Wholesale CBDC vs. retail CBDC: Key differences

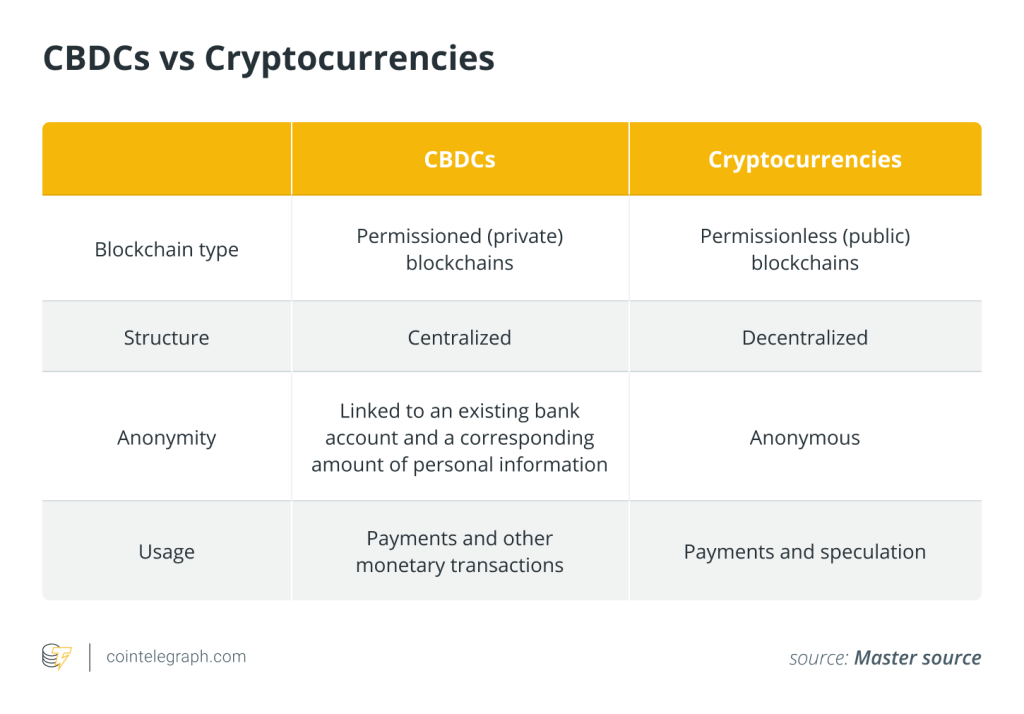

With the increasing adoption of cryptocurrencies and other digital assets globally, central banks have acknowledged the demand for an alternative to traditional fiat and central bank money. Central bank digital currencies (CBDCs) are digital currencies issued by a central bank that can improve the efficiency and inclusiveness of today’s payment systems.

While this article mainly focuses on wholesale CBDCs and retail CBDCs, it is essential to note that other types of CBDCs are under development, such as hybrid CBDCs (which is a type of CBDC that combines retail and wholesale CBDCs) and central bank digital currency-fiat (which is a CBDC is pegged to a fiat currency, such as the United States dollar).

Besides, synthetic CBDCs can be issued by private organizations as private liabilities (yet they are fully backed by central bank reserves and are, therefore, only sometimes regarded as actual CBDCs). One can also consider the digital currency e-cash developed by the People’s Bank of China as a particular form of CBDC. All specific sets of CBDCs have pros and cons that must be considered carefully.

What is a wholesale CBDC, and how does a wholesale CBDC work?

Generally, a wholesale CBDC is a digital form of central bank money that can be used alongside or instead of traditional forms of central bank money, such as reserve balances held by banks at the national central bank. By nature, wholesale CBDC is especially suitable for giant, low-frequency transactions, such as settling securities trades or transferring funds between banks. Thus, financial institutions and prominent financial market participants use wholesale CBDC to facilitate interbank settlements and other wholesale payments.

