How to buy Bitcoin in Switzerland

Is Bitcoin legal in Switzerland? Discover Swiss banks’ attitudes toward crypto and various ways to buy BTC.

Switzerland has emerged as a digital innovation hub due to progressive regulations and a welcoming atmosphere for crypto enterprises. At the core of this innovation lies Zug, dubbed the Crypto Valley, which houses hundreds of firms spearheading fintech and blockchain development. The country’s robust regulatory framework ensures security and privacy for stakeholders involved, earning it a prominent position in the landscape of crypto innovation.

The Henley & Partners Crypto Adoption Index report 2023 places Switzerland second, with an impressive score of 46.9%. Switzerland performed well in innovation and technology, regulatory environment and economic factors.

This article delves into the process of purchasing Bitcoin (BTC) in Switzerland and explains if Bitcoin is legal in Switzerland, Swiss banks’ attitudes toward cryptocurrency, and how to buy Bitcoin via crypto exchanges, Bitcoin ATMs, P2P platforms and Swiss Federal Railways (SBB) machines.

Is Bitcoin legal in Switzerland?

Switzerland follows a forward-looking approach when it comes to cryptocurrencies such as Bitcoin. Swiss regulators acknowledge Bitcoin as a legal asset or property, with exchanges and digital currency platforms allowed to function within Swiss borders once they obtain the required permissions.

Gains made via Bitcoin are liable for income tax for corporations and professional traders or wealth tax for individuals. A robust blockchain ecosystem has been cultivated in Switzerland thanks to the country’s crypto-friendly regulations, especially in the canton of Zug, which is known as Crypto Valley because of the concentration of cryptocurrency and blockchain-related enterprises there.

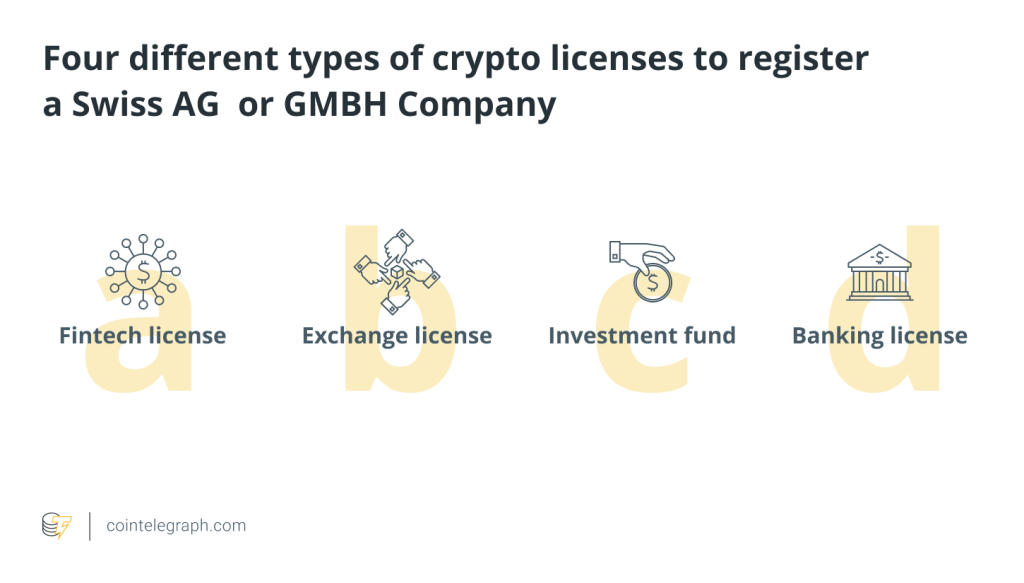

Switzerland has enacted laws governing virtual asset service providers (VASPs) to ensure security and transparency in the crypto industry. VASPs need to comply with the Financial Services Act (FinSA) and the Anti-Money Laundering (AML) Act to operate in Switzerland. They need to implement Know Your Customer (KYC) processes and conduct extensive customer due diligence. These organizations must also register with the Financial Market Supervisory Authority (FINMA) and follow stringent reporting guidelines.

Regulations in Switzerland consider a VASP to be operating professionally if it:

- Generates a gross revenue exceeding 50,000 Swiss francs per calendar year.

- Establishes business relationships with more than 20 contractual parties within a calendar year.

- Exercises unrestricted control over third-party funds totaling more than 5 million francs.

