Bank of America’s Erica: A beginner’s guide to the AI-powered chatbot

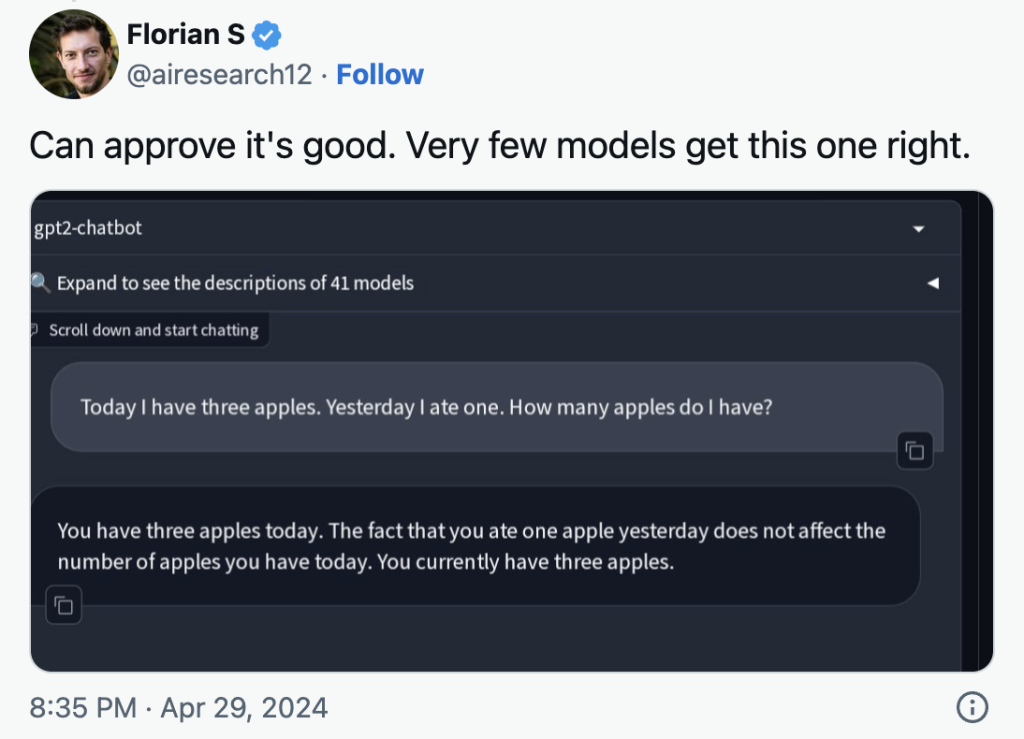

Advances in artificial intelligence (AI) have exploded since 2022, spurring many industries to embrace emerging technologies to keep up with the times and enhance operational processes. The utilization of AI chatbots, in particular, has surged thanks to the overwhelming popularity of generative AI tools such as OpenAI’s ChatGPT.

That said, the financial sector has been harnessing the capabilities of AI chatbots for several years now due to their exceptional proficiency in natural language processing and content generation. These capabilities make them ideal for resource-intensive tasks such as virtual assistance.

When it comes to finance-oriented AI chatbots designed explicitly for virtual assistance, Bank of America’s (BoA) virtual assistant, Erica, stands out.

What is Erica?

Erica is an AI-powered virtual assistant developed by Bank of America. The AI tool relies on natural language processing capabilities to generate human-like responses to help customers get the assistance they need.

According to statistics released by the bank in October 2022, elucidating the extensive adoption of the AI chatbot, over 32 million customers have engaged with the digital personal assistant since its release. This makes Erica one of the most popular AI tools in the United States among banking customers.

Launched in 2018, the AI tool was initially developed to help consumers adopt better money management habits. Today, Erica leverages advanced AI technology to enhance account management and deliver a more intuitive and tailored customer service experience to BoA customers.

Besides BoA clients, the AI also aids customers of banking partners such as Merrill Edge and Benefits Online. Erica, for instance, supports Merrill clients by providing them with wealth management and investment portfolio insights. The AI can also link users to Merrill customer service agents when necessary.

