3 tips for protecting Bitcoin profits amid Ethereum ETF mania

Looking to protect the millions you’ve made from crypto during the Bitcoin-Ether ETF mania before this bull run comes crashing to an end? Here are a few ideas.

Cryptocurrency’s leading act has been knocked off the top spot. The much-hyped launch of exchange-traded funds (ETFs) for Ethereum in the United States has sent Ether (ETH) soaring more than 20% since May 20. Bitcoin’s (BTC) performance looks lackluster by comparison. Opportunities to bet on crypto’s kingpin still abound — but not all are worth taking.

If you’re an inveterate Bitcoin maxi, stop here. You already know the U.S. dollar is on the brink of collapse, and $200,000 BTC is right around the corner. For everyone else, here are three practical tips for protecting your crypto profits after this bull run loses steam.

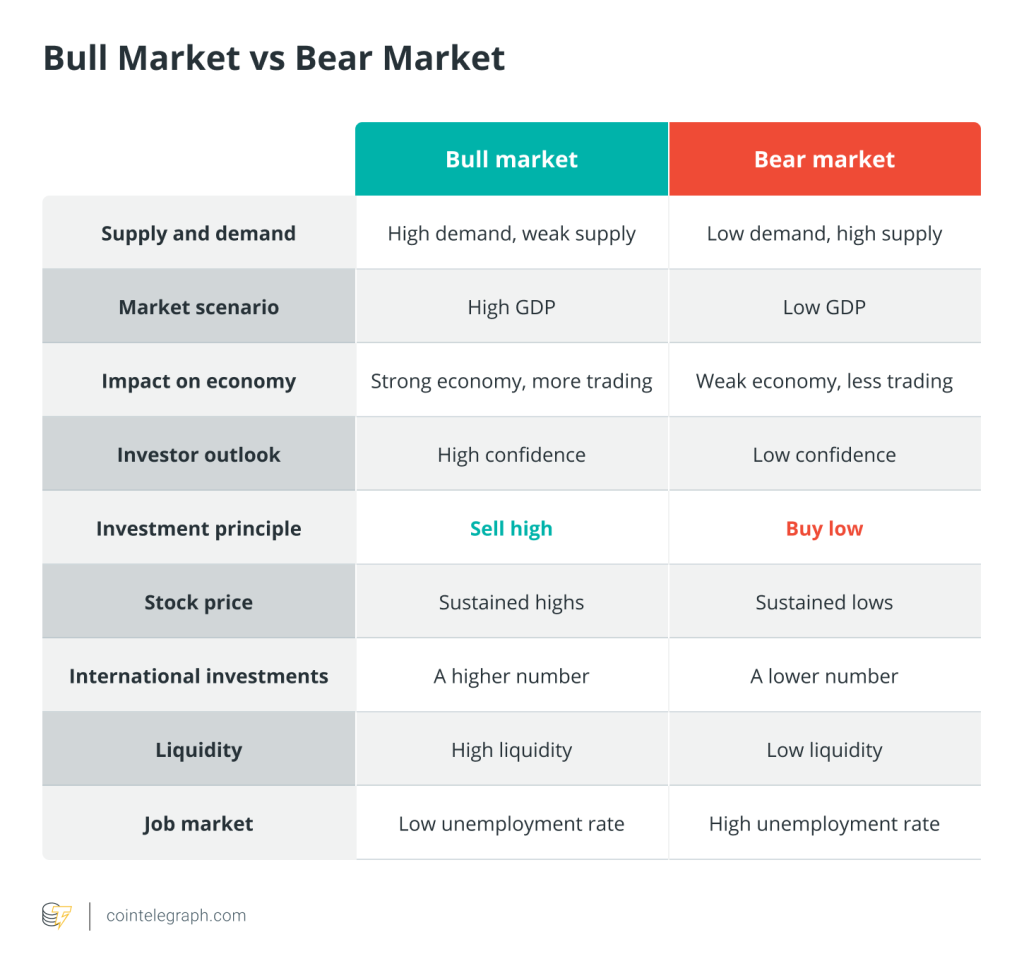

Realize Ether ETFs may not be bullish for Bitcoin

The greenlight for Ether ETFs is bullish for crypto as a whole, but not necessarily for BTC — especially not in the short-term. With Ethereum dominating the market’s narrative in the coming months, expect BTC to retest prior price support levels.

Related: Here’s why US debt is out of control — and Japanese debt isn’t

Rather than placing big directional bets, consider market-neutral plays. One of the more profitable strategies this year has been a relatively simple carry trade between BTC’s spot and perpetual futures markets. With Bitcoin bulls doubling down on long positions, funding rates on futures exchanges have soared north of 20%. Contrarians have been cashing in, collecting payments for shorting BTC perpetuals while offsetting risk in the spot markets.

