Nigeria’s eNaira CBDC: An overview

In a pioneering move for the African continent, Nigeria became the first country to introduce a central bank digital currency (CBDC) in 2021. Its initiative, eNaira, marked not only a significant stride for Nigeria but also stood as the fifth digital currency introduced globally.

The primary objectives were to boost financial inclusion, enhance cross-border CBDC transactions, simplify diaspora remittances, and supplement existing payment infrastructures. However, despite these ambitious goals, adopting the digital naira has remained modest. This article will delve into both the strengths and downsides of eNaira for Nigerians.

What is a CBDC?

In an era where physical currency faces a diminishing role, exacerbated by factors such as cash shortages and hygiene concerns, digital financial transactions have become increasingly prevalent, particularly during the COVID-19 pandemic.

The global shift toward digital financial interactions has prompted a notable transformation within the financial services sector, driven by the emergence of distributed ledger technologies (DLTs) like blockchain.

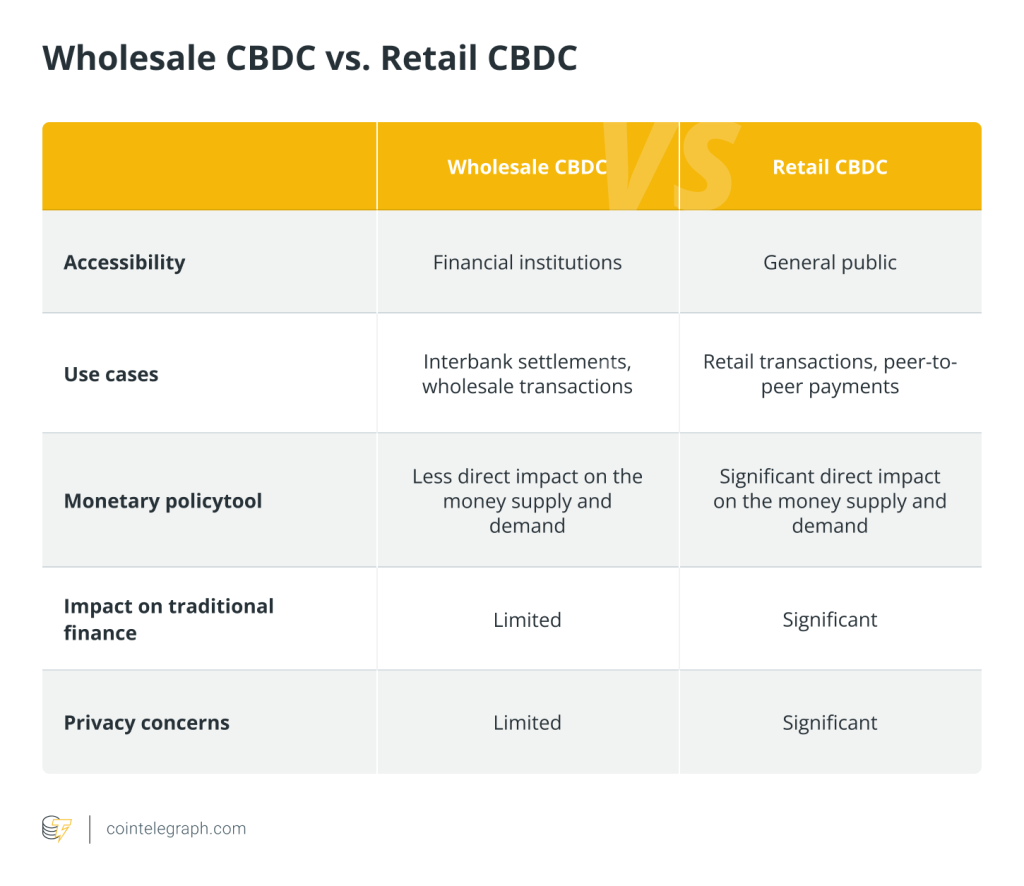

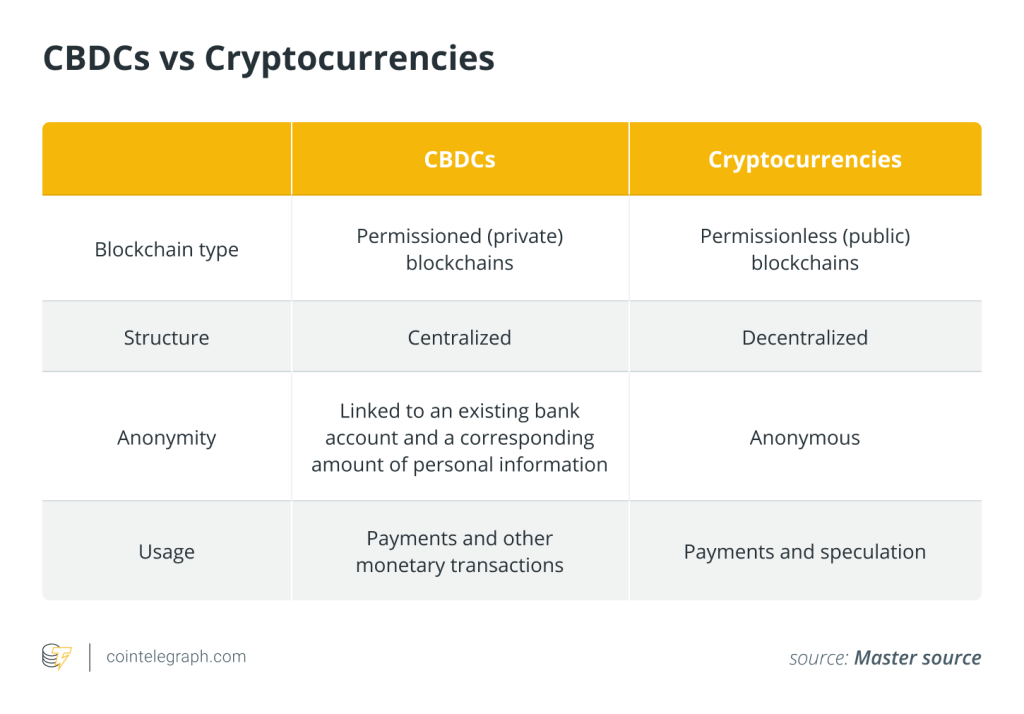

CBDCs emerge as a pivotal element in this evolving landscape. Unlike traditional physical currencies, CBDCs are digital currencies issued and overseen by governments. While they share some characteristics with cryptocurrencies, a key distinction is that national digital currencies are pegged to and mirror the value of the country’s official fiat currency.

As individuals increasingly gravitate toward digital financial ecosystems, CBDC development offers a strategic avenue for central banks to navigate and shape the future of monetary transactions.

eNaira, Nigerian CBDC

