Weekend Wrap: Yuga gets PROOF, bank’s alleged secret lending to SBF and more

Yuga Labs has acquired a river NFT conglomerate while FTX investors allege a Bahamian bank helped the exchange carry out fraud.

Yuga Labs acquires PROOF

Nonfungible token (NFT) giant Yuga Labs’ recent acquisition of NFT conglomerate PROOF has gone off without a hitch — though trading activity in the lead-up to the announcement has raised some eyebrows.

On Feb. 16, Yuga announced that it bought PROOF and its Moonbirds, Oddities, Mythics, and Grails NFT collections for an undisclosed amount. PROOF’s assets, intellectual property and team will come under Yuga, and PROOF founder and CEO Kevin Rose will join Yuga as an adviser.

However, some observers have since noticed a spike in Moonbirds’ daily sales volume two days before the announcement, jumping to nearly $1.3 million — quadruple the volume from the day prior. This then continued to climb to $1.5 million on Feb. 15, bringing up the collections floor price along with it, per DappRadar.

Sales also spiked, with over 300 NFTs sold on Feb. 14 — triple that of the just over 100 sold the day before.

The well-timed trades saw some X users crying foul. Pseudonymous developer “cygaar” noted the sales uptick and sarcastically posted on Feb. 16 that there was “definitely no insider trading here.”

Moonbirds chart before the Yuga acquisition tweet.

Nope, definitely no insider trading here. pic.twitter.com/UqV0DeXUr8

— cygaar (@0xCygaar) February 16, 2024

Pseudonymous trader “Cirrus,” said they found one wallet bought nearly 200 PROOF-associated NFTs in the days before Yuga’s announcement, adding the owner was “sitting on a couple hundred thousand in profit after the Yuga news.”

Found Nancy Pelosis NFT wallet

80 Moonbirds, 71 Moonbird Mythics, 28 Oddities, and 13 Mythic eggs bought in the last 7 days

Sitting on a couple hundred thousand in profit after the Yuga news pic.twitter.com/VqImNT77tA

— Cirrus (@CirrusNFT) February 16, 2024

Under the deal, PROOF’s collections will be folded into Yuga’s existing NFT lineup that includes its flagship Bored Ape Yacht Club (BAYC), CryptoPunks, Mutant Ape Yacht Club, Meebits and its upcoming Otherside metaverse.

Moonbirds, launched in April 2022 and a once top-performing NFT, has taken a massive price hit since its launch. Its current 1.76 Ether (ETH) floor price, worth about $5,000, is nearly 30% below its 2.5 ETH mint price when ETH traded around $3,000, per NFT Price Floor data.

Yuga Labs and PROOF did not immediately respond to a request for comment.

Deltec Bank’s alleged “secret line of credit” to Alameda

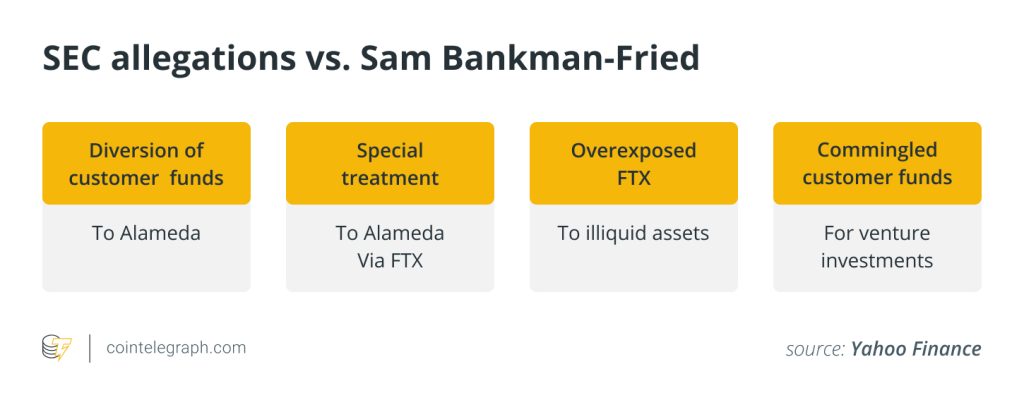

FTX investors who lost out in the collapse of the fraudulent exchange have alleged Bahamian Deltec Bank gave a “secret line of credit” to FTX’s sister firm Alameda Research to buy Tether (USDT) and helped FTX funnel customer funds to Alameda.

A trove of messages, documents and a declaration from former Alameda Research boss Caroline Ellison was published in a nearly 160-page Feb. 16 filing in a Florida District Court.

The suit alleged that starting in 2021, Deltec gave Alameda a three-day short-term credit line, which sometimes swelled to over $2 billion, for the trading house to buy USDT and profit when the stablecoin traded just over $1.

“Alameda could create USDT on credit through the unofficial Deltec Line of Credit and sell that USDT for a gain before having to fund the purchase by depositing U.S. dollars in Tether’s Deltec account,” Ellison said in a declaration included in the filing.

Such a service wasn’t offered to other Deltec customers, and a Deltec executive told Alameda to keep the service a secret, the suit alleges.

Alameda opened an account at Deltec partly to gain easier access to USDT, as it could transfer money to Tether’s Deltec account to create tokens, the suit claimed.

The lawsuit also alleged Deltec helped FTX founder Sam Bankman-Fried misappropriate FTX customer funds by transferring them between FTX and Alameda’s accounts. Ellison claimed Alameda and FTX customer funds were also commingled when it sent funds to Tether to purchase USDT.

