The NFT marketplace: How to buy and sell nonfungible tokens

Nonfungible tokens, or NFTs, are an evolution in the cryptocurrency space and a step forward in the reinvention of modern finance and other industries.

Money is fungible because there is no distinction between one dollar and another. Stocks of the same sort in the same company and commodities of the same quality are often interchangeable. However, NFTs, being nonfungible, represent unique physical and digital assets like a piece of art, a song, or an in-game collectible that other investments cannot replace. Each nonfungible token is recorded on the blockchain, has metadata and a unique identifier that makes it impossible for NFTs to be exchanged for or equal to one another.

By enabling digital representations of individual items combined with the benefits of smart contracts, NFTs can remove intermediaries and connect content creators with audiences directly, offering blockchain-generated certificates of authenticity for digital assets. Thereby, the concept of NFTs has the potential to change the current crypto and art landscape drastically.

So, what else makes nonfungible tokens attractive for artists and collectors? Where and how to buy NFTs? How to sell an NFT, and which way of selling is best to choose?

Let us sketch out the answers to the above questions in this article.

What are NFTs?

Nonfungible tokens are “one-of-a-kind” cryptographic digital assets that represent real-world objects and digital items like art, music, virtual land, in-game collectibles, videos, photographs and other creative products. In the digital world, they can be bought and sold like any other piece of property without having a tangible form of their own. NFTs are unique, limited in quantity and valuable due to their scarcity. They cannot be duplicated and can be easily authenticated. NFTs may be seen as proof of authenticity and certification of ownership for virtual or physical assets recorded on the blockchain.

