RippleNet: A beginner’s guide to the decentralized network of banks

RippleNet is one of many Ripple products, and Ripple is a company built around the XRP cryptocurrency. While Ripple has developed various financial products looking to harness XRP over the years, it has eventually rebranded many of these ideas under one umbrella: RippleNet.

This article will explain RippleNet, what it is and why it was conceived, as well as who uses it. However, before getting into RippleNet, one must understand Ripple the company and its significance to the XRP token.

What is Ripple?

Released in 2012, Ripple and the XRP token were designed to offer cheap, trustless and instant international payments to banks and other financial institutions worldwide.

Powered by blockchain technology, the Ripple network validates transactions in a way similar to the proof-of-stake (PoS) consensus method. The network has more than 150 selected users who validate transactions, known as the unique node list.

However, it’s worth noting that Ripple isn’t nearly as decentralized as its blockchain contemporaries, nor does it claim to be. Instead, Ripple is a for-profit entity providing a service to financial entities, with the Ripple team holding the majority of XRP tokens.

Such centralization stands against the mantra of many crypto enthusiasts, but considering Ripple is meant to exist as a business harnessing blockchain rather than an open-source entity, the platform is developing similar to that of a traditional company.

For example, the team has developed all sorts of Ripple products over time. Since these developments, the group has combined them all into one premiere service called RippleNet.

Ripple vs. XRP

Before getting into the RippleNet product, it’s essential to differentiate between the company Ripple and the XRP cryptocurrency.

For one, Ripple utilizes XRP in a variety of its products but cannot control the asset or its technology despite holding the vast majority of XRP. In this way, the value of XRP does not directly tie to the success or failure of Ripple and vice versa.

Ripple cannot limit anyone from harnessing the power of XRP and utilizing it for their own services, either, though Ripple’s holding so much XRP might limit any competition. Now, to answer the question: what is RippleNet?

What is RippleNet?

RippleNet utilizes blockchain technology to provide financial institutions around the world the ability to move funds around, intending to build a unified global payments system, as there isn’t any sort of global payments system in traditional finance. Instead of having one unified global payments system in traditional finance, various financial entities have built siloed transfer systems to make international payments. These systems do not interact well with one another, and making international payments through said systems is expensive and time-consuming.

In today’s internationally connected world, such an outdated payment system feels out of place. Users of all sorts are waiting weeks for payments to process despite being charged high fees, which limits the number of users entering the international market.

RippleNet aims to solve these problems by offering one decentralized global network of banks for all to use. By connecting to the network via an application programming interface (API), users can allegedly move their money around internationally faster and cheaper than traditional methods. The decentralized network claims to process payments in just three seconds, harnessing the global power of its XRP token.

Technically, RippleNet is a set of products that harness the power of the XRP blockchain rather than a blockchain in its own right. That said, all transactions made using RippleNet products are recorded on the XRP blockchain, but this does not make RippleNet a blockchain in and of itself.

Not only this, but RippleNet removes the need to pre-fund accounts with on-demand liquidity (ODL), its service that uses XRP to source liquidity instead. RippleNet supports more than 55 countries and pairs with over 120 fiat currencies, ensuring countries all over can easily send payments to one another.

How RippleNet works?

RippleNet is further broken down into a few key offerings that customers can take advantage of: xCurrent, xRapid and xVia.

xCurrent

xCurrent focuses specifically on banks, providing them with cross-border payments at a lower cost than traditional international settlements. Banks harness xCurrent by installing the platform’s software via an Application Programming Interface (API) that can convert conventional payments to the XRP-powered alternative.

xCurrent is designed to fit within banks’ existing compliance and risk capabilities, streamlining the installation process. xCurrent documentation notes that the solution abides by all current Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

