On-chain vs. off-chain transactions: Key differences

Public ledger transactions, also known as on-chain transactions, entail recording data directly into a blockchain, such as Bitcoin’s on-chain data. The fact that these transactions are public and frequently involve transaction fees makes it difficult for the chain to scale because of the small block size. The blockchain community has thus looked toward off-chain methods to deal with these problems.

Off-chain transactions represent a set of solutions designed to alleviate the constraints of on-chain transactions. Users can carry out a variety of transactions privately and securely using these off-chain techniques outside the main network. They maximize scalability by lowering the volume of on-chain transactions and the corresponding transaction fees.

What are on-chain transactions?

On-chain transactions take place on the blockchain, the public ledger that keeps track of every cryptocurrency transaction. These transactions include the transfer of digital currencies such as Bitcoin (BTC) and Ether (ETH) from one address to another and are transparently and irrevocably recorded on the blockchain. Blockchain explorers can be used by anyone to view and verify on-chain transactions.

These transactions serve as a record of ownership and the transfer of digital assets and are essential to the operation of cryptocurrencies. They are the opposite of off-chain transactions, which entail moving cryptocurrency away from the blockchain, are frequently quicker, have cheaper transaction fees, but could include trusted intermediaries.

The integrity and security of the blockchain network depend on on-chain transactions, which are also the major focus of blockchain research and auditing to guarantee the precision and transparency of crypto transactions.

How do on-chain transactions take place?

Let’s take an example of how Bitcoin on-chain transactions are processed to understand how on-chain transactions work:

Initiation

A user initiates a transaction by transmitting a specified quantity of Bitcoin from their wallet to another user’s wallet.

Digital signature

The sender signs the transaction using their private key to demonstrate ownership and approve the transfer.

Transaction propagation

The signed transaction is sent out to the Bitcoin network and received by numerous nodes.

Mempool

The transaction is added to the mempool, which serves as a temporary repository for pending transactions, and then it waits to be included in a block.

Mining

To build a new block, miners gather transactions from the mempool. The person who successfully solves the cryptographic puzzle adds the block to the Bitcoin blockchain.

Block confirmation

The transaction is regarded as secure once a miner has verified it. The confirmation time for a Bitcoin transaction is typically 10 minutes.

Recording on the blockchain

The confirmed transaction is recorded permanently and is accessible to everyone on the Bitcoin blockchain.

Notification

The fact that the transaction has been confirmed and the BTC has been sent is communicated to both the sender and the recipient.

What are off-chain transactions?

Off-chain crypto transactions take place away from the blockchain network and are not instantly logged there. These transactions are instead processed through secondary layers or other settlement methods, with the final settlement eventually published on the blockchain.

Off-chain transactions are distinguished by their ability to improve scalability and lessen congestion in blockchain networks. They speed up transaction processing and provide efficiency and cost-effectiveness, making them perfect for small-scale payments and daily transactions. Another distinguishing feature is privacy, with transaction information kept secret until it is settled on the main blockchain.

Furthermore, because users must rely on off-chain solution providers, these transactions are tied to the concept of trust. Notably, they support interoperability between several blockchains through technologies like sidechains and enable complicated smart contract interactions. However, the regular settlement on the main blockchain presents a special set of problems because it is essential to guarantee security and trustworthiness.

Several mechanisms are employed to confirm off-chain transactions depending on the particular off-chain protocol or technology being utilized. Examples of off-chain solutions and technologies include:

Payment channels

Payment channels let users build private channels for carrying out numerous transactions off-chain, such as the Lightning Network for Bitcoin or the Raiden Network for Ethereum. On the blockchain, only the final settlement is documented.

For instance, the Lightning Network — a layer-2 scaling solution for Bitcoin — functions by setting up a network of two-way payment channels. Off-chain transactions occur within these channels, and participants can verify transactions by signing updated channel states. The final settlement is documented on the Bitcoin blockchain when the channel is closed.

Sidechains

Sidechains are independent blockchains that can communicate with the primary blockchain. To facilitate quicker and more private transactions, users can move assets between the main chain and sidechains.

State channels

State channels resemble payment channels that can support more intricate interactions between smart contracts. They preserve the security of the primary blockchain while enabling users to carry out a number of transactions off-chain.

Centralized off-chain services

Some off-chain transactions may take place through centralized services, where transactions are confirmed within the service’s database. Although they might not be as trustless as decentralized systems, these transactions can offer speed and cost advantages.

How do off-chain transactions take place

Let’s use the example of a sidechain to understand how off-chain transactions take place. Here’s the specific process:

Sidechain creation

A sidechain is created as a separate blockchain network that can communicate with the primary blockchain. Frequently, this sidechain is developed to offer scalability options.

Two-way peg

The implementation of a two-way peg mechanism enables users to move their assets, such as cryptocurrency tokens, back and forth between the main blockchain and the sidechain. This pegging mechanism connects the two chains.

Also, users can freely move their assets back and forth between the main blockchain and the sidechain using the two-way peg, ensuring interoperability.

Asset locking

A user locks a certain number of cryptocurrency tokens from the primary blockchain into a smart contract to start an off-chain transaction. This ensures the assets are safeguarded throughout the off-chain transaction and serve as collateral.

Off-chain transaction

After locking the assets, the user can use the sidechain to carry out several off-chain transactions. These transactions occur outside the main blockchain, allowing quicker processing and lower costs.

Record-keeping

The sidechain has a separate ledger to keep track of off-chain transactions, even when the specifics of each transaction are not instantly published on the main blockchain.

Final settlement

The user starts an on-chain transaction when they want to settle it or return to the main blockchain. The outcome of all off-chain transactions on the sidechain is reflected in this transaction.

