LEARN LTH SUPPLY INDEX IN 3 MINUTES ——BLOCKCHAIN 101

If You’ve Been in Crypto Long Enough, You Might Have Heard This:“It’s not about whether you want to sell—most whales never even moved their coins.”

This brings us to today’s key indicator: Dormant Supply, also known as the Inactive Coins Index. Sounds complex, but once you understand the logic behind it, it could help you detect market trend shifts earlier than most.Just give it 3 minutes—you’ll know what it is and how to use it.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is Dormant Supply?

To put it simply, this indicator tracks one thing: “How many coins haven’t moved in a long time?”

One of blockchain’s biggest strengths is transparency—you can see when every single coin last moved. Was it a month ago? A year? Still lying there five years later? Dormant Supply zooms in on these long-inactive coins, especially those sitting untouched in wallet addresses over extended periods.

Common time brackets include:

-

Coins inactive for 6 months

-

Coins inactive for 1 year

-

Coins inactive for 2 years or even 5+ years (the hardcore tier)

All of these make up what we call Dormant Supply.

So What’s the Point of This Data?

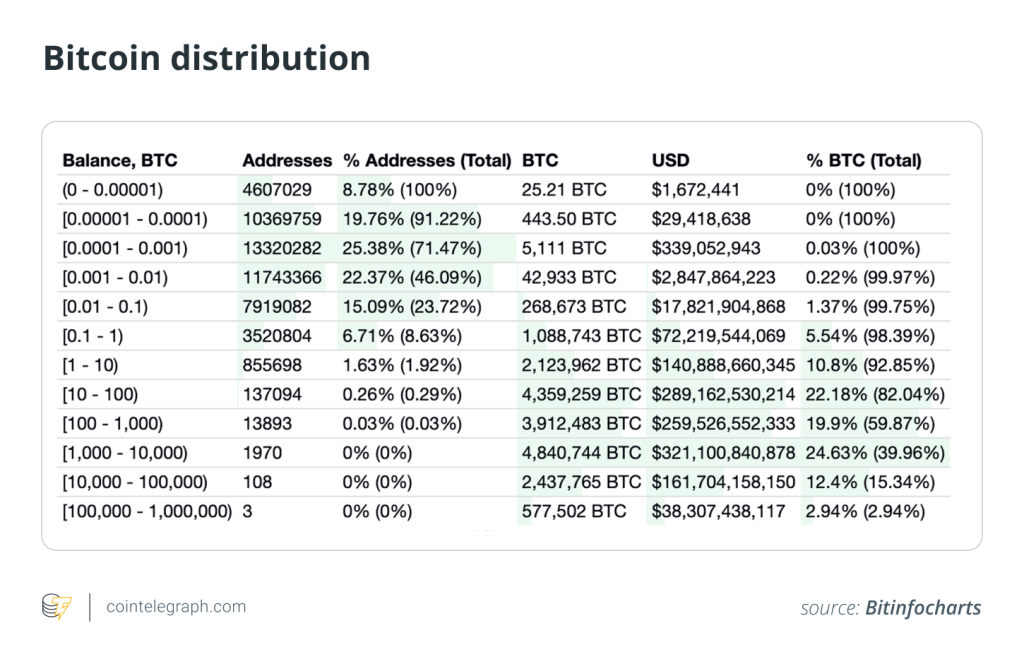

Imagine this: over 50% of Bitcoin hasn’t moved in two years. These holders are staying put, refusing to sell.

What does that tell you?Probably that these people have rock-solid conviction—they’re holding through bull and bear markets alike.And that’s exactly where Dormant Supply becomes meaningful. It signals three major things:

1. Market Confidence / HODLer Sentiment

The higher the Dormant Supply, the more long-term holders there are—indicating a “stable” market where belief is strong.If this ratio keeps rising during a bear market, it suggests more and more people are buying the dip and not planning to sell.

2. Potential Selling Pressure

On the flip side, Dormant Supply can also be a potential ticking time bomb.Remember: when coins that haven’t moved in years suddenly start moving, it could mean big players are cashing out—and prices might drop quickly.A commonly paired metric is called Dormant Flow—if Dormant Supply is falling while on-chain active addresses spike, that’s often a sign that OG whales are selling.

3. Early Clues to Bull Market Breakouts

In previous Bitcoin bull cycles, a clear pattern emerged:Dormant Supply rises steadily → market supply tightens → no one wants to sell → prices surge.

Here’s a simple example:

In late 2020, when Bitcoin hovered around $10,000, Dormant Supply (>1 year) exceeded 60%.Many thought it was “dead money”—but in reality, it was the calm before the bull storm.Those long-term holders were locking coins away. By Q1 2021, Bitcoin had blasted past $60,000.

So Stop Just Staring at Price Charts—Dormant Supply Is the Sentiment Thermometer You’re Missing

A Few Practical Tips on How to Use It

-

Don’t rely solely on Dormant Supply—combine it with Active Addresses and Exchange Inflows for better context

-

Ignore short-term price swings—focus on long-term Dormant trends

-

Pay attention to sudden drops in Dormant categories—it could mean whales are on the move

To Summarize

Dormant Supply / Inactive Coins Index isn’t complicated.At its core, it’s simply:“Track the coins that haven’t moved in years—to understand what real long-term holders are doing.”

-

It can tell you: Who’s holding firm?

-

It can warn you: Who might be selling soon?

More importantly, it helps you cut through noise and emotional traps with on-chain data—letting you spot what others don’t.Master this indicator, and while it won’t make you rich overnight, it might just save you from a lot of mistakes.

If you liked this quick “indicator deep-dive,” stay tuned for the next one.We’ll explore another underrated yet powerful on-chain signal: Exchange Netflow—one of the sharpest tools for tracking sell pressure.

Don’t miss it.

Responses