What needs to happen for Ethereum (ETH) price to reach $4K?

Ethereum’s Achilles heel is institutional adoption, scalability, and sustainable DApp ecosystem growth.

Ether (ETH) last traded above $4,000 on March 14, over two months before the Ether spot exchange-traded fund (ETF) approval by the United States Securities and Exchange Commission on May 23. Traders are questioning whether the bullish momentum has faded and, if not, what might drive a sustained rally above $4,000.

Spot spot Ether ETF launch was less than optimal

Part of investors’ lack of enthusiasm can be attributed to the cryptocurrency market’s underwhelming performance. The current sector’s total capitalization is $2.42 trillion, which is 16.5% below the 2024 peak of $2.82 trillion on March 14. Contributing factors include the US Federal Reserve’s apparently successful strategy to curb inflation without causing a recession, which has reduced the appeal of alternative assets.

However, Ether appears to be facing its own issues. Its price relative to Bitcoin (BTC) has declined by 10% in two months. The $406 million net outflows from aggregate Ether spot ETFs in the US since their debut on July 23 are partly to blame, although the outflows are concentrated in Grayscale’s products.

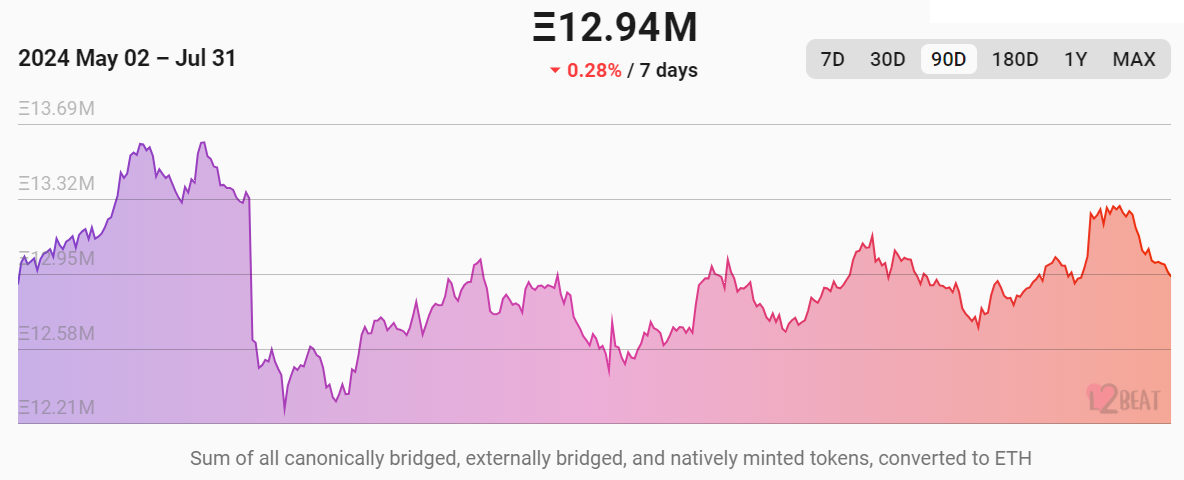

The Ethereum network’s stagnant total value locked (TVL) at ETH 17.8 million, unchanged from two months ago, suggests that ecosystem growth may have stalled. Some analysts argue that Ethereum gas fees, which have been above $1.8 for the past couple of months, incentivize its layer-2 scaling solutions. However, the TVL for these solutions has remained relatively flat at ETH 12.9 million over the past two months, according to L2Beat data.

In essence, for Ether to reclaim the $4,000 support level, there needs to be increased interest from institutional investors. This could be reflected in a trend of net spot ETF inflows in the US or at least the cessation of outflows from the Grayscale ETHE fund. As institutional money enters the space, traders would expect confirmation by measuring the ecosystem’s TVL.

Still, some investors have become skeptical of decentralized applications (DApps) deposit growth. This skepticism is due to the involvement of venture capital funds or projects that see large inflows ahead of airdrops but fail to sustain the initial hype. Consequently, TVL growth should align with improvements in other onchain metrics, such as the number of active addresses.

Ethereum TVL needs to grow, but its roadmap must also be addressed

Even though Ethereum fans claim the project’s decentralization is far superior to competitors like Solana (SOL), BNB Chain (BNB), and Tron (TRX), this argument falls short when reputable investment firms choose to launch their projects elsewhere. The latest example occurred on July 23, when US-listed asset manager Hamilton Lane opted for Solana’s Libre to launch a tokenization project.

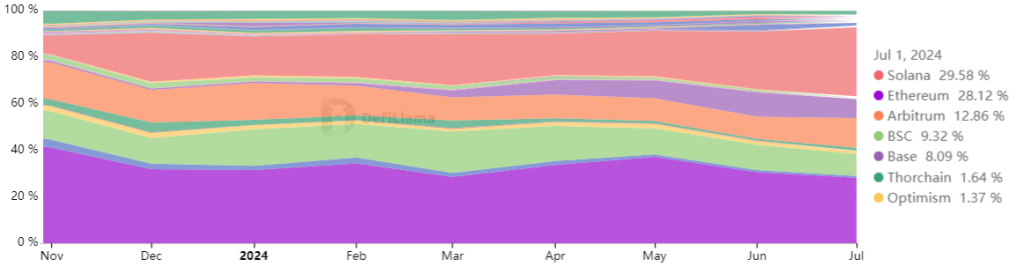

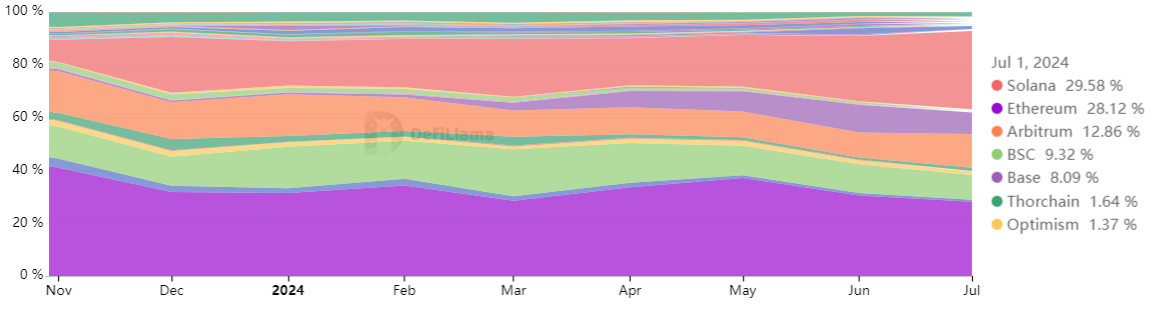

More concerningly, Ethereum’s dominance among retail traders has been recently challenged, as Solana has taken the lead in decentralized exchange (DEX) trading volumes. Fueled by memecoins launched on Pump.fun, Solana reached a 29.6% DEX market share in July, surpassing Ethereum’s 28.1%, according to DefiLlama data.

Related: Coinbase L2 Base hosts 80% of active Uniswap traders — Token Terminal

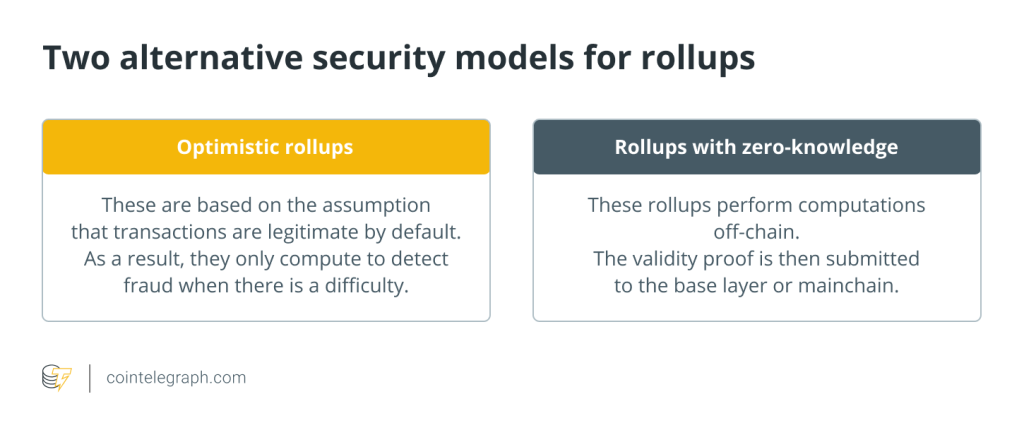

Lastly, Ether’s sustainable price growth depends on clearer timelines for Ethereum’s proposed scalability improvements, including sharding (parallel processing) and miner extractable value (MEV) mitigation strategies. Proposed changes, such as Danksharding, aim to increase the current limit of one blob per block to 64, significantly enhancing data availability.

The next upgrade, dubbed the Pectra fork, is expected to introduce Verkle trees, reducing storage requirements and enhancing data accessibility. Additionally, investors are eagerly awaiting the implementation of zero-knowledge SNARKs, which are expected to increase privacy and compress transaction data into succinct proofs, reducing the blockchain’s storage requirements.

Ether’s path to $4,000 in 2024 remains feasible, but only if these issues related to institutional adoption, increased scalability, and DApps ecosystem growth are addressed.

Responses