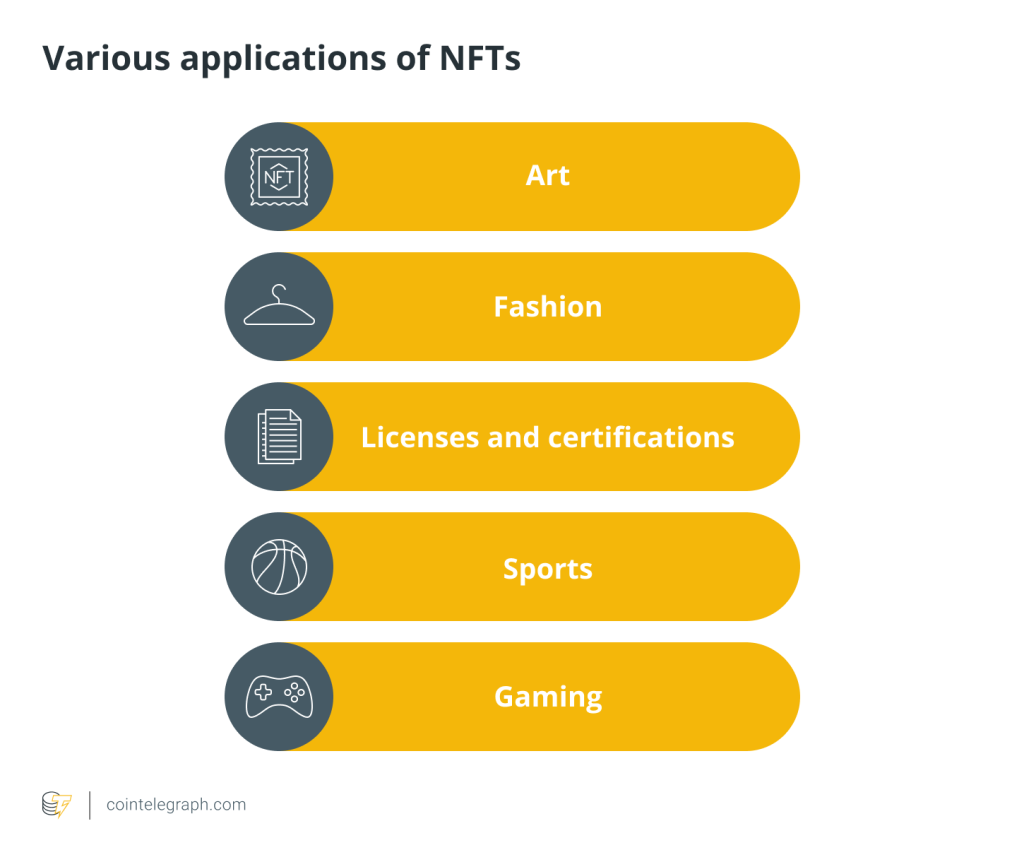

NFTs’ potential use cases include prominent ones like digital art, collectibles within gaming, music, fashion, sports, academia, decentralized finance (DeFi), tokenization of real-world objects, domain name ownership, licenses and certifications, patents, documentation and others. Furthermore, NFTs could be used to track metadata, improve event ticketing and even transform real estate.

Although NFTs have been around since the early 2010s (the prototypes of NFTs were experimental assets created on the Bitcoin network in 2012 named colored coins), NFTs have recently been gaining popularity in the crypto community. Therefore, NFTs are becoming an increasingly nifty way to buy and sell digital items. NFTs provide artists and other content creators with an opportunity to monetize their work and sell it directly to the audience in the form of NFTs, with absolute independence on the creative industries’ middlemen embodied in galleries, auction houses and major record labels.

How to buy NFTs?

Some might say that buying portable network graphics (PNG) or graphics interchange format (GIF) files for thousands or millions of dollars seems irrational. However, people are still willing to spend vast amounts of money on something they could easily view, screenshot and download on the internet for free. Why?

NFTs directly tie social and financial capital in terms of developing the network of relationships among people and demonstrating community membership. The information recorded immutably on the blockchain contains built-in authentication. It essentially lets content creators digitally “autograph” their NFTs, and allows the audience an opportunity to connect with artists, own their favorite art and join the particular community.

As NFTs are referred to as “Investment-as-a-Status,” buying them is considered to be one of the most efficient paths to maximizing social capital by forming more links and bonds in the crypto space.

When collectors buy an NFT, they purchase something unique and scarce — the ultimate criterion for every true collector — even if an image or piece of music has been shared online hundreds of times.

It is worth noting that collectors are not buying original content itself, as they probably won't own the copyright to it. Due to the technology, the content creator retains the copyright and the majority of NFT platforms provide the opportunity for them to claim royalties in the future when the object is sold again. Rather, when purchasing NFTs, collectors buy tokens connecting their name with the content creator's art on the blockchain, which is the most valuable thing.

