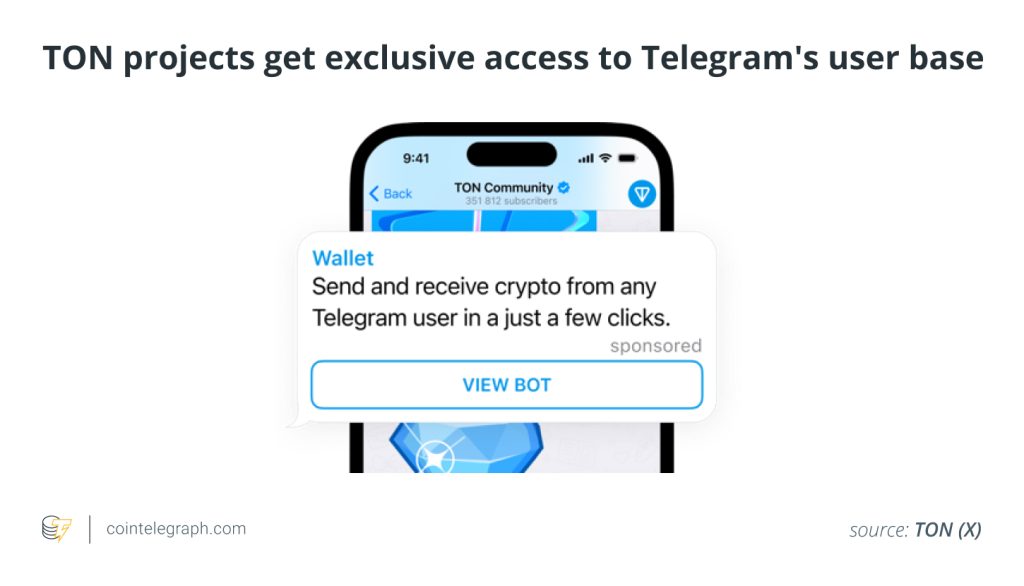

On May 2, Pantera Capital announced that it invested an undisclosed sum in The Open Network, citing the PoS ecosystem’s integration with the Telegram messaging service in April as the primary factor behind the investment.

The partnership between the Open Network and Telegram positions the former to become one of the largest crypto networks due to Telegram’s massive reachability, which has 900 million monthly users and 36.7 million monthly downloads, argues Pantera Capital.

Related: New Telegram mini-apps will be so convenient users won’t know it’s crypto

Since the announcement, the value of Toncoin has risen by approximately 46%, reflecting the market’s optimistic response to these developments.

TON price technical bounce

Toncoin’s recent gains have been driven by a rebound that started after it reached a key support confluence, marked by an ascending trendline, the 50-day exponential moving average (EMA), and the 0.618 Fibonacci retracement level.

This critical support zone is visually indicated with a red circle on the chart.

Simultaneously, the resurgence in TON’s price followed a dip in the daily relative strength index (RSI) to 37.45, a scenario reminiscent of a similar price recovery in February. During that period, the RSI also approached a comparable low point, coinciding with a supportive confluence of the 50-day and 200-day EMAs and the 1.0 Fibonacci retracement line.

From a fractal analysis perspective, Toncoin’s behavior around the support levels, indicated by the daily RSI and EMAs, is mimicking its previous price movements.

TON price could rise over 20% in May

As of May 10, TON’s price tested its 0.236 Fib line at around $7.17 as resistance while eyeing an extended rebound toward the 0.0 Fib line at approximately $8.77, up about 22% from the current price levels, in May.

Conversely, a pullback from the 0.382 Fib line resistance could have TON’s price eye the 0.382 Fib line at around $6.19 as its immediate downside target. A decisive break below the 0.382 Fib line would put the price at risk of declining toward $5.40 in May, a level aligning with the ascending trendline support and the 0.5 Fib line.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses