Bitcoin and inflation: Everything you need to know

Bitcoin (BTC) is often touted as a hedge against inflation under the assumption that fiat money will eventually decrease in value due to central bank money printing. On the contrary, Bitcoin has a fixed supply of 21 million coins. The restricted upper limit gives Bitcoin an upper hand against inflation. But, is Bitcoin inflation proof?

The COVID-19 pandemic saw many countries printing more money to provide stimulus requirements for their respective citizens, thereby driving the value of money down. McKinsey Global reported that governments worldwide had provided $10 trillion by June 2020 to allay the economic havoc brought about by the worldwide crisis.

As the value of fiat money went down, the value of assets with a limited supply like stocks, real estate, shares and Bitcoin went up. Despite mass unemployment and economic unrest globally, the prices of these assets went up steadily. Bitcoin attracted traditional investors who saw the cryptocurrency’s potential as a hedge against inflation, driving a historic price run that saw the decentralized digital currency gain over 250%.

What is inflation?

Inflation is generally characterized by currencies losing value over time and an uptick in the price of consumer goods. Owing to their limited supply, cryptocurrencies like Bitcoin generally experience low inflation rates.

Inflation is usually identified as a sustained upward trend in the price of goods and services in an economy. It also corresponds to the economy’s currency losing purchasing power — meaning that it takes more and more units of currency to buy a certain amount of goods and services as inflation continues.

Inflation affects any product or service, including utilities, automobiles, food, medical care and housing. The prevalence of inflation in an economy affects individual consumers and businesses because it effectively makes money less valuable. In short, inflation reduces a consumer’s purchasing power, makes savings less valuable and delays retirement. Central banks around the world monitor inflation so that they can respond effectively. The U.S. Federal Reserve, for example, has a 2% inflation target. Should inflation rates rise beyond the intended target, the system adjusts its monetary policy accordingly to combat inflation.

Is inflation here to stay?

Inflation has been more of a persistent than a transitory phenomenon of late. Largely driven by the global response to the pandemic, financial markets are seeing a steady rise in inflation rates worldwide.

While high inflation rates may still subside eventually, Yahoo argues that inflation is here to stay for the following three reasons:

-

Supply and demand imbalances in the labor market

-

Rising prices in real estate

-

Entry prices that are expected to move up as well

Is inflation good or bad for an economy?

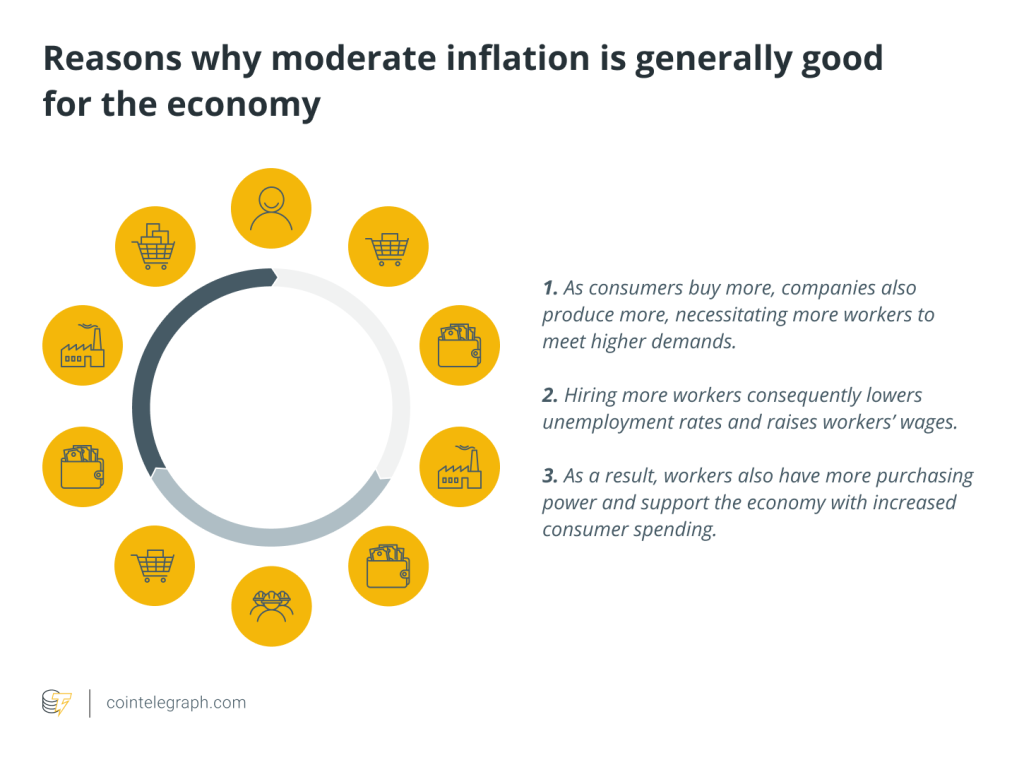

Inflation reduces a currency’s purchasing power. So does this mean that inflation is bad? Not necessarily. Most economists believe that moderate levels of inflation can benefit an economy. How so?

A moderate inflation rate drives consumer spending. This is crucial for any economy to grow and is also why the US Federal Reserves targets a 2% inflation rate in a bid to stabilize prices.

In a healthy economy, stable and moderate inflation rates are to be expected. Economic growth is characterized by increased spending on goods and services by consumers and businesses, and demand that exceeds supply. As demand surpasses supply, producers raise prices, driving inflation. In this context, inflation can be considered a good thing.

However, any rise or fall in prices that happens too much, too quickly is generally not a good sign. A rapid increase in prices drives consumers to anticipate further increases down the road. Consumers may then resort to hoarding or purchasing more goods and services now in anticipation of higher prices in the future. This behavior drives demand further up, consequently pushing producers to raise prices. This phenomenon is typically referred to as “hyperinflation” or “runaway inflation.”

Deflation, on the other hand, is characterized by a consistent fall in prices. When this happens, consumers hold off their purchases in anticipation of lower prices down the road. As demand continues to spiral downwards, producers also keep lowering prices to attract buyers.

For these reasons, moderate inflation is generally good for the economy as it encourages spending and bolsters economic growth.

Bitcoin and inflation

While the economics around the Bitcoin market is complex, some cryptocurrencies, including Bitcoin, are designed to resist inflation or experience predictable and low inflation rates. And while Bitcoin is generally heralded as a hedge against inflation, recent economic developments have seen Bitcoin performing less as a pure hedge.

What role does Bitcoin play in inflation?

Largely driven by institutional investments, the cryptocurrency has become increasingly aligned with general market movements. This means that when the market goes down, Bitcoin likely goes down as well.

Consequently, when news of inflation strikes, the Federal Reserve will likely enact a dual mandate. Policy interest rates will go up, and there will be monetary tightening. As a result, assets (including crypto like Bitcoin) will see a price decline.

Do cryptocurrencies experience inflation?

Yes, cryptocurrencies experience inflation — even Bitcoin, which is often seen as “inflation-resistant.” Much like gold, Bitcoin experiences inflation as more of it is mined. However, given that mining for new Bitcoin is automatically reduced by 50% every four years, inflation rates are also bound to decrease eventually.

As long as Bitcoin’s value continues to rise against fiat currencies, Bitcoin’s typical annual inflation rates aren’t usually a major area of concern for investors. Other cryptocurrencies, however, may perform differently.

Stablecoins, for example, are pegged to fiat money and can be considered a low-volatility cryptocurrency for saving money. However, stablecoins are also subject to inflation and could lose value over time. As their reserved currency loses value, so do the stablecoins.

Is Bitcoin deflationary or inflationary?

Bitcoin is technically an inflationary currency. This is because it was designed to mimic the stable inflation rate of gold. While the common definition of deflation may connote that Bitcoin is deflationary because its purchasing power increases over time, deflation refers to a decrease in the money supply (or substitutes thereof).

To be clear, deflation is not just a decrease in prices, although it is colloquially defined as such. Deflation is a monetary phenomenon that causes such a price decrease. Bitcoin, then, cannot be deflationary because its supply will not decrease. Instead, its supply will steadily increase until it reaches a hard cap of 21 million coins. (This is projected to happen sometime in 2140.)

When this cap is reached, Bitcoin will be neither inflationary nor deflationary. Instead, it will become disinflationary, as it was programmed to be — culminating in a constant monetary base and an unchanging supply.

Is Bitcoin inflation proof?

So, the question is, “Is Bitcoin a good hedge against inflation?” While gold has long been considered the go-to hedge against inflation, cryptocurrencies like Bitcoin also provide great alternatives.

Rather than “inflation-proof,” which suggests complete impenetrability against any outside changes, Bitcoin can be considered as more of an “inflation-resistant” asset. As the largest, most established cryptocurrency, Bitcoin is generally considered a good inflation hedge. It may even be considered a better hedge than gold.

Although Bitcoin is more volatile than gold, it offers better long-term growth prospects and therefore protects against inflation. How so?

Limited supply

Bitcoin’s fixed supply makes it a good inflation hedge. When an asset’s supply is fixed and limited, it means that new coins cannot enter circulation — thereby eliminating the risk of inflation.

Not tied to a specific economy or currency

Bitcoin, like gold, does not belong to any single entity, economy or currency. It is an international asset class that reflects global demand. Bitcoin is a better option than equities because it does not have to deal with the many economic and political risks associated with stock markets.

Easily transferable

Much like gold, Bitcoin is durable, easily interchangeable, scarce and secure. Bitcoin has the edge over gold, given that it is more portable, decentralized and transferable. Due to its decentralized nature, anyone can store Bitcoin, compared to gold that has a controlled supply in sovereign nations.

Why is inflation important for crypto?

High inflation rates for fiat money may lead to more investments in digital currencies to assuage fears over their fiat losing value over time. Cryptocurrencies like BTC and Ether (ETH) provide a great alternative to investors who want to diversify their investment portfolios.

Benefits of Bitcoin’s fixed supply

One of the keys to making an asset resistant to inflation is scarcity. Because Bitcoin has a limited supply, it remains scarce, thereby ensuring that its value will remain steady over time, which is the reason why it is dubbed “digital gold.”

The creator of Bitcoin, Satoshi Nakamoto, intended for each unit of Bitcoin to appreciate over time. This was ensured through its limited maximum supply, as well as the slow rate at which new Bitcoin is mined.

When the maximum number of Bitcoin is reached, no new Bitcoin can further be created. Transactions will be carried out as usual, and miners will still be rewarded, but only with processing fees.

What will happen to Bitcoin in a recession?

Bitcoin was forged from the ashes of the 2007–08 financial crisis, also known as the “Great Recession.” In response to widespread bank failure, Satoshi Nakamoto built Bitcoin to provide the public with a currency that did not need third parties or central authorities. The result was a cryptocurrency independent of any entity or sovereign nation.

In a recession, adverse economic effects can ripple through countries with economic ties. Since Bitcoin is also inherently diversified, it can serve as a recession-resistant asset. While the U.S. dollar is subject to the benefits and limitations of the U.S. economy — such as GDP, export prices, monetary policy and currency demand — Bitcoin isn’t limited to any one country’s loss or gain.

Also, Bitcoin has value regardless of how an economy is performing. This is because it’s a scarce and secure asset. It is also globally transferable. Bitcoin’s primary purpose is as a store of value, and this is precisely why it’s expected to perform better than other cryptocurrencies, like Ethereum, when a recession hits.

How Bitcoin can help clients in the long run

Bitcoin is unlikely to topple major centralized currencies, but it has changed the financial landscape since its inception in 2009. Its technology has facilitated revolutionary advancements in decentralized finance (DeFi) and is beneficial to unbanked clients in far-reaching and low-income territories.

Blockchain technology has paved the way for numerous advancements, but its primary function is to serve users faithfully. At its core, blockchain technology provides users with a secure, permissionless and decentralized way to conduct financial transactions. Bitcoin, alongside other crypto assets, serves as inflation and recession-resistant alternatives to fiat.

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] There you will find 22183 more Info to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Here you can find 90900 more Info on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Here you can find 66374 more Information on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] There you will find 22583 additional Information on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Here you can find 9092 additional Information to that Topic: x.superex.com/academys/beginner/2435/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2435/ […]