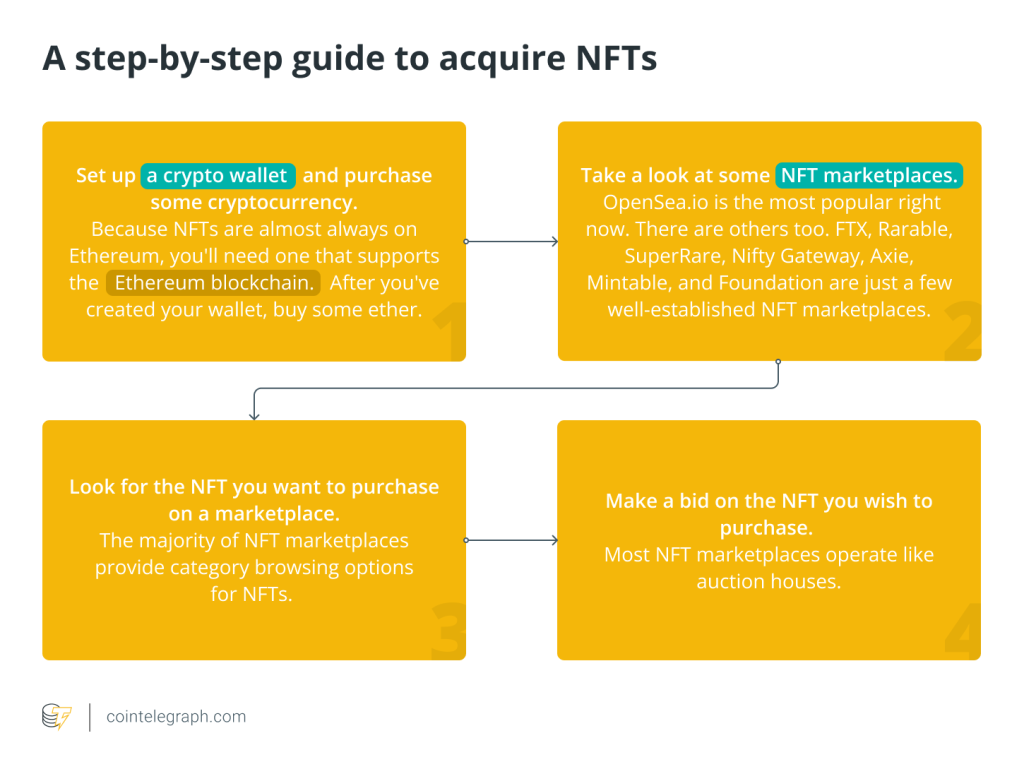

Thus, buying NFTs allows collectors to own original items recorded on the blockchain that serves as proof of ownership. A step-by-step instruction on buying NFTs is discussed in below sections.

Choosing a crypto wallet and cryptocurrency to fund a wallet

When a desirable collection and an NFT marketplace are chosen, collectors need to create an account on the marketplace in order to buy NFTs. Before doing so, however, they will need to connect their cryptocurrency wallet to the chosen NFT platform, as until then, they won’t be able to buy or sell anything.

A crypto wallet as a place to securely keep digital assets is an essential part of any blockchain system. Crypto community members need wallets to use blockchain services, access various platforms, sign transactions and manage their balances according to blockchain fundamentals. In this way, all crypto platforms and NFT marketplaces, in particular, eliminate the need to store user account data, making their operations more accurate and secure.

Before setting up a wallet, it is crucial to ensure that the wallet matches the cryptocurrency used on the platform the buyer intends to use. As most of the NFT services are Ethereum-based, they accept Ethereum’s native cryptocurrency Ether (ETH) as a viable payment.

A hosted wallet, also known as a custodial wallet, is considered to be the most user-friendly and easy to set up. It is called hosted because users’ crypto is automatically stored in it by a third party, similar to how banks keep the money in checking and savings accounts. Since third parties are responsible for the safety of users’ cryptocurrency, with this type of wallet, users have nothing to worry about because they will never lose their cryptocurrency even if they lose or forget their password or private key.

The biggest disadvantage of using a custodial wallet is not only a lack of autonomy but also a loss of anonymity since this type of wallet often recommends users to perform Know Your Customer (KYC) verification that refers to ID verification. On top of that, users have to make sure that the hosting company is both trustworthy and competent.

A non-custodial wallet does not rely on a third party to keep users’ cryptocurrency safe. Instead, it gives them complete control of the security of their crypto funds. Users don’t have to submit a request every time they want to send cryptocurrency, as they are free to choose the type of transaction fee — either the default one or a higher fee depending on how fast they want a transaction to process.

Although these wallets provide the required software to store cryptocurrency, the responsibility to remember and protect passwords lie entirely on users themselves. If users lose or forget their passphrases, also known as mnemonic and seed phrases, they will not be able to access their wallets.

A seed phrase refers to a randomly generated list of 12 to 24 words (arranged in a specific order). It is generated by cryptocurrency wallet software and is used by users to regain access and control of their crypto funds on-chain. It is advisable to keep a copy of the seed phrase offline to make it safe.

For instance, write it down and store it somewhere secure. The unrecommended method is to keep the seed phrase on a device connected to the internet or to leave it in any digital format, like a print file or a photograph. If a malicious actor discovers the user’s seed phrase, he will have full access to the wallet's crypto assets.

Also, with non-custodial wallets, users can access such advanced cryptocurrency operations as staking, lending, borrowing and more.

A hardware wallet, also known as a cold wallet, is a physical device about the size of a USB flash drive. This sort of wallet is quite complex in use and relatively expensive. The apparent benefit of using a hardware wallet is the secure storage of users’ private keys without the security risks of online wallets described above. A hardware wallet can keep crypto funds offline and secure them even if the user’s computer is hacked.