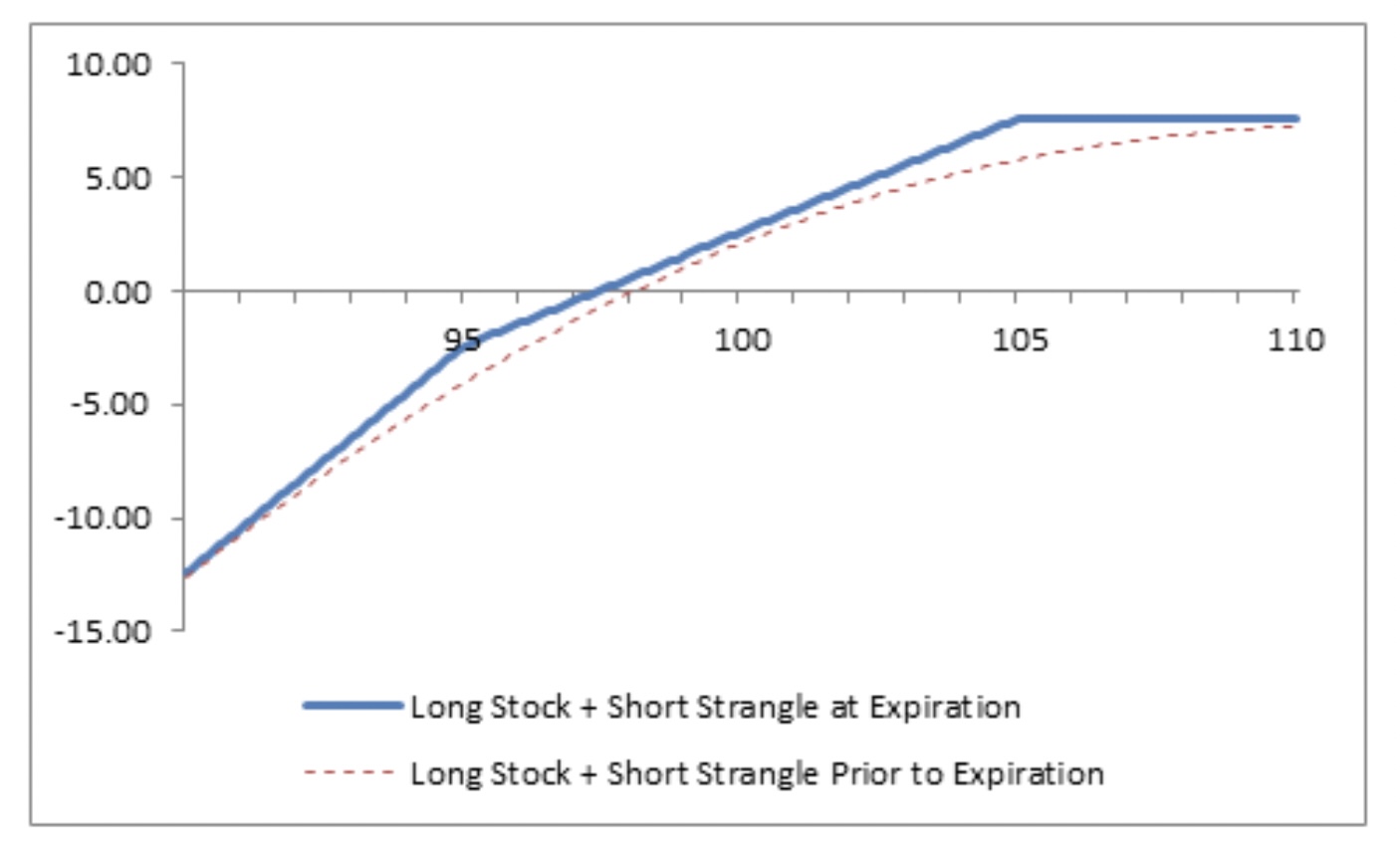

For a more sophisticated trade, investment research firm 10x Research swears by the so-called “covered strangle.” This moderately bullish bet against extreme volatility involves holding spot BTC while selling out-of-the money call and put options that will expire in December — at the $100,000 and $50,000 levels, respectively. The strategy offers a “17% downside buffer or 17% more yield, depending on where BTC closes in December,” according to 10x Research.

