SEC sanctioned for ‘abuse of power,’ probes Ethereum: Law Decoded

The U.S. Securities and Exchange Commission wants an extra $158 million to address the “Wild West of the crypto markets.”

A United States district court has imposed sanctions on the Securities and Exchange Commission (SEC) for acting in “bad faith” in its lawsuit against Debt Box.

The SEC initially filed a motion to dismiss without prejudice, but that was denied by Judge Robert Shelby, who slammed the regulator for intentionally lying to the court about evidence it obtained to secure a temporary restraining order and freeze Debt Box’s assets in August 2023.

The “critical evidence” the SEC offered to have obtained “lacked any basis,” which was nonetheless advanced in “deliberately false and misleading ways,” Shelby explained.

Meanwhile, several advocacy groups have filed amicus briefs in support of an appeal by Coinbase, calling for the SEC to create clear rules for the crypto industry.

In separate filings with the U.S. Court of Appeals for the Third Circuit, the Crypto Council for Innovation, the Satoshi Action Fund, the Texas Blockchain Council, investment firm Paradigm, digital asset company Lejilex and the U.S. Chamber of Commerce said the SEC lacked clear guidelines for market participants to successfully follow in the United States.

Many of the filings argued that companies would be more inclined to leave the country without clear rules of the road.

That, however, hasn’t stopped the SEC from expanding its activities. On March 19, it asked Congress for an extra $158 million from the federal budget for 2025 to address “significant growth and change in our markets,” including the “Wild West of the crypto markets.”

The Congressional Budget Justification — a document outlining the SEC’s budgetary needs for the upcoming 2025 fiscal year — requests over $2.5 billion for 2025, up from the $2.4 billion it requested in 2024.

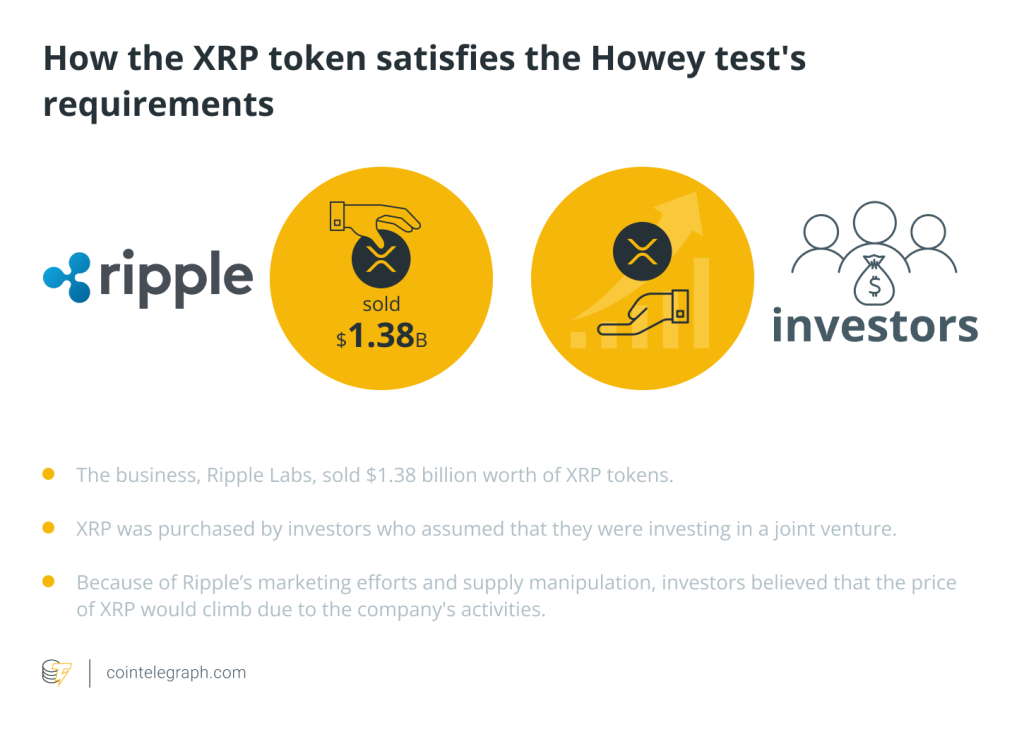

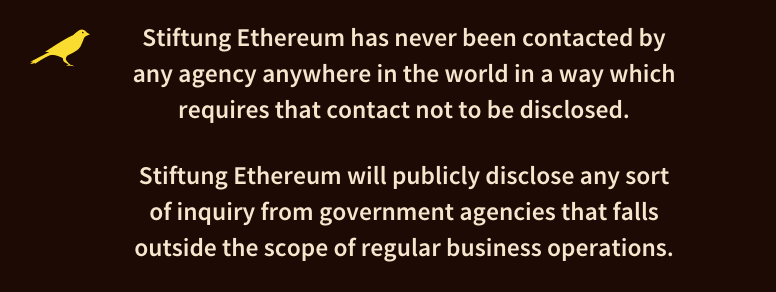

The commission has reportedly issued subpoenas to companies related to attempts to label Ether (ETH) as a security. Several U.S.-based companies reportedly received subpoenas from the SEC requesting they provide documents and financial records pertaining to dealings with the Ethereum Foundation.

According to people familiar with the matter, the commission launched a campaign to classify ETH as a security following the blockchain’s transition from proof-of-work to proof-of-stake in 2022.

IMF wants Pakistan to tax crypto

The International Monetary Fund (IMF) has asked the Federal Board of Revenue (FBR) of Pakistan to charge capital gains tax on cryptocurrency investments as one of the requirements to qualify for $3 billion in bailout funds.

During the review talks around a $3 billion stand-by arrangement, the IMF recommended that Pakistan’s FBR impose taxes on crypto capital gains.

The adjustment in tax rates, as recommended by the IMF, aims to collect yearly taxes on capital gains on real estate assets, irrespective of whether the owner chooses to sell or retain the property.

Additionally, property developers could have to comply with stricter tracking and reporting requirements, which will be supported by hefty fines for noncompliance, ultimately enforcing new tax rules in the real estate market.

Continue reading

Nigeria orders Binance to disclose all user data, launches criminal investigation

A Nigerian High Court has directed the operators of Binance Holdings to provide the Economic and Financial Crimes Commission with comprehensive data and information relating to all persons from Nigeria who are trading on its platform. I

n the motion, the lawyer representing the anti-graft agency, Ekele Iheanacho, contended that Binance’s activities in Nigeria contain elements of criminality.

The Nigerian government has also reportedly launched criminal proceedings against the exchange for tax evasion.

Meanwhile, Binance executive Nadeem Anjarwalla has escaped detention using a fake passport, according to reports in a local publication citing sources familiar with the matter.

Anjarwalla and his colleague, Tigran Gambaryan, have been detained in a guest house for several weeks in Abuja, Nigeria’s capital.

Continue reading

Australian regulator is working on “outcome-based” crypto policies

The Australian Securities and Investments Commission (ASIC) will focus on desired regulatory outcomes as it closes in on building and releasing a range of regulatory reforms for the crypto sector.

ASIC Commissioner Alan Kirkland shared the body’s game plan to promote the growth of responsible financial innovation at “The Brief – Open Forum” as part of Blockchain APAC’s Policy Week.

Kirkland pointed out the need to solve the “regulatory trilemma” regarding financial innovations, such as consumer protection, market integrity and encouraging financial innovation.

The ASIC aims to foster trust for crypto and decentralized financial systems by improving oversight and balancing the trilemma factors. According to the commissioner, the ASIC has provided informal regulatory assistance to over 900 entities since 2016.

Continue reading

Responses