The choice of the right wallet depends on the collectors’ preferences and partially on what kind of safety they are willing to have. They can keep the buying process simple with a hosted wallet, have complete control of their crypto with a non-custodial wallet, or take additional cautions with a hardware wallet — the choice is entirely on collectors.

In the upshot, once collectors set their wallets and have enough crypto funds, they can go ahead, connect them to a suitable NFT marketplace, create an account and start buying NFTs.

Options for buying NFTs

There are a few possible options for buying nonfungible tokens, and the majority of them resemble an eBay scheme. Thus, it is quite simple for a regular collector to grasp how buying NFTs works.

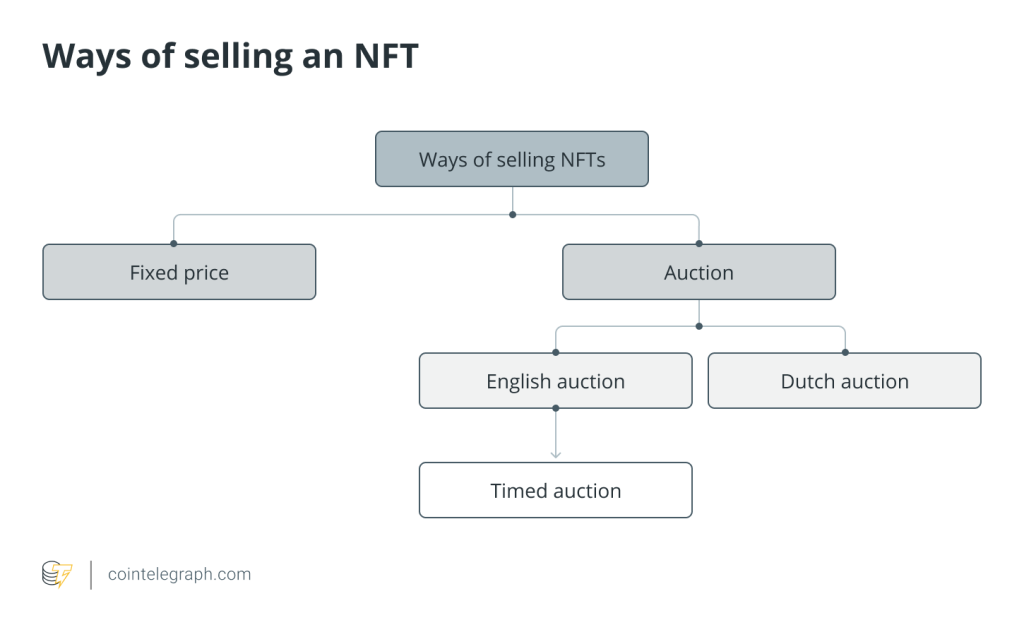

The most common option is an auction. Most NFT marketplaces function like auction houses. They usually offer two types of auctions. The first one is an English auction when the highest bid wins at the end of the auction. Timed auction (a form of English auction) is an auction in which each lot can be bid over a specified period and at the end of the period, the buyer who has submitted the highest bid wins and buys an NFT.

Another type is a decreasing-price auction named Dutch auction. An NFT's price starts at a certain level (the ceiling price) and then regularly declines by a set amount (e.g., 0.1 BTC every 10 minutes). When a user bids the current price, the NFT Dutch auction closes.

Nonfungible tokens can also be bought through NFT drops. In this case, collectors have to wait for one of the drops to be announced and try their luck in buying scarce NFTs before they sell out. These kinds of drops can be sold in seconds and usually require collectors to sign up to the particular NFT platform and fund their crypto wallets beforehand so that the buyers do not miss out on the chance to purchase NFTs when they are dropped.

Furthermore, some NFT platforms have a “fixed price” or “buy now” option. It refers to a sale at a predetermined price that NFT creators set at which they want to sell their nonfungible tokens straightaway. Fixed-priced buying may be seen as the easiest solution for collectors since they do not need to depend on auctions and wait for a certain drop time.