- Executes transactions with a total volume surpassing 2 million francs annually.

How Switzerland’s banking sector is embracing cryptocurrencies and blockchain

Let’s take a look at the kind of crypto products rolled out by Swiss banks and how they have been embracing blockchain technology:

Types of cryptocurrency products and services offered by banks in Switzerland

Swiss banks offer various types of cryptocurrency products and services:

- Trading and brokerage: Certain banks enable their clients to buy and sell cryptocurrencies through partnerships with specialized platforms.

- Integration of wealth management: Some banks use cryptocurrency in investment portfolios for specific clientele.

- Custodial services: To attract institutional investors and alleviate security concerns, several banks hold cryptocurrency assets on behalf of their clients.

- Crypto-related products: A few banks are leading the way in innovation by developing investment funds or structured products based on cryptocurrency performance.

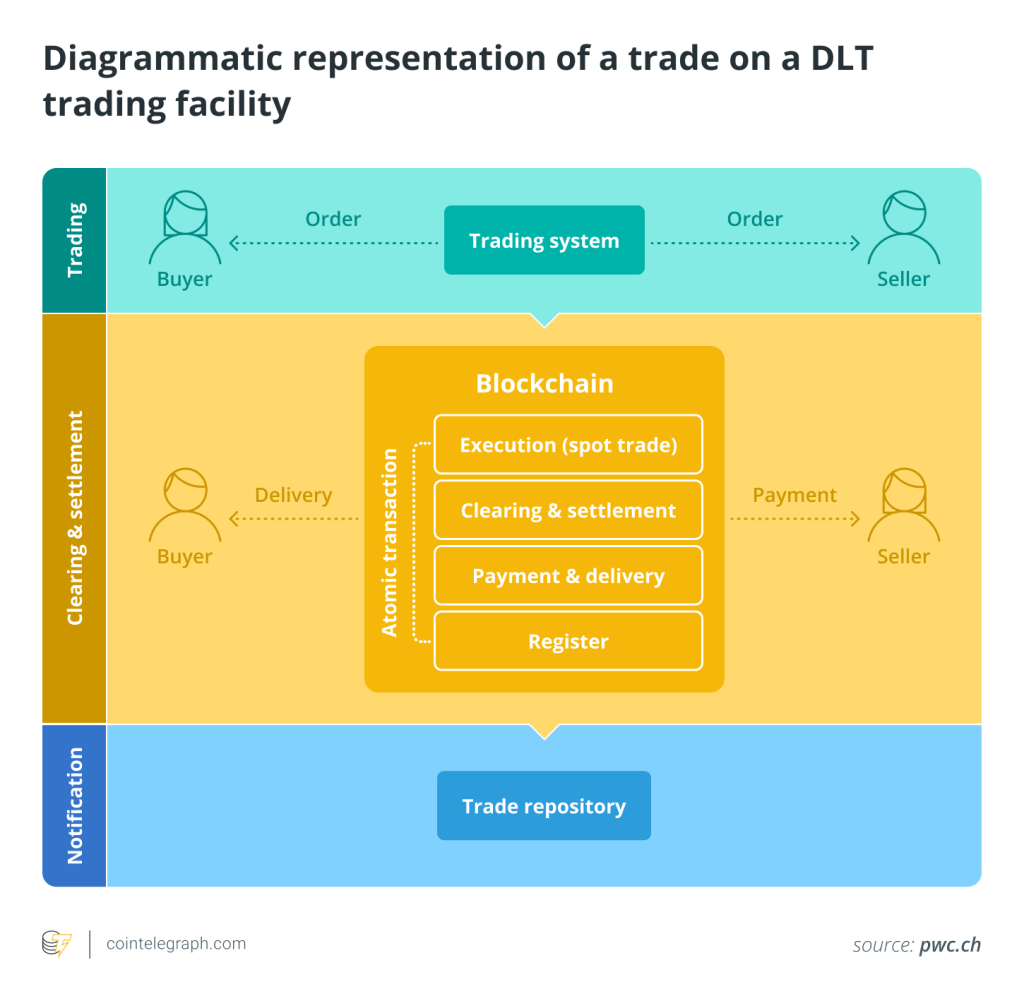

Swiss banks dabbling with blockchain technology

Many banks in Switzerland are embracing blockchain technology to enhance their operations. For instance, Cantonal Bank incorporates blockchain to diversify revenue streams and attract younger, tech-savvy customers. Falcon Private Bank, Julius Bär, and Vontobel banks cooperate with cryptocurrency experts to provide trading and asset storage services.

