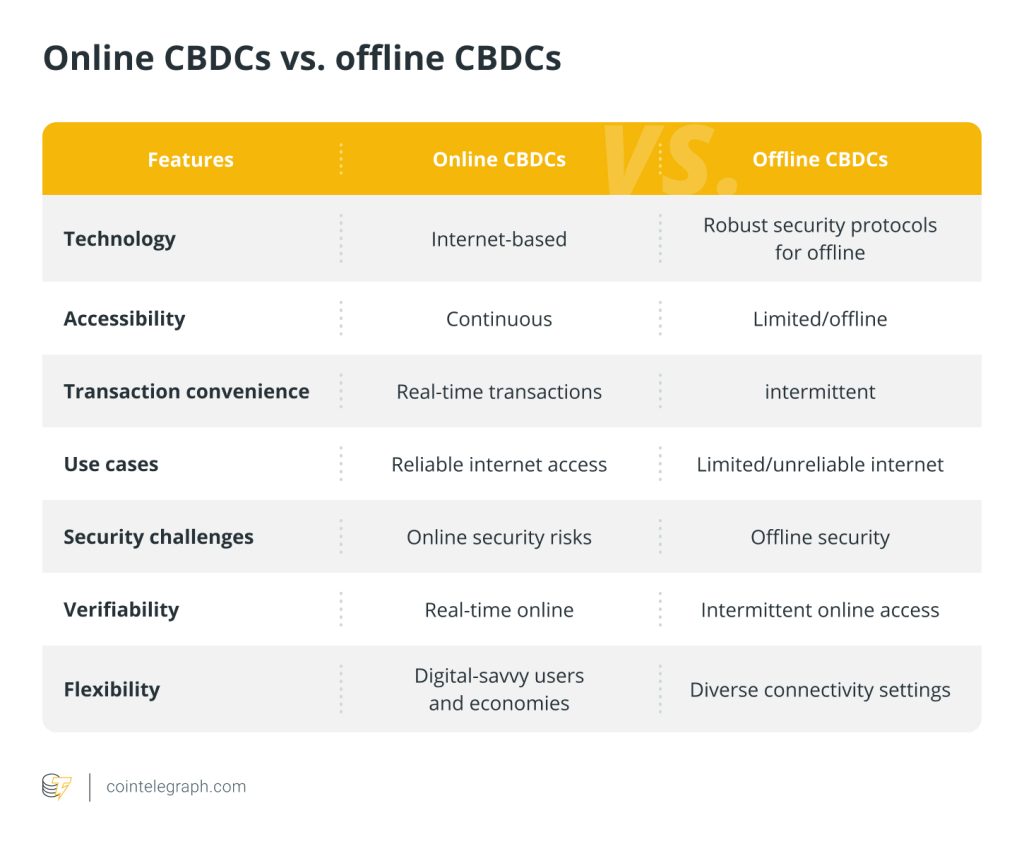

Online vs. offline CBDCs: Key differences

In recent years, numerous countries have been intensively researching and actively engaged in developing and implementing central bank digital currencies (CBDCs), showcasing a notable shift toward exploring digital monetary policy options.

The global interest in transitioning to digital currencies underscores the importance of comprehending their nature and features. A highly debated issue revolves around whether CBDCs should function exclusively online or offline or incorporate elements of both.

What are CBDCs?

While physical currency remains widely used globally, its usage continuously declines, particularly amid the COVID-19 pandemic due to cash shortages and hygiene concerns. As individuals increasingly move away from cash, there’s a growing reliance on digital financial transactions. Worldwide, banks and financial institutions conduct a substantially higher volume of transactions digitally than in physical branches.

