What is FedNow: A beginner’s guide to the Fed’s instant payment system

What is FedNow?

FedNow is a real-time, round-the-clock payment system launched by the Federal Reserve, the central bank of the United States, that allows for instantaneous money transfers. This innovative initiative took five years to develop and will greatly speed up payments in the U.S., putting it on par with other advanced economies such as the United Kingdom, European Union, India and Brazil, which are known for their sophisticated payment infrastructure.

The sole purpose of FedNow is to facilitate instant retail payments, even on weekends and at night, distinguishing it from other payment networks. While FedNow has some unique benefits, it has several features in common with other payment systems. For instance, FedNow serves as an interbank mechanism like Automated Clearing House (ACH) and Fedwire. However, in contrast to ACH, FedNow uses a real-time gross settlement (RTGS) approach, similar to Fedwire.

ACH is an electronic payment system for batch-processed fund transfers in the United States, whereas Fedwire is an RTGS system for immediate and high-value fund transfers in the United States. Without netting or batching numerous transactions together, the RTGS system processes each individual transaction separately and settles it right away.

So, if banks can already use Fedwire, why is the FedNow service required? Existing interbank payment systems like Fedwire are not well equipped to allow immediate retail payments, necessitating the development of a new system.

For instance, Fedwire has set business hours of Monday through Friday, excluding holidays, from 9:00 pm ET the night before to 7:00 pm ET. Additionally, transfers for third parties must be started each business day at 6:00 pm ET. An instant retail payment system like FedNow attempts to make it possible for customers and businesses to send money instantly, anytime and from any location, ensuring that the recipient will get it right away.

When did FedNow launch?

The FedNow Service will be rolled out in several stages, beginning with its primary launch on July 20, 2023. The initial release will provide essential features to meet diverse market needs, supporting a broad spectrum of use cases, including the rising demand for account-to-account (A2A) transfers and bill payments.

So, who can use FedNow? The design of FedNow enables its potential use in a range of consumer, commercial and governmental contexts. FedNow helps businesses by streamlining payments to clients, consumers and staff members and accelerating business-to-business (B2B) transactions.

Faster payments made through FedNow will help customers in a number of ways, including by making it easier for them to pay bills conveniently and send money to friends and family. Additionally, the government may use FedNow to transform the financial environment in the U.S. and lead to the completion of tasks like tax returns at record speed.

Will FedNow replace PayPal?

FedNow and PayPal are both significant players in the payment sector, but they have different consumer needs and cater to different kinds of transactions. While PayPal primarily serves as a digital payment platform for online and person-to-person transactions, FedNow concentrates on improving the infrastructure for interbank and retail payments.

As technology progresses and consumer preferences shift, the payment industry is expected to witness further advancements and transformations to cater to the evolving needs of users worldwide.

How FedNow works?

In contrast to peer-to-peer (P2P) platforms like Cash App or Venmo, FedNow doesn’t use a P2P approach to settle payments; instead, it does so directly in central bank accounts. FedNow competes with fintechs by providing real-time payment infrastructure despite not being a P2P platform. Smaller banks are intended to benefit from FedNow’s development by being able to obtain real-time payments at lower costs as opposed to depending on larger lenders through FedWire.

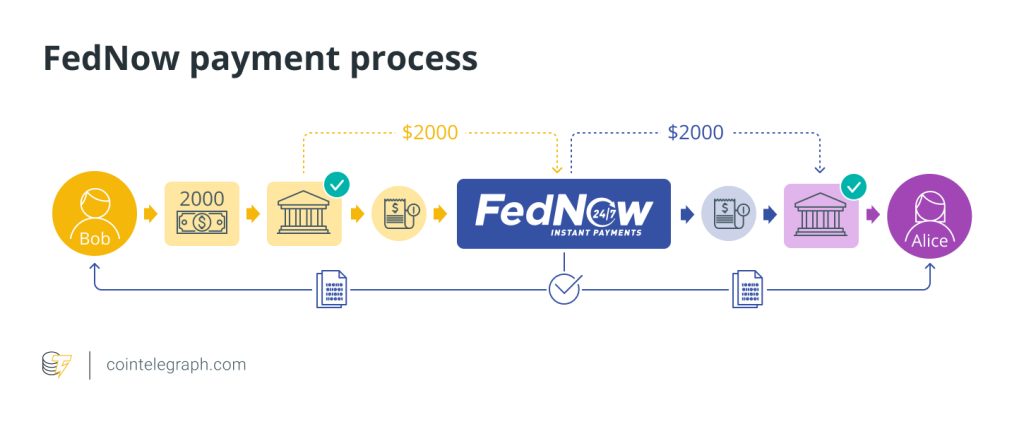

Let’s illustrate the FedNow payment process using an example where a $2,000 payment is made to Alice by Bob through FedNow:

- By sending a payment request using his bank’s end-user interface outside of the FedNow Service, Bob starts a $2,000 payment to Alice.

