The privacy issues of central bank digital currencies (CBDCs): An Overview

Privacy concerns have risen alongside ongoing research into central bank digital currencies (CBDCs) worldwide, which has prompted a closer look at these issues. This article will explain privacy issues associated with CBDCs, methods to balance anonymity and privacy, and regulatory measures to protect individuals’ privacy.

Are CBDCs a threat to financial privacy?

CBDCs do not fundamentally threaten financial privacy. However, how CBDCs may affect privacy depends on a number of factors, including their implementation, design, legal framework and user awareness.

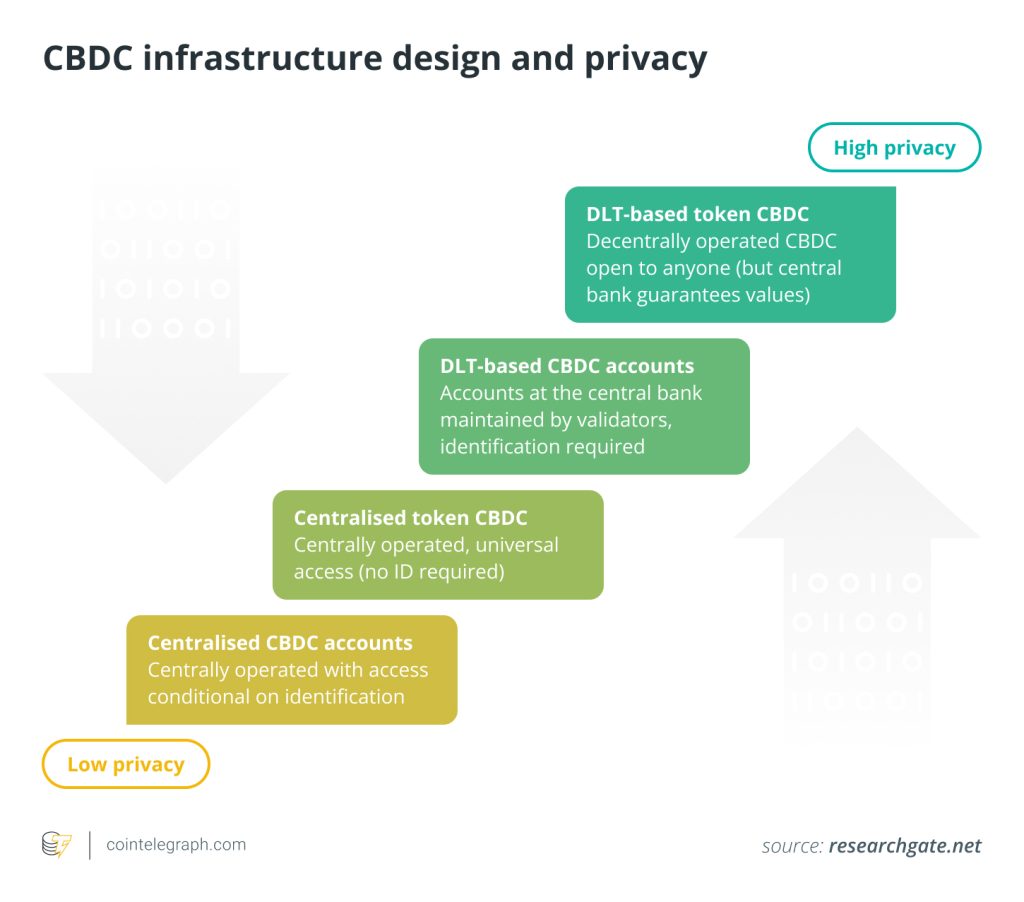

Design and implementation

The way CBDCs are designed affects how much financial privacy is at risk. CBDCs may not necessarily pose a serious risk if they are created with privacy protections in mind. For instance, CBDC transactions may offer a level of privacy comparable to cash transactions if they are intended to be pseudonymous, which means they conceal the identities of the parties to the transaction.

Data gathering and surveillance

Financial privacy protection may be jeopardized if CBDCs are implemented in a fashion that permits central authorities to track and gather information on all transactions. Governments or central banks may utilize this information for a variety of objectives, such as monitoring citizen behavior or enforcing tax laws.

Participation of third parties

The degree to which payment processors or banks participate in CBDC transactions can potentially have an impact on privacy. Intermediaries may have access to transaction data and may share it with other parties if CBDC transactions are carried out through them.