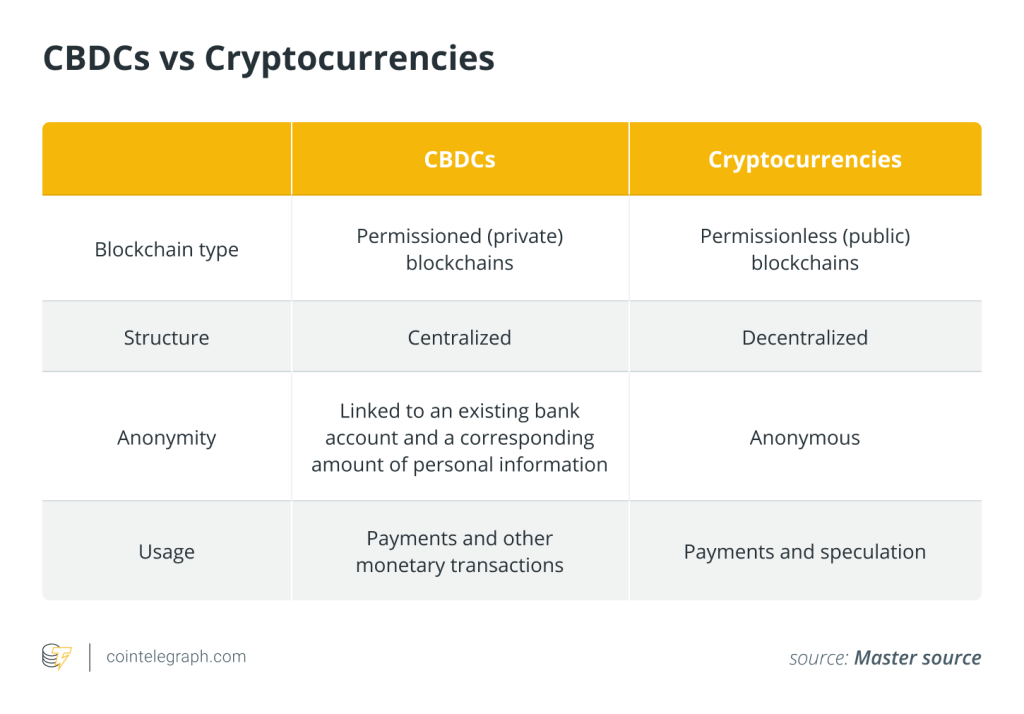

The financial services sector has experienced significant digital disruptions, marked by the rise of distributed ledger technologies (DLTs) like blockchain. CBDCs play a crucial role in this narrative, capturing the attention of central banks as they navigate this evolving landscape.

They represent a digital form of currency issued and regulated by governments. While sharing similarities with cryptocurrencies, CBDCs differ because their value is pegged to and mirrors the country’s official fiat currency.

How do CBDCs work?

The approaches for developing CBDCs differ. Usually, the issuance of CBDCs involves the central bank creating a digital representation of the national currency. These digital tokens are then distributed to authorized financial institutions, allowing for a controlled and regulated circulation within the financial system.

