How to buy Ethereum: A beginner’s guide to buying ETH

Ethereum and Ether defined

Ethereum is an open-source blockchain available for people to construct solutions upon. The network enables basically anyone to build decentralized apps (DApps) and generally use the network, with Ether (ETH) being a key part of the process.

Ether is Ethereum’s native cryptocurrency that enables all operations on the Ethereum blockchain. A variety of methods exist for obtaining Ether, many of which are detailed in this guide.

This article explains where to buy Ether, how to trade Ether and how to buy Ether. Is Ether worth buying?

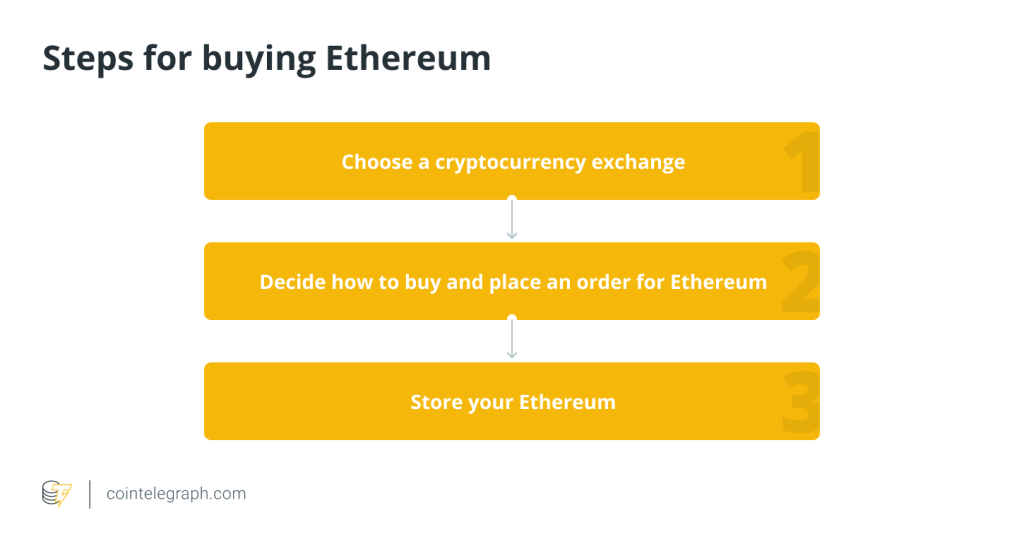

How to buy Ethereum?

Investors can acquire and hold Ether as a long-term investment, similar to Bitcoin (BTC), hoping that its value will rise over time. To purchase ETH, follow the steps as discussed in the sections below.

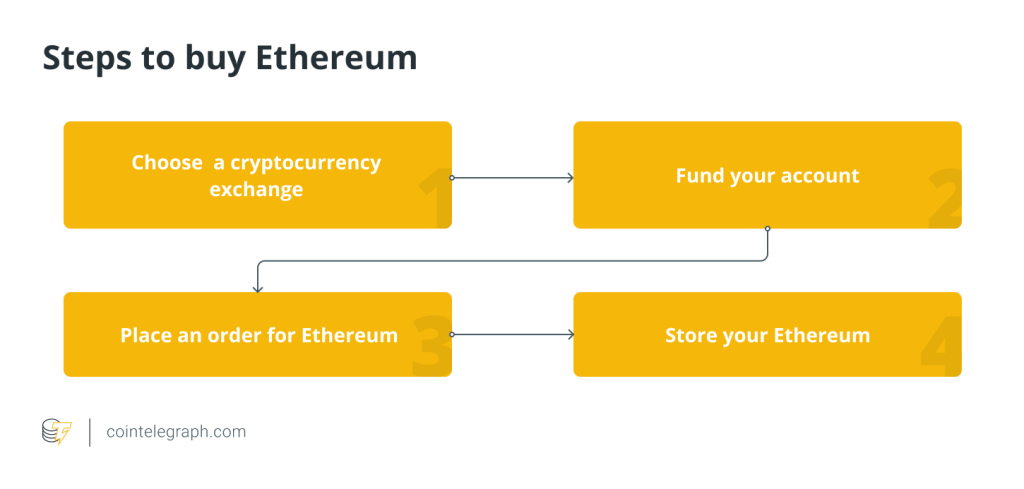

Choose a cryptocurrency exchange

Perhaps the easiest and most popular way of buying ETH is through a crypto exchange. Ether is the second-largest cryptocurrency by market cap behind Bitcoin, so finding an online crypto exchange that operates within your jurisdiction and trades in ETH should not be too difficult.

First of all, you will need to pick an exchange that allows customers from your region and then register with that exchange. Make sure to research your chosen exchange. Check its validity and whether or not it accepts the currency with which you wish to trade. The registration process may vary depending on the exchange and your region.

Some exchanges require significant personal information and identification documents, while others require much less. Exchanges that initially require less information for account creation, however, will often require additional information to unlock certain activities such as expanded withdrawal limits. This information is gathered in compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

After passing all the necessary checks, you will need to choose a deposit method. Depending on the exchange, various methods exist including bank wire transfers, credit and debit card payments and Single Euro Payments Area (SEPA) transfers.

Deposit and withdrawal fees may vary depending on the type of transfer and the exchange used. Fee details can often be found in the footer of an exchange’s website. Googling an exchange’s name in combination with the word “fees” may also prove helpful in finding exchange fee details.

Decide how to buy and place an order for Ethereum

For buying ETH, you must connect your bank account or debit card to fund your account. Fees will most likely vary depending on the option you choose. Moreover, exchanges vary as far as which currencies they allow for transfer. Some exchanges facilitate fiat currency transfers, such as United States dollar and euro transfers, as well as crypto asset transfers, while other platforms may only allow crypto-asset transfers. Deposit and withdrawal times vary depending on the method used and the asset transferred.

As soon as the funds are in your exchange account, you can start trading. You'll be able to trade your USD for Ether after your account has been filled. Simply enter the dollar amount you want to swap for ETH. Depending on Ethereum's pricing and how much you wish to buy, you'll most likely be buying shares of a single ETH currency. Your purchase will be displayed as a percentage of a total Ether.

The user-friendliness of this process depends on the particular exchange, with many of them striving to make the process as easy as possible. You can see various amounts of valuable information such as current value and related news on your exchange’s website. Once you’ve obtained Ether, you may wish to withdraw it to a wallet of your choosing off the exchange.

Store your Ethereum

It's easier to leave your crypto investment in your exchange account if you only have a small quantity. However, if you wish to shift your holdings to a safer storage location, a digital wallet can provide extra security. There are numerous types of digital wallets, each with varying levels of protection. Choose wisely.

How to buy Ethereum with cash?

This section explains how to invest in ETH using cash. Keep reading to understand appropriately.

For various reasons, purchasing Ether directly from another party may be preferable. Regulations pertaining to such transactions, however, may vary depending on geographic region. Online peer-to-peer (P2P) exchanges typically still involve KYC and AML processes.

P2P exchanges aim to facilitate over-the-counter (OTC) trading of local currencies for crypto assets such as BTC or ETH. Based on the Ethereum blockchain’s structure, OTC trading of ETH benefits from Ethereum smart contracts in helping the process.

P2P crypto services essentially function as marketplaces that enable users to pay local currencies to individual entities in exchange for varying amounts of crypto assets such as Ether. Such P2P platforms or services generally utilize escrow features. Money transfer methods can include bank transfers, payment platforms, etc.

Meeting with someone in person, in a public place, may also be an option for buying Ether directly. Such transactions come with risks, however, so take every precaution necessary, similar to when conducting a traditional financial transaction with a stranger. You will also need active internet access for the transaction.

Trading ETH peer-to-peer can be more private than using centralized exchanges. This method of trading, however, can require a certain level of trust between the two involved parties, especially if meeting in person. On top of that, if you decide to engage in P2P trades, it is your responsibility to ensure that you are complying with your local regulations.

Related: How to sell Bitcoin: 5 ways to 'cash out' your cryptocurrency

Buying ETH with Ethereum ATM

An alternative way of purchasing Ether is doing so through an Ethereum ATM, which typically will require providing certain personal details.

Using a cryptocurrency ATM also requires an Ethereum wallet — a place for the machine to transfer your purchased ETH. Ethereum wallets will be covered later in this guide.

Once you have a wallet, you will need to locate your nearest ATM that facilitates Ether transactions. A Google search should suffice for finding an Ether-friendly ATM.

After locating your nearest ATM, find the QR code in your wallet and hold it up to the machine’s camera so it can scan it. Then, insert your cash into the ATM and confirm the amount of Ether to complete your purchase. The Ether you purchased will be sent to the provided address. The process is similar to using a Bitcoin ATM.

For more on buying Bitcoin, including details on purchasing BTC with an ATM, check out: How to buy Bitcoin: A step-by-step guide

How to buy Ethereum with a credit card?

Purchasing ETH with a credit card works similarly to any other online purchase:

To begin, go to the credit card Ethereum broker’s website or app and register for an account. Some will ask you to link a bank account or establish your identity by submitting a photo of your ID at this point.

Platforms will either require you to fund your account or allow you to buy once you have joined up and been approved. If you need to fund the account, you can do so with your credit card. Simply pick “purchase” to fill out an order form for the ETH transaction if you can buy directly from your credit card without funding your account. The ticker symbol ETH can be used to look for Ethereum.

Fill in the quantity of Ether you’d like to purchase. Some brokers require you to enter an amount of Ethereum and then display the price in fiat currency. Others let you enter a dollar amount and see how much ETH you’ll get in return.

Following your purchase, the broker will ask you to choose a payment method from a list of possibilities. Some have a different choice for credit cards, while others include a “credit or debit” option.

The balance of ETH should be reflected in your account when you enter your credit card information and complete the purchase. You own Ethereum at this point, and the platform is holding it for you.

It’s worth mentioning that not all credit card issuers allow you to buy cryptocurrency using your card, and some regard cryptocurrency purchases with a credit card as a high-risk activity that could result in your credit limit being reduced.

How to buy Ethereum with PayPal?

The eToro platform is the simplest option to buy Ethereum with PayPal. You may purchase, hold, and send cryptocurrencies using the eToro wallet, which is essentially a contract for differences (CFD) trading platform.

Aside from ETH, PayPal may be used to purchase Bitcoin, Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH) and Ripple (XRP). The site is highly user-friendly and it is frequently recognized as one of the most incredible venues for new investors.

Another alternative is to go to Localcryptos (previously Localethereum), an informal trade network where you can identify and contact people who sell ether in different places. They may accept PayPal payment from you, depending on their preferences.

Localcryptos is a service that connects you with people who wish to sell ETH in your neighborhood or around the world. It's similar to the “eBay of Ethereum.” So before you click on a payment button, make sure you read their conditions of trade and try to understand as much as you can about them.

Mainstream alternatives to buy Ethereum

A number of mainstream alternatives exist when it comes to gaining price exposure to ETH. The Chicago Mercantile Exchange, or CME, offers Ethereum futures trading. Although they settle into cash and not actual Ether, the CME’s Ether futures still provide ETH price exposure for those interested in using traditional financial systems.

Grayscale offers trading of Ether in stock share form. Called the Grayscale Ethereum Trust, each share represents a fraction of one ETH coin, tradable via mainstream trading platforms.

Ethereum is available on most platforms where crypto is accepted. ETH is one of the most popular cryptocurrencies, so it is generally one of the first crypto assets added to platforms. A number of Ethereum exchange-traded funds (ETFs) have also been given the regulatory go-ahead outside of the U.S. So, investing in Ethereum is not difficult anymore.

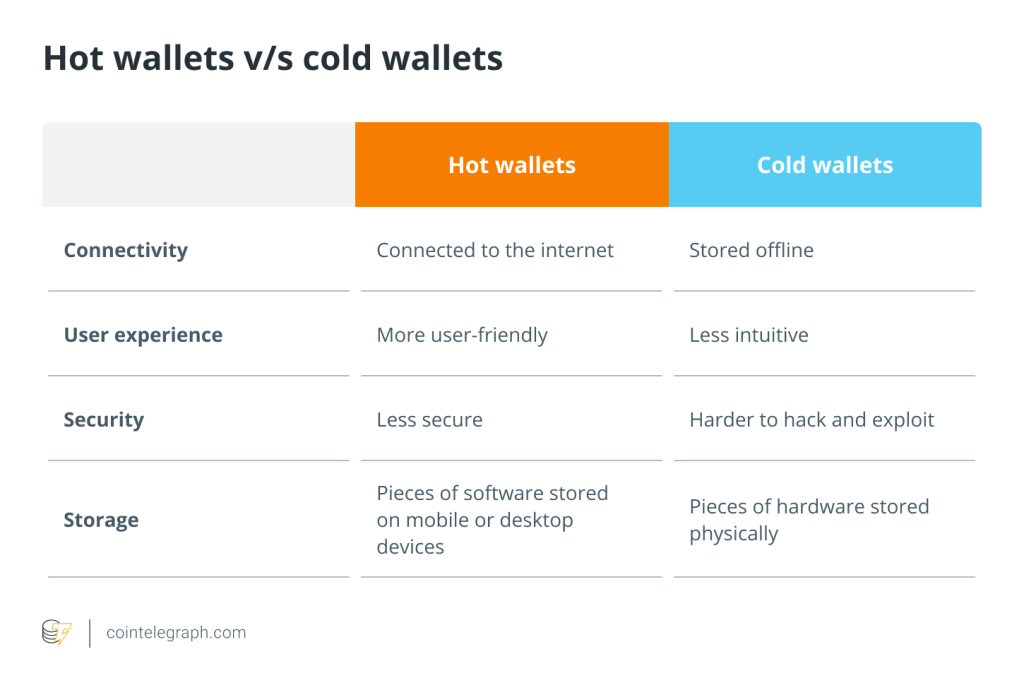

Ethereum wallets

A good understanding of crypto wallets and how Ethereum transactions work in general may be beneficial information for potential Ether buyers. There are multiple different types of wallets including local and hardware wallets. You can also use a wallet provided by a cryptocurrency exchange.

Another thing to consider is whether you want to use a so-called “full node” wallet, which requires you to download the entire Ethereum blockchain (very large in terms of computer storage size) or a “light client,” which doesn’t require a full copy of the blockchain to operate. Of course, if you’re new to Ethereum, a light client would be a preferred option. Some crypto wallets offer the ability to buy or exchange crypto assets within their related wallet apps.

If you’re buying Ether from an exchange, using a wallet on the same platform is the easiest option, but there are pros and cons to that approach. Unfortunately, the cryptocurrency world is filled with instances of exchange hacks.

An exchange hack might occur on a broader scale, during which the overall exchange loses funds to the hack, or you might be hacked individually. Some exchanges have insurance measures in place, although details vary, and a hack might still result in lost funds or delays associated with the return of the funds.

Thus, using a wallet that is controlled by the asset holder away from exchanges can serve as a more secure option as it provides more control over asset holdings, as well as varying levels of security, based on users’ measures and practices. Using such wallets, however, puts more responsibility on the asset holder.

Holding ETH on an exchange calls on a number of best practices for account and asset safety, including the use of two-factor authentication (2FA). Crypto exchanges, however, generally have customer service and do not require private key management by the user.

Off-exchange wallets, also called self-hosted crypto wallets, on the other hand, put responsibility entirely on the user to care for his or her passwords, private keys and asset storage. What is a private key? At its simplest, a private key gives the holder access to funds stored in that key’s related wallet.

Read more about private keys here: Secure Encryption Key Management Modules, Explained

If your wallet becomes inaccessible and you lose your backup seed phrase, there will be no way of accessing your wallet ever again, and whatever funds you held there will be essentially lost. Each Ethereum wallet comes with a public wallet address. Use this address to send funds to that wallet from an exchange or elsewhere, if you so desire.

Related: Crypto wallets in 2021: From hot to cold, here are the options

Is it too late to invest in Ethereum?

Ethereum as a project is still very much in development. So, is ETH a good investment? A significant number of solutions have been built on the Ethereum blockchain, although scaling for such widespread usage has been an issue, as seen with CryptoKitties in 2017 and decentralized finance (DeFi) in 2020 and 2021.

The ETH blockchain is transitioning to Ethereum 2.0, which includes changing consensus algorithms from proof-of-work (PoW) to proof-of-stake (PoS). The move is expected to help the network scale.

Ether is established as the second most well-known cryptocurrency to date, valued with the second-largest market cap among all crypto assets, with BTC holding the number one spot.

Ethereum’s price has sustained a number of significant pushes upward over the years, at times trading above $4,000 per coin. It’s difficult to predict any crypto asset’s long-term value, however. In 10 years’ time, Ether might be worth nothing or its value might continue rising. Scaling ability also remains to be seen.

Transacting Ethereum safely

One of the most important aspects of the Ethereum network is that transactions are irreversible. Therefore, be sure to never type an address by hand, as it is essentially a very long case-sensitive string of random letters and numbers. A single mistake can lead to your funds disappearing forever. Make sure to double-check all the details before confirming a transaction.

Avoid storing a large amount of Ether in wallets provided by exchanges. Since an exchange is essentially in charge of your wallet, loss of funds is not impossible, and this may occur due to a hack or even an exchange’s fraudulent activity. Self-hosted wallets provide more control over stored funds. If you’re intending on storing large amounts of Ether, consider investing in a hardware wallet.

Implement extra safety steps where possible such as two-factor authentication and so on. Finally, always remember to guard your backup seed phrase, and remember that, although self-hosted wallets provide greater freedom, they also come with added responsibility and required knowledge.

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Here you can find 39404 more Info to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Here you can find 89039 additional Information on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Here you will find 99370 additional Information to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Here you can find 13737 more Information to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] There you will find 84430 additional Information on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] There you can find 83075 more Information on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] There you will find 7755 additional Info on that Topic: x.superex.com/academys/beginner/2806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2806/ […]