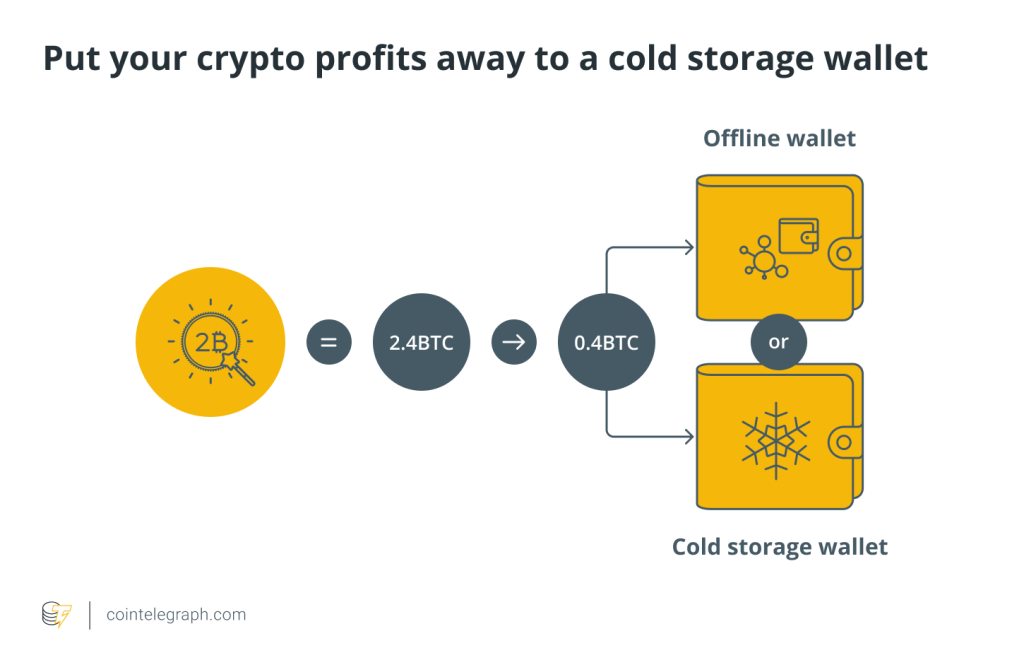

Skip self-custody — Put something in ETFs

Bitcoin’s laurels as a long-haul inflation hedge hardly matter if scams and exploits drain your wallet to zero. Hence why self-custody, venerated by maxis, is a no-go for all but the most tech-savvy holders. More than $27 billion has been drained by exploits to-date, or more than 1% of crypto’s total market capitalization. The hit-rate for retail holders is even higher.

Related: Warren’s alleged work with short-seller shows anti-crypto army heating up

The safest option is longing BTC futures on established platforms like the Chicago Mercantile Exchange (CME). Cash-settled futures are immune to exploit risk, and bite-sized BTC Micro Futures closely mirror spot positions. Even so, routinely rolling expired contracts adds considerably to complexity and costs.

Like it or not, Bitcoin spot ETFs really are the best bet for most holders. With carefully-vetted custodians and expense ratios of 0.25%, BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) strike an attractive balance between security and cost. Be warned, however, tha bid-ask spreads and trading premiums drag on returns, and custodians’ partial reliance on hot wallets creates meaningful exploit risk.

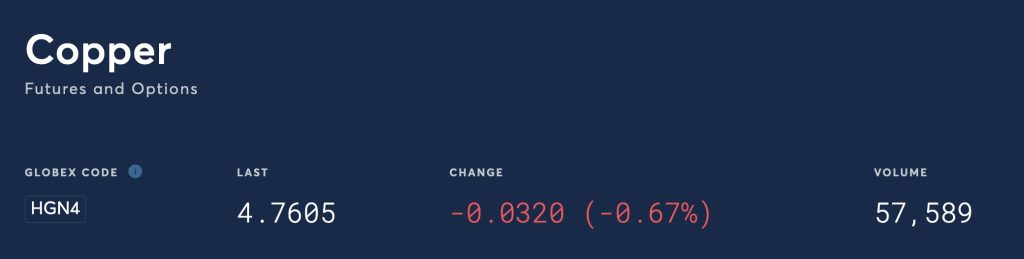

Consider the booming copper industry

The best Bitcoin play may not involve Bitcoin at all. Forget about digital gold — for a true long-haul inflation hedge, consider copper (yes, the metal). Copper’s correlation with Bitcoin surpasses practically every other commodity. It has compelling use cases (such as wire and penny production), and having been with us since the Neolithic period, is unlikely to be displaced by a rival smart contract network.

On the flip side, Bitcoin’s correlation with technology stocks has been steadily waning. Gone are the days of BTC as a leveraged bet on the NASDAQ. Copper futures, among the most liquid and capital-efficient in the market, trounce BTC as a serious inflation hedge, while delivering superior risk-adjusted returns.

Bitcoin was the first mover in crypto, but it’s the last-mover that counts. After the approval of Ether ETFs, Ethereum’s institutional adoption is poised for take off. It’s a good time for BTC maxis to begin thinking beyond Bitcoin.

Alex O’Donnell is the founder and CEO of Umami Labs. Prior to Umami Labs, he worked for seven years as a financial journalist at Reuters, where he covered M&As and IPOs.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses