How to start mining cryptocurrency: A beginner’s guide

Cryptocurrency mining has become a popular way for individuals to make money online by confirming transactions on blockchain networks. In exchange for completing complex mathematical challenges, miners are rewarded with newly minted currency.

The proof-of-work (PoW) consensus method is used in cryptocurrency mining, which requires miners to solve challenging mathematical puzzles, making it difficult for malicious actors and preserving the integrity of the network.

This comprehensive guide will explain how to start mining different cryptocurrencies, such as Bitcoin (BTC), Litecoin (LTC), Dogecoin (DOGE), Ether (ETH), Zcash (ZEC), and Monero (XMR).

How to mine Bitcoin

The process of creating new Bitcoin and adding transactions to the blockchain is known as Bitcoin mining. In exchange for using computing power to crack complex mathematical puzzles, miners receive newly created BTC and transaction fees.

To mine Bitcoin, the first crucial step is acquiring the proper hardware. The use of application-specific integrated circuits (ASICs) is the most popular and effective method of mining Bitcoin. These are specialist devices created just for mining Bitcoin. They are more powerful than general-purpose CPUs or GPUs.

Bitcoin miners have two main options for mining the cryptocurrency: solo mining and pool mining. Solo mining is the act of mining alone and making an autonomous attempt to break blocks. Although a successful miner may receive the entire block reward with this strategy, it has become more difficult due to the enormous processing power needed to compete in the current mining environment.

However, pool mining is the most popular and practical option for most miners. In pool mining, individuals join a collective group in which their combined processing capacity is used. Blocks are solved by the mining pool as a whole, and rewards are distributed based on the computational power of the individual pool members. Even though the incentives are smaller than solo mining, pool mining lowers the volatility in earnings and makes it a more reliable option for miners to receive rewards.

Miners must download and set up mining software suitable for their hardware and preferred mining pool after deciding on the mining strategy that works best for them. CGMiner, BFGMiner and BitMinter are a few examples of mining software. Once set up, miners can watch for the efficiency and revenue of their mining operation, ensuring that their hardware is adequately powered and vented.

Moreover, miners should carefully analyze the costs of Bitcoin mining, including electricity and hardware expenditures, in addition to knowing the technical aspects of mining. As the environment evolves, staying updated on modifications to mining equipment, wallets, software and the Bitcoin network is critical. Finally, to ensure compliance, miners should always abide by local laws and rules around cryptocurrency mining.

How to mine Litecoin

Litecoin mining entails verifying transactions on the Litecoin blockchain while earning rewards in the form of newly generated Litecoin and transaction fees. Miners must first purchase specialized hardware, such as ASIC miners, which are made for Scrypt-based cryptocurrencies like Litecoin, to start mining.

Next, choose an appropriate mining pool since solo mining can be very complex. Litecoin mining pools like LTC.top, F2Pool and Antpool allow miners to pool their computing power and raise their chances of winning rewards.

The next step is for miners to download and set up mining software, such as CGMiner and BFGMiner, that is compatible with their selected hardware and pool. Once everything is set up, miners start working and adding to the combined computational power. When the pool successfully mines a block, rewards are earned.

These rewards are then divided among participants according to each miner’s contributions. It’s essential to safely store earned LTC in a reliable wallet, keep an eye on mining activity, and stay updated on changes to the network and advancements in the Litecoin ecosystem.

How to mine Dogecoin

Dogecoin mining validates transactions on the Dogecoin blockchain, with miners getting compensated with new Dogecoin and transaction fees. Miners must purchase specialized Scrypt-based ASIC mining equipment made for Dogecoin before choosing between pool and solo mining.

The next step is to set up appropriate mining software and join a Dogecoin mining pool. Input pool details and worker credentials into the software. A worker is a separate mining instance with its own credentials.

Since each worker has its own set of credentials, it is essentially a distinct mining instance. Miners assign a unique name and password to each worker for identification. One can now start mining and add to the power of the pool. When the pool successfully mines a block, rewards are distributed based on contribution.

Can Shiba Inu (SHIB) be mined like DOGE? It is important to note that traditional mining is not possible with SHIB. It is an Ethereum-based token, not a PoW cryptocurrency that can be mined. One may use exchanges or decentralized platforms to buy, sell or participate in decentralized finance yield farming to obtain SHIB.

How to mine Ethereum

Ethereum has shifted from a PoW consensus process to a proof-of-stake (PoS) mechanism. Mining operations have been discontinued under this new arrangement, and validators contribute to the security of Ethereum by staking their Ether holdings.

With the Merge, Ethereum Classic became the largest PoW smart contract platform. Since both employ the same ETHash algorithm, it inherits miners from Ethereum, making switching to ETC mining pools straightforward. As Ethereum Classic (ETC) is still proof-of-work, miners can contribute hashing power and earn ETC in return.

How to mine Zcash

Mining Zcash involves utilizing computing power to solve challenging mathematical puzzles on the Zcash blockchain network. Due to its use of the Zero-Knowledge Succinct Non-Interactive Argument of Knowledge, or zk-SNARK, cryptographic technology, which enables anonymous transactions, ZEC is known for its emphasis on privacy.

An individual requires the appropriate hardware and software to mine Zcash. ASIC miners are often the most effective mining hardware for ZEC because they efficiently carry out the computational processes necessary for mining Zcash.

The miner must decide whether to mine alone or in an appropriate mining pool, such as Flypool, Nanopool or Slushpool. Many miners prefer mining pools because they provide a more steady revenue stream. Like mining other cryptocurrencies, miners must download and set up mining software compatible with their hardware and decide on a mining pool.