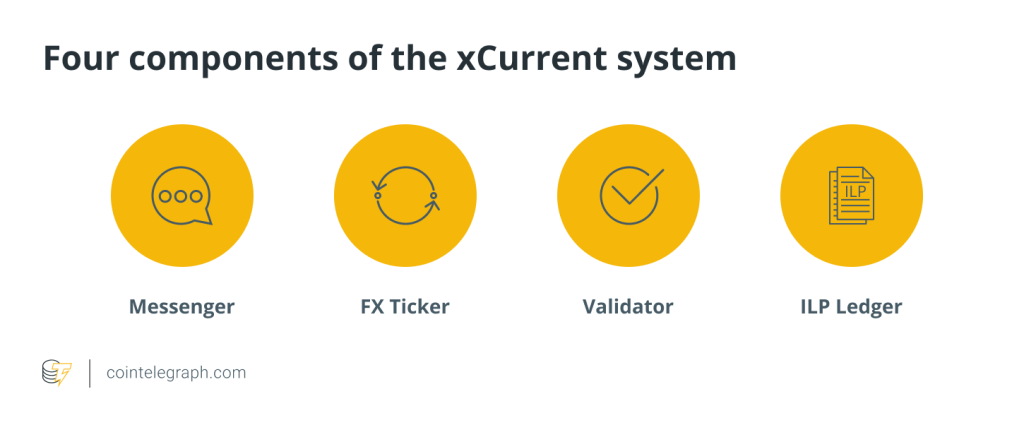

The xCurrent system can break down even further into four components: Messenger, FX Ticker, Validator and InterLedger Protocol (ILP Ledger).

Messenger enables RippleNet-connected banks to communicate with one another and exchange risk information, KYC, payment details, expected time of fund delivery and more. Allowing banks to share this information further enforces a unified network of interconnected financial entities.

FX Ticker is a space for RippleNet liquidity providers to post their FX rates, meaning entities know the value of converting one fiat to another at all times. The FX Ticker also works with the ILP Ledger to validate FX prices and will initiate payment transfers from one bank’s ILP Ledger to another.

The Validator segment of RippleNet facilitates the movement of funds between ledgers, corroborating information with the ILP Ledger to ensure all movements are legitimate. Whether or not a transaction is successful or a failure is up to the validator.

Finally, there’s the ILP Ledger. Each bank participating in this Ripple payment protocol has its own ILP Ledger, or subledger, that tracks all of its debits, credits and liquidity. The ILP Ledger can automatically settle transfers between all parties by keeping track of said data.

xRapid

While xCurrent provides cheap and fast cross-border payments, xRapid ensures customers can source liquidity via the XRP token. Traditional finance methods require businesses to pre-fund accounts in foreign destinations, as it can take weeks to convert one fiat into another.

xRapid offers near-instant conversions, freeing up liquidity in a process also known as on-demand liquidity and removing the need for businesses to pre-fund foreign areas, keeping that money in its accounts instead.

xVia

xVia is the API segment of Ripplenet, ensuring customers can easily connect to the services mentioned above. xVia enables sending payments with detailed information while attaching detailed information such as invoices.

Other benefits of RippleNet include supply chain payment management, international bill payments, real-time remittances, peer-to-peer payments, cash pooling and a global currency account, according to RippleNet documentation.

Who uses RippleNet?

While Ripplenet presents itself as a global-spanning operation, one might wonder how many banks use Ripplenet.

Ripple notes that hundreds of banks use their service, from smaller entities to worldwide institutions. For example, Bank of America, Santander and American Express are massive groups that utilize the Ripplenet service. Santander is a company that has processed more than 450 million euros on RippleNet across six European and American countries.

While individuals might invest in and use the XRP token to move funds as they would with other cryptocurrencies, no one can deny that Ripple’s use case is the most prevalent one by far.

Also, regulating cryptocurrencies such as XRP affects those who use RippleNet. In some countries, financial institutions might be banned from using RippleNet, as their local governments might limit or outright prohibit digital assets.

While Ripple works with banks to abide by their local regulations upon RippleNet’s implementation, the onus is on the bank to understand if RippleNet is a service they can legally utilize.

Even so, Ripple is doing everything it can to expand its RippleNet product. Recently, Ripple has taken a 40% stake in a cross-border payments firm Tranglo. The goal of Ripple’s acquisition is to expand its ODL offerings in Southeast Asia.

Further cementing its desire to expand, two of Ripple’s Southeast Asia-centric employees will join the Tranglo board. Brooks Entwistle, Ripple’s managing director of Southeast Asia, and Amir Sarhangi, the vice president of Ripple product and delivery, will be the ones joining Tranglo’s board.

RippleNet partners

RippleNet has the support of various partners and investors as well, all ensuring the network can expand as far as possible. Some of these investors include the CME Group, Andreessen Horowitz, Accenture, GV and Seagate.

Why does XRP token have value?