Here’s how a wholesale CBDC can operate:

Wholesale CBDC use cases and some examples

Several potential use cases exist for wholesale CBDCs, with some being more “hands-on” and others more policy-oriented. To start with straightforward uses, wholesale CBDCs can easily facilitate cross-border payments among banks and other financial institutions, reducing the cost and complexity of these transactions by removing intermediaries, alongside improving the speed and reliability of settlements. Interestingly, wholesale CBDCs can be used as the very collateral in financial transactions, providing a new way to manage risk and enabling a broader range of assets as collateral.

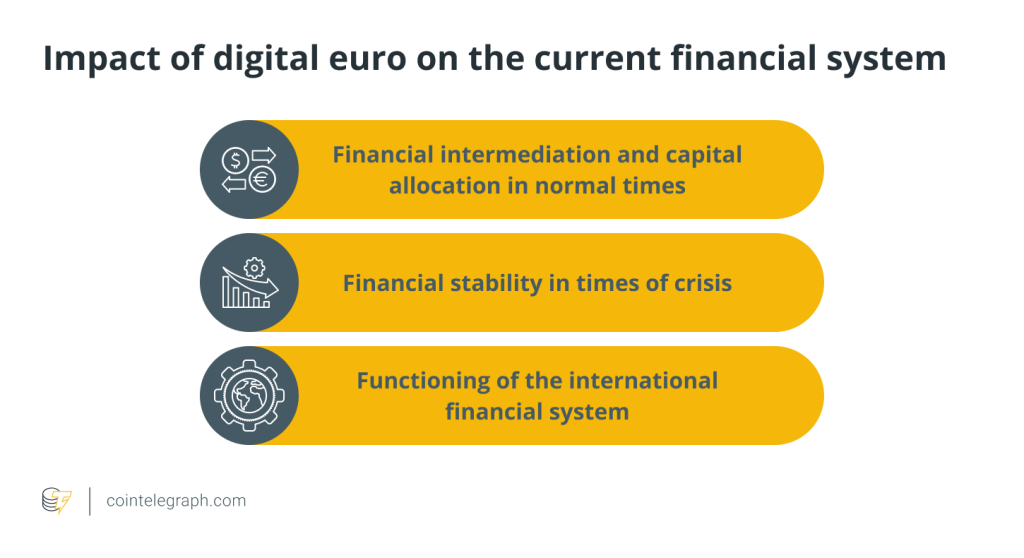

In terms of policies, a central bank can also use a wholesale CBDC to provide liquidity to financial institutions in times of stress, helping to maintain financial stability and support the smooth functioning of the financial system. And by controlling the supply of a wholesale CBDC, the central bank can use it as a direct tool for monetary policy, which is arguably of increasing importance, certainly in times of stagflation and high-interest rates.

As noted, many central banks worldwide are currently exploring or testing wholesale CBDCs. For instance, the Bank of Canada conducted research on the use of wholesale CBDCs for interbank settlements and completed several successful pilot projects. The European Central Bank is also exploring the use of wholesale CBDCs for interbank payments and established a task force to assess the potential benefits and risks of a wholesale CBDC for the euro area.

In Asia, the Bank of Japan is also researching the use of wholesale CBDCs for interbank settlements and has announced plans to conduct a pilot project. Moreover, the People’s Bank of China has been actively studying and developing a wholesale CBDC, known as the Digital Currency Electronic Payment (DCEP), and has conducted several pilot projects in various cities across the country.

What is a retail CBDC, and how does a retail CBDC work?

Like wholesale CBDCs, retail CBDCs offer the potential to provide a convenient and secure electronic payment and new opportunities for central banks to conduct monetary policy and provide financial services to the public. A retail CBDC could be used by the general public in much the same way as cash, only in digital form.

In simple terms, and similar to the wholesale CBDC, here’s how a retail CBDC might operate:

Retail CBDC use cases and some examples

There are many potential use cases for retail CBDCs, as they fundamentally enable payments. Indeed, retail CBDCs can be used as a means of payment for national goods and services, providing an alternative to physical cash or traditional electronic payment methods. Retail CBDCs can facilitate cross-border payments, reducing the cost and complexity of these transactions and improving the speed and reliability of settlements. But there are also secondary use cases or indirect effects from retail CBDCs.

