Stablecoins 101: What are crypto stablecoins and how do they work?

Stablecoins are a class of cryptocurrencies that attempt to offer investors price stability either by being backed by specific assets or using algorithms to adjust their supply based on demand.

The first stablecoin was issued in 2014 and since then, they have gained traction, as stablecoins offer the speed and security of a blockchain while getting rid of the volatility that most cryptocurrencies endure.

Stablecoins were primarily used to buy cryptocurrencies on trading platforms that did not offer fiat currency trading pairs. Fiat currency refers to government-backed currencies that are not backed by commodities like gold or silver. As their adoption grew, stablecoins are now used in several blockchain-based financial services such as lending platforms and can even be used to pay for goods and services.

Stablecoins are blockchain-based versions of fiat currencies, which means they are programmable and can interact with blockchain-based applications and smart contracts (which are self-executing agreements written in code).

Understanding stablecoins

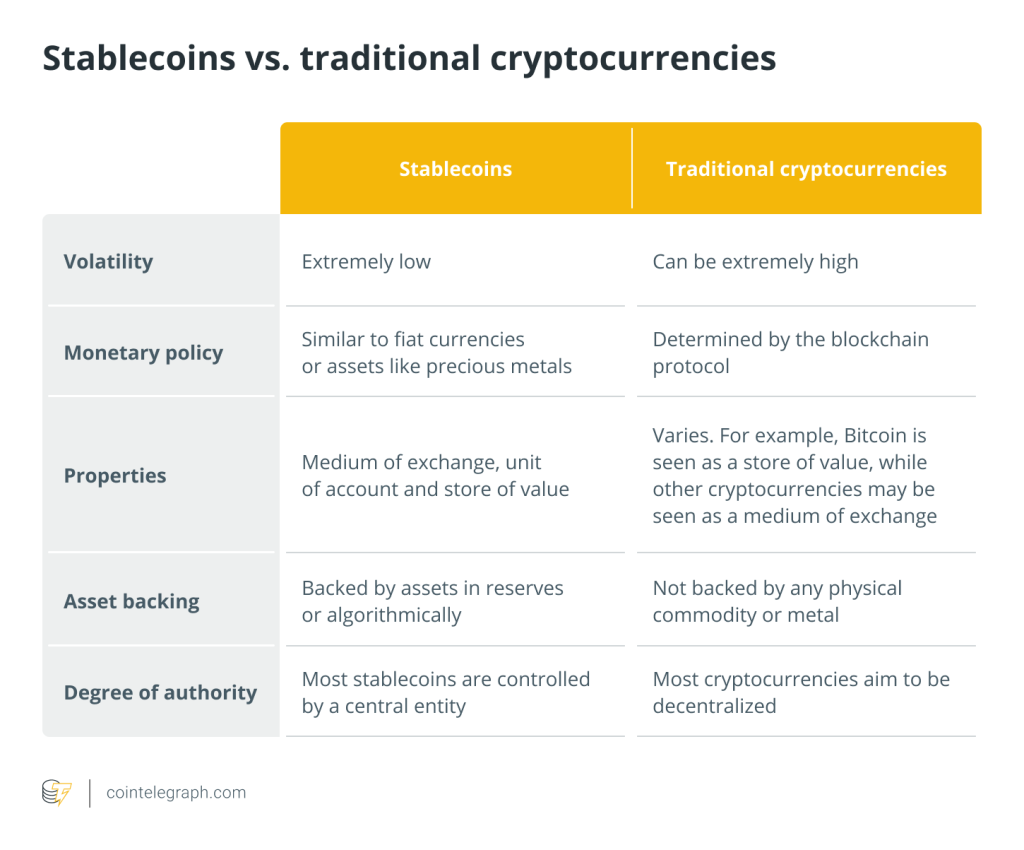

Popular cryptocurrencies like Bitcoin (BTC) and Ether (ETH) tend to suffer from high volatility. Volatility refers to the amount of uncertainty related to the changes in the value of an asset. A higher volatility means the asset’s price can swing wildly over time in either direction, while lower volatility means its price is relatively stable.

Volatility can be measured in quantifiable daily returns by looking at an asset's percentage in points (pips) movements. Even the leading cryptocurrencies often move over 10% during periods of market turmoil, affecting their use as mediums of exchange. An asset as a medium of exchange means it can facilitate the purchase and sale of goods and services.

To be used as a currency, an asset is expected to act as a medium of exchange, a unit of account and a store of value, meaning an asset has to maintain its value, be used to value goods and services and facilitate commerce. The most apparent benefit of stablecoin technology is that it can be used as a medium of exchange, bridging the gap between fiat and cryptocurrencies. Stablecoins can reach a utility entirely different from the ownership of legacy cryptocurrencies by reducing price volatility.

Stablecoins are inherently stable assets, making them a good store of value and encouraging their adoption in regular transactions. Stablecoins also increase the mobility of crypto assets around the ecosystem.

Stablecoin and fiat currency holders know that the purchasing power of their holdings won’t change over short periods of time and can be used to buy goods and services. Stablecoins set themselves apart by being blockchain-based, as described above.

The value of most stablecoins is pegged to the value of either a specific fiat currency such as the United States dollar or a particular commodity such as gold. Being pegged means that their price is fixed, so one stablecoin tracking the U.S. dollar should be worth one dollar.

This peg can be maintained through a number of different mechanisms. The most common method used by stablecoins is called asset backing. Asset backing refers to the total amount of stablecoin tokens in circulation with respect to the number of assets backing it. A stablecoin is backed 1:1 if, for every stablecoin in circulation, there are assets worth an equivalent amount backing it.

In the case of stablecoins backed by a U.S. dollar, it’ll keep its value as long as the stablecoin is redeemable for the U.S. dollar. However, if its value moves sharply in either direction, traders looking to profit off of price differences between markets will step in to close the gap.

What are stablecoins used for?

Being based on the blockchain allows stablecoin holders to take advantage of numerous opportunities. The first stablecoins were issued as fiat currency replacements on exchanges and gave investors a safe haven away from the volatility of other crypto assets.

Stablecoins can now be used to lend for rates better than those offered by traditional savings accounts or take out cryptocurrency-backed loans in the decentralized finance (DeFi) space. While stablecoins may earn higher yields than traditional savings products, it is crucial to note that stablecoin offerings do not provide any government-backed insurance.

Stablecoins have been issued on various blockchain networks that support smart contracts and are widely used throughout the DeFi space and on exchanges. Blockchain networks that support smart contracts allow applications like decentralized exchanges (DEXs) to be built on top of them. Decentralized exchanges are marketplaces where transactions are made directly between traders.

Stablecoins can also be used to pay salaries in cryptocurrency as they make it cheaper to move money across borders. Only a transaction fee to move funds on the blockchain has to be paid. Moreover, cross-border transactions are settled faster on the blockchain, taking between a few seconds to an hour, depending on numerous factors. These factors include the type of network being used, potential network congestion, the amount paid in fees and the transaction complexity. However, the traditional financial system may take days to settle cross-border transactions.

While traditional cryptocurrencies don’t have a fixed price and may swing wildly, stablecoins’ low volatility helped investors maintain their funds on the blockchain while reducing risk.

How stablecoins remain stable

Government-issued fiat currencies remain stable through the actions of controlling authorities like central banks, which ensure their currencies' prices remain relatively stable. Stablecoins can be backed by a physical commodity such as gold, by algorithms, or by government-issued fiat currencies.

Stablecoins take advantage of the stability provided by central banks and the government to create reserves in government-backed fiat currencies such as the U.S. dollar. To monetize stablecoin reserves, some of the funds backing stablecoins are allocated to fixed-income securities such as short-term corporate debt and government-backed debt obligations that ensure that the funds remain redeemable and adequately backed.

Stablecoins are kept stable via a few basic mechanisms, including fiat backing, crypto backing, commodity backing and algorithm backing, to be explained in the following sections.

Fiat-backed stablecoins

Stablecoins backed by fiat currencies maintain reserves in fiat currencies like the U.S. dollar. For every token in circulation, fiat-backed stablecoins often have one dollar in reserve — either in cash or cash equivalents.

Stablecoin reserves are maintained by central entities that regularly audit their funds and work with regulators to ensure that the entities holding stablecoin reserves remain compliant. It means that to buy stablecoins directly from the issuers, users have to go through Know Your Customer (KYC) and Anti-Money Laundering (AML) checks similar to those on exchanges. These processes involve collecting users’ personal information, including a copy of their government-issued identification document.

Once in circulation, anyone can send and receive stablecoins, although the central entity issuing them may have the power to freeze funds on addresses. Stablecoins have been frozen in the past, as issuers assisted law enforcement in their investigations or attempted to recover stolen funds, for example.

Cryptocurrency-backed stablecoins

Cryptocurrency-backed stablecoins are those backed by other cryptocurrencies. Cryptocurrency-backed stablecoins can be issued to track the price of the cryptocurrencies backing them or track the price of a fiat currency.

A crypto-backed stablecoin can be issued to launch one asset on a different blockchain. For example, Wrapped Bitcoin (WBTC) is a stablecoin backed by Bitcoin issued on the Ethereum blockchain.

Alternatively, cryptocurrency-backed stablecoins can track the value of a fiat currency through balancing mechanisms on the blockchain, which use the stablecoins’ backing to ensure price stability. In these cases, stablecoins are overcollateralized to ensure that they can maintain their peg even during periods of high volatility in the market. Being overcollateralized means that the assets backing a stablecoin are worth more than the value of stablecoins in circulation. For example, $1,000 worth of Ether may be held in reserve to collateralize the $500 value of a cryptocurrency-backed stablecoin. Frequent audits and monitoring tools add to the stability of the stablecoin’s price.

Cryptocurrency-backed stablecoins are a more decentralized version of fiat-backed stablecoins, as they can be created through the use of automated smart contracts with no central entity controlling them.