- Bob’s bank confirms that he has sufficient funds ($2,000) in his account and approves the transaction.

- The FedNow Service receives the payment instruction from Bob’s bank.

- The FedNow Service verifies the payment and then sends the instruction to Alice’s bank for approval or denial.

- Alice’s bank approves the payment request, indicating that her account is prepared to receive the funds.

- The FedNow Service deducts $2,000 from Bob’s account and transfers it immediately to Alice’s account.

- All parties involved are notified of the successful fund transfer.

It is important to note that FedNow has implemented measures within the existing infrastructure to cap the maximum payment limit at $500,000 (participants will have the option to set a lower limit).

Benefits of FedNow

The benefits of FedNow include:

Real-time payments and lesser costs

FedNow facilitates instant fund transfers, making it possible for recipients to get their money right away, boosting cash flow and hastening the process of getting money. Additionally, FedNow can help businesses and individuals interact at a lesser cost by lowering their dependency on pricey accelerated payment methods.

24/7 availability and government efficiency

FedNow is available round-the-clock, every day of the week (including weekends and holidays), for uninterrupted payment services. Additionally, the adoption of FedNow by the government may result in more effective financial operations, possibly accelerating procedures like tax returns and government payments.

Enhanced financial inclusion

FedNow may expand its advantages to underrepresented populations and encourage financial inclusion. Moreover, FedNow provides access to real-time payment infrastructure at more affordable rates to smaller financial institutions.

Streamlined business operations

Organizations can use FedNow to streamline payment procedures, thus simplifying the settlement of invoices, controlling cash flow and facilitating B2B transactions with speedier, more secure payments.

Competition and innovation

With FedNow’s introduction into the payment ecosystem, financial service providers may be encouraged to compete more fiercely and innovate, resulting in better products and services.

What financial institutions are participating in FedNow?

A wide range of early adopter financial organizations — including JPMorgan Chase, Wells Fargo Bank, U.S. Bank and Avidia Bank, among others — are participating in adopting the FedNow service. These organizations are leading the way in adopting FedNow’s real-time payment capabilities, providing their clients with quicker, more practical payment alternatives.

Several settlement agents and liquidity providers — including BNY Mellon, Catalyst Corporate Federal Credit Union and Bankers’ Bank — have also partnered with FedNow to support its functioning. These organizations are essential for facilitating seamless fund transfers and preserving system liquidity.

Additionally, a range of service providers contribute to the success of FedNow by supporting payment processing for participating financial institutions. These service providers include Fiserv, Jack Henry and Finastra, among others. Their knowledge and products assist in the efficient, secure transfer of money, improving FedNow’s overall user interface.

These banks, settlement agents, liquidity providers and service providers working together highlight FedNow’s broad support and dedication, which is expected to completely transform the real-time payments environment in the United States.

Is FedNow a CBDC?

