BIS announces CBDC, tokenization projects for 2024

The BIS program for this year features six new projects, exploring the issues of cyber security, fighting financial crime, CBDCs, and green finance.

The Bank for International Settlements (BIS) Innovation Hub will proceed to the second phase of its central bank digital currencies (CBDCs) privacy testing and launch the blockchain-based tokenization project in 2024.

On January 23, the BIS announced its work program for this year. It features six new projects, exploring the issues of cyber security, fighting financial crime, CBDCs, and green finance. As Cecilia Skingsley, head of the BIS Innovation Hub, specified in the announcement, another critical area is tokenization, where the new project, Promissa, will be followed by “more initiatives.”

Related: Basel Committee suggests introducing maturity limits for stablecoin reserve assets

The Promissa Project, launched in 2024 in collaboration with the Swiss National Bank and World Bank, aims to build a proof of concept (PoC) of a platform for digital tokenized promissory notes. The latter is the traditional debt or financial instrument, legally projecting the obligation of one party to pay a determinate amount of money to another at a certain time. According to the BIS, most promissory notes, which play a prominent role in the development banks’ financial system, are still paper-based. The Bank hopes to conclude the PoC by early 2025.

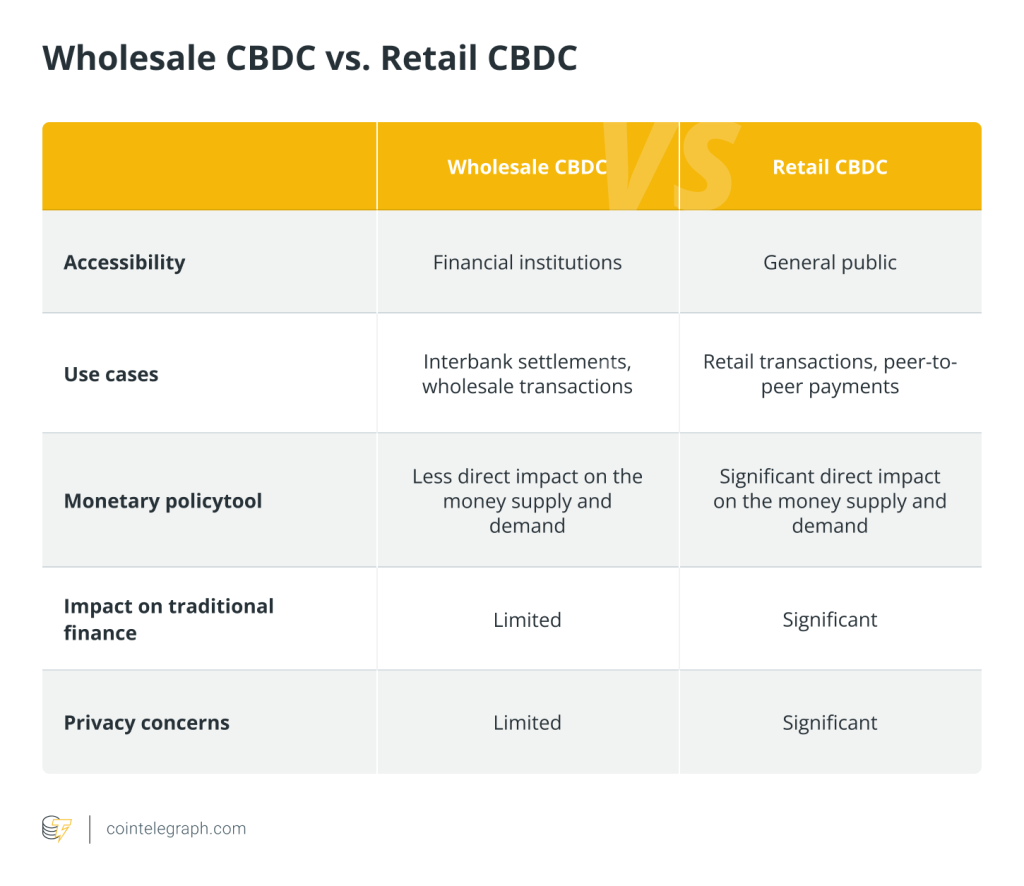

Project Aurum, conducted jointly by the BIS and the Hong Kong Monetary Authority (HKMA), will enter a new phase of researching the privacy of payments in retail CBDC. In 2022, the HKMA completed the wholesale interbank system, e-wallet and a retail CBDC prototype of the Aurum project.

Four other new projects from the BIS — Project Leap, Project Symbiosis, Project Hertha and Project NGFS Data Directory 2.0 — don’t interfere directly with the digital assets industry.

The Bank will also continue its work on such projects as Project Mandala, seeking to automatize the compliance procedures for cross-border payments, Project Pyxtrail, monitoring the balance sheets of asset-backed stablecoins, and Project mBridge, experimenting with a multi-CBDC platform for cross-border payments.

The BIS remained one of the leading global advocates for CBDCs and a fiery critic of stablecoins in 2023. In November 2023, Agustín Carstens, general manager of the BIS, urged Central banks around the globe to lead digital innovation and called CBDCs the “central element” of this leadership.

… [Trackback]

[…] There you can find 61532 more Info on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Here you will find 9301 more Information on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Here you will find 92838 additional Info on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] There you can find 60421 additional Info on that Topic: x.superex.com/news/blockchain/3347/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/3347/ […]