Analysis of the Recent NFT Surge: A Genuine Recovery or Just a Short-Term Game?

#NFT #CryptoPunks #Moonbirds

What comes to your mind when you think of NFTs?

- NFTs were once that piece of code sold for tens of millions of dollars.

- NFTs were once the global crypto craze driven by Bored Apes.

- NFTs were once the crowned king that crashed from million-dollar deals into obscurity.

Over the past two years, the NFT market has gone through a dramatic shift from hot to cold. In the eyes of most retail investors, NFTs have long been “dead.” Yet recently, a wave of collective pumps has brought this sector back into the spotlight. According to CoinGecko, the total market cap of the NFT sector recently climbed back above $6 billion, standing at $6.417 billion, with a 24-hour gain of 23.2%. Trading volume soared by 318.3%, breaking through $40 million.

This has raised many questions: Is the NFT sector really coming back from the dead, or is it just another round of short-term capital games? This article analyzes the current NFT surge from multiple angles, exploring the deeper reasons behind it and the possible future direction.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Sudden NFT Market Spike: Which Projects Are Leading the Charge?

Several top-tier projects have stood out in this NFT rebound:

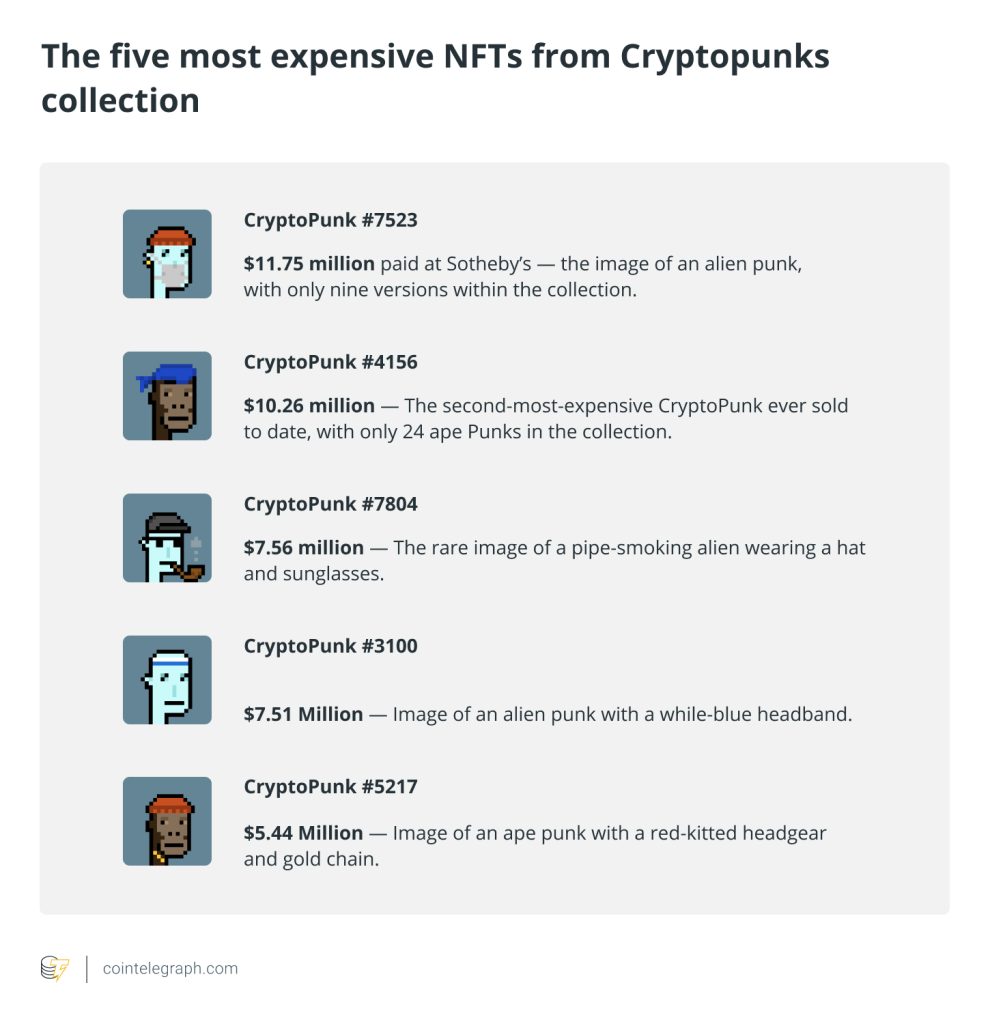

- CryptoPunks: A whale player swept up 45 CryptoPunks for millions of dollars, and also bought a batch of Chromie Squiggle NFTs. Within just 5 hours, 76 CryptoPunks changed hands — this was the largest concentrated purchase since 2021. The floor price for CryptoPunks quickly rose to 47.5 ETH, up 15.9% in 24 hours.