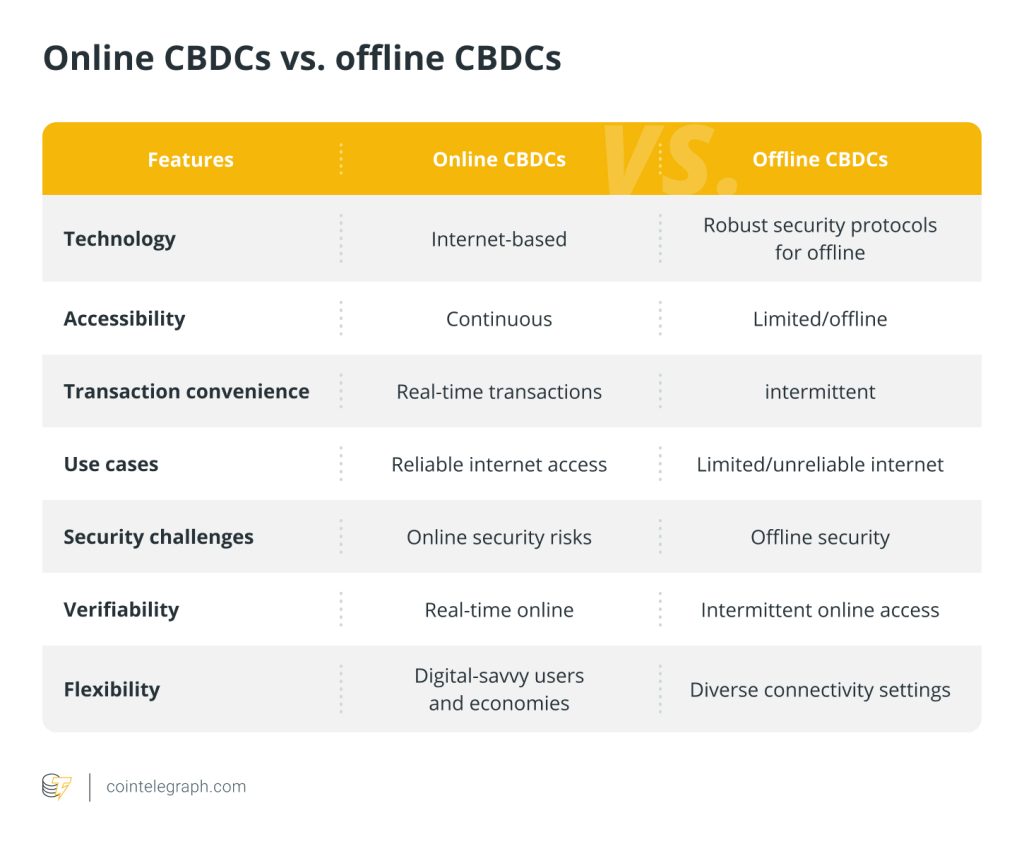

Features that promote anonymity

Some CBDC designs may include elements that promote various levels of anonymity. CBDCs, which resemble digital cash, could, for instance, enable offline transactions or provide better privacy features. The existence or absence of such features may severely impact user privacy.

Legal and regulatory framework

The impact of CBDCs on financial privacy will be greatly influenced by the laws and rules governing them. CBDCs might pose less of a hazard if stringent privacy safeguards are in place. On the other hand, if governments have extensive monitoring authority, CBDCs might be applied to increase surveillance capacity.

User awareness and control

Ultimately, how much privacy CBDCs provide will also depend on how well-informed users are about privacy concerns and how much control they have over their own data. Some privacy concerns can be reduced if users can choose more private transactions and know the consequences of their decisions.

Financial surveillance risks associated with CBDC usage

CBDCs offer many benefits, but they also add concerns related to surveillance, such as:

Government surveillance

Since CBDCs are created and managed at the federal level (such as in the United States), governments have the ability to keep an eye on business dealings and financial activity. This degree of control might result in increased state surveillance, violating people’s financial privacy.