The eNaira stands as Nigeria’s CBDC, a digital rendition of the national currency, the naira, and can be used the same way as cash. It embodies the Central Bank of Nigeria’s (CBN) effort to harness digital technologies for the advancement of financial inclusion, payment system efficiency and broader economic development. The Nigerian CBDC aims to boost financial stability and accountability in the informal sector and streamline remittance processes.

According to data from the Central Bank and Enhancing Financial Innovation and Access, about 36% of the Nigerian population is unbanked. In 2023, they estimated about 40 million financially excluded people, which is one-quarter of the population.

At its core, the eNaira is designed to propel financial inclusion in Nigeria, ensuring that a broader segment of the population can participate in and benefit from the evolving digital economy. During the eNaira’s debut, CBN governor Godwin Emefiele highlighted its potential:

“The CBDC would enhance the relationship between mobile banking and e-business and speed up the rate of financial inclusion.”

To elevate financial inclusion from 64% to 95%, the eNaira is anticipated to contribute an estimated $29 billion to Nigeria’s gross domestic product over the next decade.

The history behind eNaira

The origin of the eNaira dates back to the initiation of the Cashless Policy by the CBN in 2012, led by former governor Sanusi Lamido. The policy aimed to encourage digital transactions and reduce the circulation of physical cash within the financial system.

The turning point for the eNaira occurred in February 2021 when the CBN announced its plan for a CBDC pilot, following a ban on cryptocurrency transactions by Nigerian banks. On Oct. 25, 2021, Nigeria launched eNaira, making history by becoming the first African nation to launch its digital currency, joining 100+ countries exploring CBDCs.

