Emojis can predict better crypto trading outcomes, according to scientists

The researchers came up with two algorithms based on social media sentiment, both showed consistent positive returns.

A multidisciplinary team of researchers from Europe and Asia recently conducted research to determine if it was possible to predict positive crypto trading outcomes using nothing but emoji sentiment on social media.

According to the team’s preprint research paper, emoji associated with positive sentiment accurately foreshadowed positive market movement:

“The strong predictive link between high positive sentiment levels and subsequent BTC price increases suggests that optimistic social media discourse, as encapsulated by the most positively perceived emojis, acts as a barometer for market sentiment. It may reflect broader investor optimism, potentially driving buying behavior and influencing market trends.”

In order to discover the relationship between social media posts featuring emojis associated with positive sentiment toward cryptocurrency and increased trading returns, the researchers turned to X, formerly Twitter.

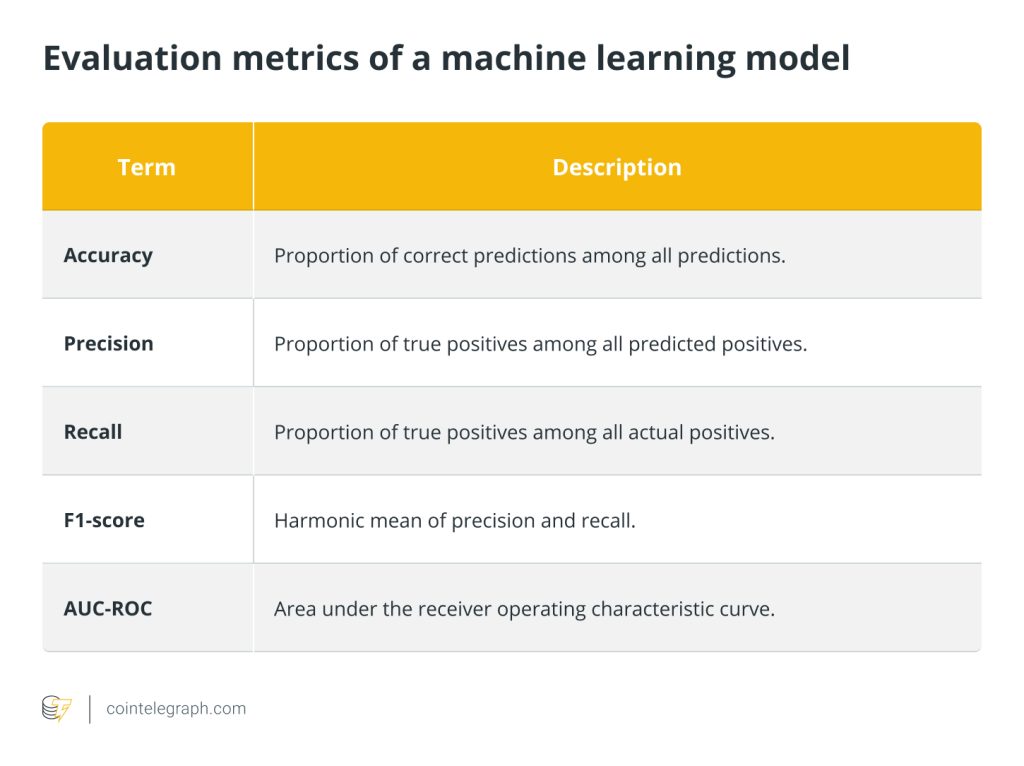

The team employed the use of GPT-4, the artificial intelligence system that underpins ChatGPT, to parse data sets full of cryptocurrency posts featuring emojis by sentiment.

Related: Study: ICOs with smiling members raise up to 95% more money

Once they developed an algorithmic method by which they could use the sentiment analysis to drive next-day trading, the team set up a simple routine: if the bot showed positive emoji sentiment for a given day, the team bought a Bitcoin (BTC) and sold it the very next day.

Per the research, this strategy resulted in consistently positive gains that surpassed normal market trends.

It’s probably fair to assume that the majority of the crypto community on social media is familiar with the idea that a rocket ship emoji indicates positive sentiment and, as such, is often associated with positive performance predictions.

Turning this notion into an actionable data stream is only the first of the researcher’s contributions. Secondly, they figured out the sweet spot for time-stepped data.

“A ‘time pace’ of 30 to 40 days,” writes the researchers, “offers a balanced window that is sufficiently long to integrate meaningful sentiment trends and short enough to remain responsive to recent shifts.”

In this case, it means that with a month or so worth of data on social media emoji sentiment, and access to GPT-4, the researchers were able to beat the market.

There were a couple of caveats. Firstly, their trading strategy didn’t take trading and other associated fees into account. And, secondly, they tested their algorithms against a strategy that involved buying BTC every day and selling it the next day.

Responses