Ethereum price (ETH) hits $4,000 for the first time since 2021

ETH price set a new multi-year high at $4,000 right as Bitcoin price hit a new all-time high.

Ether’s (ETH) price topped the $4,000 level for the first time since December 2021.

Ether climbed from a price of $3,873 on March 8, soaring more than 4% in the last 24 hours and 74% year-to-date, to hit a 27-month at $4,003 on Bitstamp, according to data from CoinMarketCap.

Ether’s price performance appears to be boosted by Ethereum’s upcoming Dencun update and the possible approval of a spot Ether exchange-traded fund (ETF) by the United States Securities and Exchange Commission.

ETH resumed its uptrend on March 8, while other top-cap cryptocurrencies flashed greed and Bitcoin (BTC) reclaimed $68,000. Ether has stayed on the path, marching steadily toward the much-awaited $4,000 psychological level as the community waited for the Ethereum network’s Dencun upgrade.

The Dencun upgrade, the most significant improvement to the Ethereum network since the Merge, aims to implement a number of Ethereum Improvement Proposals (EIPs), including EIP-4844, which introduces “proto-danksharding.”

Proto-danksharding is a feature that allows the blockchain to use blobs, thereby simplifying the transaction process by storing some data off the blockchain, speeding up transactions and cutting costs for layer-2 chains and rollups that depend on Ethereum.

Ethereum developers have set the Dencun mainnet to go live on March 13.

Another factor driving ETH’s price performance is the expectation that the SEC will approve one of the several spot Ether ETF applications before it.

Related: Bitcoin price hits a new all-time high

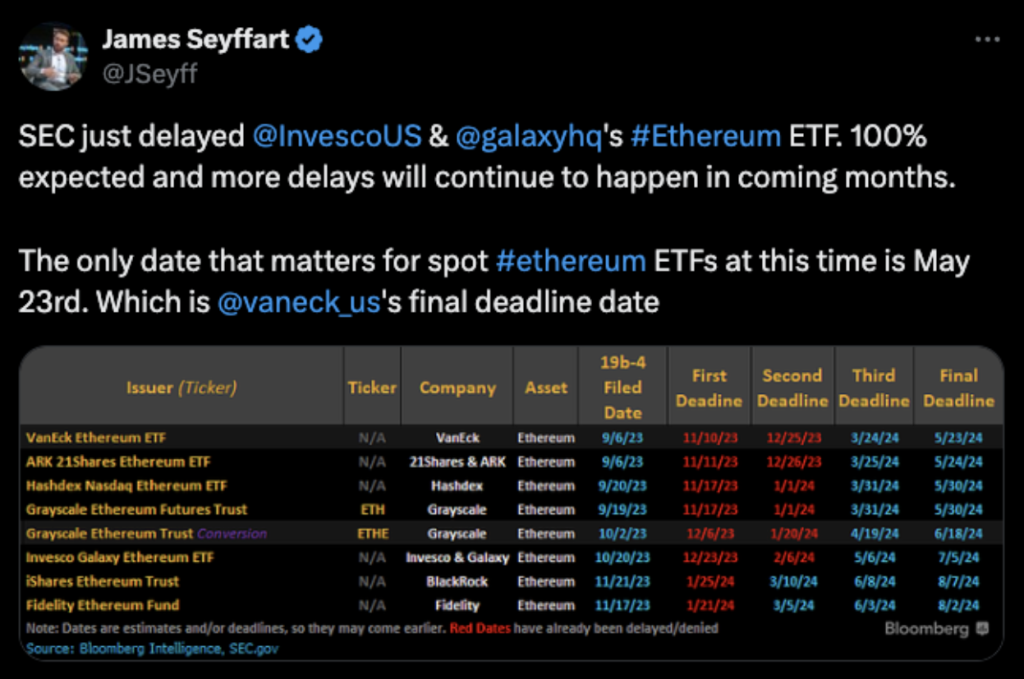

Despite the regulator delaying its decision on spot Ethereum ETF applications from BlackRock and Fidelity, market participants remain hopeful that one will be allowed soon. The financial watchdog is expected to deliver a decision on all the spot Ether ETF applications on the same day, as it did with Bitcoin ETFs on Jan. 10, so as not to give one issuer undue advantage over others. The statutory deadline for the SEC to allow or deny an Ether ETF is set for May 23.

Bloomberg ETF analyst James Seyffart believes the SEC will not take as long to process Ether ETF applications as it did with Bitcoin ETFs. In a Feb. 7 post on X, Seyffart that May 23 is the “only date that matters” when it comes to Ether ETFs.

Drawing from the success of spot Bitcoin ETFs since their market debut on Jan. 11, a spot Ether ETF product is expected to perform in a similar manner, allowing more capital to flow into the second-largest cryptocurrency by market capitalization.

Institutional investors could further increase their Ether exposure, as attention will subside from Bitcoin’s recent all-time high, according to Siddharth Lalwani, the co-founder and CEO of Range Protocol. He told Cointelegraph:

“Once the attention from Bitcoin moves away to the potential of an ETH ETF, liquidity will retrace and consolidate at high levels, leading to price rallies for the macro outlook. All in all, it’s pretty safe to say that it won’t be long before institutional investors take bigger positions in Ether. ”

Responses