Peg-out

The locked assets are released by the on-chain transaction on the main blockchain, making them available to the user. This technique is frequently referred to as “pegging out.”

Blockchain confirmation

The final balances are updated in accordance with the on-chain settlement transaction’s confirmation on the main blockchain.

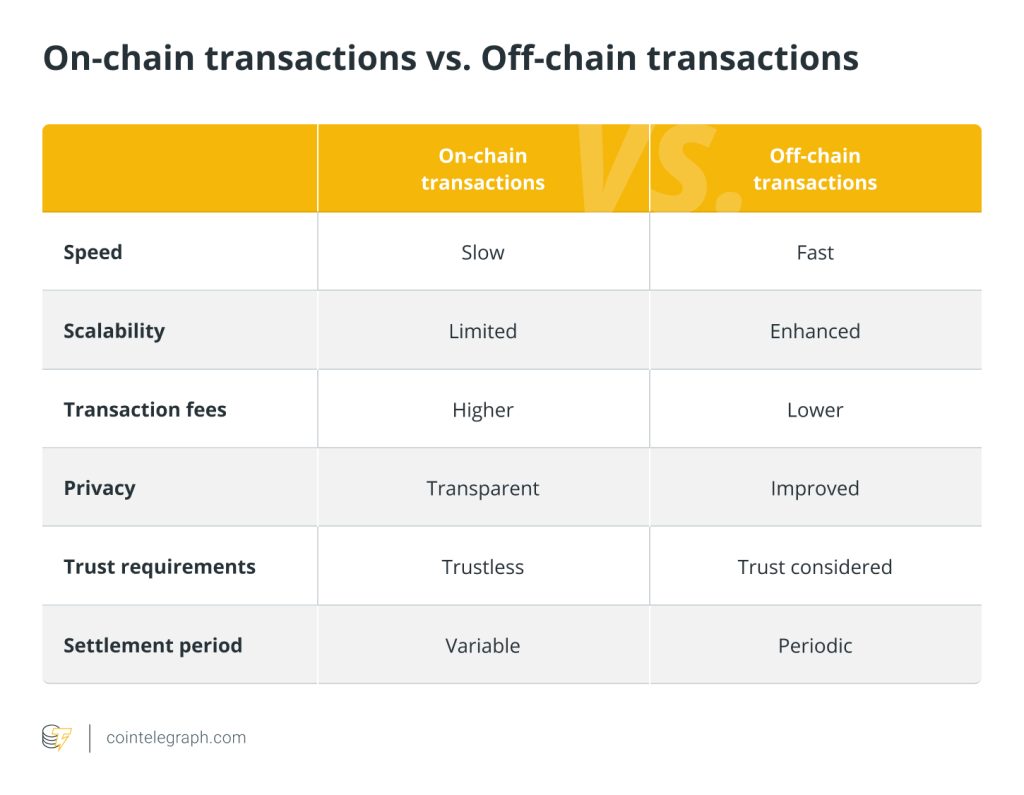

Here is a quick summary of the differences between on-chain and off-chain transactions:

Advantages and disadvantages of on-chain transactions

Advantages of on-chain transactions

On-chain transactions provide strong security and decentralization while functioning in a trustless setting that does not require intermediaries. Their openness guarantees that all transaction information is recorded on the blockchain and encourages accountability.

On-chain transactions are exceptional at handling high-value transactions, such as asset transfers or real estate deals, where security and certainty are crucial. Moreover, blockchain’s inherent security and irrevocable nature ensure trust and certainty, minimizing fraud risks in critical financial transactions.

Additionally, on-chain transactions are dependable and less susceptible to network outages due to blockchain technology’s inherent characteristics and mechanisms, guaranteeing transaction completion even under difficult circumstances. While on-chain transactions tend to be more dependable, it’s crucial to note that they are not fully impervious to network disruptions.

Disadvantages of on-chain transactions

On-chain transactions have drawbacks despite their advantages. Due to block confirmation delays, they may be comparatively slow, especially when the network is busy. Scalability problems may make them less effective when there is a lot of demand.

Transaction costs may increase, particularly during periods of congestion, making them less affordable for smaller transactions. Users who value transaction privacy may not like the transparency that improves security.

Finally, on-chain transactions may not be feasible for routine microtransactions due to high fees and slower processing times and are suited for particular use cases, such as high-value transfers.

Advantages and disadvantages of off-chain transactions

Advantages of off-chain transactions

Off-chain transactions offer several benefits. As they are not impacted by the delays brought on by block confirmation timing, they are noticeably faster than on-chain transactions.

Off-chain transactions are, therefore, perfect for routine payments and microtransactions where speed is crucial. By easing congestion on the main chain and permitting higher transaction throughput, off-chain solutions also improve the scalability of blockchains.

Additionally, they frequently have cheaper rates, which makes them affordable for users. Since the transaction details are not instantly posted on the main blockchain, off-chain transactions frequently provide customers with increased privacy.

Disadvantages of off-chain transactions

Off-chain transactions also have certain disadvantages. Users could need to put their trust in network operators or off-chain solution providers because these transactions might not be completely trustworthy.

Settlement delays and possible security issues are introduced by periodic settlement on the main blockchain. Off-chain solutions may also be less accountable because they are less transparent than on-chain transactions.

Finally, not all use cases — such as the transfer of highly valuable assets — are appropriate for off-chain transactions, especially those that demand the complete security and decentralization of the primary blockchain.

Written by Jagjit Singh

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] There you can find 79563 more Info to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] There you can find 30436 more Info to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Here you can find 76162 additional Information on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Here you can find 62433 additional Info to that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Here you can find 10870 additional Info on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2270/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2270/ […]