The central bank can use a retail CBDC to provide liquidity to the market, helping to maintain financial stability and support the smooth functioning of the financial system. And in countries where access to traditional financial services is limited, a retail CBDC could provide an alternative way for individuals and businesses to access and use digital currency. Finally, much like wholesale CBDCs, the central bank can use retail CBDCs as a tool for monetary policy by adjusting interest rates.

It is important to note that the specific design and features of a retail CBDC will depend on the goals of the central bank issuing the digital currency. For instance, the People’s Bank of China has been actively researching and developing a retail CBDC, the DCEP or digital yuan, launched in China in 2020. The digital yuan can increasingly be used to purchase at participating merchants or transfer funds between individuals.

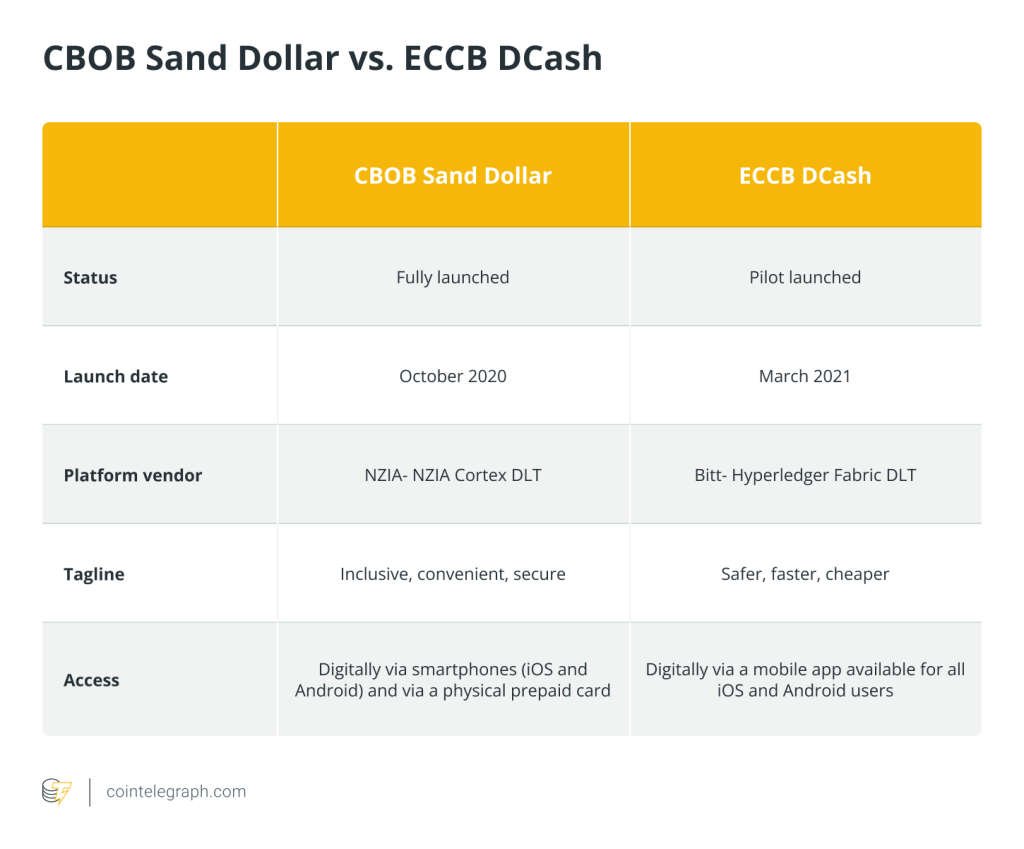

Moreover, the Central Bank of the Bahamas has launched a retail CBDC, known as the Sand Dollar, which the general public uses for electronic payments. Likewise, the Eastern Caribbean Central Bank (ECCB) has also launched a retail CBDC, known as the Digital Eastern Caribbean Dollar (DXCD), which is currently being used by the general public in the countries of the ECCB monetary union.