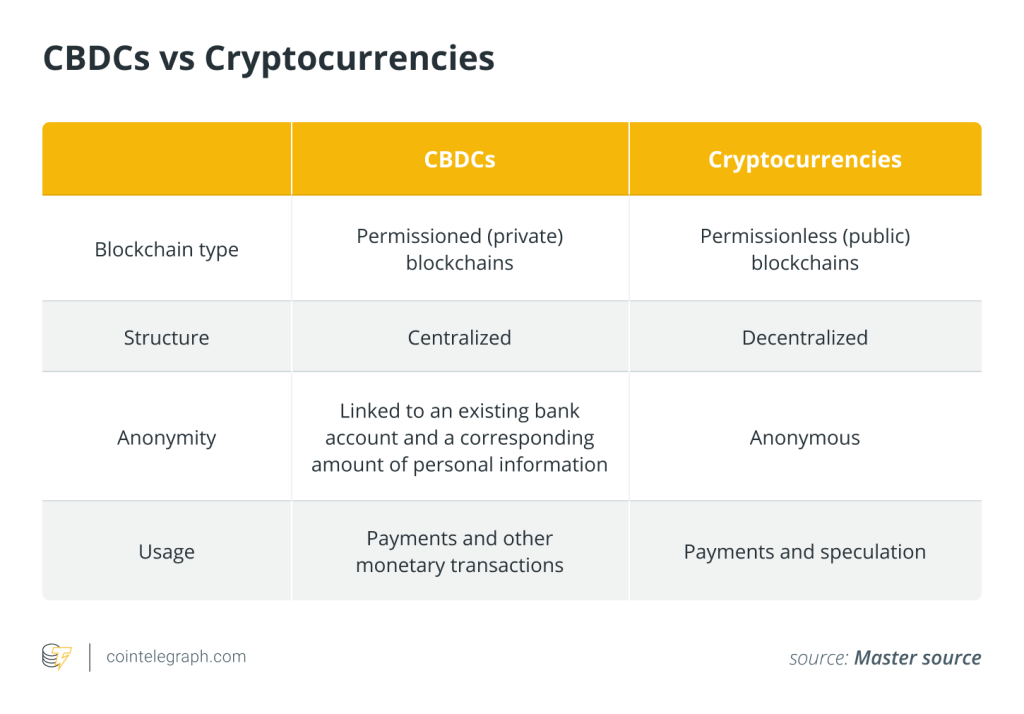

Transaction tracking

Transaction tracking is enabled due to the recording of CBDC transactions on a blockchain or centralized ledger, which allows for tracking money flows. This openness would make it easier to monitor financial transactions, which might jeopardize user privacy.

Social scoring

Governments may issue social ratings based on financial behavior using CBDC data. Individuals may experience negative effects, such as being denied access to services or job prospects based on their financial past.

Data breaches

CBDCs depend on digital infrastructure, which is open to hacking and other security threats. Individuals’ financial information might be made public if hackers access CBDC transaction records.

Third-party access

Although CBDCs seek to eliminate middlemen, some implementations may call for the use of outside service providers. If not adequately regulated, these firms might have access to transaction data, causing privacy risks.

As per the Bank of England’s technology paper, the central bank oversees certain operations and elements, like architectural components, while third parties handle routine maintenance tasks. Such arrangements can raise privacy concerns.

Specific cyber threats that CBDCs may be vulnerable to

CBDCs are not immune to unique cyber threats that require stringent security precautions. Cybercriminals may target CBDC systems to violate security measures and gain unauthorized access, which could result in the theft of users’ digital assets. Another concern is phishing attacks, where hostile actors try to trick users into providing private keys or account credentials to compromise their CBDC holdings.

Additional concerns include malware and ransomware, which can infect users’ devices, compromise CBDC transactions or demand ransom payments in CBDCs. Additionally, user privacy is a concern due to the ability to track and analyze financial actions if CBDCs are issued using blockchain technology.

Furthermore, smart contract-based CBDC platforms may be prone to code flaws or vulnerabilities, making them vulnerable to attack. Finally, centralized CBDC systems must address systemic risks associated with a single point of failure.

These issues highlight how crucial it is to implement strong cybersecurity measures, encourage user education, and continuously review and improve security policies to protect CBDCs from the ever-changing panorama of cyber threats.

How can CBDCs balance anonymity and traceability for users

It may be difficult to strike a balance between anonymity and traceability when using CBDCs. Also, this balance must be struck carefully, considering both user privacy and legal needs. Although it is a difficult task, ongoing research in this area strives to create novel solutions that adequately handle these issues.

For instance, research unveiled at the 2022 IEEE International Conference on Communications in Seoul, South Korea, introduced an innovative approach to achieving anonymity and traceability in CBDCs. It uses commercial banks to manage accounts and coins, increases efficiency through coin splitting and combination, protects user anonymity from commercial banks, and uses BBS+ signatures to provide central bank monitoring for user tracing and double-spending prevention.

BBS+ Signatures enable multi-message signing, generating a single output signature. They support proof of knowledge, allowing the prover to selectively reveal specific, originally signed messages while keeping others confidential. The system fosters inclusivity by enabling payments to users without business bank accounts while ensuring balance, anonymity, traceability and practicality for mobile device applications.