The address of the pool and the miners’ individual worker credentials must be entered into the mining software to start mining as soon as the setup is complete. Newly produced ZEC and transaction fees are rewards for successfully mining a Zcash block. These incentives are divided among the pool’s members based on their provided computational capacity. To hold ZEC, miners need a secure Zcash wallet.

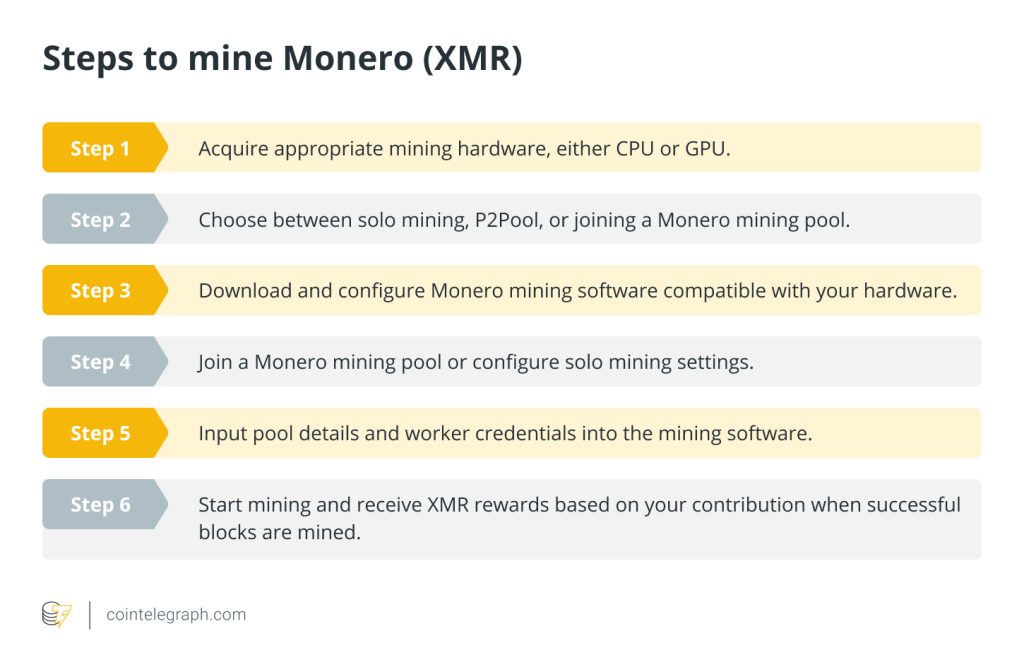

How to mine Monero

To mine Monero, miners must use a computer’s processing capacity to solve challenging mathematical puzzles, adding protection and privacy to Monero transactions. In 2014, Monero adopted the CryptoNight proof-of-work algorithm. Over time, Monero made deliberate changes to the algorithm to purposefully break compatibility with existing ASICs. As a result, three different variants—CryptoNightv1, CryptoNightv2, and Cryptonight-R—emerged.

It's crucial to note that Monero has subsequently moved away from CryptoNight and its variants. Monero made a huge update in November 2019 by switching its mining algorithm to RandomX. CryptoNight prioritized ASIC resistance, while RandomX focuses on CPU efficiency, making it less susceptible to specialized mining hardware.

Individuals require hardware and software tools like lXMRig, and CSminer to start mining XMR. Monero mining supports a range of configurations, enabling efficient participation using both CPU and GPU miners. Consistent returns are more likely when miners pool their resources in mining pools. However, according to the Monero Project, solo mining with Monero software helps strengthen the network.

Additionally, miners can use P2Pool, which offers a cutting-edge method for mining XMR that enables miners to take advantage of frequent rewards while preserving decentralization. Since it functions as a peer-to-peer mining pool, miners have complete control over their Monero nodes and mining operations. The superior block templates from P2Pool add to its blockchain and act as “shares” for miners.

After choosing a mining pool, users download and set up mining software specific to their hardware and the specified pool. The pool mining options available to mine XMR include nanopool.org and supportxmr.com, among others. During configuration, miners provide the location of the pool and the credentials of the workers.

To contribute processing power to the pool’s joint efforts to validate Monero transactions, miners activate their mining software. Successful miners receive XMR, which is allocated according to how much they contributed to the pool, as compensation. After mining XMR, it is crucial to safely store earned XMR in a reliable wallet.

Key risks associated with crypto mining and how to address them

Cryptocurrency mining entails risks that miners and organizations should be aware of and successfully manage. First, as countries worldwide develop cryptocurrency legislation, regulatory uncertainty poses a problem. To lessen this, miners should be aware of local laws, pay taxes and consider mining in areas with established crypto legislation.

Another significant issue is price volatility in cryptocurrencies. Extreme price swings in cryptocurrencies might affect profitability. Miners can deal with this by investing a portion of their earnings in secure assets to lower their exposure to market volatility.

Security is also an issue, as hackers target miners to steal cryptocurrencies. Security can be improved by establishing strict security controls, employing reliable mining pool services and keeping offsite backups.

Furthermore, electricity prices, in particular, might reduce earnings. Miners should evaluate the cost-effectiveness of their setup, look into renewable energy sources and choose efficient hardware to reduce this risk.

Last but not least, mining is a highly competitive industry. Earnings are impacted by the gradual increase in mining difficulty. To be profitable and competitive, it is crucial to join mining pools, stay updated on hardware developments and optimize strategies occasionally.

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Here you can find 98349 additional Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] There you can find 40863 more Information to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2306/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2306/ […]