Several bigger countries are also considering the launch of a retail CBDC or are actively working on the development of one. For instance, beyond wholesale CBDCs, the Bank of Thailand is assessing the feasibility and potential benefits of a retail CBDC. Nigeria also shifted away from physical cash to make its payment system more efficient, reduce the cost of banking services, and improve the effectiveness of its monetary policy by introducing the eNaira in 2021.

In Europe, the Bank of Sweden has completed a successful pilot project of a retail CBDC. It is currently conducting further research on the feasibility and potential benefits of a retail CBDC, the e-krona.

Benefits of wholesale CBDCs vs. benefits of retail CBDCs

There are several distinct benefits to using wholesale or retail CBDCs. Sometimes, such benefits appear similar, or they may even overlap. Fundamentally, wholesale CBDCs can improve the efficiency and speed of interbank settlements by reducing the need for intermediaries in the settlement process. Wholesale CBDC could also reduce the costs associated with these transactions, either monetarily or in the light of delays or errors.

Likewise, retail CBDCs can be easily accessed and provide fast and secure electronic payment. They can also reduce the need for physical cash, which can be expensive to produce and distribute and may pose a risk of money laundering and other illicit activities.

Both types of CBDCs come in handy when managing various risks. For instance, a wholesale CBDC can provide a stable and reliable means of settlement, reducing the risk of liquidity shortages and contributing to the strength of the financial system. And as a very alternative to cash, retail CBDCs can be considered more secure than said means of payment, as retail CBDCs are less prone to risks such as loss or counterfeiting.

A wholesale CBDC can provide financial institutions with access to a digital form of central bank money, which may be more convenient and accessible than traditional forms of central bank money, such as physical cash or reserves held at the central bank.

In terms of accessibility, it is interesting to note that retail CBDCs can provide a means of payment and access to financial services to individuals and communities that may be underserved or excluded by the traditional financial system.

Because both wholesale and retail CBDCs may be recorded on an (open) distributed ledger, they can provide greater transparency and traceability in financial transactions, which can help to reduce the risk of fraud and improve the overall integrity of the financial system.