Maerki Baumann Bank provides corporate banking accounts to companies, particularly those raising funds through security token offerings (STOs). Santander Private Banking International has also announced plans to provide cryptocurrency trading and custody services to its high-net-worth clients in Switzerland. All these services will be offered following Switzerland’s advanced crypto legislation.

How to buy Bitcoin in Switzerland

Users have several options when it comes to buying Bitcoin in Switzerland:

Cryptocurrency exchanges

Switzerland, known for its robust financial regulatory ecosystem, hosts both global and local crypto exchanges. International exchanges such as Binance, Crypto.com and Kraken enable residents to trade various cryptocurrencies. Native exchanges like Bitcoin Suisse also cater to institutional investors and individual traders.

Here is a step-by-step process of how to use a cryptocurrency exchange to buy Bitcoin in Switzerland.

Choose a crypto exchange

Users should do their research and pick a secure cryptocurrency exchange with a track record to prove its credentials. Users should conduct thorough research, read user reviews and consider their trading needs before selecting a platform.

Set up an account

Once the user has chosen an exchange, they must create an account. Swiss regulations require the exchanges to ensure all users have completed identity verification processes, including KYC.

Fund your account

At this stage, users need to fund their exchange account with Swiss francs or any other recognized fiat currencies. Users may use bank transfers, credit/debit cards or other payment options.

Place an order

The user can state how much Bitcoin they wish to acquire. When choosing spot trading, they could place a market or a limit order. A limit order runs only when the price hits a predetermined threshold. A market order executes immediately at the current market price.

Verification

Before confirming the transaction, one should double-check the details of their order, including the price and quantity. After verification, the exchange will process their order and credit their exchange account with the cryptocurrency ordered.

Store crypto

After buying Bitcoin, one might keep it on the exchange or, for added security, transfer it to a private cryptocurrency wallet.

Bitcoin ATM

Bitcoin ATMs, or BTMs, let customers buy Bitcoin and other cryptocurrencies using cash.

Similar to conventional ATMs, users can deposit cash, choose their preferred cryptocurrency, and receive coins of the equivalent value in their chosen wallet. Users can also deposit cryptocurrencies and withdraw cash after completing verification.

According to Coin ATM Radar, over 130 ATMs are present across Switzerland as of May 2024. Basel, Bern, Genève, Ipsach, Lausanne, Biel/Bienne, Chur and Lugano are home to most of the ATMs, with Zurich being home to almost 40 Bitcoin ATMs.

Peer-to-peer platforms

The peer-to-peer (P2P) exchange refers to buying or selling Bitcoin directly with another person on a platform:

Choose and register on a P2P platform

Opt for a credible platform that facilitates P2P trading. Platforms such as Paxful and Remitano offer escrow services to guarantee security.

On the P2P platform, create an account. Share the required details and finish any identity verification processes the platform requests.

Find sellers

Users need to look through the platform’s list of sellers and select one that fits their requirements. Take into account aspects such as transaction restrictions and seller credibility.

Open a trade

One can open a trade with the chosen seller by mentioning the quantity of Bitcoin they wish to purchase and their preferred method of payment. Online wallets, PayPal, bank transfers and cash deposits are a few popular ways to make payments.

Discuss terms

Speak to the seller and negotiate the conditions of the trade, including the exchange rate and payment instructions. Users should address any queries or worries they may have before completing the purchase.

Finalize the transaction

Pay the seller via bank transfer or debit/credit card. The money will go to the escrow account. Users need to ensure that Bitcoin has arrived in the wallet before sending confirmation to the exchange.

Swiss Federal Railways machines

In 2016, the SBB introduced a new medium for buying Bitcoin straight from ticket vending machines. With over 1,000 machines spread around 700 rail stations, this program provides access to cash-based Bitcoin transactions.

To buy Bitcoin from the railway ticket machines, a user must have a Bitcoin wallet and a Swiss mobile phone number. Anyone can access crypto-enabled SBB machines to buy Bitcoin 24/7. Buyers can also purchase and keep Bitcoin offline using a paper wallet.

Though convenient, SBB’s Bitcoin service imposes exorbitant fees, ranging from 6% to 14%, making Bitcoin purchases expensive.