Commodity-backed stablecoins

Commodity-backed stablecoins are essentially blockchain-based representations of commodities and are backed by reserves held by a central entity.

Physical assets such as precious metals, oil and real estate are used to back commodity-backed stablecoins. Gold is the most commonly collateralized commodity. However, it is necessary to understand that these commodities can and will fluctuate in price and, hence, can potentially lose value.

Stablecoins backed by commodities make it easier to invest in assets that might otherwise be out of reach on a local level. Obtaining a gold bar and locating a secure storage site, for example, is difficult and expensive in many areas. As a result, owning tangible assets such as gold and silver is not always a viable option. However, commodity-backed stablecoins are also handy for those who want to swap tokens for cash or gain custody of the underlying tokenized asset.

Algorithmic or hybrid stablecoins

Algorithmic or hybrid stablecoins are stablecoins that rely on complex algorithms to keep their prices stable, effectively balancing funds held on the blockchain via smart contracts with supply and demand to maintain price stability.

The algorithmic stablecoins function as real central banks, defending the peg of their currency in the market. When the price of the stablecoin goes over the peg they buy assets and sell them when the price drops below the peg.

Some algorithmic stablecoins are known for losing their peg during black swan or unexpected events because the market volatility shoots upwards due to a lack of over-collaterization. An algorithmic stablecoin system will lower the number of tokens in circulation when the market price falls below the fiat currency's price. Alternatively, if the token's price exceeds that of the fiat currency it represents, new tokens are issued to bring the stablecoin's value down.

Non-collateralized or seigniorage-style stablecoins

Non-collateralized or seigniorage-style stablecoins are similar to algorithmically-backed stablecoins, but they do not have any reserves in smart contracts. Instead, seigniorage-style stablecoins rely on complex processes meant to adjust the circulating supply of their coins in response to supply and demand.

Non-collateralized or seigniorage-style stablecoins destroy and inflate supply on-chain to maintain their peg. No collateral is used to mint these stablecoins as they are self-collateralized. For instance, let’s assume the value of stablecoin A is $1.00. The price lowering to $0.70 shows that there is more supply than demand for a stablecoin. The algorithm buys stablecoin A with seigniorage, reducing supply and bringing the price back to $1.00.

If the price remains below $1.00 and there are not enough earnings to buy more of the coin's supply, seigniorage shares are issued. It means users are effectively investing in the expansion of the supply of non-collateralized stablecoins. On the flip side, if the price of a stablecoin rises above $1.00, the algorithm generates more tokens, increasing supply until the price falls below $1.00. The profits are referred to as “seigniorage.”

Advantages of Stablecoins

Stablecoins have several advantages over fiat currencies and other cryptocurrencies. Firstly, they bring the stability of fiat currencies to the blockchain, meaning that they are more secure and more transparent versions of fiat currencies that can interact with applications built on the blockchain.

Stablecoins can be used as a currency and are cheaper for making transactions than traditional fiat currencies, and are available to a network of applications that offer higher yields than conventional savings accounts. On blockchain-based applications, stablecoin holders can also take out loans backed by their coins or take out insurance to protect their crypto assets on other applications.

Stablecoins make cross-border payments faster and cheaper and can be easily traded for fiat currencies on exchanges, as they are widely accepted on trading platforms and are highly liquid.

Commodity-backed stablecoins make precious metals and other commodities easy to carry and more divisible while maintaining the same value as their reserve. Gold, for example, can be used as a medium of exchange through these stablecoins and can even be lent out to earn interest.

Disadvantages of Stablecoins

The main disadvantage associated with stablecoins is counterparty risk. Counterparty risk describes the likelihood that another party involved in an agreement might default. In this case, a stablecoin issuer may not have the reserves they claim to have or may refuse to redeem tokens for their reserves.

Stablecoins that rely on central entities and auditors are subject to human error, as audits may fail to spot inaccuracies or potential problems. Moreover, fiat currency-backed stablecoins are often held in commercial paper, a form of short-term unsecured debt. The use of commercial paper adds to the counterparty risk, as the company issuing that debt could default on its obligations.

Periods of market turmoil or failure to produce audits may also lead to risk premiums. Risk premiums represent the additional compensation investors get for the added risk of investing in an asset (i.e., stablecoins). The risk premiums lower the value of stablecoins compared with their peg, which means buying cryptocurrencies with stablecoins becomes slightly more expensive than with fiat currencies.

Algorithmic stablecoins can often lead to Ponzi schemes where new tokens are only created through new users depositing collateral. A Ponzi scheme is a type of fraud that generates returns for investors with funds from new investors and eventually collapses when new investors stop making investments. This means the value of these assets can quickly implode if new users stop coming.

Finally, the central entities issuing tokens may have the power to freeze them on addresses at the request of law enforcement. Law enforcement agencies may require tokens to be frozen even during investigations related to money laundering, counter-terrorism financing, or other illicit activities.

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Here you can find 85903 more Information to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Here you can find 21963 additional Info on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Here you can find 28416 more Info to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3745/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3745/ […]