Bitcoin mining rigs could surge post-halving

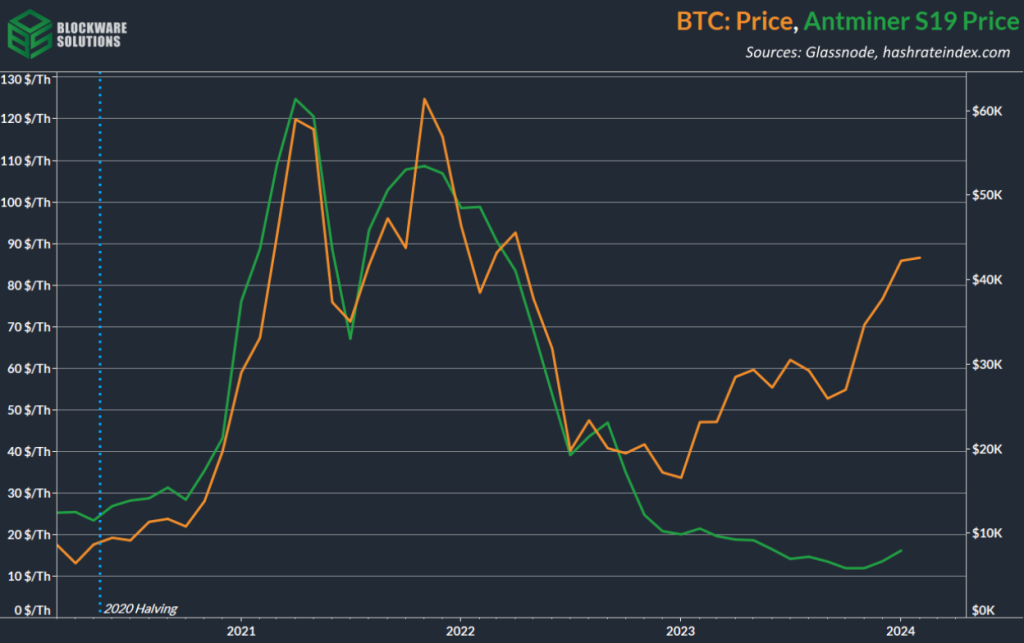

The price of Bitcoin (BTC) mining hardware could surge after the blockchain’s mining rewards are halved in April, so miners should “embrace the halving, rather than running away in fear,” suggests Blockware Solutions.

In a Feb. 16 report, the hosted mining rig retailer said the “winningest strategy” in the last market cycle was entering the Bitcoin mining market around halving time and forecasted “that is likely to be the case again this time around.”

“The latest generation ASICs are fresh on the market, machines are at bear market prices, and BTC is on the cusp of its next bull market,” it added.

Pointing to research conducted in January 2023, Blockware said mining rig prices are “highly correlated” with Bitcoin’s price. It found in the 2021 bull cycle that for every 1% rise in Bitcoin’s price, the price of the popular Bitmain S19 miner would jump 0.96%.

In the 12 months after 2020’s halving, Bitcoin went from around $9,000 to around $60,000, and the cost of S19s jumped from roughly $2,200 to almost $12,000, Blockware said.

It pointed to the billions of dollars of inflows to Bitcoin exchange-traded funds, illiquid supply and macroeconomic factors as “bullish catalysts” for the cryptocurrency. Bitcoin’s halving — where block rewards are halved to 3.125 BTC — is expected on or around April 20, per Blockchair.

Bored Apes add to Miami food scene as Yuga teases clubhouse

A Bored Ape Yacht Club (BAYC) holder has opened a Cuban restaurant in Miami themed around his NFT, while Yuga Labs has also teased a real-life clubhouse in the city.

“Bored Cuban” — a name inspired by the NFT collection — opened on Feb. 15, and Yuga co-founder Greg Solano attended its launch. It joins one other BAYC-themed restaurant located in Los Angeles called Bored & Hungry.

Related: Ethereum NFTs rally, with EtherRock and BAYC leading sales

The restaurant is located by Miami International Airport and is emblazoned with a Bored Ape smoking a cigar and wearing guayabera, a shirt originating from Latin America. Bored Cuban owner Eric Castellanos owns the related NFT, which also serves as the shop’s mascot.

Dope vibes at @boredcuban thanks to @MiamiBoredApe pic.twitter.com/7sGrqoz5RQ

— Roc Sol (@rocsolmiami) February 15, 2024

Meanwhile, Yuga Labs — through the BAYC — teased in a cryptic Feb. 17 X post that it’s seemingly planning a Miami-based clubhouse.

The BAYC shared an animated picture of an ape pouring over blueprints of a “Miami clubhouse” with the caption “(IRL).”

(IRL) pic.twitter.com/ldCDjiR7xL

— Bored Ape Yacht Club (@BoredApeYC) February 18, 2024

While the teaser saw generally positive feedback, one BAYC holder questioned how to make the clubhouse “more inclusive” to NFT holders globally.

“BAYC is a worldwide club,” they wrote. “Having a single clubhouse in Miami whilst cool only benefits a small percentage.”

Other news

FTX investors sued law firm Sullivan & Cromwell, alleging it participated and benefited financially from FTX’s “multibillion-dollar fraud” and knew of the exchange’s “omissions, untruthful and fraudulent conduct, and misappropriation of Class Members’ funds.”

The decentralized exchange FixedFloat was exploited for around $26 million worth of Bitcoin and ETH, with FixedFloat tight-lipped about how the attack was carried out while it investigates.

Responses