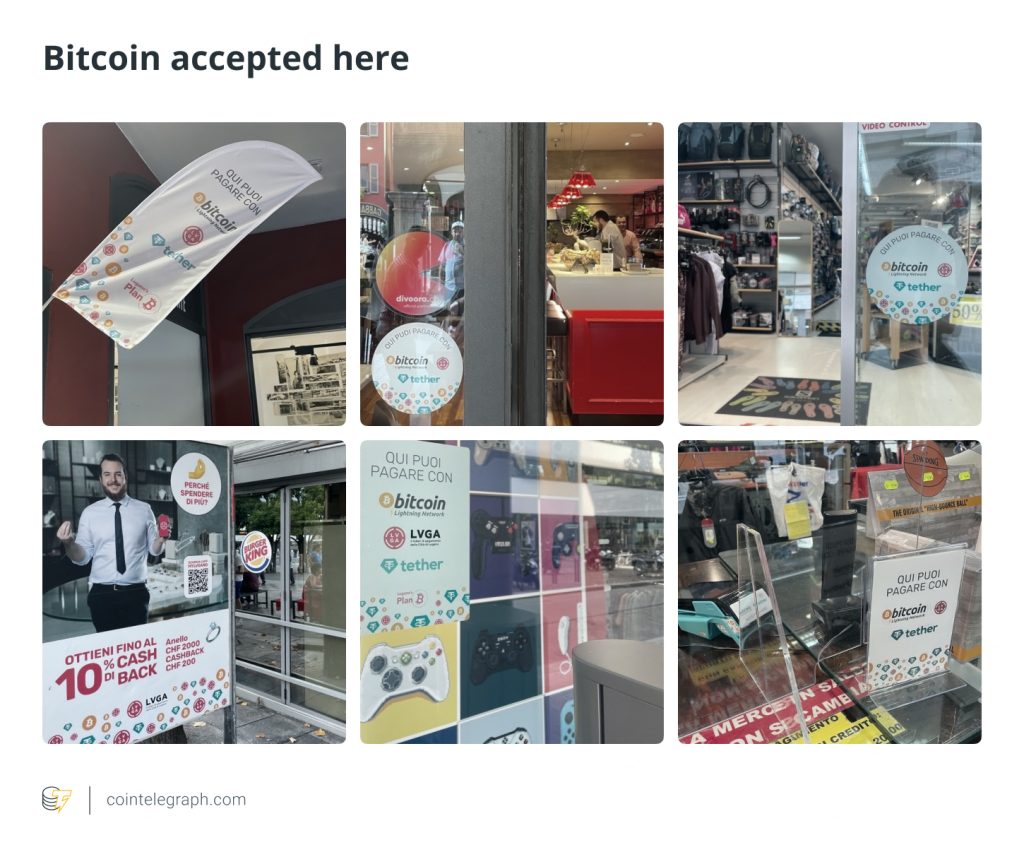

How and where to spend Bitcoin in Switzerland

Spending cryptocurrency is becoming more and more feasible in Switzerland as the adoption is steadily increasing. In Zurich and Geneva, lots of restaurants, shops and luxury boutiques take payments in crypto.

Lugano, the largest city in the Italian-speaking region of southern Switzerland, has de-facto adopted BTC as legal tender. Renowned brands such as McDonalds, Rolex and Lamborghini and regular businesses like pharmacies, convenience stores and tobacco shops in the city accept BTC as payment.

Across the country, a large number of online merchants and service providers give customers BTC and other crypto payment choices, with no shortage of services facilitating the conversion between fiat and crypto.

The country hosts many Bitcoin ATMs, simplifying the process of exchanging Bitcoin for Swiss francs and vice versa. Switzerland’s positive approach toward digital currencies has provided holders with a range of choices regarding how to buy Bitcoin and other cryptocurrencies.

How to store Bitcoin in Switzerland

Storing crypto assets is important due to risks such as thefts, hacking, scams and cyberattacks. Leaving assets on exchanges could expose them to hacking risks. Though spreading assets across multiple exchanges reduces risk, reliance on centralized exchanges might result in potential hazards. Hot wallets that are connected to the internet are always susceptible to hackers.

For heightened security, crypto can be kept offline in cold wallets. Physical devices like USB drives or paper wallets that are disconnected from the internet are termed cold wallets. This isolation gives them better protection against online threats and makes them a preferred choice for long-term storage of cryptocurrency assets.

Responses