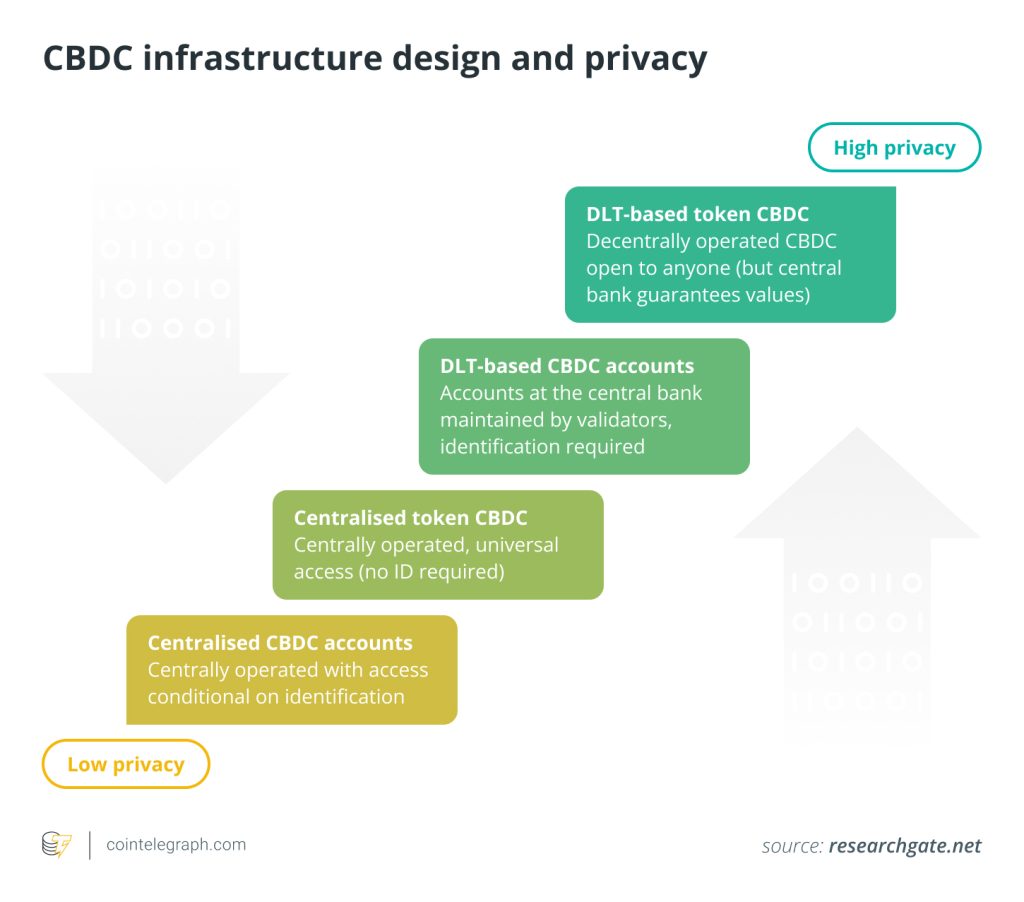

The technological architecture of CBDCs can also vary significantly. One method involves DLTs, which facilitate secure and transparent transactions recorded in a decentralized manner, ensuring a tamper-resistant and verifiable ledger. For instance, Nigeria’s e-Naira, launched in 2021, operates like physical cash and utilizes a Fabric-based blockchain with DLT.

In contrast, the United Kingdom has opted for a different approach to the digital pound. The Bank of England prioritizes centrally governed, distributed database technologies over DLT solutions, deeming them more efficient and suitable. This highlights the varied technological preferences observed among countries developing their CBDCs.

Types of CBDCs based on accessibility and functionality

The landscape of CBDCs is marked by diversity, as there is no singular blueprint for their implementation. Instead, many approaches are being piloted across different countries, reflecting the nuanced considerations and objectives of each central bank. These varied models range from other technological infrastructures to distinctive regulatory frameworks.

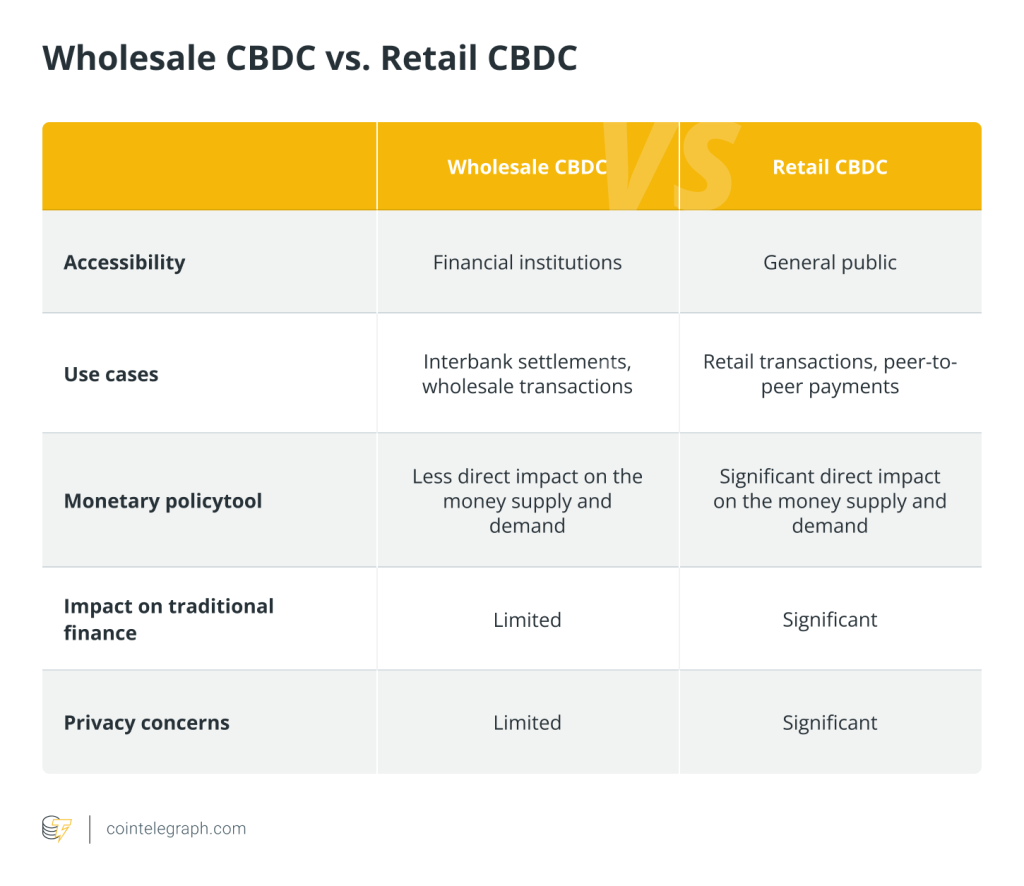

Some countries are exploring a retail CBDC, which would allow the general public direct access to the digital currency, essentially creating a digital version of physical cash. In contrast, others are focusing on a wholesale CBDC, primarily designed for financial institutions and interbank transactions, aiming to enhance the efficiency of the financial system.

For example, the European Central Bank is currently investigating the utilization of wholesale CBDCs for interbank payments, while the People’s Bank of China has been actively engaged in the research and development of a retail CBDC known as DCEP, or digital yuan.

Additionally, the degree of privacy and anonymity afforded by CBDCs varies, with some countries prioritizing user privacy, while others emphasize regulatory oversight.

Online CBDCs

CBDCs are a digital representation of a nation’s official currency on the online frontier, accessible through electronic channels like digital wallets, online banking platforms and various internet-based financial systems.

This online dimension ensures convenience and aligns with the broader societal trend toward a cashless economy. It enhances payment security and benefits the system with increased speed, reduced costs and greater access for those without bank accounts. For transactions and validation, online CBDCs must be connected to the internet to provide instant access to the central banking system.

Offline CBDCs

These digital currencies can be accessed and used without a continuous internet connection. They enable transactions even in settings with spotty or nonexistent internet access. To store transactions temporarily and then synchronize them with the central system when an internet connection is available, offline CBDCs frequently employ particular protocols or mechanisms.

Can CBDCs be used offline?

Moreover, CBDCs navigate a realm of both online and offline functionalities. Offline CBDC transactions enable users to conduct transactions without relying on an external power source or a general ledger connection.

Offline CBDCs pose both opportunities and challenges in design. Genuine peer-to-peer offline transactions are complex due to the inherent connection to a remote ledger. Design choices for retail CBDCs vary based on the level of synchronization with the general ledger.

In intermittent outages, systems may store limited payment data on CBDC devices for later completion. For out-of-range use, more robust offline processing may be needed, and off-grid use introduces complexities in distribution and reconciliation.

However, offline capacity brings technical and policy challenges. Risks include double-spending if an offline device is compromised and loss of funds due to device-based storage. Offline payment requires unique user devices, creating challenges for tamper-proof security.

While efforts to expand internet access continue, broadband ubiquity is distant, particularly in sparsely populated areas. Despite challenges, central banks anticipate CBDCs coexisting with cash, recognizing the persistent importance of offline capabilities in a world where cash use is declining, especially in advanced economies.

The road ahead

In navigating the landscape of CBDCs, the distinctions between online and offline functionalities reveal a dynamic interplay of financial innovations. The debate surrounding CBDCs is not merely about online versus offline; it’s a nuanced exploration of how these digital currencies reshape our understanding of payments in an ever-evolving financial ecosystem.

CBDCs redefine the terrain of electronic payments, with online CBDCs presenting a seamless digital currency experience, while their offline counterparts revolutionize the concept of offline digital payments. The dichotomy between offline and online CBDCs echoes the broader shift toward a cashless society, emphasizing financial inclusion and accessibility, particularly in regions constrained by geographic remoteness or lacking robust communication and power infrastructure.

As this article dissects the types of CBDCs, the offline payment system emerges as a critical player, enabling transactions without a constant reliance on the internet. This feature aligns with the principles of a retail CBDC and addresses key policy objectives, ensuring continued public access to central bank money. The integration of CBDC offline payments may be pivotal, offering a versatile solution for peer-to-peer transactions and cross-border payments and providing financial flexibility in a fintech-driven era.

Ultimately, the transformative power of CBDCs may lie in their ability to bridge the realms of online and offline transactions, redefining the landscape of digital payments. CBDCs are charting a course toward a more inclusive, innovative and interconnected financial future, whether through the convenience of online digital currency or the resilience of offline digital payments. In this era of mobile banking, digital wallets and evolving digital identities, CBDCs stand as a testament to the ongoing evolution of our global payment systems.

Written by Sasha Shilina

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Here you can find 63015 additional Info to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 94870 additional Information on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you can find 22243 more Information to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 3540 additional Information to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 97382 more Info to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 77536 additional Information to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 55052 additional Information on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you can find 18499 more Info on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] There you will find 41175 more Info on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Here you will find 57911 more Info on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1957/ […]

… [Trackback]

[…] Here you will find 96189 additional Info to that Topic: x.superex.com/academys/beginner/1957/ […]