Following its directive to limit daily and weekly cash withdrawals, the CBN listed eNaira as an option after its introduction, promoting the use of alternate channels such as online banking, mobile banking apps and eNaira for transactions.

This step was anticipated to encourage the adoption of the eNaira, as it saw notable transaction volumes and downloads in its first year of operation, in addition to introducing new currency notes and prohibiting cash withdrawals from public or government accounts.

In August 2022, the Central Bank of Nigeria initiated the second phase of eNaira’s development, aiming to expand the user base to 8 million. Since October 2022, the number of eNaira wallets has surged over 12 times, reaching 13 million. Additionally, the value of transactions has witnessed a 63% upswing, totaling 22 billion naira ($48 million) in 2023, propelled in part by the currency crisis earlier in the year.

eNaira’s platform model

The eNaira’s design embraces a forward-thinking platform model that involves constructing a technology platform that not only aligns with existing structures in the payment system but also amplifies the value offered to users.

The eNaira payment platform provides a foundational layer upon which financial institutions and payment service providers can build and innovate. This integration allows for the creation of diverse and layered payment services, expanding the use cases for the eNaira.

Moreover, the platform model encourages interoperability, allowing financial institutions and payment service providers to collaborate seamlessly. The CBN has meticulously established a regulatory framework for its CBDC to guarantee the seamless operation of this platform model.

These Nigerian digital currency regulations cover various aspects, including operational procedures, compliance with existing Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) guidelines, privacy and data protection, dispute resolution and consumer protection.

eNaira’s infrastructure

The creation of the eNaira was a collaborative effort with Bitt Inc, a Barbados-based fintech company, introducing a robust three-tier architecture. The CBN oversees the issuance and distribution of the digital currency to authorized financial institutions. These institutions, in turn, offer eNaira wallets and services to customers.

End-users then utilize these wallets for smooth transactions with merchants and other users, creating an efficient digital payment system. Governed by the CBN, this innovative digital currency embraces cutting-edge technology to deliver a seamless financial experience.

Provided by Bitt Inc, the Numa architecture operates on ISO 20022 messaging standards, enhancing the eNaira’s programmability and interoperability with various financial systems.

Built on DLT, precisely the Hyperledger Fabric variant, the eNaira’s foundation has undergone rigorous stress tests, affirming its capability to process over 2,000 transactions per second (TPS) and up to 3,000 TPS. The open-source nature of the Hyperledger protocol holds the potential for integrating smart contracts, expanding possibilities for decentralized applications (DApps).

However, the private nature of the Fabric blockchain introduces a nuanced dimension. While offering security benefits, it contrasts with the complete transparency associated with public blockchains. This privacy-oriented approach aligns with traditional financial norms but raises considerations around the balance between security, transparency and decentralization within the eNaira ecosystem. As the project evolves, finding an equilibrium among these aspects will likely be a focal point for optimizing the eNaira’s technological foundation.