While Bitcoin (BTC) and other cryptocurrencies intend to replace traditional financial institutions, Ripple and the XRP token aim to work with banks and financial entities instead. That said, only a community of users can dictate the XRP token’s value.

If entities are pouring money into XRP to utilize it, the value will rise. But, if financial institutions ignore XRP to focus on their own existing systems, the value of XRP will fall, and Ripple as a company might cease to exist.

However, there is only a limited amount of XRP in existence. At the asset’s launch, 100 billion XRP were pre-mined. Similar to Bitcoin and other cryptocurrencies, there will never be more XRP than 100 billion.

A sender burns a small amount of XRP whenever they commit a transaction, meaning the currency is deflationary, which will affect its long-term value. Not only this, but the asset’s value experiences manipulation by current and former employees of Ripple.

Although he no longer works there, co-founder Jed McCaleb was rewarded 9 billion XRP before he left. That said, McCaleb receives the XRP at set intervals, which he sells or donates. Leaving a vast amount of XRP to be sold at set intervals will also affect the XRP price.

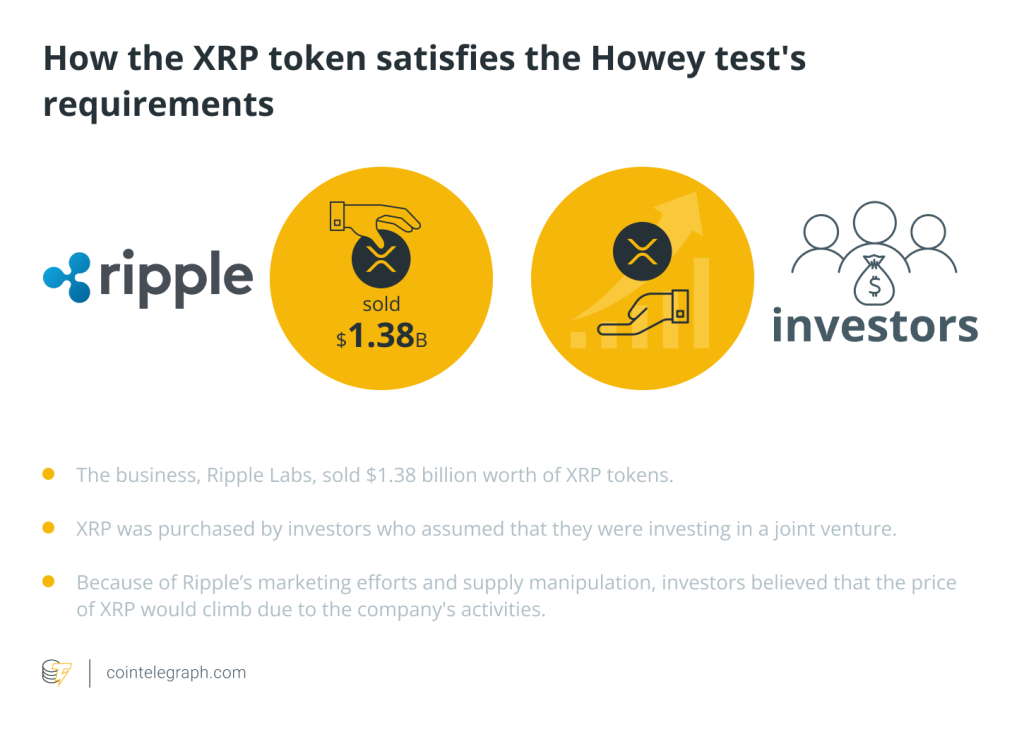

Since 2020, Ripple and its senior executives have been involved in a lawsuit with the United States Securities and Exchange Commission (SEC). The SEC sued Ripple for selling XRP, which the SEC considers unregistered security. This case is still ongoing, but a conclusion will certainly affect XRP and its value.

Future of RippleNet

RippleNet is currently working to offer ODL in more locations than ever before while also expanding its services in regions that will accept its API integrations. That said, Ripple is likely to grow RippleNet through additional business acquisitions such as its acquisition of Tranglo.

Various large institutions are already working with RippleNet, so there’s reason to believe the system is reliable and has a real-world use case. What matters now is regulations working on accepting RippleNet and all of the changes it would bring about.

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Here you can find 55262 additional Info to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Here you will find 53775 more Info on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Here you will find 20482 additional Info on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] There you will find 7007 additional Info to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3314/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3314/ […]