Even so, collectors need to pay attention to the price’s currency and its format, as the prices are often listed in decimals of cryptocurrency (for example, ETH) and may not be accompanied by the fiat (for example, USD) value. Buyers also need to keep in mind that this dollar value can frequently change due to the cryptocurrency market’s volatility at any given time.

On top of that, the amount of crypto in the wallet must be greater than the price of the NFT they want to purchase since, most likely, collectors will have to pay the transaction fee, also known as a gas fee, while buying. Gas fees are payments that are required to process and validate transactions on the blockchain successfully. Users make them compensate for the computing energy needed for it.

Where to buy NFTs?

There are a bunch of various online marketplaces in the crypto space that have an option to buy and sell nonfungible tokens. Not all of them operate identically, provide the same functionality and offer similar types of NFTs. However, the majority of platforms are based on the Ethereum blockchain. Other non-Ethereum NFT services belong to blockchains like Cosmos, Polkadot, or Binance Smart Chain, to name a few.

Other differences between NFT marketplaces include various factors whether they are supporting required NFT standards and file formats, NFT platform accessibility, a price to create (or mint) an NFT and other details which could be more important to content creators than to buyers.

Although every NFT marketplace works differently, most of them have a wide range of NFTs to buy. At the same time, veteran buyers choose a marketplace, depending on the certain type of nonfungible token they want to purchase.

How to sell an NFT?

How to sell the NFTs you minted

There are two main ways of selling NFTs: selling a minted NFT (the way for content creators) and selling an NFT that the collector has already bought and is now willing to trade.

The first way is likely to be the endpoint of the nonfungible token creation (or minting) process. Minting refers to an easy procedure after which representing innovative products such as works of art, collectibles, songs, memes, etc., becomes a part of the blockchain, tamper-proof and secure, and the content turns into an NFT and becomes “tokenized.” Since then, these digital items can be sold and traded as NFTs, as well as digitally tracked when re-sold from this time on.

