LEARN NETWORK VALUE TO TRANSACTIONS RATIO(NVT RATIO) IN 3 MINUTES – BLOCKCHAIN 101

-INDEX-IN-3-MINUTES@2x-1024x576-14.png)

“Look, Bitcoin is down again! Yesterday, Jack in the group said he sold early. How does this old fox always dodge the crash?”

One late night, you stare at the K-line chart on your phone and ask this question for the 108th time. Actually, Jack just knows one more indicator than the average person: the NVT Ratio. Known as the “blockchain version of the P/E ratio,” this mysterious number acts like a thermometer for the crypto market, telling you whether the market is overheating or underperforming. Today, we’ll break down this tool hidden in institutional traders’ pockets in plain language.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

-INDEX-IN-3-MINUTES@2x-1024x576.png)

What is the NVT Ratio?

1.1 Understanding NVT Through Grocery Market Economics

Imagine Leo selling “Metaverse goods” at your local market. On the first day, he prices them at 10 yuan per pound and sells 100 pounds. The total value of the stall (network value) = 10 yuan × 100 pounds = 1000 yuan. The NVT Ratio = Total Value 1000 yuan ÷ Daily Transaction Volume 100 yuan = 10.

The next day, Jace sets up a stall next door selling the same Metaverse goods at 50 yuan per pound but only sells 2 pounds. Although the stall’s total value soars to 50 yuan × 100 pounds = 5000 yuan, the daily transaction volume is only 100 yuan, pushing the NVT Ratio to 50. At this point, you realize: The price is inflated! Transactions can’t support this valuation!

This is the essence of the NVT Ratio: measuring the market’s temperature using on-chain transaction volume.

The formula is simple:

NVT Ratio = Cryptocurrency Market Cap ÷ Daily On-Chain Transaction Volume (usually a 7-day average)

1.2 Why It’s Called the “Blockchain P/E Ratio”

Traditional stock markets use the P/E ratio (Price ÷ Earnings per Share) to judge whether a stock is overpriced. In crypto, the NVT Ratio serves a similar purpose. A high NVT indicates investors are paying too much premium for every dollar of transaction volume.

Case Study Breakdown:

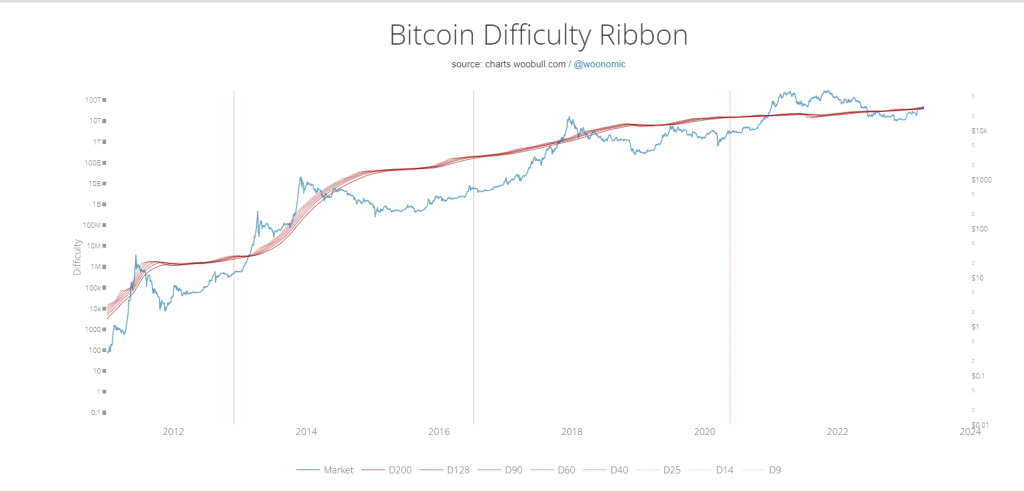

- Bitcoin Bull Market Peak:Market cap $1.2 trillion, daily on-chain transaction volume ~$30 billion → NVT≈40

- Bear Market Bottom:Market cap $300 billion, daily on-chain transaction volume $20 billion → NVT≈15

- Current State: Market cap back to $900 billion, daily transaction volume $45 billion → NVT≈20

This data reveals the truth: the market was clearly overheated during the bull run, while the current NVT is in a healthy range.

1.3 How Institutional Traders Use It as a “Cheat Code”

A Wall Street quant fund once leaked their NVT playbook:

- Red Alert Line NVT>40: Automatically triggers reduction procedures

- Green Buying Zone NVT<15:Activates dollar-cost averaging bots

- Death Cross: When the 30-day moving average NVT crosses below the 90-day moving average, it signals a trend reversal

Before a recent crash, Bitcoin’s NVT suddenly jumped from 28 to 37, and whale addresses showed massive transfers. This data allowed the fund to sell three days early, avoiding an 18% drop.

Three Practical Scenarios for NVT Ratio (With Latest Cases)

2.1 Spotting Scam Coins: A Recent Rug Pull Example

An exchange listed a token claiming to be a “DAO 3.0 revolutionary,” with its market cap skyrocketing to $5 billion. But the on-chain data showed:

- Market Cap: $5B

- 7-Day Average On-Chain Transaction Volume: $8M

- NVT Ratio=625 (normal projects usually have NVT between 20-50)

This meant each holder would need to trade 125 times daily to support the price—clearly a sign of exchange wash trading. Unsurprisingly, the team rug-pulled, and the token went to zero.

2.2 Catching Bottom Signals: Ethereum Buying Opportunity

During a recent ETH price crash, the market was in panic. But the NVT data revealed:

- Market Cap: $330B

- On-Chain Transaction Volume: $22B/day (including NFT, DeFi, stablecoin settlements)

- NVT≈15 (close to the historical low of 12)

Combined with fundamentals like a 35% staking rate and 400% YoY growth in L2 transaction volume, professional investors jumped in. ETH subsequently rebounded by 28.6%.

2.3 Warning of Market Risks: A Bitcoin Anomaly

One day, Bitcoin suddenly surged 5%, and the community cheered “the bull run is back.” But the NVT indicator showed:

- Market Cap: $1.28T

- On-Chain Transaction Volume: $28B

- NVT≈45.7(above the 40 warning line)

The rally was entirely driven by futures market leverage, while real on-chain transfers dropped 20%. Sure enough, Bitcoin crashed a few days later, liquidating over $1.2 billion.

Please note that all the cases are not based on recent trends, but rather past prices and trends selected for ease of understanding.

Beginner’s Guide: Three Common NVT Mistakes

3.1 Mistake 1: Applying the Same Standard to All Coins

Best For: BTC/ETH and other foundational chains (reference range 15-40)

Exceptions:

- Meme coins (e.g., DOGE): NVT often >100

- Stablecoins (e.g., USDT): NVT is meaningless

- Newly listed tokens: Observe for at least 30 days

3.2 Mistake 2: Ignoring Fake Transaction Volume

Beware of exchange wash trading:

- Check native on-chain transfers (e.g., BTC’s UTXO, ETH’s Gas usage)

- Compare CEX trading volume with on-chain deposit/withdrawal data

3.3 Mistake 3: Relying Solely on One Indicator

Cross-validate with other metrics:

- MVRV (Market Value to Realized Value)

- Exchange Net Inflows

- Stablecoin Market Cap Changes

Conclusion

The NVT Ratio is like your smartwatch—it can’t predict the future, but it tells you if something’s off. As the crypto market grows more complex, remember this simple truth: When on-chain transactions can’t support the market cap, even the fanciest technical analysis is just a house of cards.

Responses