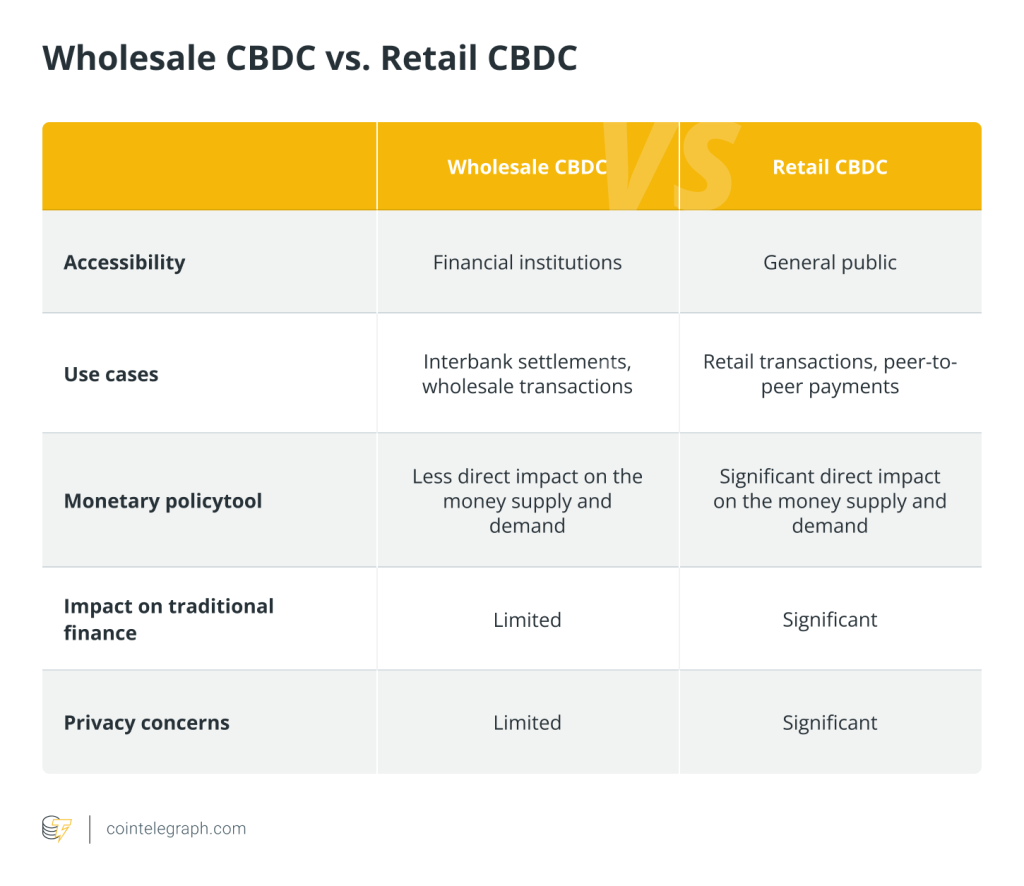

Wholesale vs. Retail CBDC: Key differences

There are several vital differences between CBDCs and retail CBDCs that relate to their use, who uses them and their impacts. Importantly, wholesale CBDCs are meant for use in interbank settlements and other financial transactions between institutions and other eligible market participants. In contrast, retail CBDCs are planned for use by the general public and other institutions.

As noted, both wholesale and retail CBDCs can be used as a tool for establishing monetary policy, such as by adjusting the interest rate on deposits of the (banks’) digital currency held at the central bank.

However, actively managing the retail CBDC supply may provide more direct and immediate effects on the real economy. In theory, a central bank could set interest rates on retail CBDC deposits or implement limits on the number of retail CBDCs that individuals or businesses hold, de facto immediately impacting not only the supply but also the demand for currency.

Notably, the use of a retail CBDC may have a more significant impact on the traditional intermediation model of the banking sector, as it is meant to be used by the general public and may thus reduce the demand for classic bank deposits and banking services. On the other hand, using a wholesale CBDC may have a limited impact on the said model, as it is aimed at interbank settlements and other financial transactions between financial institutions.

Finally, a wholesale CBDC may raise fewer privacy concerns, as it is primarily for institutional and commercial use. In contrast, using a retail CBDC may raise more privacy concerns, as it is designed to be used by the general public and could enable the central bank to track and monitor the financial transactions of individual users.

What’s next?

Perhaps more than any other sector that cryptocurrencies, blockchain and disintermediation will impact, the financial system is vulnerable to “creative destruction” in which the old gets replaced by the new. Let’s suppose regulators and bankers do not keep up with technological progress. In that case, the banking systems that have functioned relatively well for so long could be disintermediated and permanently left behind — certainly, as far as Bitcoin’s (BTC) impacts are considered a social, cultural and technological form of progress.

Could we thus be headed to an age of widespread retail and wholesale CBDCs? According to a CBDC tracker from the American think tank Atlantic Council, almost a dozen countries have fully deployed a CBDC, and about 90 other countries have launched CBDC pilots, development or research programs. Of these countries, retail CBDCs are already being implemented and developed by several central banks. In contrast, wholesale CBDCs are mostly being tested in a few countries for the time being.

As we move into an increasingly digital world, the potential for CBDCs to revolutionize the way we transact and exchange value is undeniable. Only time will tell how this technology will shape the financial landscape, but it will be a pivotal force in shaping the world. While there are uncertainties ahead, the potential benefits for individuals, businesses and society at large provide reasons to be hopeful yet cautious toward an innovative future.

Written by Alexandra Overgaag

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Here you will find 47248 additional Information on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] There you can find 53998 more Info on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] There you can find 32721 more Information to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] There you will find 91773 additional Info on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2387/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2387/ […]