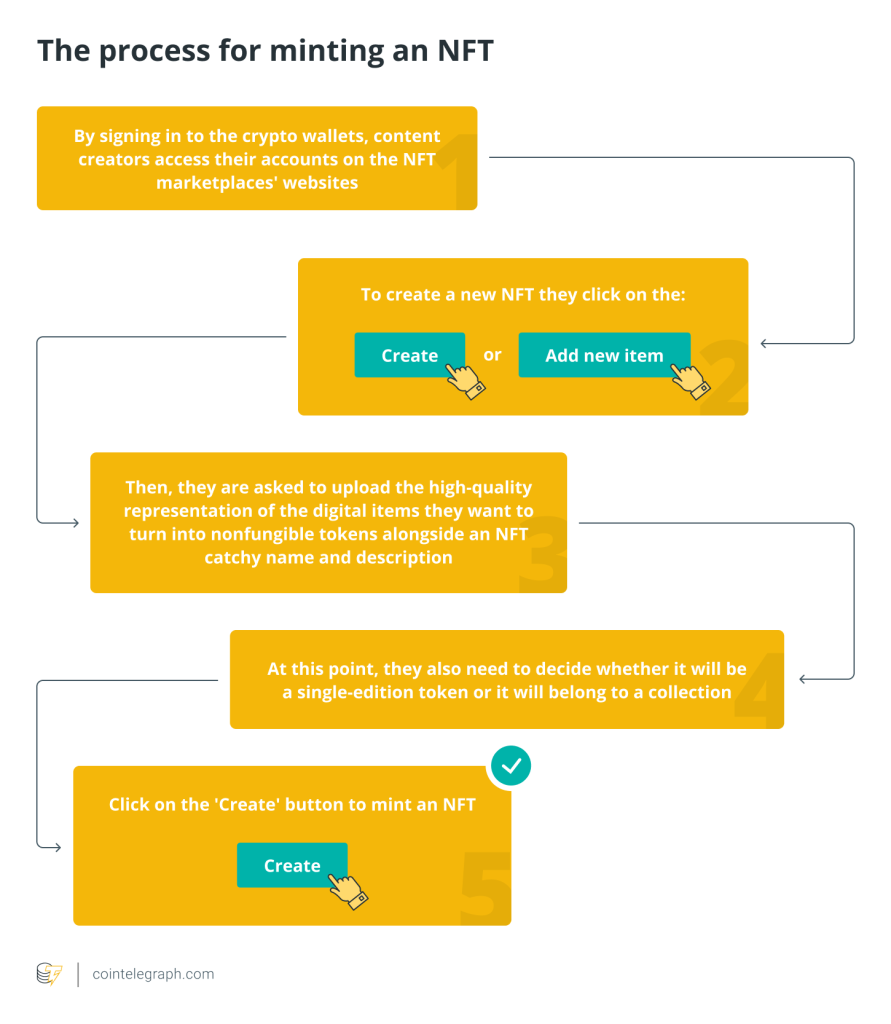

To start minting, content creators only need a Mac or a PC, a cryptocurrency wallet that supports NFTs with some amount of crypto in it and an account on a blockchain-focused NFT marketplace.

Before clicking on the “Create” button, it is usually advisable to make a final check. The minting process is complete when the creators sign their NFTs and pay the gas fees. After that, the transaction is considered to be validated, and content creators are able to see their newly minted NFT in their profiles on the chosen NFT platform.

Furthermore, NFT marketplaces may ask content creators to set a royalty percentage when selling NFTs. Royalties allow them to earn a specified commission every time the NFT is sold to a new collector. Royalties can potentially establish lifelong passive income streams for content creators automatically due to the basics of the nonfungible tokens’ technology.

The majority of the NFT marketplaces also have an option to choose a selling method or a chance to set a price for the NFT while minting a token. Thus, freshly minted NFTs are often considered to be put up for sale right after their creation.

In other cases, to sell NFTs, content creators need to go to their accounts on the NFT marketplaces and locate the digital items from their NFT collections. Once they find needed NFT items, they will need to click on them. This action will reveal a “sell” or “list for sale” button. Once the creators have this option, they can click on it and define the selling method whether it would be an auction or a fixed “buy it now” price.

If they are lucky enough, with the helping hand of the NFT platform representatives, they will feasibly be able to have an opportunity to create a drop for their nonfungible tokens, which will probably add a certain level of awareness and likely will help them successfully sell their creations.

How to sell NFTs you bought

The process of selling collected nonfungible tokens is no more complicated than the process of selling NFTs that are freshly minted.

At the slightest desire, collectors can effortlessly resell their NFTs on the secondary market. The term “secondary market” encompasses all subsequent resales of the work, while the “primary market” refers to the first sale of an NFT. To sell NFTs, collectors need a few things that they probably already have: an account on the NFT marketplace of choice, a crypto wallet connected to it and an amount of cryptocurrency used on that marketplace.

The main difference here is that collectors will not be able to receive royalties when NFTs from their temporary collection is sold. Royalties as the percentages of all future sales will be sent directly to the wallets or the NFTs’ original creators.

Thus, content creators are considered to be forever associated with copyright on their creative products in form of NFTs, while collectors only receive nonfungible tokens in their collection temporarily. Nonfungible tokens collectors, just like collectors in other traditional markets, have only basic ownership rights like the right to possession, to sell, or gift the items they have purchased, and these rights are terminated with the sale of the particular NFT.

To sell NFTs, collectors need to go to their profiles on the NFT platforms and select NFTs that they want to sell. After clicking on the saleable NFT, they will need to find the “sell” or “list for sale” button. Clicking on this button will take them to a pricing page where they would be able to select the conditions of the sale. At that point, they’ll need to set a price for the NFTs or choose to start an auction. In case collectors want to start an auction they need to inquire which type of auction is supported on the selected NFT platform. Most often it could be either an English auction, timed auction, or a Dutch one.

NFTs renaissance continues to spread despite the volatility and undeveloped nature of the cryptocurrency market as a whole and the high level of uncertainty about nonfungible tokens valuations. If content creators and collectors sometimes do not profit from selling NFTs, buying nonfungible tokens is still considered a great way to support artists, musicians, designers, or other creative people collectors are interested in such digital assets.

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2848/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2848/ […]