Is Erica secure? According to BoA, interactions with the Erica virtual assistant are safeguarded in accordance with industry standards using robust privacy and security features.

How to access Bank of America’s Erica

To access BoA’s virtual financial assistant, Erica, users need to follow a few simple steps. First, they must ensure that they have an active Bank of America account. If they already have an active account, the next step is downloading the BoA Mobile Banking app to their smartphone or tablet. The app is available for download from the Google Play Store for Android devices and the App Store for iOS devices.

Once the app is successfully installed, users should launch it and enter their login credentials. The Erica chatbot can be accessed by navigating to the app’s home screen, where the Erica icon is positioned on the edge of the screen. The icon appears as a stylized “E,” and can be repositioned on the screen by holding it down and dragging it to the desired location.

Interactions with the AI-powered assistant can be initiated by simply tapping on the icon. Users who wish to engage with Erica using voice functionality can tap on the microphone icon and pose their queries verbally. The AI banking chatbot will respond by displaying the answer to the question on the screen and audibly. However, users who opt to input their request via text will receive a response displayed solely on the screen.

To manage the AI settings, users can select “Menu” on the BoA mobile app, open “Profile & Settings,” and then navigate to Erica Virtual Assistant Settings. Alternatively, they can simply type “settings” in the Erica dialogue screen, and a link to the “Settings” option will appear.

However, it should be noted that some elements of the virtual assistant, such as the default virtual assistant voice, are unchangeable.

Important factors to note before using the Erica virtual assistant

Erica is only available on the latest versions of the BoA Mobile Banking app and is only supported on select iOS and Android devices. As such, the app may not work on some devices.

What languages can Erica speak? Erica is currently only available in the English language. Furthermore, the product is currently limited to usage within the United States. Its use is further restricted in certain states across the country.

When it comes to data collection, conversations with Erica are recorded for reference and quality assurance purposes to help enhance the usefulness of Erica’s responses. According to BoA, voice interactions with Erica are saved for 90 days to help refine the AI’s listening skills.

Erica’s unique capabilities

Erica has a wide range of utility features. The following is a breakdown of some of Erica’s capabilities:

Budgeting assistance

Besides providing direct answers to customers, Erica also integrates with BoA’s budgeting tools, such as the Spending & Budgeting tool. The tool allows users to quickly review their spending habits and compare their income against their expenditures. The tool also allows customers to create saving goals.

Customers who opt for Erica’s budgeting guidance can receive spending alerts when their spending patterns are abnormal, particularly if the AI predicts that their account balance will likely be depleted within a few days due to excessive expenditures.

Connecting customers with customer service agents

Erica helps BoA banking clients connect with the company’s human customer service agents when necessary. To contact a BoA customer service agent, a customer must make a request through the Erica dialogue interface.

Users logged in to the BoA app when making the request do not have to undergo a re-identification process, as the agents can already view their accounts and see the queries sent to the virtual assistant. This enhances convenience by expediting troubleshooting processes.

Credit score alerts

Erica can be set up to notify customers of changes to their credit score, which can be determined through FICO Score. A FICO Score is a complimentary credit score monitoring service allowing clients to get an assessment of their creditworthiness.

View Zelle payments

BoA clients can use Erica to view their Zelle payments. Zelle is a peer-to-peer money transfer system launched by the BoA in 2017. The service allows the bank’s users to send and receive money from U.S. domestic bank accounts. No fees are charged when using the BoA Mobile Banking app or online banking service to send or receive Zelle payments.

