Why is XRP price down today?

XRP price is falling with the wider crypto market, pulled down by negative technical trends, whale distribution, and disappointing ETF news.

XRP (XRP) has been experiencing a downward trend in recent weeks, and Jan. 23 looks no different. On the day, the cryptocurrency dropped over 4% to $0.50. The reasons for this decline are both technical in nature and influenced by market sentiment.

XRP price technicals and investor behavior

From a technical perspective, XRP’s ongoing decline is part of a broader downtrend that typically starts when the price tests a multi-month descending trendline resistance, as shown below.

XRP’s most recent retest of the trendline came on Dec. 28; its price has fallen by about 25% since.

As of Jan. 23, this cryptocurrency is navigating another crucial technical threshold — a multi-month ascending trendline support. This particular support level has historically marked the onset of more extensive recoveries in the past months.

XRP shows bearish momentum, with the price trading below key moving averages and the RSI suggesting potentially oversold conditions. This could further attract buyers looking for a bargain at. current levels.

No spot XRP ETF product for now

In addition to technical factors, XRP’s price decline today follows the buzz around the potential launch of a spot XRP exchange-traded fund in the U.S.

As of late, the market was hoping that BlackRock, the world’s largest asset manager, would launch a spot XRP ETF.

These expectations dwindled on Jan. 18, when the firm reportedly clarified that it had no plans to launch such an investment product, dashing hopes for increased exposure and institutional investment for XRP.

XRP price has dropped by over 13% since the clarification.

Regulatory challenges

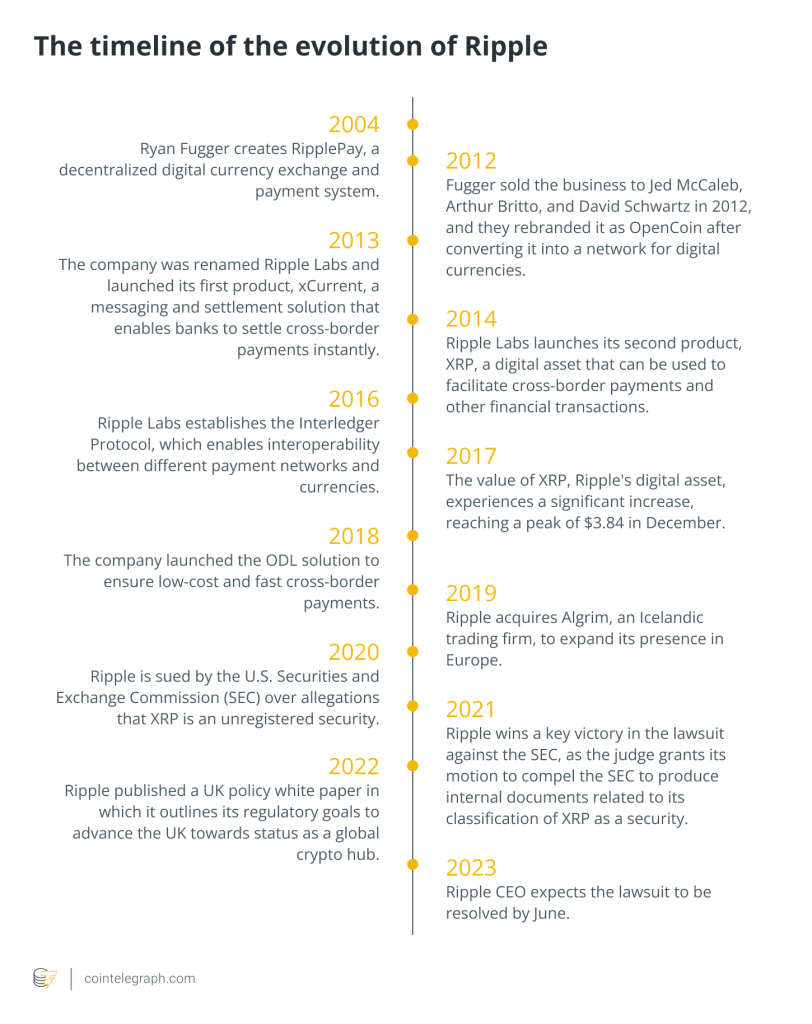

Further impacting investor sentiment, Ripple, the company behind XRP, is embroiled in ongoing legal disputes with the U.S. Securities and Exchange Commission (SEC).

The SEC’s demand for Ripple to produce financial statements and a lawsuit scheduled for April 2024 exacerbates the air of regulatory uncertainty surrounding XRP. This has likely dampened investor enthusiasm and could be partially responsible for the recent sell-off.

XRP’s supply among whales drop

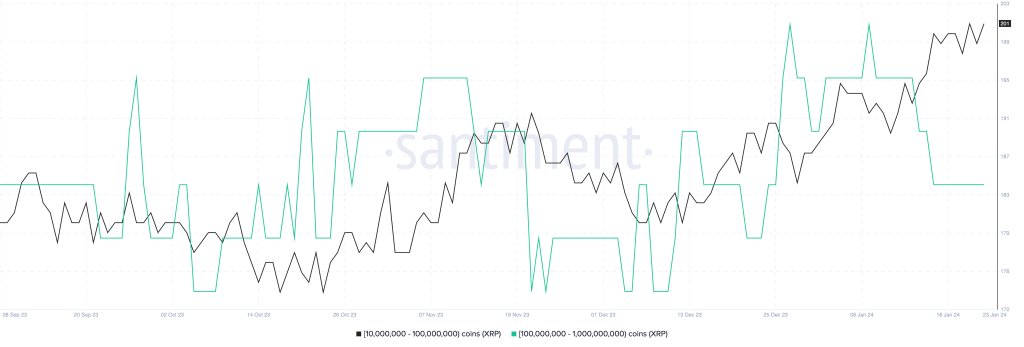

XRPs decline today and January so far coincides with a decline in the supply held by its richest investors.

Related: XRP price falls near critical support level as Bitcoin and crypto market correct

In January, there was a notable decrease in the XRP supply held by addresses with balances ranging from 100 million to 1 billion tokens (green). This reduction aligns with a rise in the supply held by investors who possess between 10 million and 100 million tokens (black).

This trend suggests that holders within the 100-million-to-1-billion token balance group have actively sold or redistributed their XRP holdings.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] There you can find 96569 additional Info on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] There you can find 61793 additional Information on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] There you can find 62907 additional Info on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] There you will find 40398 additional Information on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Here you will find 84443 more Info to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] There you can find 68141 more Information to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Here you can find 11790 additional Information to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Here you will find 93549 additional Information to that Topic: x.superex.com/academys/markets/3365/ […]

… [Trackback]

[…] Here you will find 81497 additional Info to that Topic: x.superex.com/academys/markets/3365/ […]