- Moonbirds: Surprisingly, this surge was driven by OpenSea. On July 20, OpenSea’s official X avatar was briefly changed to a Moonbirds image, triggering a short-lived FOMO. Moonbirds’ floor price spiked 33.3%, currently sitting at 1.94 ETH.

- Pudgy Penguins: A rare source of attention during the NFT winter, it gained outside exposure by appearing in season 2 of the American TV show Poker Face. The floor price rose to 16.4 ETH, a 13.8% gain in 24 hours.

The “collective” nature of this price surge has led many to suspect that capital might be orchestrating a push behind the scenes.

Why Did the NFT Market Suddenly “Come Back from the Dead”?

This surge wasn’t entirely without signs. Based on capital flow and market sentiment, there are several key reasons:

1. ETH’s Strong Rally Is Reviving Related Assets

NFTs are still predominantly traded on the Ethereum blockchain. As ETH recently rebounded strongly and shot up to new highs, follow-up capital naturally began looking for derivative targets — and NFTs are a natural choice. Especially for seasoned ETH players, they prefer to allocate assets within the Ethereum ecosystem, and leading NFT projects become a logical “alternative investment.”

In fact, this mirrors a common rule in the crypto market. When BTC breaks through key resistance levels, altcoins often follow with a delayed rise; when ETH strengthens, the NFT ecosystem gets renewed attention. The flow of capital among top assets is an internal “rotation effect” of the market.

This NFT rebound is most likely a “chain reaction” triggered by ETH’s price increase, not an improvement in the fundamental value of NFTs.

2. Whale Sweeps Create an Illusion of Liquidity

Whale behavior tends to have a more pronounced impact on NFTs than on tokens, because NFT liquidity is far more limited. A large-scale purchase can quickly raise the floor price and generate buzz.

The recent CryptoPunks sweep is a textbook example. In the NFT secondary market, concentrated purchases of just a few dozen items are enough to make it seem like “new money is entering,” which then draws in follow-up buyers.

But this type of surge is often unsustainable, because it’s not driven by real user demand — it’s just “ignition” capital in an illiquid market.

3. Market Has Been Cleansed — Easier for Whales to Control

After enduring a long bear market, most retail investors have already exited the NFT space. Project teams and institutions now hold a large share of core assets. Compared to altcoins, NFTs’ non-fungible nature and low trading depth make “control” cheaper and easier.

Some old players in the space bluntly say this rebound “feels more like a warm-up move from the whales,” meant to create the illusion of a “NFT season comeback” to draw attention. This is supported by comments from BitmapPunks founder FreeLunchCapital, who revealed that institutions had contacted him in advance to stockpile NFTs.

4. Spillover Sentiment: “Alt Season” Drives Correlated Moves

Recently, there’s been rising anticipation around a new “altcoin season.” Activity in DeFi and some Layer 2 projects has prompted speculators to start betting on “the next hot trend.” As an integral part of the crypto space, NFTs naturally get pulled along when speculative sentiment spreads.

Arthur Hayes previously predicted on X that “DeFi and NFT markets will make a comeback.” While this was mocked by some at the time, such opinions inevitably help shape market expectations.

NFT Opportunities and Pitfalls: Can It Regain 2021 Glory?

Looking at the trends, it seems extremely difficult for the NFT market to return to its 2021 peak. The reasons are simple:

- User onboarding and market expansion have stalled: The 2021 NFT boom was driven by artists, celebrities, and Web2 capital. That level of external stimulus is currently lacking.

- Speculative nature remains dominant: Practical use cases for NFTs have yet to fully materialize. Most projects are still stuck in the “collectible” or “emotional game” phase.

- Liquidity issues persist: Even for top projects, offloading assets is far harder than with cryptocurrencies.

That said, this doesn’t mean NFTs are completely devoid of opportunities. On the contrary, in a “cold market,” a few projects with genuine innovation and real application potential might still break through.

Conclusion: How Far Can This NFT Rally Go?

The recent NFT price spike seems more like a “short-term sentiment + whale maneuver” driven partial rebound, rather than a signal of full recovery. While ETH’s rise and altcoin season expectations have indeed brought some inflows, for NFTs to reclaim their former glory, it takes more than just price action. It requires new user demographics, new narratives, and real-world application scenarios.

For ordinary investors, it’s okay to stay alert as the NFT market warms up — but avoid chasing blindly. This space is even more volatile and unpredictable than crypto, and every “pump” could also be the final exit signal.

Disclaimer: The content of this article is for informational purposes only and does not constitute any investment advice. Investors should assess their own risk tolerance and investment goals before engaging in crypto investments. Do not follow the crowd blindly.

Responses