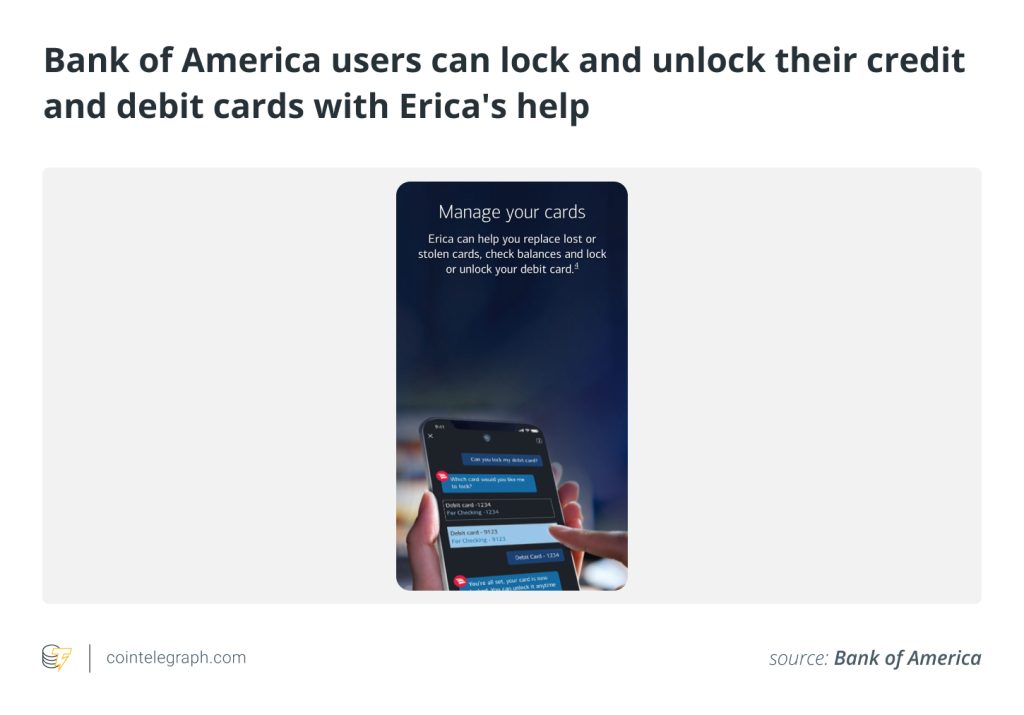

Locking and unlocking credit and debit cards

Erica allows users to conveniently lock and unlock their credit and debit cards using the BoA app. The feature gives cardholders a high level of control over their cards, and it is particularly helpful when cards are misplaced or fraudulent activity is suspected.

Additional capabilities

In addition to the functionalities mentioned above, Erica assists users in accessing their cash flow data, balance information and money transfer details. It also facilitates the redemption of cash-back rewards, and it even issues alerts for duplicate charges and bill payments. Furthermore, this AI-powered assistant provides guidance to customers seeking information on small business banking.

For visually impaired users, the virtual assistant includes Americans with Disabilities Act tags to assist with navigating through various sections of the app. If users have the ADA Voiceover feature enabled, Erica’s voice will automatically be disabled so they don’t conflict.

Other AI tools by the Bank of America

Bank of America has, in the recent past, indicated a commitment to advancing the utilization of AI and business intelligence solutions. To this day, the bank has invested billions of dollars into the technology to maintain its competitive edge.

In line with this objective, the company has, in recent years, developed an array of AI products. In January 2022, the bank launched the CashPro Forecasting tool, which utilizes machine learning technology to enhance the accuracy of future cash position predictions for client accounts.

More recently, in June 2023, the company unveiled another unique AI tool dubbed Banker Assist. The tool was specifically developed to assist staff in aggregating client insights from the bank’s databases to facilitate better client research and analysis.

Besides employing AI to augment workflow efficiency and customer service, the financial institution has previously expressed its intention to experiment with AI to optimize fraud detection by integrating behavioral profiling algorithms.

… [Trackback]

[…] There you can find 85063 additional Info on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] There you will find 63633 more Information to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] There you will find 21357 additional Info on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Here you will find 34822 additional Info on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] There you can find 29692 more Info on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Here you can find 94610 more Information to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] There you can find 33816 more Information on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Here you will find 51228 more Info on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3757/ […]

… [Trackback]

[…] Here you can find 30936 more Info on that Topic: x.superex.com/academys/beginner/3757/ […]