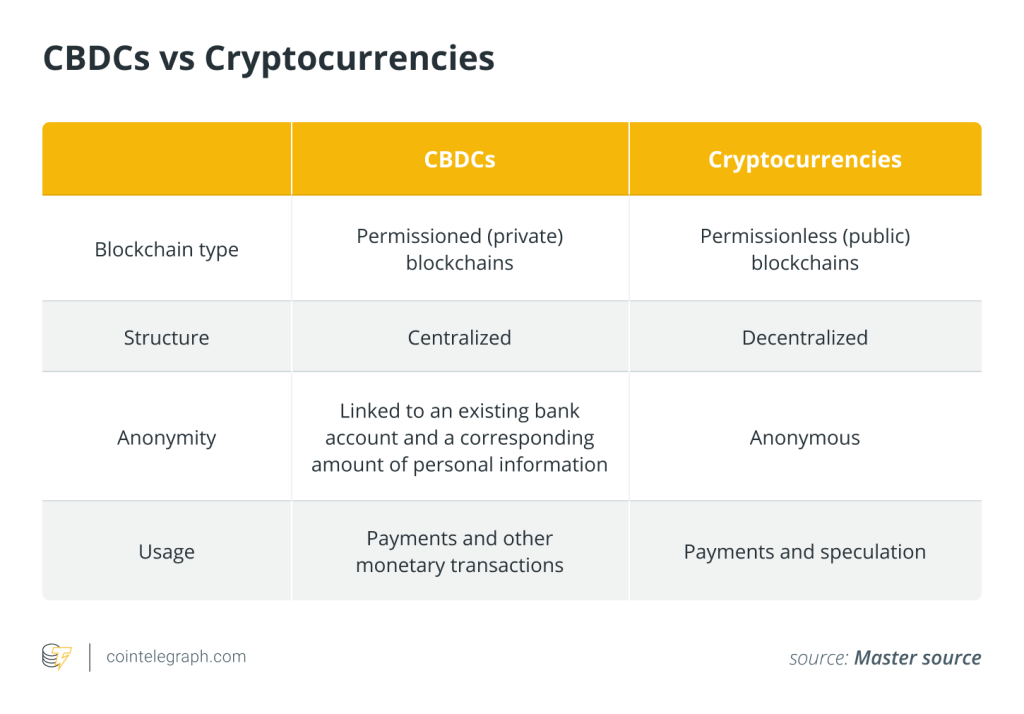

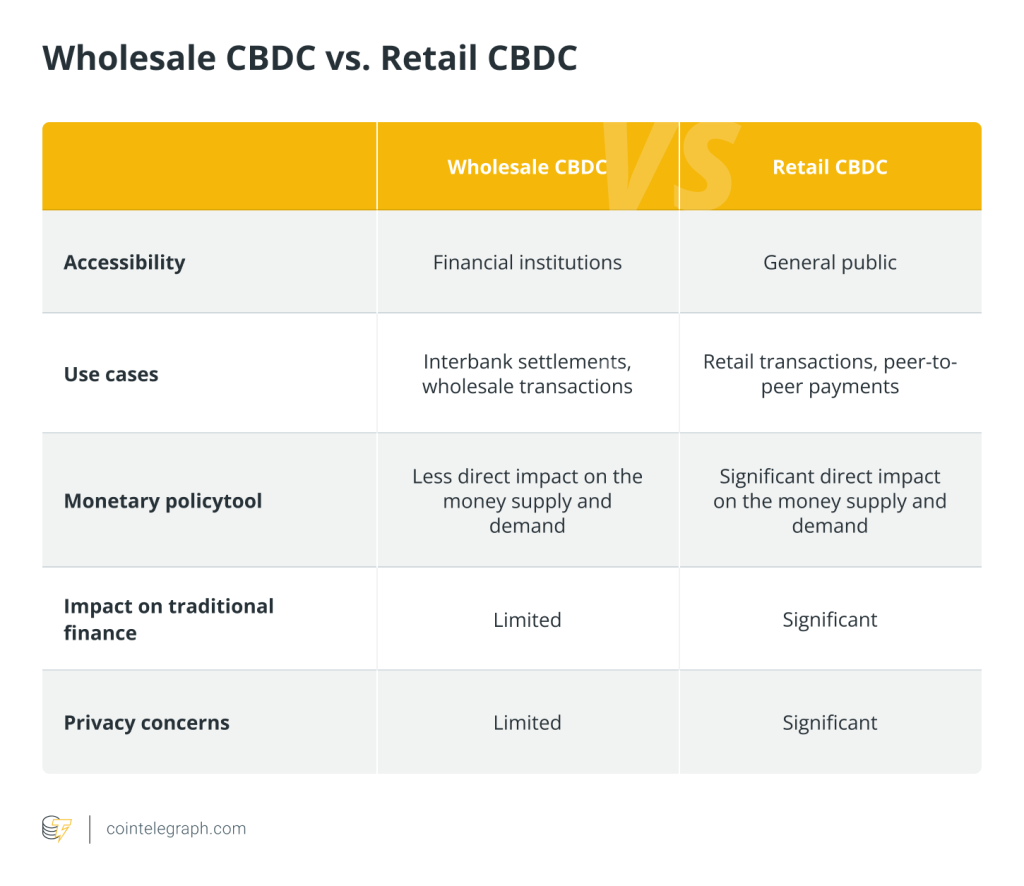

FedNow is not a central bank digital currency (CBDC). Instead, it is a real-time payment system that the U.S. Federal Reserve established to allow for immediate fund transfers between banks and financial organizations. The FedNow Service enables businesses and customers to transact in real time, with the goal of improving the speed and efficiency of retail payments in the United States.

On the other hand, CBDCs are intended to serve as legal tender and have the backing of the central bank, which promotes currency stability and confidence. While FedNow is a significant advancement in payment infrastructure, it is distinct from a CBDC, as it does not replace physical cash or serve as a digital representation of the dollar issued by the Federal Reserve.

Will FedNow disrupt stablecoins?

The development of real-time payment systems like FedNow and digital payment platforms may impact the adoption and use of stablecoins. As central banks explore the possibility of creating their own CBDCs, such projects may put stablecoins in competition by providing comparable advantages, such as fast settlement and stability, but with the support and confidence of the central bank.

However, factors such as regulatory developments, technological advancements and consumer preferences could affect FedNow’s capacity to disrupt stablecoins. As the financial landscape evolves, the interaction between traditional payment systems, CBDCs, stablecoins and other digital payment solutions will shape the future of the payment industry. To fully comprehend the potential effects of the most recent developments, it is imperative to stay informed.

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Here you can find 39157 additional Info to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Here you can find 62015 additional Info on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] There you will find 11444 additional Info to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2292/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2292/ […]