BTC price due $55.4K next amid warnings over end of Bitcoin 'euphoria'

Bitcoin may be "up only" on short timeframes, but seasoned traders are already preparing for a blow-off BTC price top and subsequent bear market.

Bitcoin (BTC) is on the way to $55,000 this week — but warnings of a new bear market are already surfacing.

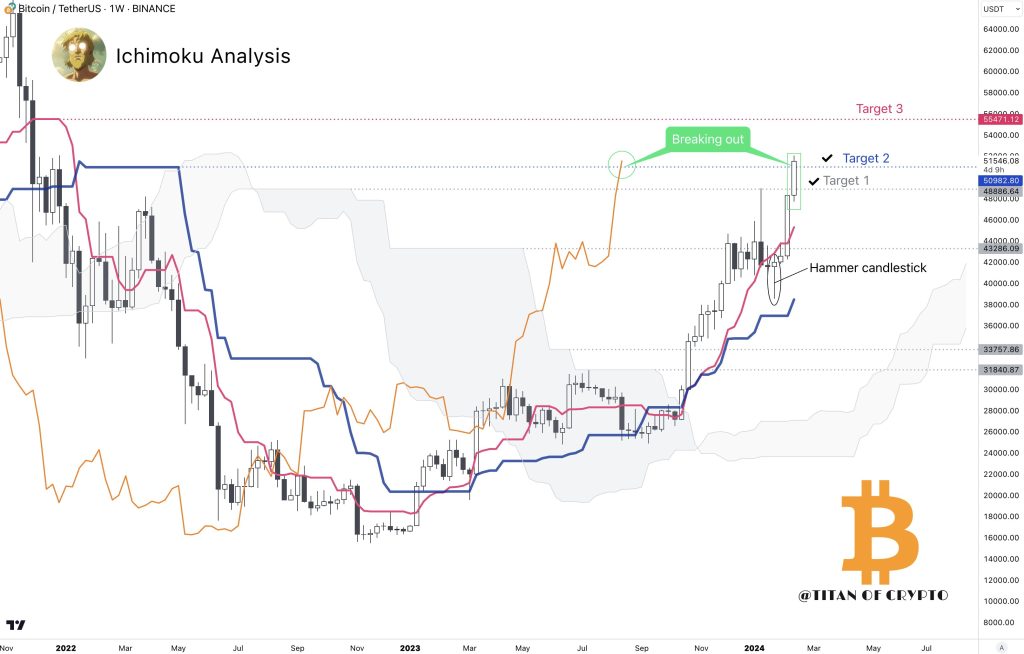

In his latest analysis on X (formerly Twitter) on Feb. 14, popular trader Titan of Crypto confirmed a $55,400 BTC price target next.

BTC price: Ichimoku analysis points higher

Bitcoin bulls continue to fight for the road toward all-time highs, with resistance around $52,000 currently forming the battleground.

Titan of Crypto, capturing overall market sentiment, suggested that “extremely bullish momentum” could take BTC/USD another 6% higher in the coming week.

Uploading a weekly chart including Ichimoku Cloud data, he outlined one more upside target left to hit, with two already achieved.

“Both target 1 & 2 have been hit but $50,900 is a strong level. If Bitcoin manage to close a weekly candle above, target 3 at $55.4k is next,” part of the accompanying commentary stated.

“Note that given the extremely bullish momentum target 3 has high chance to get hit even before the end of the week.”

As Cointelegraph reported, Ichimoku currently shows a rare bullish setup on weekly timeframes, with BTC price now clearing major resistance features.

Trader cautions over “unhinged greed” coming to Bitcoin

Looking ahead, however, concerns over a potentially “overheated” market are leading to BTC price downside predictions.

Related: Bitcoin bulls flirt with $69K BTC price target as crypto market nears $2T

In a lengthy X post, trader and analyst Credible Crypto warned that even if existing all-time highs are exceeded and BTC/USD passes $100,000, the odds of a snap correction are increasing.

This, he says, represents natural market dynamics — despite heavy inflows into the spot Bitcoin exchange-traded funds (ETFs), nothing can remain in “up only” mode indefinitely.

“At the end of the day, for every major parabolic rise there is a major crash, and vice versa,” he wrote.

“You don’t get unhinged greed and euphoria (and the vertical price appreciation that comes with it) without an equal and opposite reaction when that euphoria peaks.”

Credible Crypto referenced another post by trader and YouTuber TXMC Trades, who earlier told readers not to trust in ETF inflows propelling Bitcoin higher ad infinitum.

While I do think that we are on an aggressive path to new all time highs at the moment, the tweet below is important to cement into your mind- as there will be a point in the relatively near future when a major crash/correction will be deemed “impossible” because we “are in a new… https://t.co/mYghO2GE4s

— CrediBULL Crypto (@CredibleCrypto) February 14, 2024

Others also maintain an air of caution over BTC price strength. For Michaël van de Poppe, founder and CEO of MN Trading, the market is already “slightly overheated.”

“I wouldn’t be unhappy if we got a slight correction to return to reality,” he concluded on the day.

The inflow in the ETF is great for #Bitcoin.

However, it’s not the sole argument for the markets to move.

If I look at this clean chart, it suggests that we’re:

– Super bullish.

– Slightly overheated.I wouldn’t be unhappy if we got a slight correction to return to reality. pic.twitter.com/ZNnoNQGeeK

— Michaël van de Poppe (@CryptoMichNL) February 15, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] There you will find 34962 additional Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] There you can find 88773 additional Info to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Here you can find 76849 more Info to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] There you will find 79960 more Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Here you will find 10816 additional Information on that Topic: x.superex.com/academys/markets/4462/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4462/ […]