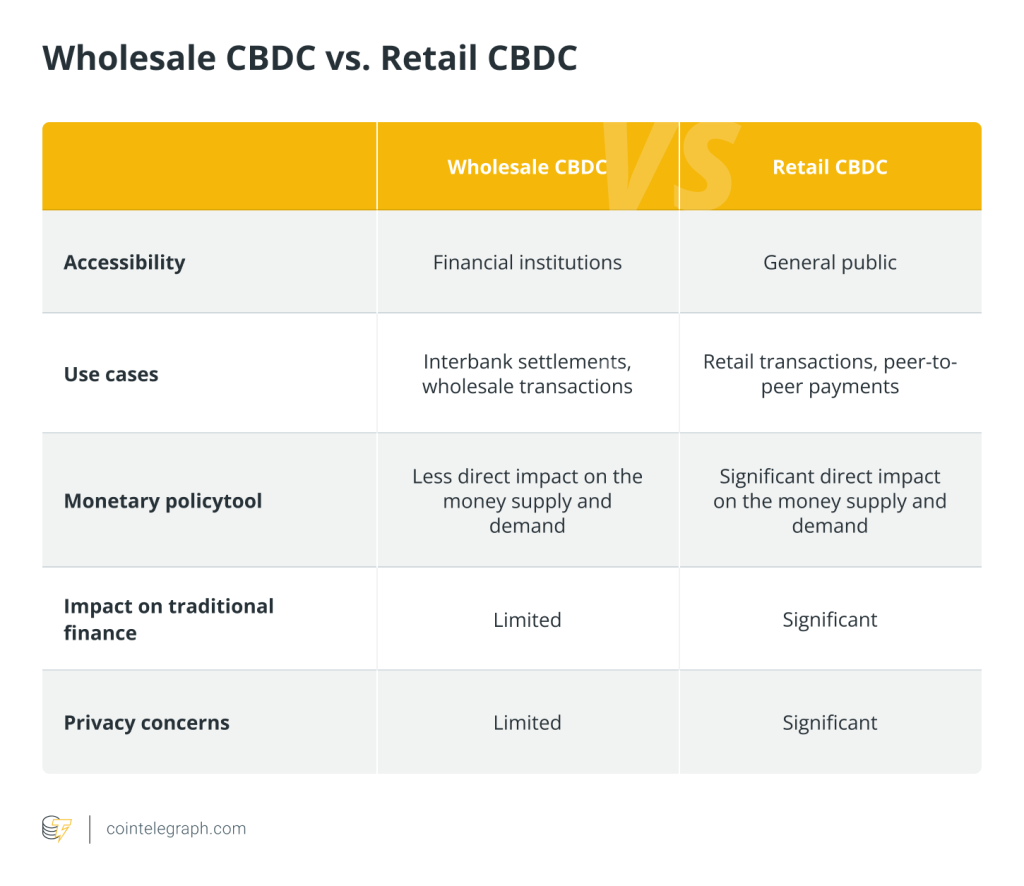

To balance privacy and transparency in retail CBDCs, another study advocates employing techno-legal techniques and a regulation-by-design framework to ensure compliance with Anti-Money Laundering requirements. It also underlines that user privacy can be preserved by utilizing privacy-enhancing technologies like zero-knowledge proofs.

Regulatory measures to protect privacy in CBDC transactions

Establishing trust and security within the digital financial ecosystem depends critically on regulatory measures intended to safeguard privacy in CBDC transactions. Concerns about the gathering, management and dissemination of users’ sensitive financial data must be addressed to implement these rules.

Effective regulatory frameworks frequently have clauses requiring strict data protection procedures, user consent for data processing and open disclosure of information by CBDC operators.

For instance, the General Data Protection Regulation (GDPR) of the European Union establishes stringent guidelines for how personal data, including financial information, should be handled, setting a strong precedence for data protection. These rules must be followed for CBDC transactions within the EU to protect the confidentiality and security of user financial information.

Additionally, some nations have passed particular privacy laws pertaining to CBDCs to find a compromise between protecting people’s privacy rights and the advantages of digital fiat currency, such as increased financial inclusion and transaction efficiency.

For instance, the European Central Bank has suggested limiting the amount of information that third parties can access to achieve a balance between privacy and anonymity. A method to achieve this is by erasing a user’s unit history. However, this action does not impact the user’s privacy concerning the central bank, which still retains access to all data transmitted by redemption units.

Furthermore, the precise details of these privacy restrictions are still in progress, and their effectiveness remains to be seen as countries strive to strike the right balance between CBDC benefits and individual privacy rights.

Written by Onkar Singh

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] There you will find 42984 more Information to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2218/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2218/ […]