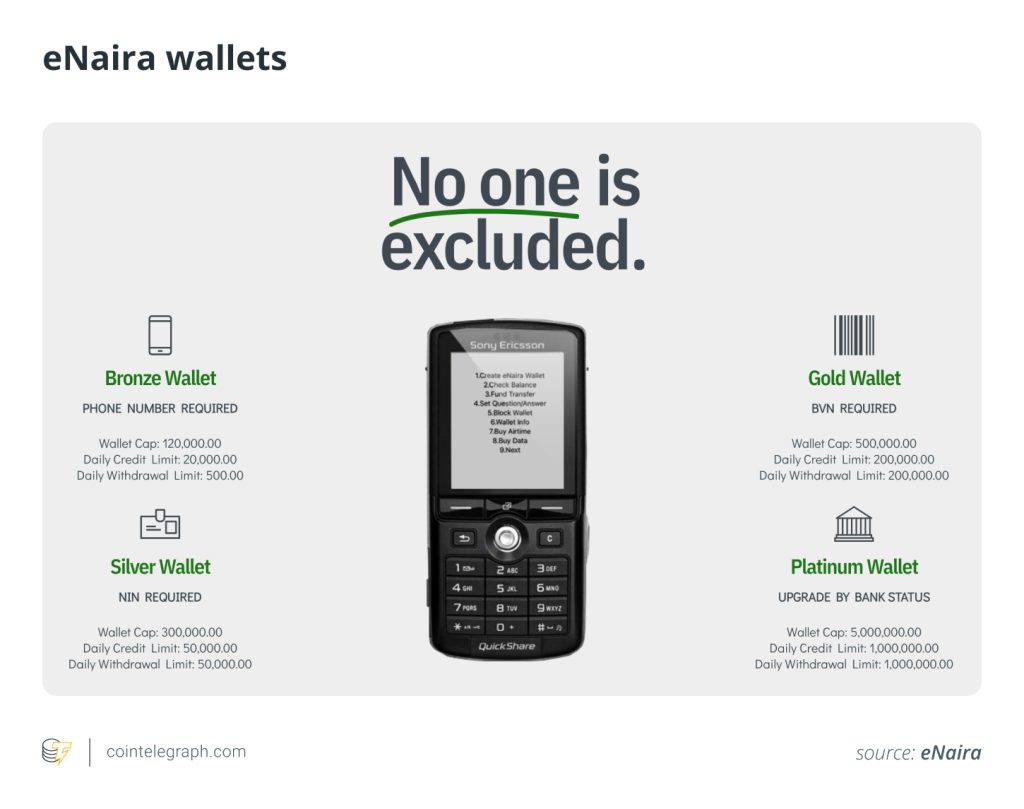

eNaira wallets

Housed within the digital confines of the eNaira wallet, this innovative form of currency serves as a unit of account, a store of value and a medium of exchange. The eNaira introduces a diverse range of wallets, each of which is crafted to meet specific needs and enhance the user experience.

The Individual Wallet, designed for those eligible to open a bank account, simplifies eNaira initiation. With initiation criteria as simple as providing a phone number, National Identification Number (NIN), or Bank Verification Number (BVN), the eNaira is accessible to a broad audience, promoting ease of use and digital currency adoption.

The Edu Wallet, tailored for the younger demographic not yet of banking age in Nigeria, links to parents’ or guardians’ accounts. This connection facilitates payments and fund reception, nurturing financial literacy from an early age.

The Merchant Wallet is a secure and user-friendly payment channel that empowers businesses to accept eNaira payments. Linked to a merchant’s business bank account, it enhances payment options and expands their customer base.

To access the eNaira, whether you’re a consumer or a merchant, you need to download the wallet app from either the Google Play Store or the Apple Store.

eNaira adoption challenges

Despite the ambitious vision behind the eNaira, the digital currency has faced criticism and encountered various challenges in its adoption journey.

Deviating from the decentralization principle, the eNaira’s private blockchain’s centralized nature and lack of transparency in transaction details challenge conventional blockchain principles. The eNaira’s centralized architecture raises questions about extensive government monitoring and control.

On the other hand, building trust in blockchain technology in Nigeria is also challenging. Even though Nigeria has the most crypto-aware population globally, users still express skepticism about eNaira’s security and stability in the rapidly evolving digital landscape. Resistance from traditional banking users, doubts and reservations surrounding digital currencies, and the learning curve associated with the eNaira ecosystem have slowed adoption.

The road ahead

As the eNaira continues to gain momentum, its future will present challenges and opportunities. From activating smart contracts to fostering widespread adoption and global collaborations, eNaira’s trajectory is poised for further evolution. It aspires to transform the way transactions occur and catalyze economic growth and financial empowerment.

In this digital frontier, the eNaira emerges not just as a sovereign digital currency but as a symbol of Nigeria’s commitment to technological innovation, financial inclusion and resilience in the face of a rapidly changing world. As users and businesses adapt to this new financial paradigm, eNaira’s journey unfolds as a chapter in the larger digital transformation narrative, shaping the future of economies worldwide.

Written by Sasha Shilina

… [Trackback]

[…] Here you will find 48200 additional Info on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Here you will find 89802 additional Info to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1949/ […]

… [Trackback]

[…] There you will find 39210 additional Information on that Topic: x.superex.com/academys/beginner/1949/ […]